Have you recently heard the word "DeFi" or "Decentralized finance" and never know what is that or anything about it?

Well here i am, to help you understand the basic details of it in simple terms

So, Lets dive in "WTF is DeFi?"

👇🧵

1/

Well here i am, to help you understand the basic details of it in simple terms

So, Lets dive in "WTF is DeFi?"

👇🧵

1/

- In the previous "WTF is" thread about ETHEREUM part 1 i told that ethereum was created with the intention to decentralize everything.

- Smart Contracts help acheive decentralization of majority of things on blockchain.

Check this 👉bit.ly/WTFisSMARTCONT…

2/

- Smart Contracts help acheive decentralization of majority of things on blockchain.

Check this 👉bit.ly/WTFisSMARTCONT…

2/

- Financial system is one main thing that runs by centralized entities like governments and intermediaries like banks

- DeFi relies heavily on - Cryptography, Blockchain & Smart Contracts

- According to @defipulse today in DeFi Total Value Locked(TVL) is $92.36B 😱

3/

- DeFi relies heavily on - Cryptography, Blockchain & Smart Contracts

- According to @defipulse today in DeFi Total Value Locked(TVL) is $92.36B 😱

3/

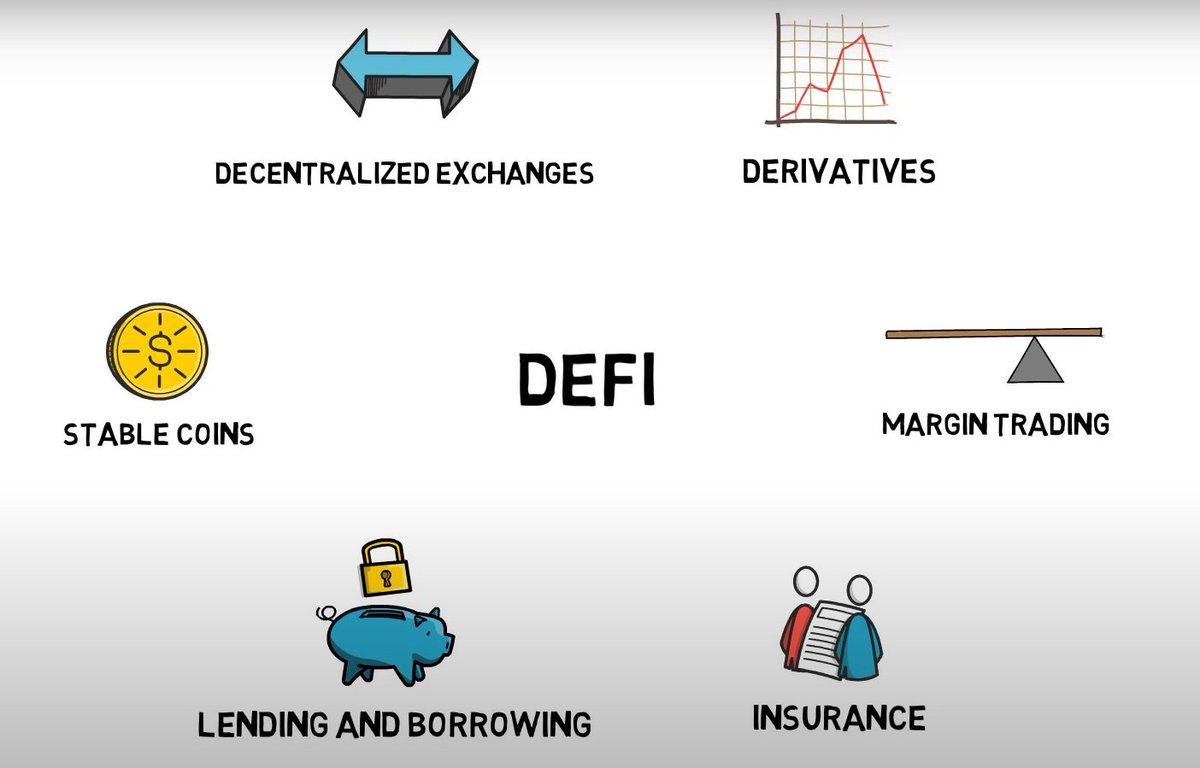

@defipulse - There are few pillars in Decentralized Finance (DeFi) :

* Stable Coins

* Lending & Borrowing

* Decentralized Exchanges

* Insurance

* Derivatives

* Margin Trading

Let's see in detail indivually for each of them

4/

* Stable Coins

* Lending & Borrowing

* Decentralized Exchanges

* Insurance

* Derivatives

* Margin Trading

Let's see in detail indivually for each of them

4/

@defipulse Stable Coins

- Stable coins are cryptocurrencies, which are pegged to stable asset such as the US dollar or a group of assets

- USDT @Tether_to, originally called realcoin, was first stablecoin that launched in 2014 and supposedly backed by $1 in the issuer’s bank account

5/

- Stable coins are cryptocurrencies, which are pegged to stable asset such as the US dollar or a group of assets

- USDT @Tether_to, originally called realcoin, was first stablecoin that launched in 2014 and supposedly backed by $1 in the issuer’s bank account

5/

@defipulse @Tether_to - Dai is one of such which aims to keep its value close to one USD through an automated system of smart contracts on the Ethereum blockchain founded in 2018 by @MakerDAO

- Stable coins are not really financial apps themselves, but are essential to make DeFi more accessible

6/

- Stable coins are not really financial apps themselves, but are essential to make DeFi more accessible

6/

@defipulse @Tether_to @MakerDAO Lending & Borrowing

In the traditional financial system, if you apply for a loan, you will need to provide various financial and non-financial information. The financial institution will conduct a credit risk assessment and evaluate whether you should receive a loan or not

7/

In the traditional financial system, if you apply for a loan, you will need to provide various financial and non-financial information. The financial institution will conduct a credit risk assessment and evaluate whether you should receive a loan or not

7/

@defipulse @Tether_to @MakerDAO In decentralized lending and borrowing, You borrow against the collateral that you provide and the protocol manages liquidations based on a targeted loan-to-value (LTV) ratio.

For example, you could provide Ethereum worth 10000 USD and borrow 4000 USDC with an LTV of 40%.

8/

For example, you could provide Ethereum worth 10000 USD and borrow 4000 USDC with an LTV of 40%.

8/

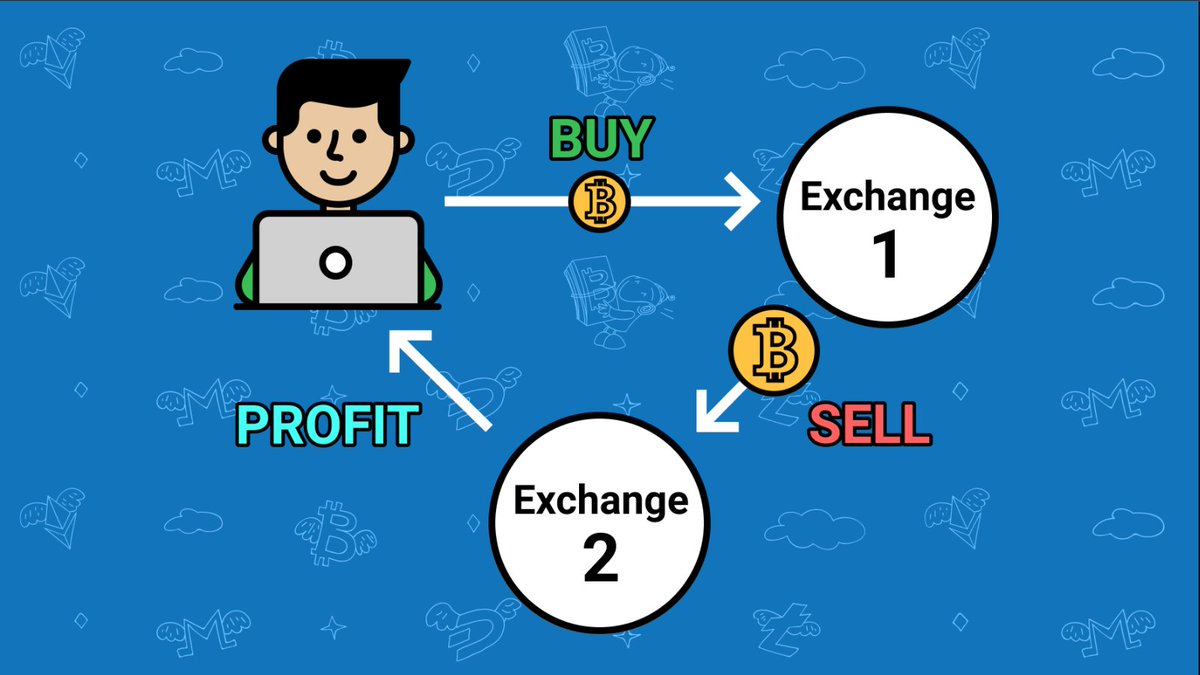

@defipulse @Tether_to @MakerDAO There is one more type of loan in CRYPTO called FLASH LOAN which last like 20-30 seconds, well basically one transaction time.

Eg: Say if you buy ETH for $3000 at @Gemini and sell it at $3005 at @coinbase, You made a profit of $5.

9/

Eg: Say if you buy ETH for $3000 at @Gemini and sell it at $3005 at @coinbase, You made a profit of $5.

9/

@defipulse @Tether_to @MakerDAO @Gemini @coinbase Now in Flashloans you can take millions of $ without any collateral and buy the ETH at Gemini and sell it at coinbase and return back the loan+fee with the help of smart contract in one transaction.

This difference in price at multiple exchanages is called arbitrage

10/

This difference in price at multiple exchanages is called arbitrage

10/

@defipulse @Tether_to @MakerDAO @Gemini @coinbase - First protocol in this field is @MakerDAO

- According to @defipulse market dominance of MakerDAO is 40.54% with $16.48B TVL as on 22nd Jan 2022 in Lending field

- There are few more famous protocols like

* @AaveAave with $11.01B

* @compoundfinance with $7.83B

11/

- According to @defipulse market dominance of MakerDAO is 40.54% with $16.48B TVL as on 22nd Jan 2022 in Lending field

- There are few more famous protocols like

* @AaveAave with $11.01B

* @compoundfinance with $7.83B

11/

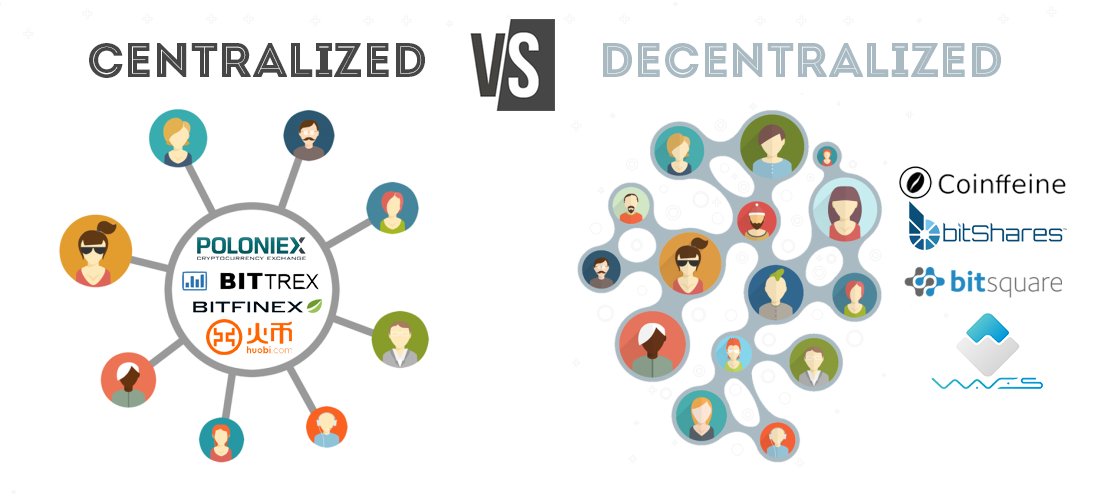

@defipulse @Tether_to @MakerDAO @Gemini @coinbase @AaveAave @compoundfinance Decentralized Exchanges(DEX)

- In centralized exchanges we need to give up the custody of our coins to the exchanges

- In DeFi-DEX we can exchange one cryptocurrency for another one in a decentralized and permissionless way and no need to giveup the custody of coins

12/

- In centralized exchanges we need to give up the custody of our coins to the exchanges

- In DeFi-DEX we can exchange one cryptocurrency for another one in a decentralized and permissionless way and no need to giveup the custody of coins

12/

@defipulse @Tether_to @MakerDAO @Gemini @coinbase @AaveAave @compoundfinance There are few types of DEX's

- Liquidity pool based

A mechanism by which users can pool their assets in a DEX's smart contracts to provide asset liquidity for traders to swap between currencies.

Provide much-needed liquidity, speed, and convenience to the DeFi ecosystem

13/

- Liquidity pool based

A mechanism by which users can pool their assets in a DEX's smart contracts to provide asset liquidity for traders to swap between currencies.

Provide much-needed liquidity, speed, and convenience to the DeFi ecosystem

13/

@defipulse @Tether_to @MakerDAO @Gemini @coinbase @AaveAave @compoundfinance - Order book based

The order book model in decentralized exchanges is one of the earliest approaches in the development of DEXs. Order books maintain records of all the open orders for purchasing and selling assets for specific pairs of assets.

14/

The order book model in decentralized exchanges is one of the earliest approaches in the development of DEXs. Order books maintain records of all the open orders for purchasing and selling assets for specific pairs of assets.

14/

@defipulse @Tether_to @MakerDAO @Gemini @coinbase @AaveAave @compoundfinance The buy orders imply a trader’s interest and sell orders show that the trader is prepared for selling. The discrepancy between the prices is responsible for determining the depth of the order book alongside the asset’s market price.

15/

15/

@defipulse @Tether_to @MakerDAO @Gemini @coinbase @AaveAave @compoundfinance According to @defipulse

- @CurveFinance has a market dominance of 46.55% with TVL of $14.41B

- The next two sposts go for @Uniswap and @BalancerLabs respectively with TVL of $8.29B and $2.19B

- @loopringorg is top Orderbook based DEX with TVL of $397.3M

16/

- @CurveFinance has a market dominance of 46.55% with TVL of $14.41B

- The next two sposts go for @Uniswap and @BalancerLabs respectively with TVL of $8.29B and $2.19B

- @loopringorg is top Orderbook based DEX with TVL of $397.3M

16/

@defipulse @Tether_to @MakerDAO @Gemini @coinbase @AaveAave @compoundfinance @CurveFinance @Uniswap @BalancerLabs @loopringorg Insurance

- Insurance is that a financial institution covers you for any future loss in exchange for premium that you pay

- In the DeFi space, code and smart contracts manage a large amount of money

17/

- Insurance is that a financial institution covers you for any future loss in exchange for premium that you pay

- In the DeFi space, code and smart contracts manage a large amount of money

17/

@defipulse @Tether_to @MakerDAO @Gemini @coinbase @AaveAave @compoundfinance @CurveFinance @Uniswap @BalancerLabs @loopringorg - There are already a countless examples of exploits and hacks on smart contracts where billions were stolen

- DeFi insurance protocols would allow you to hedge against the risk of an exploit of protocols where you have money locked

18/

- DeFi insurance protocols would allow you to hedge against the risk of an exploit of protocols where you have money locked

18/

@defipulse @Tether_to @MakerDAO @Gemini @coinbase @AaveAave @compoundfinance @CurveFinance @Uniswap @BalancerLabs @loopringorg - These protocols sometimes need real world data which can be fed by something called Oracles which are trusted sources which become a bridge between real world and crypto, like for example @chainlink

- Top protocols in this space are @NexusMutual and @InsurAce_io

19/

- Top protocols in this space are @NexusMutual and @InsurAce_io

19/

@defipulse @Tether_to @MakerDAO @Gemini @coinbase @AaveAave @compoundfinance @CurveFinance @Uniswap @BalancerLabs @loopringorg @chainlink @NexusMutual @InsurAce_io Derivatives

It is a contract whose value is derived from other assets such as stocks, commodities, currencies, etc. Traders can use derivatives to hedge their position and decrease the risk in any particular trade.

For example, if you are a manufacturer of rubber gloves

20/

It is a contract whose value is derived from other assets such as stocks, commodities, currencies, etc. Traders can use derivatives to hedge their position and decrease the risk in any particular trade.

For example, if you are a manufacturer of rubber gloves

20/

@defipulse @Tether_to @MakerDAO @Gemini @coinbase @AaveAave @compoundfinance @CurveFinance @Uniswap @BalancerLabs @loopringorg @chainlink @NexusMutual @InsurAce_io and want to hedge yourself from increase in rubber price you can buy a futures contract from your supplier to have a specific amount of material delivered at a specific future delivery date at an agreed price today

- @synthetix_io and @dydxprotocol are top in this space

21/

- @synthetix_io and @dydxprotocol are top in this space

21/

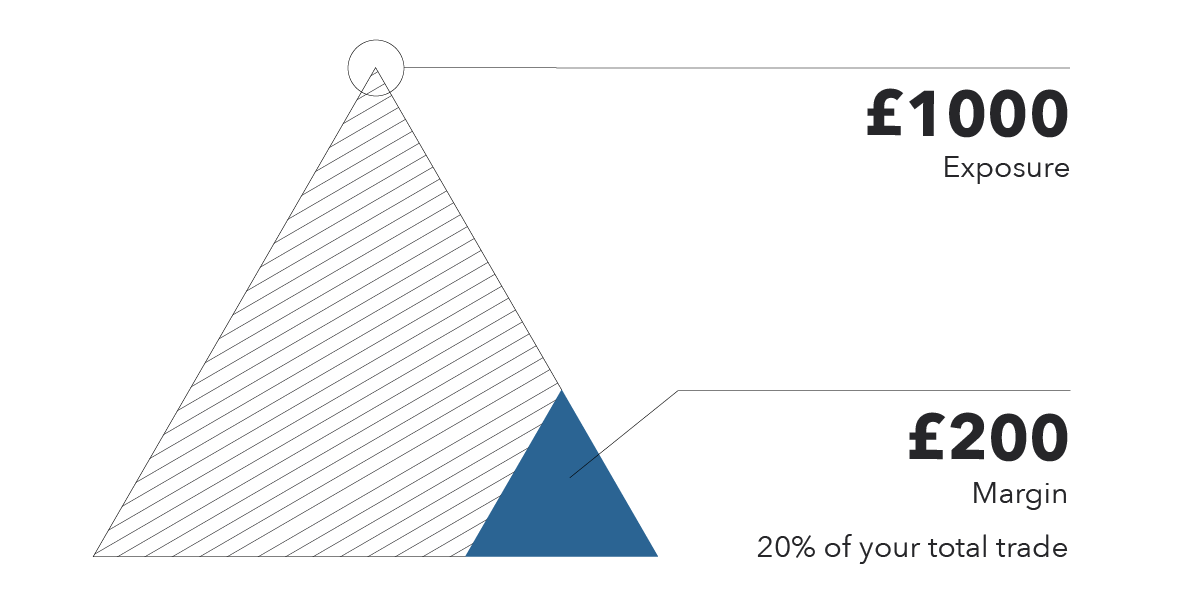

@defipulse @Tether_to @MakerDAO @Gemini @coinbase @AaveAave @compoundfinance @CurveFinance @Uniswap @BalancerLabs @loopringorg @chainlink @NexusMutual @InsurAce_io @synthetix_io @dydxprotocol Margin trading

- Similar to tradinational finance even in DeFi it is a practice of using borrowed funds to increase the position in cetrain asset.

22/

- Similar to tradinational finance even in DeFi it is a practice of using borrowed funds to increase the position in cetrain asset.

22/

@defipulse @Tether_to @MakerDAO @Gemini @coinbase @AaveAave @compoundfinance @CurveFinance @Uniswap @BalancerLabs @loopringorg @chainlink @NexusMutual @InsurAce_io @synthetix_io @dydxprotocol Well that brings an end to the thread on DeFi.

I hope it is clear and useful.

Here are further Resources:

by @WhiteboardCryp1

by @finematics

defipulse.com for statistics by @defipulse

linkedin.com/pulse/6-key-pi…

23/

I hope it is clear and useful.

Here are further Resources:

by @WhiteboardCryp1

by @finematics

defipulse.com for statistics by @defipulse

linkedin.com/pulse/6-key-pi…

23/

@defipulse @Tether_to @MakerDAO @Gemini @coinbase @AaveAave @compoundfinance @CurveFinance @Uniswap @BalancerLabs @loopringorg @chainlink @NexusMutual @InsurAce_io @synthetix_io @dydxprotocol @WhiteboardCryp1 @finematics Thank you for reading it till here.

I am a budding developer in web3, Started #21DaysOfLearnandShare to learn more and share.

If you like my explanation,

✅Like the post

✅RETWEETS are APPRICIATED

✅Please follow @0xViking for more such content

Thanks again

0xViking

I am a budding developer in web3, Started #21DaysOfLearnandShare to learn more and share.

If you like my explanation,

✅Like the post

✅RETWEETS are APPRICIATED

✅Please follow @0xViking for more such content

Thanks again

0xViking

• • •

Missing some Tweet in this thread? You can try to

force a refresh