What is a Qualified Institutional Placement and what do I like about them (more to do with the QIP doc)

Time for a thread🧵🧵🧵🧵🧵🧵

Time for a thread🧵🧵🧵🧵🧵🧵

What is a QIP?

A QIP or a Qualified Institutional placement allows a company to raise capital by issuing securities (by diluting equity) only to institutions.

Only Qib's or Qualified Institutional Buyers can participate in QIP's. This includes Mutual Funds, Foreign institutions

A QIP or a Qualified Institutional placement allows a company to raise capital by issuing securities (by diluting equity) only to institutions.

Only Qib's or Qualified Institutional Buyers can participate in QIP's. This includes Mutual Funds, Foreign institutions

and Pension funds etc. (From my knowledge PMS' or any individual investor cannot participate in Qip's).

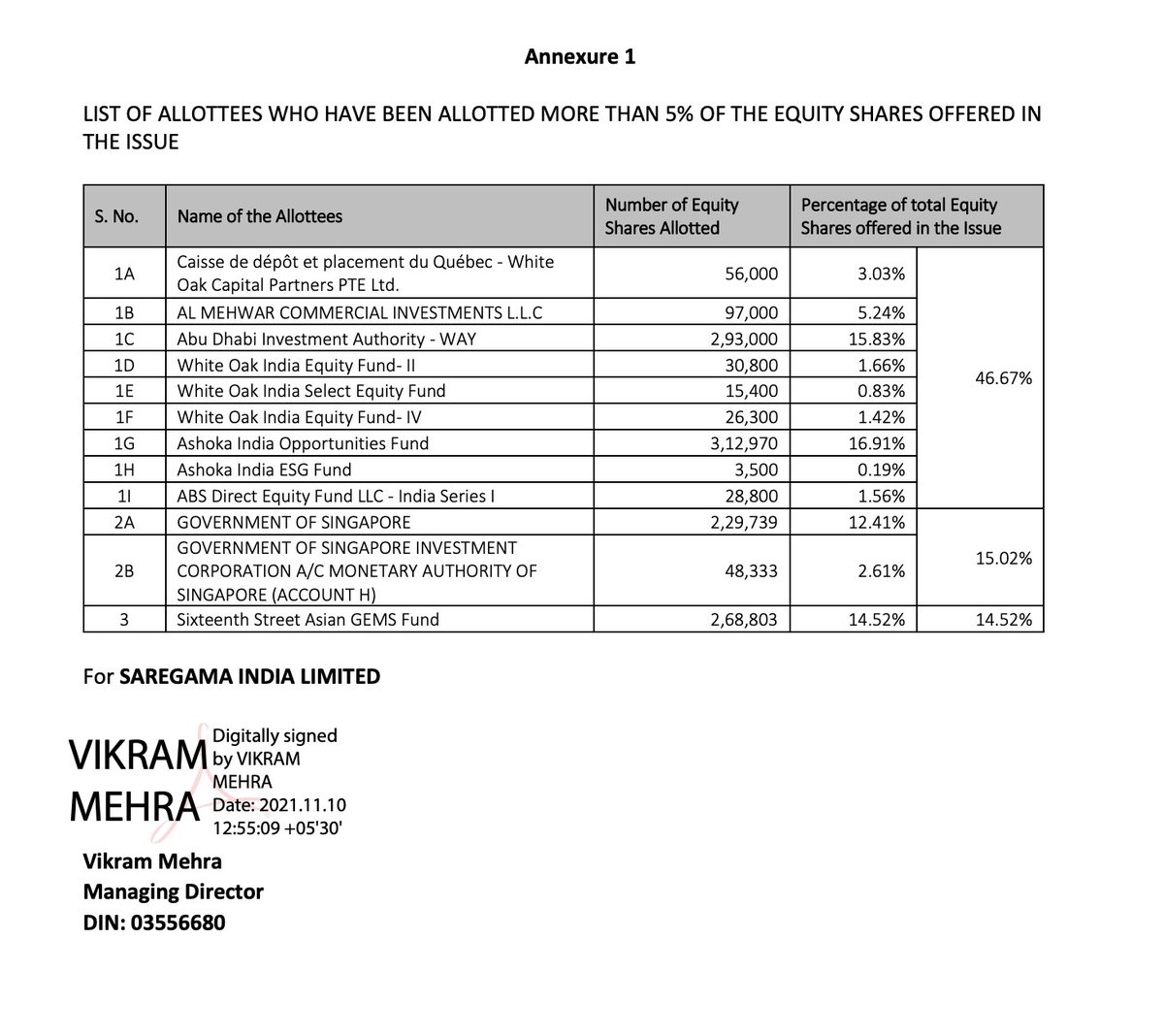

Just to give you an example:- Look at the investors who participated in the QIP of Saregama (750 crores)

Just to give you an example:- Look at the investors who participated in the QIP of Saregama (750 crores)

Another example is the Qip of Deepak Nitrite in 2016 for the Phenol Project (size of the project was 1400 crores+)

The QIP witnessed participation from some of the top domestic institutional investors namely Reliance MF, Birla MF, ICICI Pru MF etc.

moneycontrol.com/news/business/…

The QIP witnessed participation from some of the top domestic institutional investors namely Reliance MF, Birla MF, ICICI Pru MF etc.

moneycontrol.com/news/business/…

Question arises, Why did SEBI allow for creation of QIP as an instrument for raising money?

QIP was introduced in the Indian Markets in 2006 by Sebi. As the regulator was concerned that the domestic companies were getting too dependent on raising money through

QIP was introduced in the Indian Markets in 2006 by Sebi. As the regulator was concerned that the domestic companies were getting too dependent on raising money through

American Depository Receipts or Global Depository Receipts. Regulator introduced QIP as a tool to encourage domestic companies to raise capital domestically and to simplify the process rather than going abroad.

How is the pricing of QIP set?

The pricing floor for Qip is dependent upon the Floor Price below which Equity Shares cannot be issued. Pricing shall not be less than the average of the weekly high and low of the closing prices of the Equity Shares of the last 2 weeks prior to

The pricing floor for Qip is dependent upon the Floor Price below which Equity Shares cannot be issued. Pricing shall not be less than the average of the weekly high and low of the closing prices of the Equity Shares of the last 2 weeks prior to

announcement of the Qip Issue. However, companies can give a 5% discount to the floor price. Let's look at the floor price announced by Saregama:-

Original floor price=Rs.4264

Discount of 4.99%=Rs4052(The Final floor price)

Original floor price=Rs.4264

Discount of 4.99%=Rs4052(The Final floor price)

What happens on the balance sheet and EPS?

As more number of shares are issued, the share capital on the balance sheet increases and the Reserves also increase due to securities premium (premium over face value). Just look at share capital and reserves of Deepak from 2015-2018

As more number of shares are issued, the share capital on the balance sheet increases and the Reserves also increase due to securities premium (premium over face value). Just look at share capital and reserves of Deepak from 2015-2018

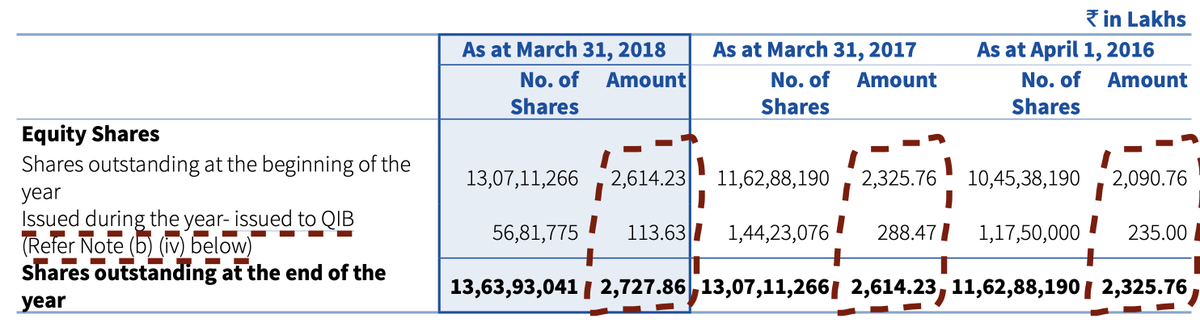

Number of shares outstanding for Deepak from 2015 till 2018 increased. Just look at how it gets reflected in the share capital schedule in the annual report (Deepak Nitrite 2016-2018)

Q. Can the promoters participate in Qips?

A. Absolutely not, the Qip's are only meant for Qualified institutional buyers. Namely- Mutual Funds, Foreign Pf Managers, Pension funds and Insurance companies etc.

A. Absolutely not, the Qip's are only meant for Qualified institutional buyers. Namely- Mutual Funds, Foreign Pf Managers, Pension funds and Insurance companies etc.

Q. Why do companies go for QIP instead of raising debt?

A. It's a very genuine question. It all depends the size of capex or project the company is undertaking. In Deepak's case they did a capex of 1400 crores, which was financed through Debt raise+Land sale+2 Qip's.

A. It's a very genuine question. It all depends the size of capex or project the company is undertaking. In Deepak's case they did a capex of 1400 crores, which was financed through Debt raise+Land sale+2 Qip's.

They couldn't have done it without the Equity raise. First reason is clearly:- Money required for large project.

Second reason is when the valuations are out of whack!

This is the example of Neogen chemicals or IndiaMart.

IndiaMart raised nearly 1000+ crores at a price band

Second reason is when the valuations are out of whack!

This is the example of Neogen chemicals or IndiaMart.

IndiaMart raised nearly 1000+ crores at a price band

of Rs9000 which gave the company a valuation of nearly 93 times PE. Companies do this as it is beneficial for existing shareholders.

Lower dilution at higher valuation leads can give higher capital which can be reused to grow the EPS Faster.

Lower dilution at higher valuation leads can give higher capital which can be reused to grow the EPS Faster.

Classic example in this case could be Neogen Chemicals, which has announced floor price of Qip at Ra 1400 (85 times Pe).

Which gives them 225 crores, they can use this capital to do more capex and repay the debt.

Coming to the third reason.

Which gives them 225 crores, they can use this capital to do more capex and repay the debt.

Coming to the third reason.

Third reason relates to the regulatory requirements. Which is majorly limited to Banks and Nbfcs. These companies have to do Qip's to meet the capital adequacy ratio and Equity capital is the currency of growth for such companies.

Here the Theory of reflexivity plays out

Here the Theory of reflexivity plays out

Assuming Bajaj Finance has a book value of Rs.20 and IDFC First also has the same book value. Bajaj Finance trades at 10 times Price to book i.e. at Rs200 vs Idfc at 1.5 times i.e. Rs 30.

Who do you think will need to dilute more to grow or meet the capital requirement? (Think)

Who do you think will need to dilute more to grow or meet the capital requirement? (Think)

At lesser dilution, Bajaj Finance can raise equivalent capital. Thus, benefitting the existing shareholders as the book value expands. This is what Bajaj Finance has been doing since 2015.

For a new bank, to get to such valuations, it takes years of trust and credibility and

For a new bank, to get to such valuations, it takes years of trust and credibility and

sustained ROE and ROA metrics, which eventually leads to higher valuations. Thus, diluting lot less at high P/B vs high dilution at a Low P/B, impacts the Pat (EPS per share) and ROE/ROA Metrics in the latter case.

Final reason for dilution, its an outright fraud which is taking investors for a ride. Here the classic example is the curious case of Manpasand Beverages, which announced a suspicious QIP just after the IPO:-

Do read this by @amitmantri

2point2capital.com/blog/index.php…

Do read this by @amitmantri

2point2capital.com/blog/index.php…

Finally coming to what do I like about them :)

Since many of the companies have been listed for years. Whenever they do a Qip, they have to release a Preliminary Placement Document which is like DRHP and it is a gold mine for information.

Since many of the companies have been listed for years. Whenever they do a Qip, they have to release a Preliminary Placement Document which is like DRHP and it is a gold mine for information.

You can check them out here:-

bseindia.com/corporates/qip…

If you have come this far, do retweet and help other investors know about what QIP really means :)

bseindia.com/corporates/qip…

If you have come this far, do retweet and help other investors know about what QIP really means :)

Just to add:-

One more reason for raising QIP capital is to fund an acquisition. Like what Pi Industries has done, they raised 2000 crores to get into Pharma adjacency which only time will tell whether they can do it or not :)

One more reason for raising QIP capital is to fund an acquisition. Like what Pi Industries has done, they raised 2000 crores to get into Pharma adjacency which only time will tell whether they can do it or not :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh