Job openings rose to 10.9 million in Dec, again approaching record highs despite the surging Omicron wave.

Even though Omicron is pushing COVID to record levels, employers are hoping that the wave will be temporary & are keeping jobs open for when the wave recedes.

#JOLTS 1/

Even though Omicron is pushing COVID to record levels, employers are hoping that the wave will be temporary & are keeping jobs open for when the wave recedes.

#JOLTS 1/

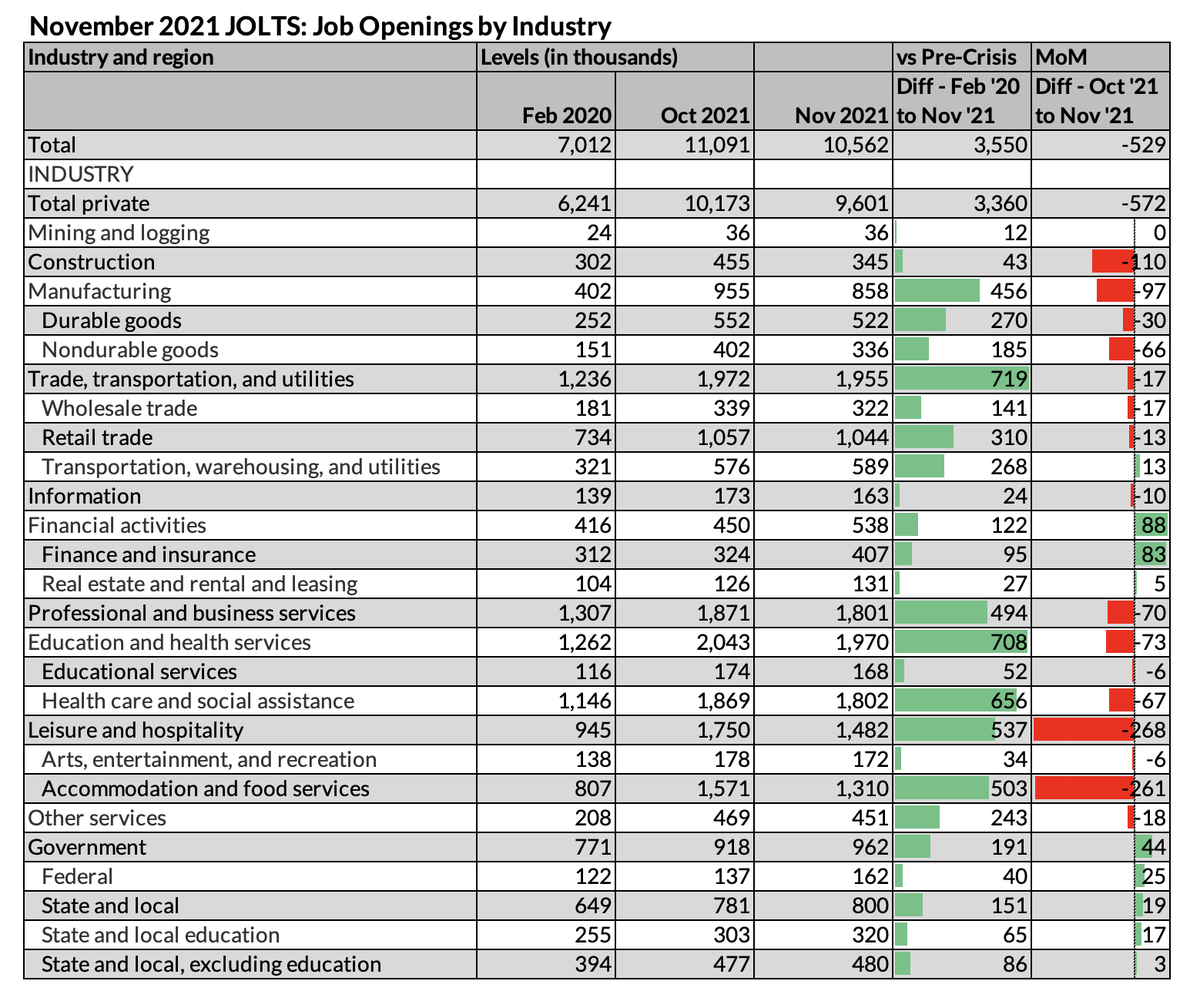

The increase in job openings in Dec was concentrated in accommodation & food services, despite the impact of Omicron. Job openings in the sector are lower than the summer peak of 1.67 million, but still up significantly over the pre-pandemic record of 1.02 million.

#JOLTS 2/

#JOLTS 2/

Quits fell slightly, but still, 4.3 million Americans quit their jobs in December—down only modestly from last month's record highs.

#JOLTS 3/

#JOLTS 3/

The decline in quits was most concentrated in health care and accommodation & food services. A bit of a surprise given that in the past, a rise in COVID cases has tended to push up quits in COVID-sensitive industries.

#JOLTS 4/

#JOLTS 4/

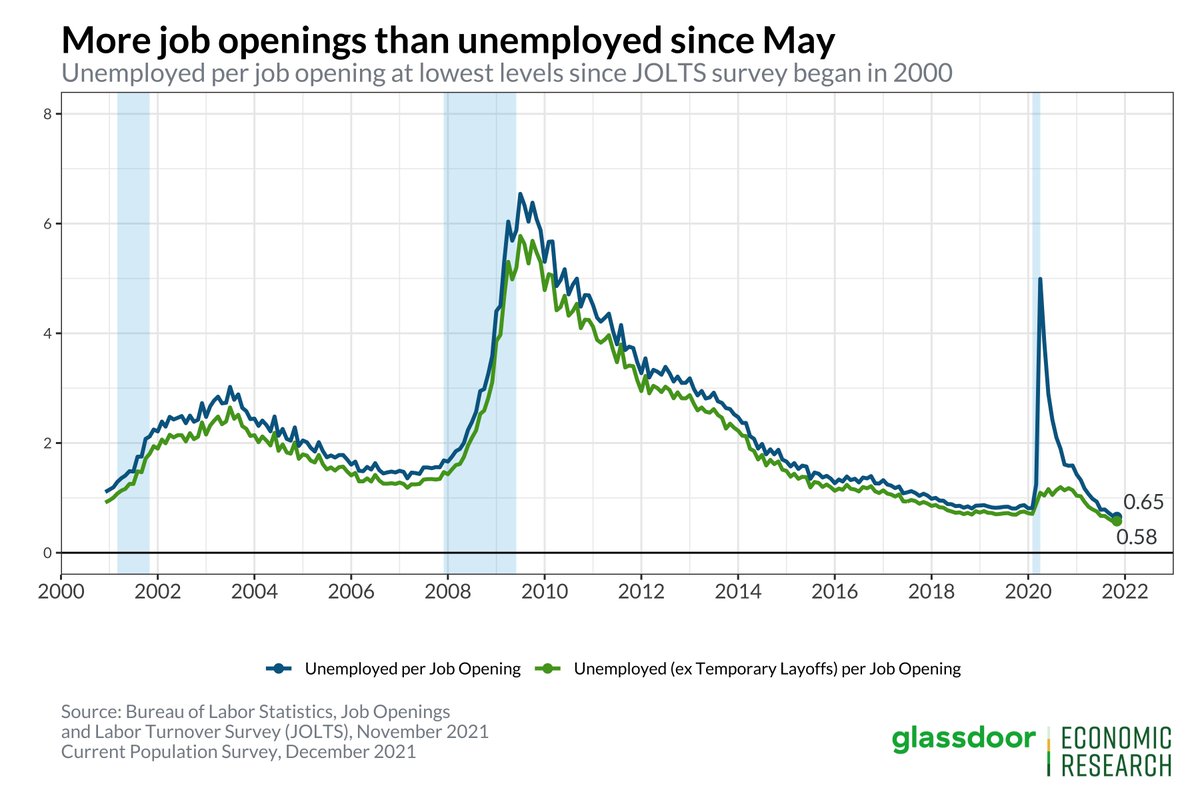

If you exclude temporary layoffs, there were just shy of 2 job openings per unemployed worker in Dec.

Speaks to the scale of the mismatch in the job market: there were 4.6 million more job openings than unemployed workers in Dec (even including temporary layoffs).

#JOLTS 5/

Speaks to the scale of the mismatch in the job market: there were 4.6 million more job openings than unemployed workers in Dec (even including temporary layoffs).

#JOLTS 5/

Quits and openings both fell in December despite Omicron, but both are still elevated. This is a reminder that in part, the "Great Resignation" can be easily explained by the tight job market, where more job opportunities for workers means more turnover.

#JOLTS 6/6

#JOLTS 6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh