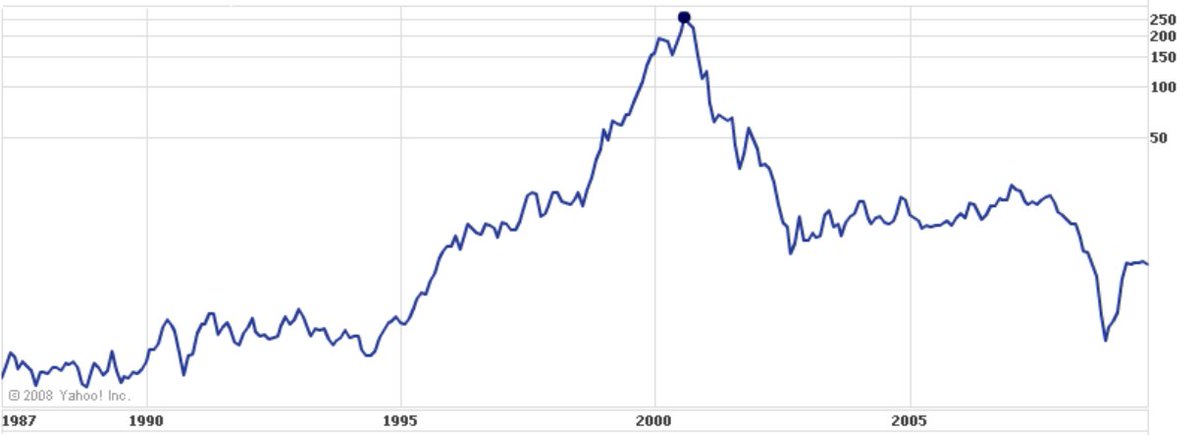

A good reminder of the risks of being involved in speculative manias from the CEO of Sun Microsystems, a company whose stock price went 100x between 1994 and 2000.

Yes, 100x in 6 years.

A short thread on what its CEO Scott McNealy had to say when the bubble burst.

1/6

Yes, 100x in 6 years.

A short thread on what its CEO Scott McNealy had to say when the bubble burst.

1/6

By 2002, the dot-com mania had largely deflated and with it many trillions in ''wealth'' were wiped out.

At an investor gathering in April that year, Scott McNealy gave a glorious short speech that includes his most famous sentence.

''What were you thinking?!?!''

2/6

At an investor gathering in April that year, Scott McNealy gave a glorious short speech that includes his most famous sentence.

''What were you thinking?!?!''

2/6

“At 10x revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends...That assumes I have 0 costs of goods sold, which is very hard for a computer company. That assumes 0 expenses, which is really hard with 39000 employees''

3/6

3/6

''That assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with 0 R&D for the next 10 years, I can maintain the current run rate...Do you realize how ridiculous those basic assumptions are?''

4/6

4/6

''You don’t need any transparency. You don’t need any footnotes.

What were you thinking?!?!”

Powerful short speech, isn't it?

5/6

What were you thinking?!?!”

Powerful short speech, isn't it?

5/6

The major pitfall in this rationale was assuming no earnings growth - Apple is trading at 8x price to sales, but its revenues can easily grow 20%+ in a single year.

Nevertheless, Sun Microsystem CEO's speech serves as a timely reminder: be careful with ''regime changes''.

6/6

Nevertheless, Sun Microsystem CEO's speech serves as a timely reminder: be careful with ''regime changes''.

6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh