Thread: How the world got to $755 billion in energy transition investment in a single year. @BloombergNEF did the math. 1/ bloomberg.com/news/articles/…

2/ Energy transition pulled in $755 billion, a 25% increase over 2020 investment, double what was invested in 2015, and a more than 20-fold increase since 2004. This is deployment money - financing market-ready tech at scale. bloomberg.com/news/articles/…

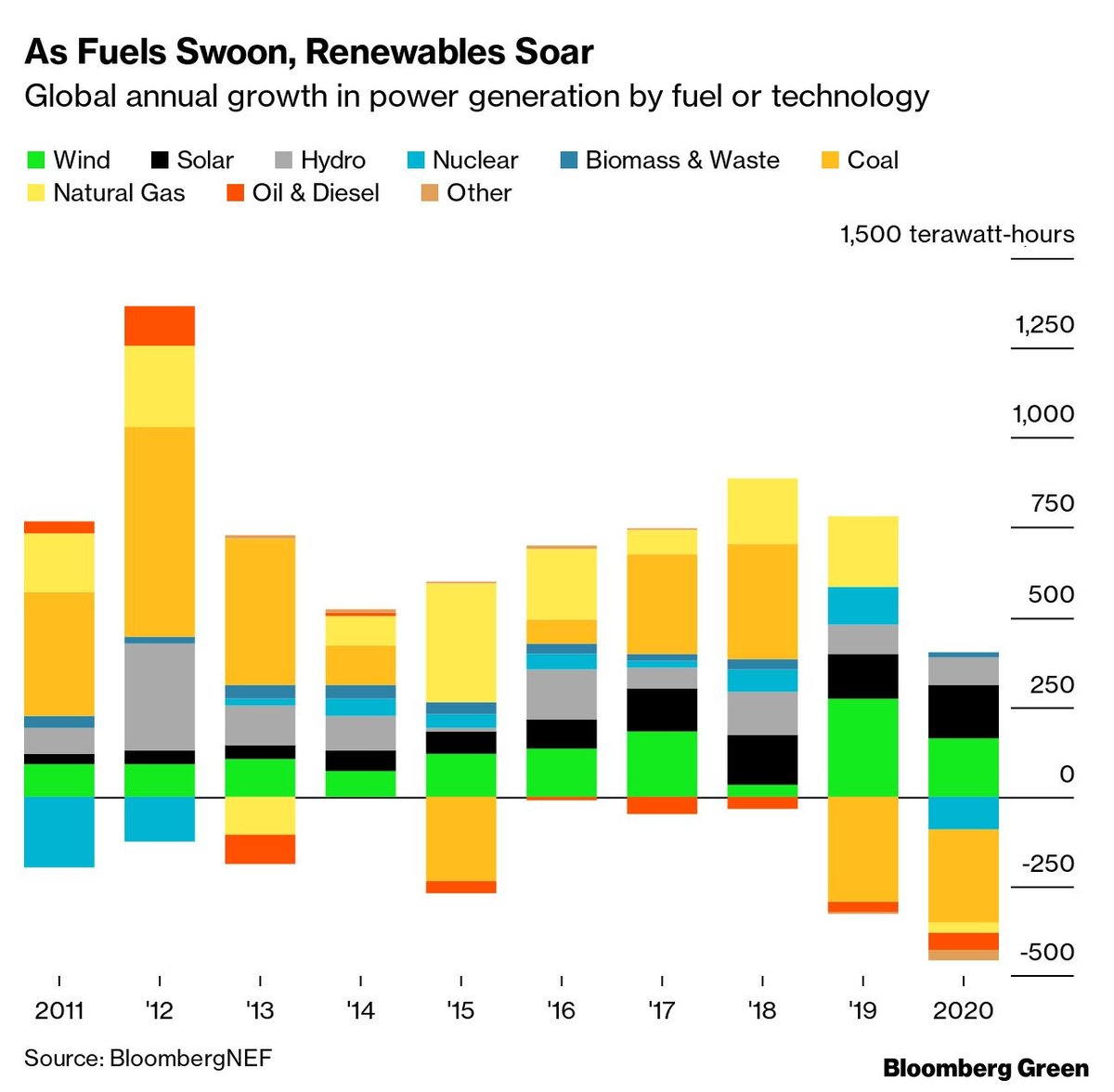

3/ Key: in pure dollar terms, renewable energy is not the growth driver it once was. With $366 billion invested last year, renewable energy is still a driver of investment *volume* (it is still almost 50% of all investment). bloomberg.com/news/articles/…

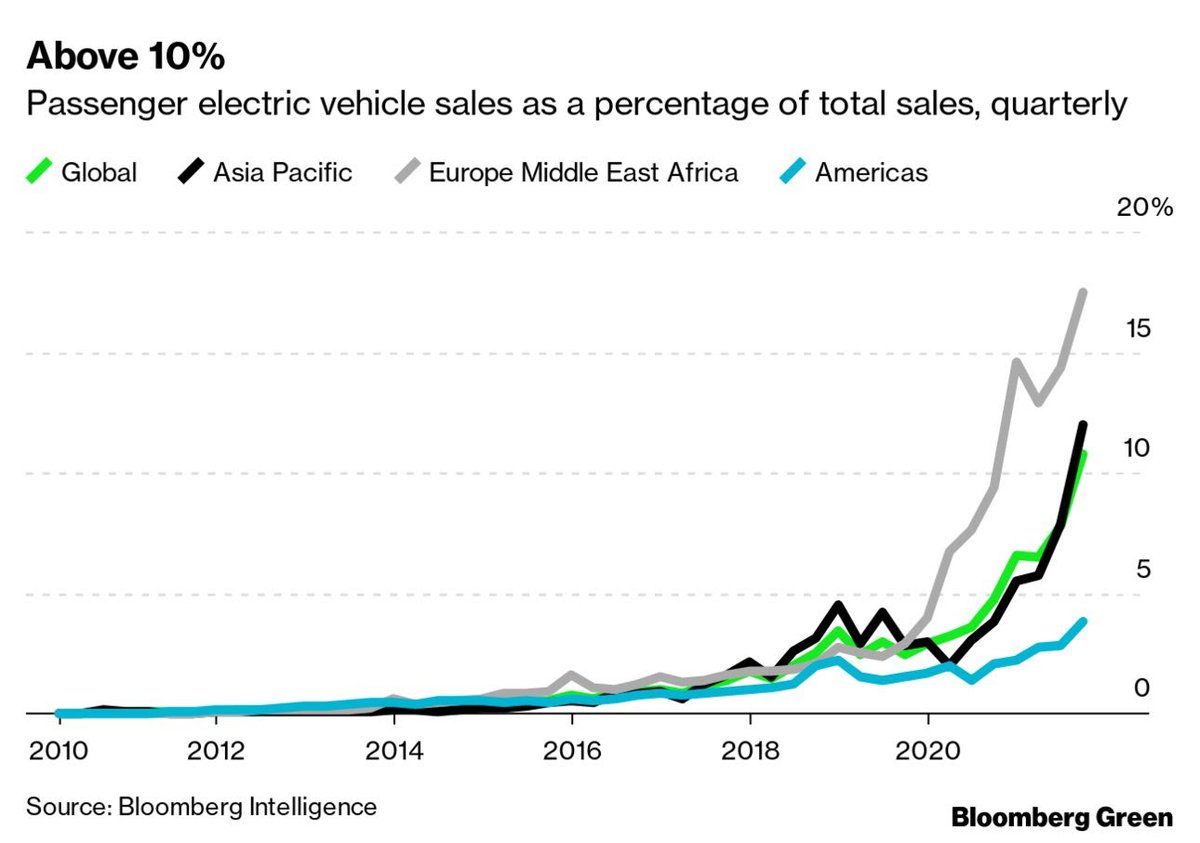

4/ Energy transition investment *growth* comes from electrified transport: $270+ billion last year. bloomberg.com/news/articles/…

5/ Look at these CAGRs: electrified transport is growing 48%, which is exactly 10x the pace of renewable energy (4.8%). For that matter, energy storage is growing at 36%, at which rate dollars invested double in two years. bloomberg.com/news/articles/…

6/ Now: climate tech investment. $165 billion last year, across sectors and asset classes. Here's the first cut, by asset class. The IPO window was wide open with $40 billion in listings, and there were $35 billion of climate tech SPACs. bloomberg.com/news/articles/…

7/ The climate tech PIPE market reached $14 billion last year; secondary share sales topped $21 billion.

8/ But the biggest climate tech asset class?

Venture capital and private equity. $54 billion in 2021.

Transport got 41% of $, energy 27%, but basically every type of endeavor got funded last year (even the buildings sector) bloomberg.com/news/articles/…

Venture capital and private equity. $54 billion in 2021.

Transport got 41% of $, energy 27%, but basically every type of endeavor got funded last year (even the buildings sector) bloomberg.com/news/articles/…

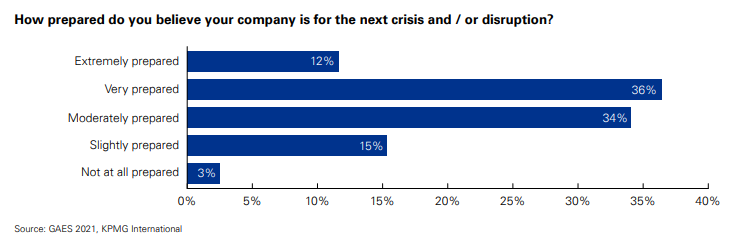

9/ As climate tech companies mature and move from VC and PE dollars to public markets liquidity, their capital needs increase. Making the move from innovation to deployment is not a matter of degree — it is a matter of orders of magnitude. bloomberg.com/news/articles/…

10/ Even if only a fraction of companies supported by last year’s $54 billion in climate tech VC and PE succeed at global scale, their capital needs for deployment will be in the hundreds of billions of dollars. bloomberg.com/news/articles/…

11/ Combine their potential successes with continued incremental growth in renewable energy, and massive growth in electrified transport, and energy transition investment will hit the $1 trillion annual mark quite soon. /end bloomberg.com/news/articles/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh