83/ War is brewing in Europe.

Napoleon, 18thC : The Russians have General Winter.

Brussels, 21st C : The Russians have General Gas. Churn out Heat Pumps! Speed up Home Insulations! ft.com/content/a0dab1…

Napoleon, 18thC : The Russians have General Winter.

Brussels, 21st C : The Russians have General Gas. Churn out Heat Pumps! Speed up Home Insulations! ft.com/content/a0dab1…

https://twitter.com/KateAronoff/status/1486379613848846344

84/ With forecasts of cold weather and a hot war, Energy markets are VOLATILE right now. A wild day in US Gas Markets with prices doubling and then crashing back down. bloomberg.com/news/articles/…

https://twitter.com/SStapczynski/status/1486846496309854213

85/ Texas is facing an Arctic blast this week.

Like last year it could freeze oil and gas production, potentially causing another supply shock. Without heat ppl die in homes. Even without the destabilized Climate, gas is unsafe if regulators are captured bloomberg.com/news/articles/…

Like last year it could freeze oil and gas production, potentially causing another supply shock. Without heat ppl die in homes. Even without the destabilized Climate, gas is unsafe if regulators are captured bloomberg.com/news/articles/…

86/ Scarily like last year. Huge implications for Texas

1) Gas Heating demand surges nonlinearly with every degree colder

2) Cold blast from destabilized Arctic could freeze gas supply and lines

bloomberg.com/news/articles/…

1) Gas Heating demand surges nonlinearly with every degree colder

2) Cold blast from destabilized Arctic could freeze gas supply and lines

bloomberg.com/news/articles/…

https://twitter.com/ScottDuncanWX/status/1488576295688626179

86/ UK energy companies are using the energy crisis to argue "Produce more domestic oil & gas!!"

But 80% of UK energy is exported to highest bidder. Companies want to make money AND prolong addiction to fossil fuels. Thread assets.publishing.service.gov.uk/government/upl…

But 80% of UK energy is exported to highest bidder. Companies want to make money AND prolong addiction to fossil fuels. Thread assets.publishing.service.gov.uk/government/upl…

https://twitter.com/tessakhan/status/1489218406905790465

87/ "Rishi Sunak’s ‘rebate’ won’t stop the energy price hike driving millions into poverty. But there's an alternative: keep the current price cap, levy a windfall tax, & bring failing energy companies into public ownership"

Superb @meadwaj on energy poli

tribunemag.co.uk/2022/02/ofgem-…

Superb @meadwaj on energy poli

tribunemag.co.uk/2022/02/ofgem-…

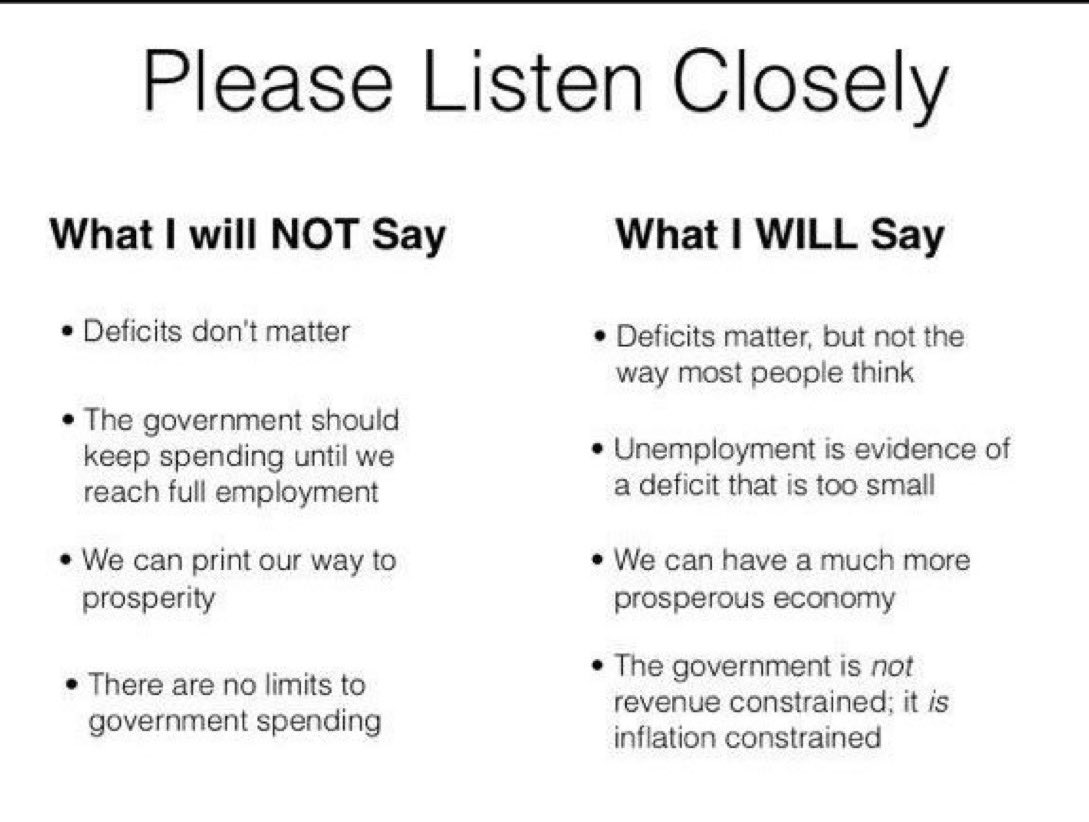

88/ Key in crisis is motivated political actors telling a story of why it happened, who was to blame, and how doing X is going fix it.

In the 1970s US, Europe,Japan began nuclear and domestic coal/gas boom. IN 2021-2 energy crisis, renewables & nuclear?

In the 1970s US, Europe,Japan began nuclear and domestic coal/gas boom. IN 2021-2 energy crisis, renewables & nuclear?

https://twitter.com/ntsafos/status/1492144035166920704

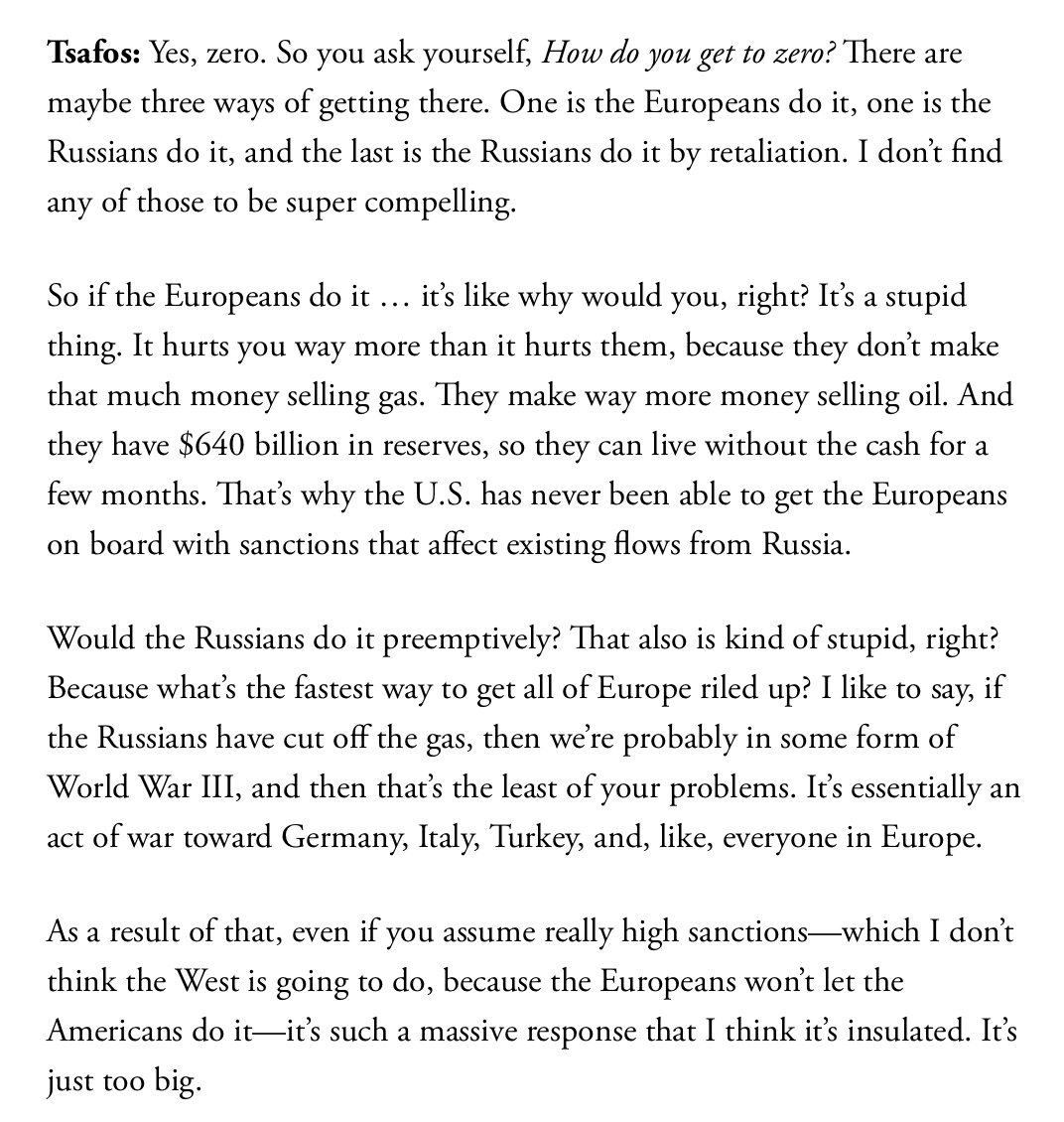

89/ Arab embargo during 1970s Oil crisis raised prices 4 Times. Gas prices in Europe have already soared 8X-10X

Does Applebaum get worldwide disruption to fertilizers, homes, industries in case Europe cuts of Russian gas and gets a hot war in Europe?

Does Applebaum get worldwide disruption to fertilizers, homes, industries in case Europe cuts of Russian gas and gets a hot war in Europe?

https://twitter.com/EmmaMAshford/status/1492858949527392259

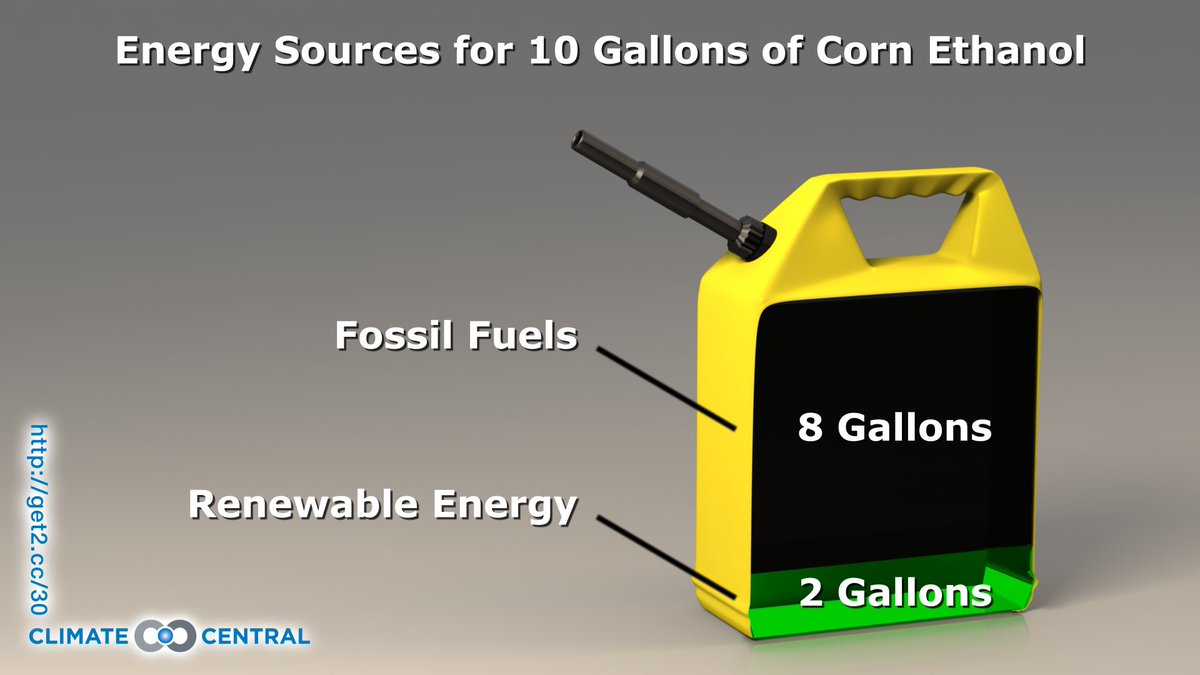

90/ Oh look, the real energy transition -- from Russian Gas to US LNG. Windfall profits for energy companies.

The Ukraine Crisis: Another Chapter in the Russian-American Carbon Rivalry

ht @guy_laron prospect.org/world/ukraine-…

The Ukraine Crisis: Another Chapter in the Russian-American Carbon Rivalry

ht @guy_laron prospect.org/world/ukraine-…

https://twitter.com/StuartLWallace/status/1492902637490085892

91/ The destabilized Polar Vortex smashed Texas unprepared gas grid last year. In response, Utility companies jacked up prices & people will be paying back the cost of gas for up to 25 years in some places!

Sierra Club "Failures of Fossil Fuels" report sc.org/uri

Sierra Club "Failures of Fossil Fuels" report sc.org/uri

92/ "More US natural gas was shipped to Europe in the form of liquified natural gas in January than the amount that flowed through Russian pipelines, making the US a bigger supplier for the first time"

@guy_laron's Russia-US rivalry over Europe energy

cnbc.com/2022/02/16/put…

@guy_laron's Russia-US rivalry over Europe energy

cnbc.com/2022/02/16/put…

93/ Broke: making invasion plans based on Winter and pickup in seasonal gas heating demand

Woke: invasion plans delayed because of cheap spot electricity prices from surging wind.

rae.gr/map-graph/

Woke: invasion plans delayed because of cheap spot electricity prices from surging wind.

rae.gr/map-graph/

https://twitter.com/JavierBlas/status/1495381490099707905

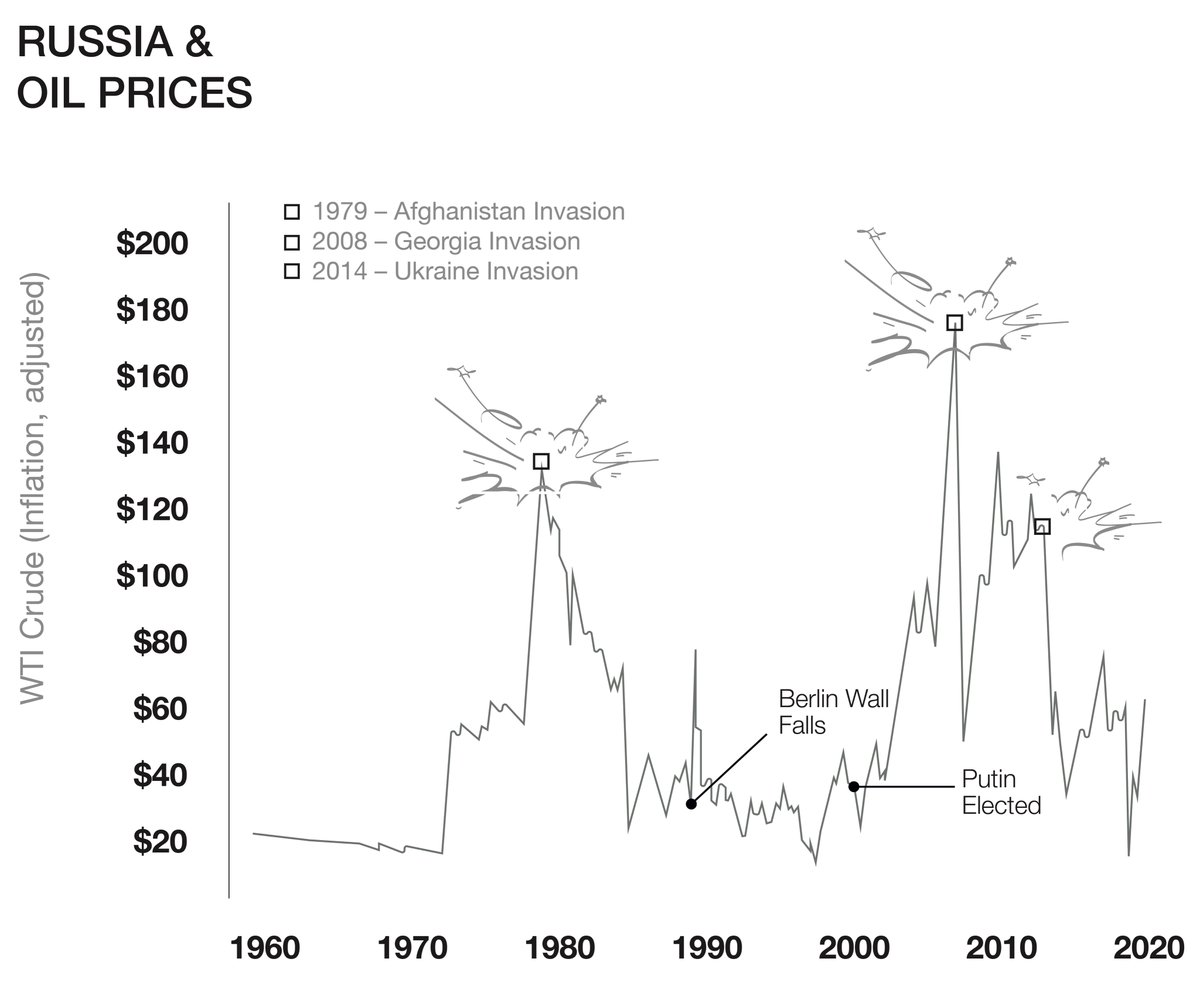

94/ Oil and gas prices have been gyrating wildly with each pronouncement from Russia over the past 6 months. Putin could finance a war entirely from betting on futures market. Ultimate insider information.

https://twitter.com/JavierBlas/status/1496051247564087296

95/ Russia's blunt threats to Germany as #NS2 shelved. US LNG may be temporary winner. But European politicians just as likely to use crisis to massively boost investment into renewables and electrification.

#GeopoliticsOfGHGs euractiv.com/section/energy…

#GeopoliticsOfGHGs euractiv.com/section/energy…

https://twitter.com/MedvedevRussiaE/status/1496112456858574849

96/ 3 months ago, the opportunistic Governor of Texas said "High fuel costs punish middle class families & stoke the supply chain crisis. Texas oil & gas is needed right now".

Now we find he jacked up prices personally!

sc.org/uri

Now we find he jacked up prices personally!

sc.org/uri

https://twitter.com/SawyerHackett/status/1496552139136585730

97/ Russia doesn't just have General Gas but General Winter. Europe had 2 decades to go off gas & into electric. Instead got dilly-dallying & went deeper into gas to heat homes & power industries

Read @ntsafos #GeopoliticsOfGHGs.

theatlantic.com/science/archiv…

Read @ntsafos #GeopoliticsOfGHGs.

theatlantic.com/science/archiv…

https://twitter.com/ntsafos/status/1497619026222239748

98/ Key in crisis is motivated political actors telling a story of why it happened, who was to blame, and how doing X is going fix it.

In the 1970s US, Europe,Japan began nuclear and domestic coal/gas boom.

IN 2021-2 energy crisis, GAS+ MILITARY +GREEN

In the 1970s US, Europe,Japan began nuclear and domestic coal/gas boom.

IN 2021-2 energy crisis, GAS+ MILITARY +GREEN

https://twitter.com/JavierBlas/status/1498994438026280969

99/ Europeans paying 13 TIMES more for gas than US

Its not just Ukraine. Traders speculated on price of Gas over year by betting that

1 Geopolitics: Russia would not supply Europe but Asia

2 Weather: seasonal winter demand would be high in N hemisphere

3 Structure: Low storage

Its not just Ukraine. Traders speculated on price of Gas over year by betting that

1 Geopolitics: Russia would not supply Europe but Asia

2 Weather: seasonal winter demand would be high in N hemisphere

3 Structure: Low storage

100/ Inspiration from topsy-turvy 1970s in energy crisis?

Republican Nixon put speed limit of 50mph on cars to save petrol. Carter raised thermostat.

US pushed other countries for ambitious climate action.

Exxon made solar panels & lithium-ion batteries

Republican Nixon put speed limit of 50mph on cars to save petrol. Carter raised thermostat.

US pushed other countries for ambitious climate action.

Exxon made solar panels & lithium-ion batteries

https://twitter.com/70sBachchan/status/1182084900226129922

101/ 7th March 2022.A day to remember. Energy markets, under stress for more than a year, blows up.

Incoming Sanctions against Russian energy were just the trigger. Everything that could go wrong had been going wrong. brookings.edu/wp-content/upl…

Incoming Sanctions against Russian energy were just the trigger. Everything that could go wrong had been going wrong. brookings.edu/wp-content/upl…

https://twitter.com/JavierBlas/status/1500753868719804423

• • •

Missing some Tweet in this thread? You can try to

force a refresh