🚨🚨 BTC Market Update: Today epic stock market expiry!

Hourly View

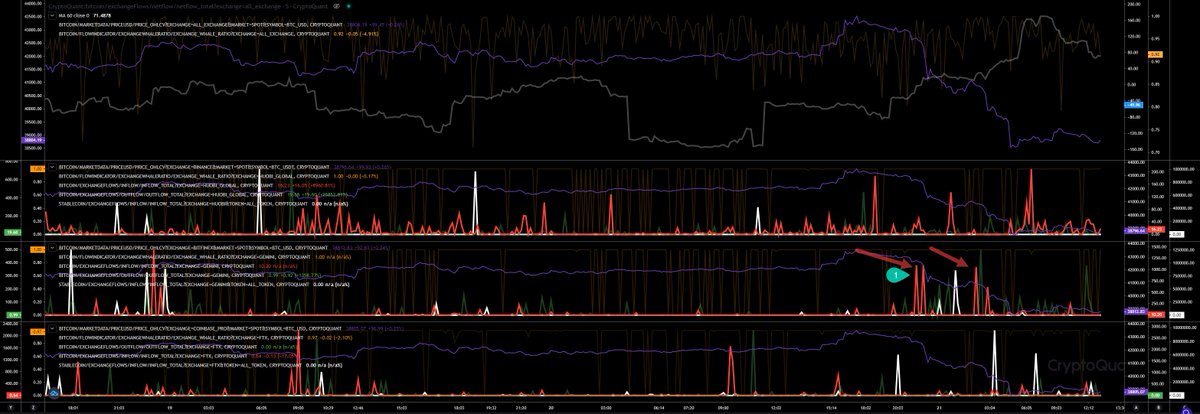

Since 18Jan22 the whales ratio (1) was rising indicating more incoming whales tokens to exchanges. But our whales ratio 30h average (2) is here key, showing the dump preparation.

#BTC #ETH #XRP

Hourly View

Since 18Jan22 the whales ratio (1) was rising indicating more incoming whales tokens to exchanges. But our whales ratio 30h average (2) is here key, showing the dump preparation.

#BTC #ETH #XRP

Since yesterday its falling again indicating that we can expect less sell pressure soon, but we should keep in mind that we have detected big positive netflows (4) since midnight. We need to observe the indicator in the next hours but if it keeps falling, we should lift up again.

In my opinion back to 40k first. But as we know today we have a big day due the epic expiry on stock markets. So, we need to be careful anyway. However, also interesting is the fact, that the exchange reserves in stablecoins has fallen by almost $5 billion since christmas.

Block View

Also here is the whales ratio 30block average (1) showing less incoming whales tokens, but the netflows are reaching Dec level. Accumulated we have almost a total positive netflow of 6,000 BTC (2). That’s big and absolutely not bullish at all!

Also here is the whales ratio 30block average (1) showing less incoming whales tokens, but the netflows are reaching Dec level. Accumulated we have almost a total positive netflow of 6,000 BTC (2). That’s big and absolutely not bullish at all!

Option Trading

Expiry 28JAN22

Also here no bullish news. Our 28Jan22 expiry max pain has dropped once again to 45k. Puts at 38k are showing the biggest volume within the last 24h indicating that option traders are shifting more and more to bearish sentiment. Even if our

Expiry 28JAN22

Also here no bullish news. Our 28Jan22 expiry max pain has dropped once again to 45k. Puts at 38k are showing the biggest volume within the last 24h indicating that option traders are shifting more and more to bearish sentiment. Even if our

Open Interest by Expiration shows a big green bar indicating much more Calls than Puts, we can see that the BTC volume by Expiration (Last 24h) is changing. More volume in Puts are arriving. The total max pain has also declined once again to from 46k to 45k and also big Put

orders at 30k and 35k are arriving now for the 25Mar22 expiry. That’s also absolutely not bullish!

URL about 21Jan expiry at stocks: spotgamma.com/the-deep-janua…

URL to App: app.laevitas.ch/dashboard/btc/…

URL about 21Jan expiry at stocks: spotgamma.com/the-deep-janua…

URL to App: app.laevitas.ch/dashboard/btc/…

Future Trading

Hourly View

As expected with such a dump, future traders flipped to shorts again (1) (Funding rate is negative showing more demand for shorts) , but it seems they like to be rekt, with a rising leverage ratio (2). I really don’t get that. If we get more volatility

Hourly View

As expected with such a dump, future traders flipped to shorts again (1) (Funding rate is negative showing more demand for shorts) , but it seems they like to be rekt, with a rising leverage ratio (2). I really don’t get that. If we get more volatility

today, some of them will disappear for sure.

With our pump yesterday we have liquidated some shorts (3) and even the way down with a rising volatility we have liquidated late high leverage shorts.

Interesting here is where the long cascade has happenend. I have said in the

With our pump yesterday we have liquidated some shorts (3) and even the way down with a rising volatility we have liquidated late high leverage shorts.

Interesting here is where the long cascade has happenend. I have said in the

past, as soon as we fall below 40k (4), we will have a cascade of high leverage longs. It happenend exactly at 40k. It seems, they were very sure that we wouldn’t lose this support.

URL to chart: cryptoquant.com/prochart/h5G7k…

URL to chart: cryptoquant.com/prochart/h5G7k…

Also Coinglass is confirming the data above. Funding rates are declining.

Only Deribit is showing a bigger demand in longs within the last 24h. As I’m expecting big volatility today, that’s going to be a very dynamic day for crypto too!

Only Deribit is showing a bigger demand in longs within the last 24h. As I’m expecting big volatility today, that’s going to be a very dynamic day for crypto too!

Market Activity

Block View

#1 - Gemini

#2 - Binance

#3 - FTX

#4 - Okex

#5 - Bitfinex

#6 - Kraken

We can see here a lower fund flow on exchanges at the local top. The trigger came from outside again, showing a rising activity on the network. Fund flows on the exchanges has

Block View

#1 - Gemini

#2 - Binance

#3 - FTX

#4 - Okex

#5 - Bitfinex

#6 - Kraken

We can see here a lower fund flow on exchanges at the local top. The trigger came from outside again, showing a rising activity on the network. Fund flows on the exchanges has

started to rise at a price level of 42.6k. Gemini is showing here a big activity. I can confirm due the detected inflows, that Gemini was the main driver here showing inflows of 2,200 BTC. Another inflow of almost 1,100 BTC happenend at a price level of 40.9k. Binance inflows

has rised at a price level of 40k showing several inflows of 500 - 1,000 BTC and Bitfinex showing big inflows at a price level of 38.8k of almost 1,500 BTC. Whales selling here. That doesn’t look bullish at all.

URL to chart: cryptoquant.com/prochart/MIV7F…

URL to chart: cryptoquant.com/prochart/MIV7F…

Exchange Walls

#1 - Bitfinex | Walls: Upper at 46.6k, Lower at 37.8k (NEW!)

#2 - Coinbase | Walls: Upper at 48k, Lower at 38k (NEW!)

#3 - Binance | Walls: Upper at 46k, Lower at 38k (NEW!)

#4 - FTX | Walls: Upper at 48.5k, Lower at 34.5k (NEW!)

#1 - Bitfinex | Walls: Upper at 46.6k, Lower at 37.8k (NEW!)

#2 - Coinbase | Walls: Upper at 48k, Lower at 38k (NEW!)

#3 - Binance | Walls: Upper at 46k, Lower at 38k (NEW!)

#4 - FTX | Walls: Upper at 48.5k, Lower at 34.5k (NEW!)

Inspos Conclusion and personal trade strategy

Nothing bullish here. Well, maybe the fact that the funding rates are flipping to negative again. But that’s it. Exchanges are reinforcing lower walls and even those in very low ranges like 30k. Option traders showing more bearish

Nothing bullish here. Well, maybe the fact that the funding rates are flipping to negative again. But that’s it. Exchanges are reinforcing lower walls and even those in very low ranges like 30k. Option traders showing more bearish

trades, exchanges receiving more dump ammo, a whales ratio that is declining a bit, but not dumping.

38k is going to be my next target. Nobody knows what will happen today with the stocks expiry. The sell pressure is very big at the moment and I guess we will dump even more, at

38k is going to be my next target. Nobody knows what will happen today with the stocks expiry. The sell pressure is very big at the moment and I guess we will dump even more, at

least that’s what I see based on the data. That wasn’t part of my plan and I think I will stay away today and start to trade again tomorrow. Too risky as really nobody knows what could happen today. We have $125 billion related to the expiry today, that can have a big impact to

the price action. Maybe it makes more sense today to set some utopic low buy orders in spots and hope we will fill the orders. However, exchanges are expecting a possible dump heading 35k as next.

• • •

Missing some Tweet in this thread? You can try to

force a refresh