Volatility in stock and crypto markets not enough to slow housing (yet). Here's what we can see in the data - this week's @altosresearch 📽️🧵👇

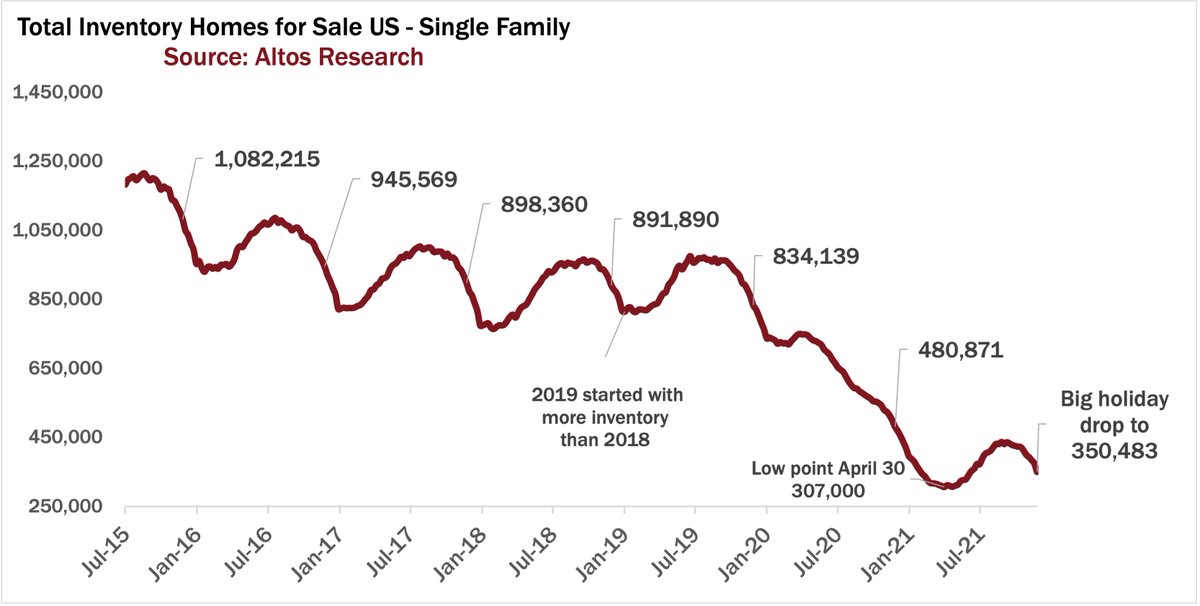

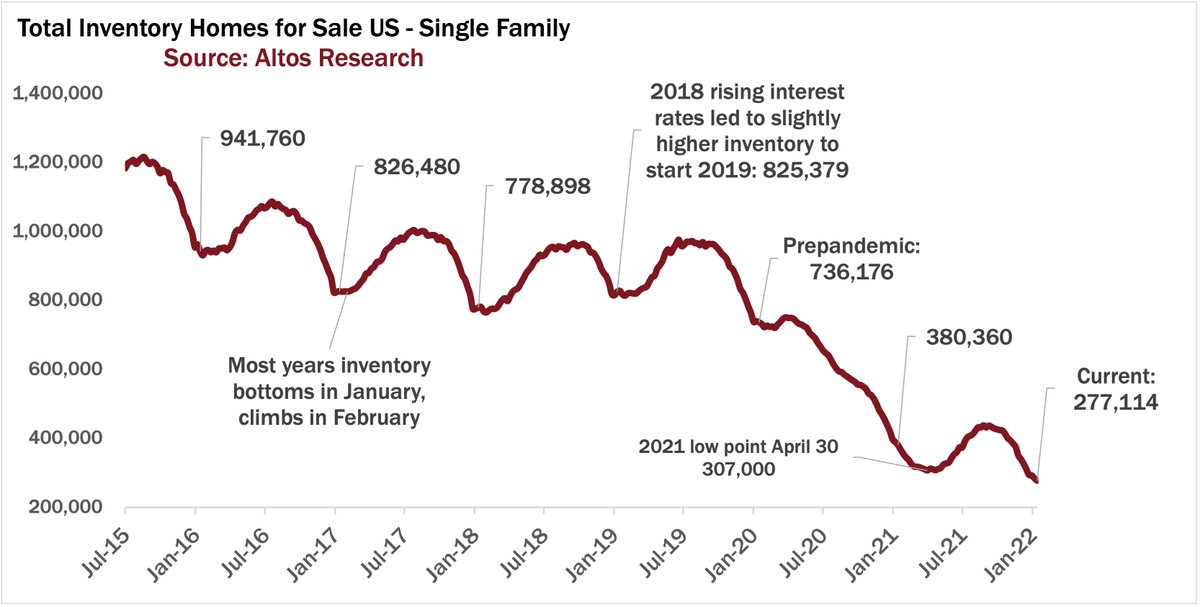

Available inventory of unsold single family homes fell by 2.4% this week to only 277,000 homes on the market. New record low.

1/7

Available inventory of unsold single family homes fell by 2.4% this week to only 277,000 homes on the market. New record low.

1/7

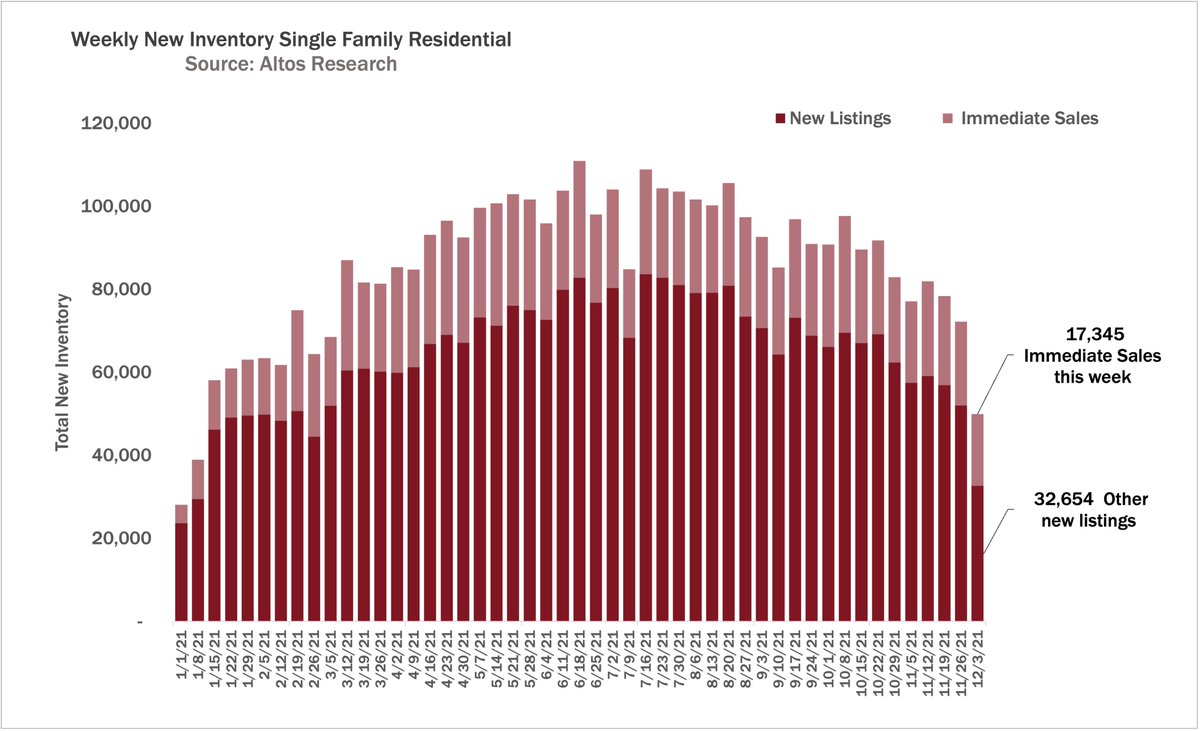

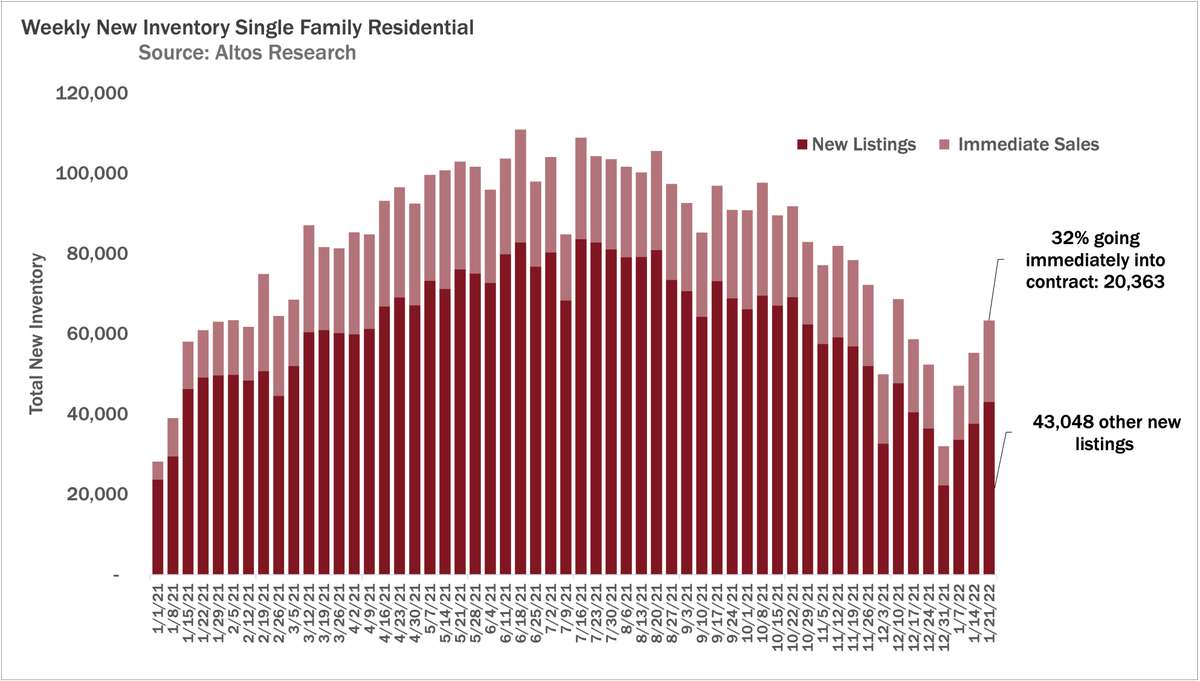

The percentage of new listings that are going into contract essentially immediate is climbing(!) up to 32% this week. Nuts.

2/7

2/7

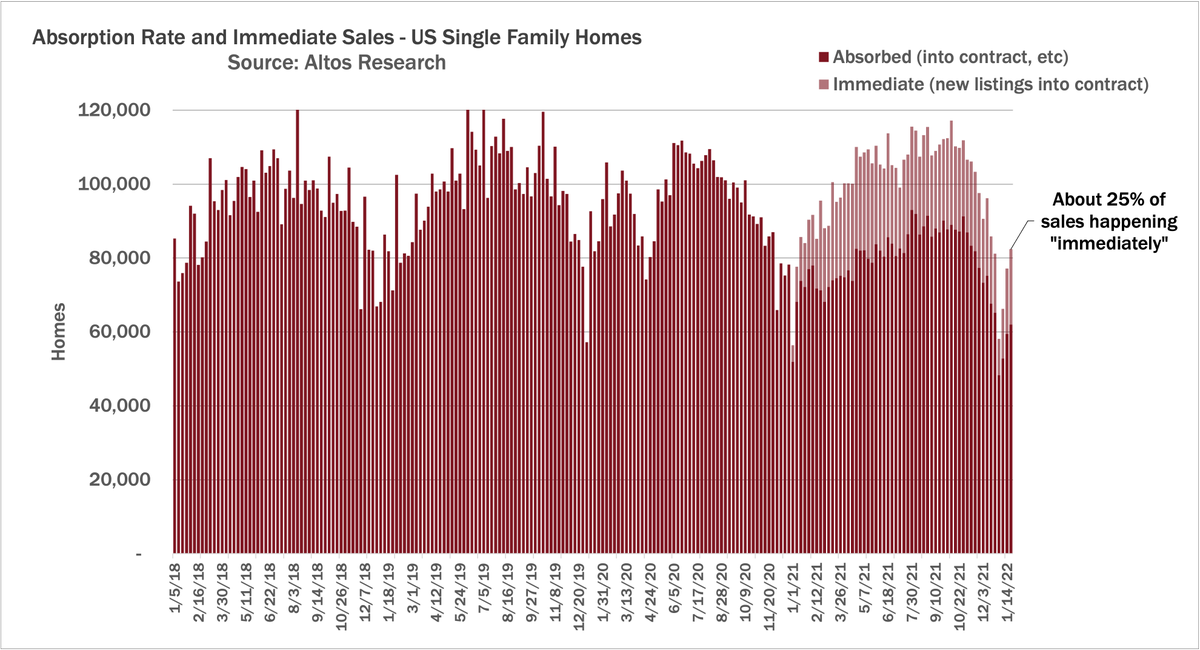

Since those immediate sales are both new inventory AND new sales in the same week, here's the other view. Immediate sales are 25% of all those going into contract this week. (We started tracking immediate sales last year.)

3/7

3/7

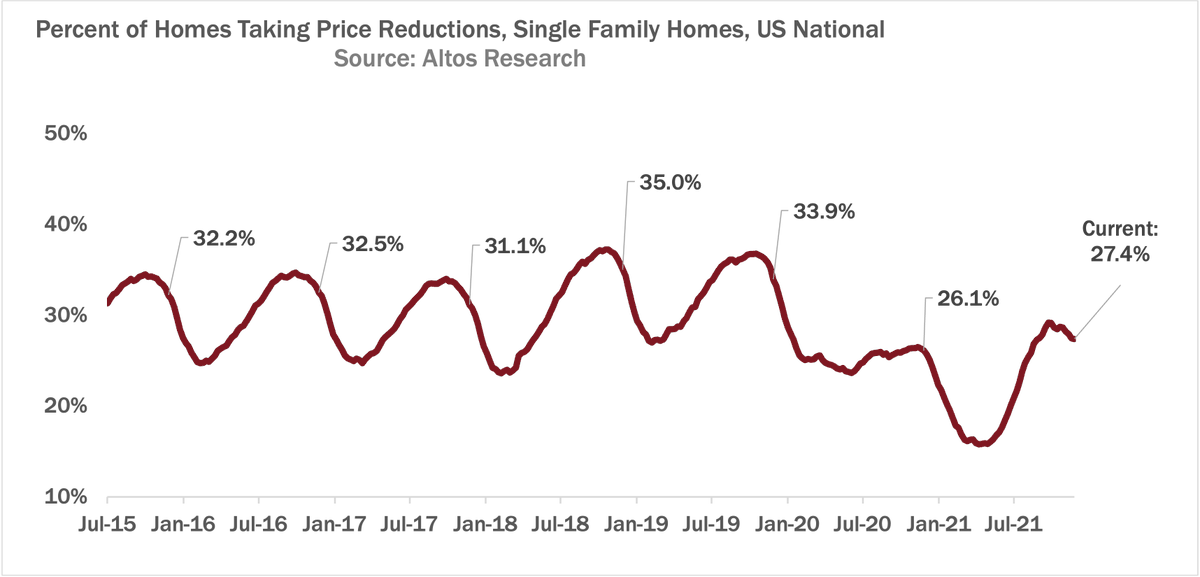

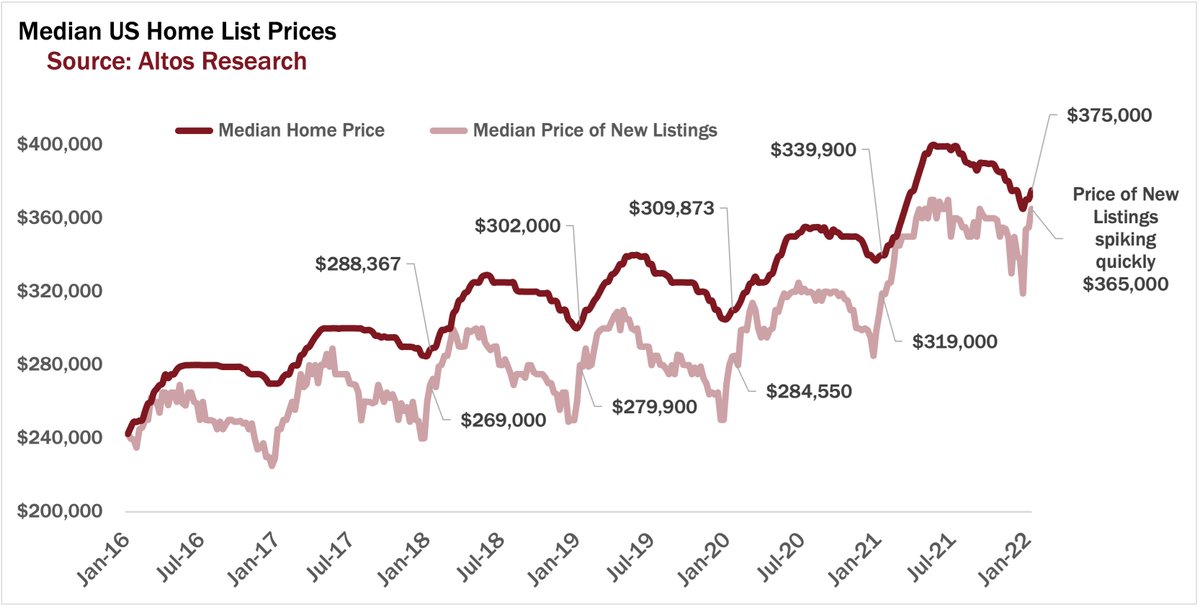

As a result, home prices spiking very quickly already. Median home price is $375,000 in the US this week. The price of the newly listed cohort is spiking even faster, up 2.8% this week. These are sellers communicating what they know about local demand.

4/7

4/7

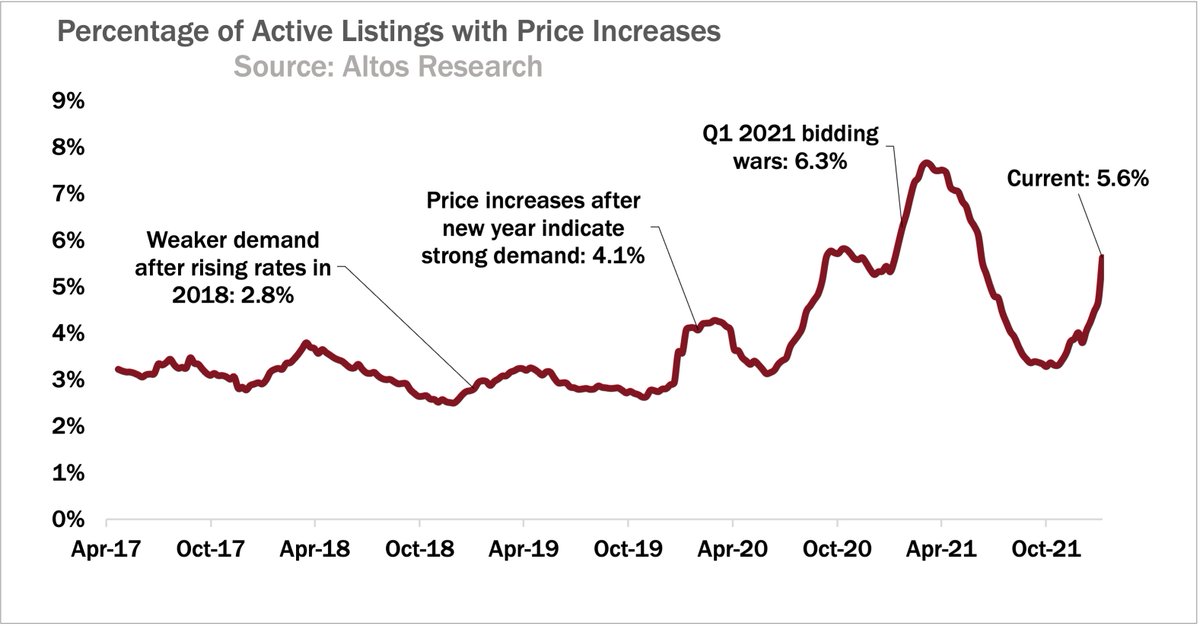

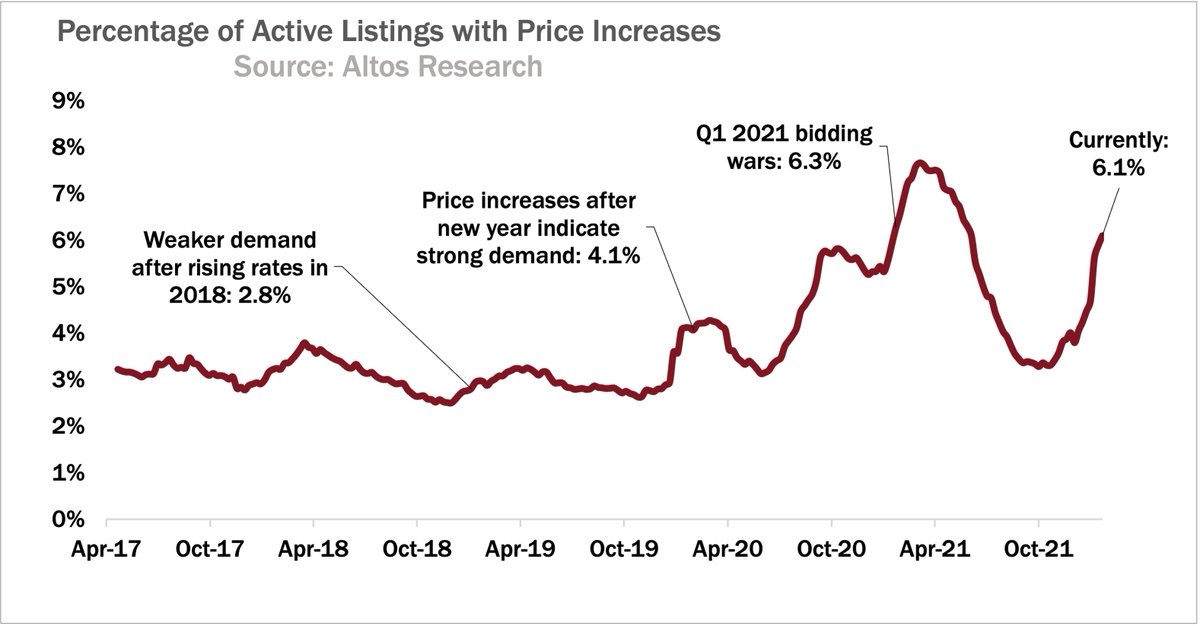

We continue to see the demand in the form of price increases. 6.1% of current listings we saw on the market last fall priced lower. Investors & speculators are leaning into the hot demand. Hopefully macro changes take the some of the steam out of this trend.

5/7

5/7

Keep in mind: home buying is much more driven by life events than by financial events. Marriage, kids, divorce, retirement.

Also - buyers right now locked rates and sold financial assets to raise cash a while ago - at the peak. That bodes well for near-term housing.

6/7

Also - buyers right now locked rates and sold financial assets to raise cash a while ago - at the peak. That bodes well for near-term housing.

6/7

Stock & crypto volatility very much on my mind. Here's how to look for impact in residential real estate.

7/7

7/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh