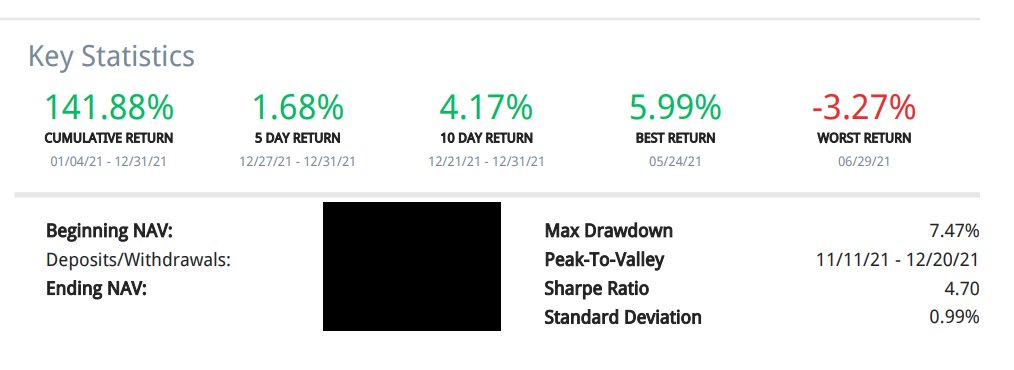

Fleshing this out. $X trades $350mm a day, has a $5bn mkt cap against a $9bn book equity (and $7.5bn tangible book). Depending on your f'casts its prob at 2-3x P/E, but spending most of FCF this yr on capex...

mini thread

mini thread

https://twitter.com/puppyeh1/status/1486856250298036227

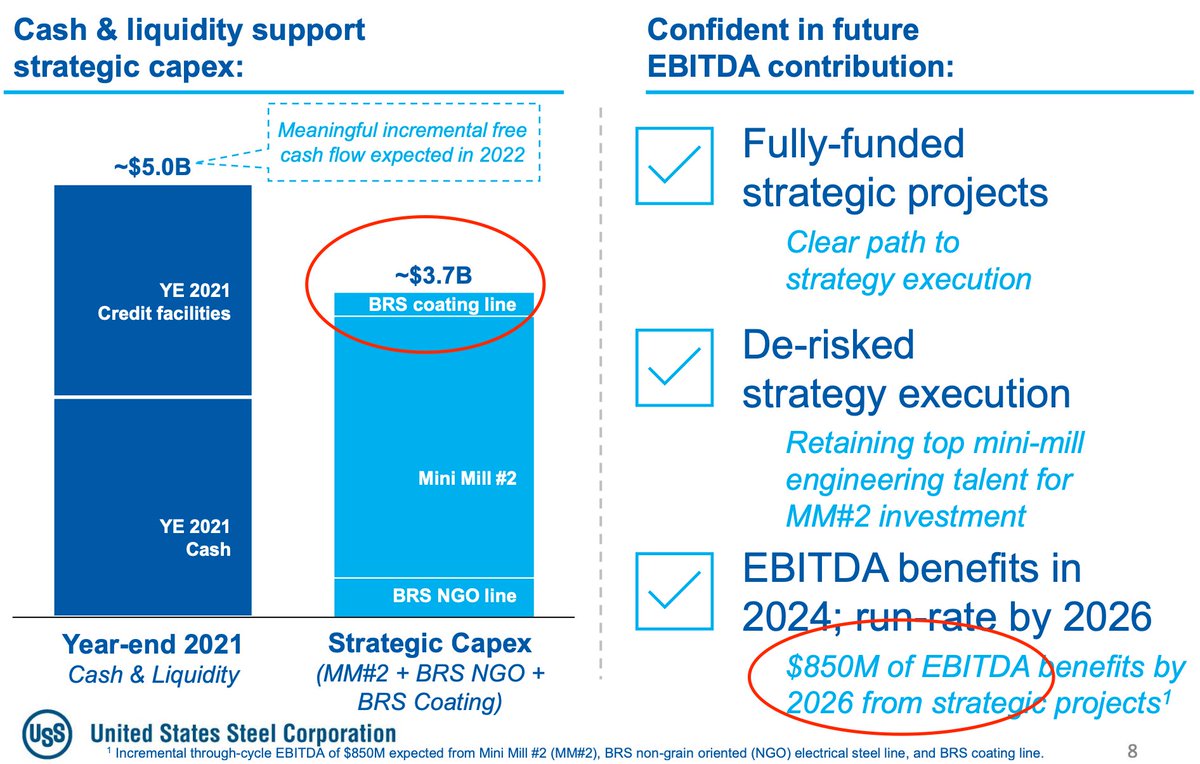

They have a $650mm buyback in place but they are also committed to $3.7bn of capex to generate - apparently- $850mm of incr EBITDA (EBITDA, not net income/FCF) by 2026:

OK so if you're following along mgmt with a 30-50% cost of equity is investing said equity into new projects with a (maybe) 15% ROIC through the cycle. TBD. 🤔

Meanwhile register is TOTALLY open (just some ETFs, no core holders). Stock is stupid liquid. Could easily build $500-1bn position quickly.

Moreover there is a mammoth short position (a lazy one imo):

Moreover there is a mammoth short position (a lazy one imo):

Here's the play. Accumulate big stake. Go public, Ackman style. Demand delay/scaled back capex plan. Point out pitiful returns relative to alternatives (buying equity at 40% CoE guaranteed returns vs 10-15% risky returns thru capex). Demand board discussions, etc...

The shorts will burn badly (hello Dillards?). But more than that - this is self-reflexive, since curtailing supply will moonshot steel pxes (for everyone). Newbuild supply from $X etc is big overhang and why mkt is freaked out right now...

Seriously why isnt this happenin rn?

Seriously why isnt this happenin rn?

Can someone pls get Carl on the phone (or Nelson, or Einhorn). Raper Capital would take a shot if I had a few extra shekels to rub together 😄

This is not investment advice. I am just spitballing (and have no position, but rapidly talking myslef into one).,,

This is not investment advice. I am just spitballing (and have no position, but rapidly talking myslef into one).,,

But it speaks to the insane value in some/many of these cyclical names. There will be strategic outcomes if prices don't correct on their own, I believe. Shorts in this particular case adds a bit of 🌶️to the case.

DYODD 👊👊

DYODD 👊👊

• • •

Missing some Tweet in this thread? You can try to

force a refresh