Does $LUNA have a problem because of the @anchor_protocol ?

Is the whole @terra_money system in danger?

Full Thread 🧵 🧐

Is the whole @terra_money system in danger?

Full Thread 🧵 🧐

@anchor_protocol @terra_money 2.

$LUNA generates value from the growth of the Terra Ecosystem. So the more demand for $UST the more value Luna gets. The protocol which generates the biggest demand for $UST is without a doubt @anchor_protocol with TVL over 10 bln UST.

$LUNA generates value from the growth of the Terra Ecosystem. So the more demand for $UST the more value Luna gets. The protocol which generates the biggest demand for $UST is without a doubt @anchor_protocol with TVL over 10 bln UST.

3.

Let’s start with how the @anchor_protocol works right now. Anchor is a protocol where you can earn on your $UST and you can borrow $UST using your $LUNA or $ETH as collateral.

Let’s start with how the @anchor_protocol works right now. Anchor is a protocol where you can earn on your $UST and you can borrow $UST using your $LUNA or $ETH as collateral.

4.

You can generate a 19.5% yield by depositing your $UST. Yield is generated from the borrower's side: interest rate paid by borrowers + rewards from staking collateral (bLUNA or bETH).

You can generate a 19.5% yield by depositing your $UST. Yield is generated from the borrower's side: interest rate paid by borrowers + rewards from staking collateral (bLUNA or bETH).

5.

If @anchor_protocol earns more than it needs to pay for depositors then additional money is sent to yield reserve. If Anchor doesn't generate enough money, it is being taken from the yield reserve.

CC: @shivsakhuja 🙏

If @anchor_protocol earns more than it needs to pay for depositors then additional money is sent to yield reserve. If Anchor doesn't generate enough money, it is being taken from the yield reserve.

CC: @shivsakhuja 🙏

6.

What’s the problem? In July around 70 mln $UST were deployed to anchor yield reserve with the promise that it's a one time action which will give Anchor time to prepare new collateral types and to add self-sustainable protocols.

What’s the problem? In July around 70 mln $UST were deployed to anchor yield reserve with the promise that it's a one time action which will give Anchor time to prepare new collateral types and to add self-sustainable protocols.

7.

Lastly the yield reserve was going down a lot - $1.5 mln daily, so in less than 30 days there will be no reserve.

Lastly the yield reserve was going down a lot - $1.5 mln daily, so in less than 30 days there will be no reserve.

8.

Lot of this is happening because of the Abracadabra scheme which enabled Degens to generate +100% APY draining Yield Reserve of Anchor. So there’s not enough borrowers to pay for depositors.

Lot of this is happening because of the Abracadabra scheme which enabled Degens to generate +100% APY draining Yield Reserve of Anchor. So there’s not enough borrowers to pay for depositors.

9.

LFG was capitalized by 50 mln of $LUNA. Sounds like @stablekwon wants to add part of this money to the Yield Reserve of Anchor - even 300 mln $. Remember it’s only around 10% of the fund.

LFG was capitalized by 50 mln of $LUNA. Sounds like @stablekwon wants to add part of this money to the Yield Reserve of Anchor - even 300 mln $. Remember it’s only around 10% of the fund.

10.

Few days ago there was an #AMA with the Anchor Team soundcloud.com/profnfa/anchor… During this talk they have revealed more information about Anchor V2.

Few days ago there was an #AMA with the Anchor Team soundcloud.com/profnfa/anchor… During this talk they have revealed more information about Anchor V2.

11.

What is the biggest change? Right now if @anchor_protocol wants to add a new type of collateral it needs around 3 months. After changes it will need three days to add a new type of collateral. So we can assume that more borrowing will come to the protocol.

What is the biggest change? Right now if @anchor_protocol wants to add a new type of collateral it needs around 3 months. After changes it will need three days to add a new type of collateral. So we can assume that more borrowing will come to the protocol.

12.

Still questions remain - whether @anchor_protocol is going to be sustainable? Lastly, a lot of people talk about it feeling they discover SOMETHING NEW.

Still questions remain - whether @anchor_protocol is going to be sustainable? Lastly, a lot of people talk about it feeling they discover SOMETHING NEW.

13.

First of all - there’s NOTHING new about it. @stablekwon and Anchor team fully understand it. So if we know that they are fully aware about the current unsustainability, why don’t they lower the yield for depositors?

12% is also a lot!

(yields on @AaveAave below)

First of all - there’s NOTHING new about it. @stablekwon and Anchor team fully understand it. So if we know that they are fully aware about the current unsustainability, why don’t they lower the yield for depositors?

12% is also a lot!

(yields on @AaveAave below)

14.

Let’s change the perspective and focus on things which Anchor delivers for @terra_money.

If you want to earn 19.5% it forces you to educate yourself on Terra Ecosystem.

Let’s change the perspective and focus on things which Anchor delivers for @terra_money.

If you want to earn 19.5% it forces you to educate yourself on Terra Ecosystem.

15.

If you want to deposit your funds you need to install terra station, and know how to use it. You use it, it’s working, there’s no hack, trust is built. You are acquired - more people in Terra Space.

If you want to deposit your funds you need to install terra station, and know how to use it. You use it, it’s working, there’s no hack, trust is built. You are acquired - more people in Terra Space.

16.

@anchor_protocol was the main factor behind the growth of $LUNA. With growing popularity more devs came to the space. More projects were built. Terra ecosystem grew.

@anchor_protocol was the main factor behind the growth of $LUNA. With growing popularity more devs came to the space. More projects were built. Terra ecosystem grew.

17.

What will happen if Anchor v2 goes cross chain? People from other ecosystems will start to use it: @solana , $Atom, $Dot and others. The user base is going to be even bigger than it is right now. The goal was always to gain mass adoption. Few people understand it.

What will happen if Anchor v2 goes cross chain? People from other ecosystems will start to use it: @solana , $Atom, $Dot and others. The user base is going to be even bigger than it is right now. The goal was always to gain mass adoption. Few people understand it.

18.

Confirmation: listen carefully to the answer to the question asked in 25:35

soundcloud.com/profnfa/anchor…

The most important part is on the transcript below.

Confirmation: listen carefully to the answer to the question asked in 25:35

soundcloud.com/profnfa/anchor…

The most important part is on the transcript below.

19.

Ok, TVL will grow but it’s going to be hard to keep sustainability. What’s then? In my opinion @anchor_protocol will lower their yield, but still yield will be highly competitive.

Ok, TVL will grow but it’s going to be hard to keep sustainability. What’s then? In my opinion @anchor_protocol will lower their yield, but still yield will be highly competitive.

20.

Of course some people will try to search for new places but let’s ask a question: What’s the most important thing about savings? Safety. Even if there will be a protocol with 25% yield on stable coins most people ll' stay on Anchor because new protocols always come with risk.

Of course some people will try to search for new places but let’s ask a question: What’s the most important thing about savings? Safety. Even if there will be a protocol with 25% yield on stable coins most people ll' stay on Anchor because new protocols always come with risk.

21.

Lastly, people ask me if it is possible that Luna will experience the same big drop which has happened in May. You need to understand that $LUNA right now and Luna from May are different because they changed dramatically. So let's go back to the crash which happened in May.

Lastly, people ask me if it is possible that Luna will experience the same big drop which has happened in May. You need to understand that $LUNA right now and Luna from May are different because they changed dramatically. So let's go back to the crash which happened in May.

23.

$LUNA price dropped with the market -> Value of borrower’s collateral dropped so there was a need to add money as collateral -> Borrowers were liquidated meaning their bLuna was sold to $UST -> $LUNA price dropped even more -> Value of…

$LUNA price dropped with the market -> Value of borrower’s collateral dropped so there was a need to add money as collateral -> Borrowers were liquidated meaning their bLuna was sold to $UST -> $LUNA price dropped even more -> Value of…

24.

Max LTV (loan to value ratio) before liquidation was 0.5. Example: if you wanted to borrow 100 UST you should have to deposit 200 ust worth of Luna.

Max LTV (loan to value ratio) before liquidation was 0.5. Example: if you wanted to borrow 100 UST you should have to deposit 200 ust worth of Luna.

25.

So once the price of $LUNA went down by 55% your collateral value was 90 ust worth of Luna so your LTV ratio was 1.11 = you were liquidated. Usually collateral was sold 30% lower than the market price of the Luna.

So once the price of $LUNA went down by 55% your collateral value was 90 ust worth of Luna so your LTV ratio was 1.11 = you were liquidated. Usually collateral was sold 30% lower than the market price of the Luna.

26.

Does this mean that people didn’t have money to save their collateral, because they used everything that they had to borrow?

Does this mean that people didn’t have money to save their collateral, because they used everything that they had to borrow?

27.

There were cases like this, but most of the time before people realized there was a need to save collateral by repaying the loan or adding more as collateral they were already liquidated - it happened too quickly.

There were cases like this, but most of the time before people realized there was a need to save collateral by repaying the loan or adding more as collateral they were already liquidated - it happened too quickly.

What has changed? People are more aware of potential liquidation so they choose to have lower LTV when they borrow. Maximum LTV before liquidation was increased to 0.6. Apps to automatically increase collateral and to repay the debt were created (not native).Kujira built the Orca

28.

@TeamKujira allows users to make liquidation bids. It means that you are able to buy someone’s liquidated collateral cheaper than you would buy $Luna on the market. Also Kujira after you stake 300 tokens give you statistics which helps in navigating the market.

@TeamKujira allows users to make liquidation bids. It means that you are able to buy someone’s liquidated collateral cheaper than you would buy $Luna on the market. Also Kujira after you stake 300 tokens give you statistics which helps in navigating the market.

29.

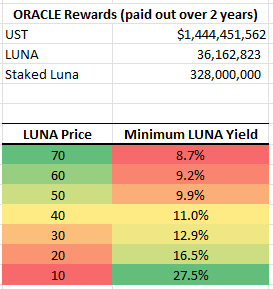

However the single most important change is Oracle Rewards. I’ll make it as simple as it can be. There is a wallet with around 1.5 bln $UST and 33 mln of $Luna. It’s not going to be minted, it’s already there!

However the single most important change is Oracle Rewards. I’ll make it as simple as it can be. There is a wallet with around 1.5 bln $UST and 33 mln of $Luna. It’s not going to be minted, it’s already there!

https://twitter.com/stablekwon/status/1451439483140775938?s=20

30.

For 2 years people who stake Luna are rewarded from this pool in $Luna and $UST. The less $Luna is staked the bigger APY people will get. The more Luna price drops the bigger APY there will be - the more profitable it is to buy and stake Luna.

For 2 years people who stake Luna are rewarded from this pool in $Luna and $UST. The less $Luna is staked the bigger APY people will get. The more Luna price drops the bigger APY there will be - the more profitable it is to buy and stake Luna.

https://twitter.com/MrRefractor/status/1467171813650276367?s=20

31.

Actually because of Oracle Rewards the lower the price the higher the demand for $Luna will be and it should prevent big liquidations.

Actually because of Oracle Rewards the lower the price the higher the demand for $Luna will be and it should prevent big liquidations.

32.

Does this mean the $LUNA price couldn’t go down? It can go down, there’s a lot of things and scenarios which could influence $LUNA price like macro, potential regulations etc.

But don't believe in fairy tales about clicking buttons and shorting.

Respect to all of you.

Does this mean the $LUNA price couldn’t go down? It can go down, there’s a lot of things and scenarios which could influence $LUNA price like macro, potential regulations etc.

But don't believe in fairy tales about clicking buttons and shorting.

Respect to all of you.

• • •

Missing some Tweet in this thread? You can try to

force a refresh