This week's Top of Mind podcast from @AltosResearch is a real treat!

I spent an hour with the one and only Bill McBride of @calculatedrisk. Bill's been a premier commentator on the US real estate market for nearly 20 years. Quick thread on the big ideas we covered:

🧵👇

1/5

I spent an hour with the one and only Bill McBride of @calculatedrisk. Bill's been a premier commentator on the US real estate market for nearly 20 years. Quick thread on the big ideas we covered:

🧵👇

1/5

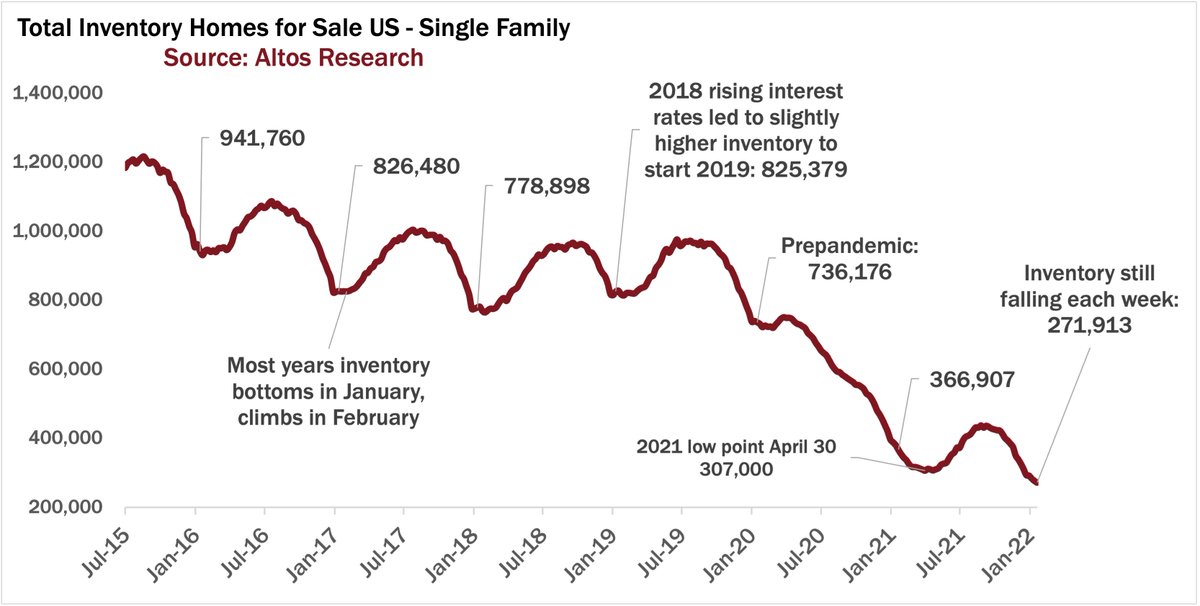

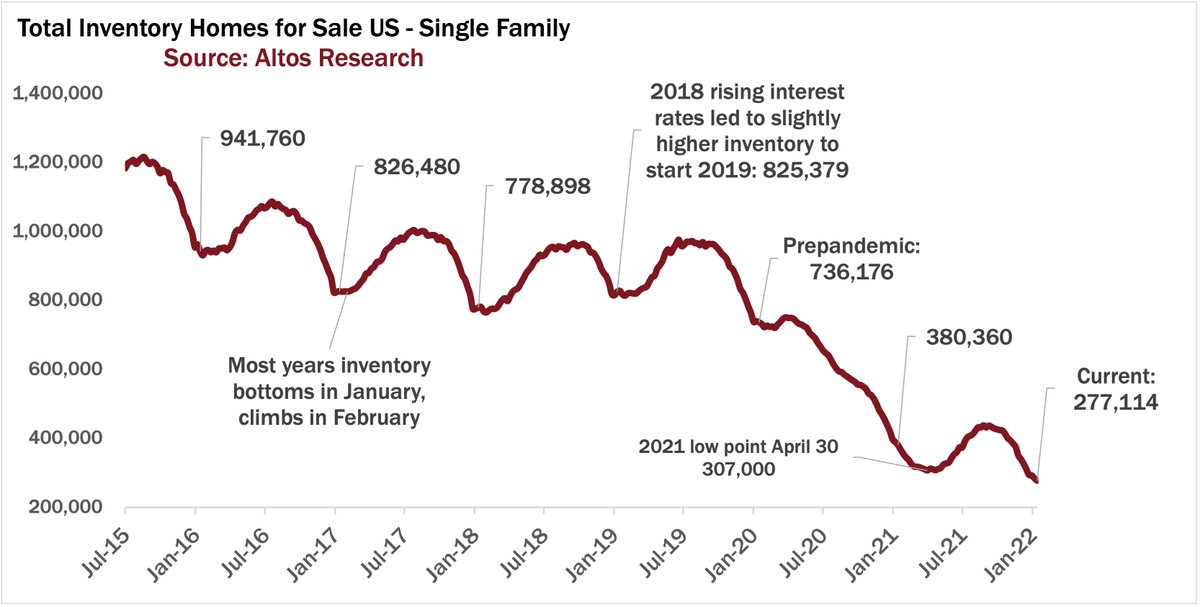

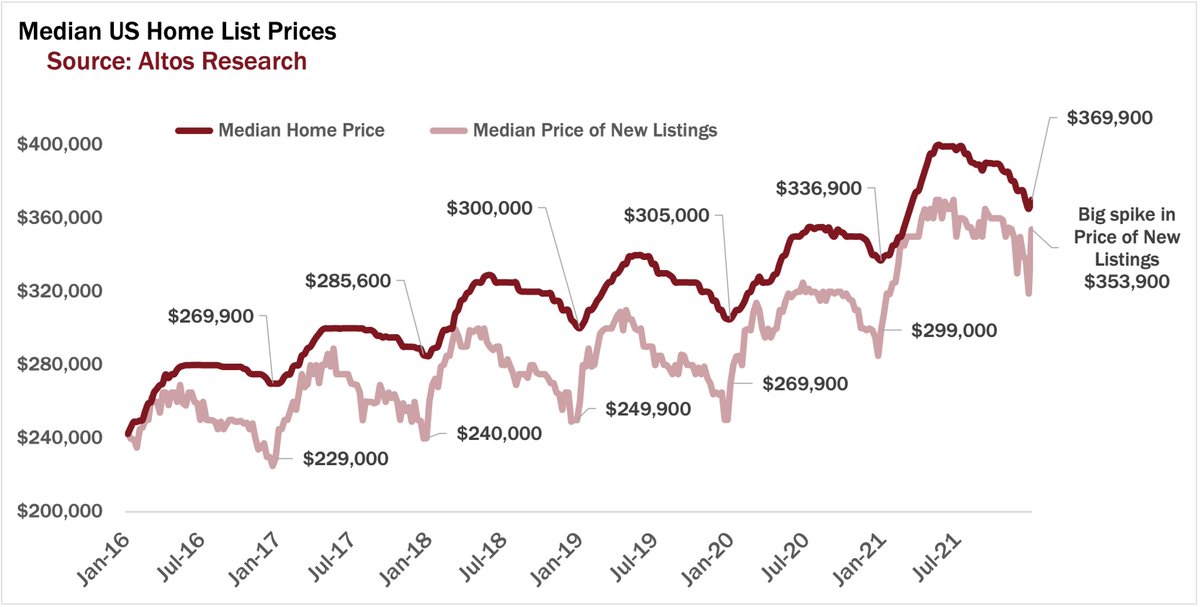

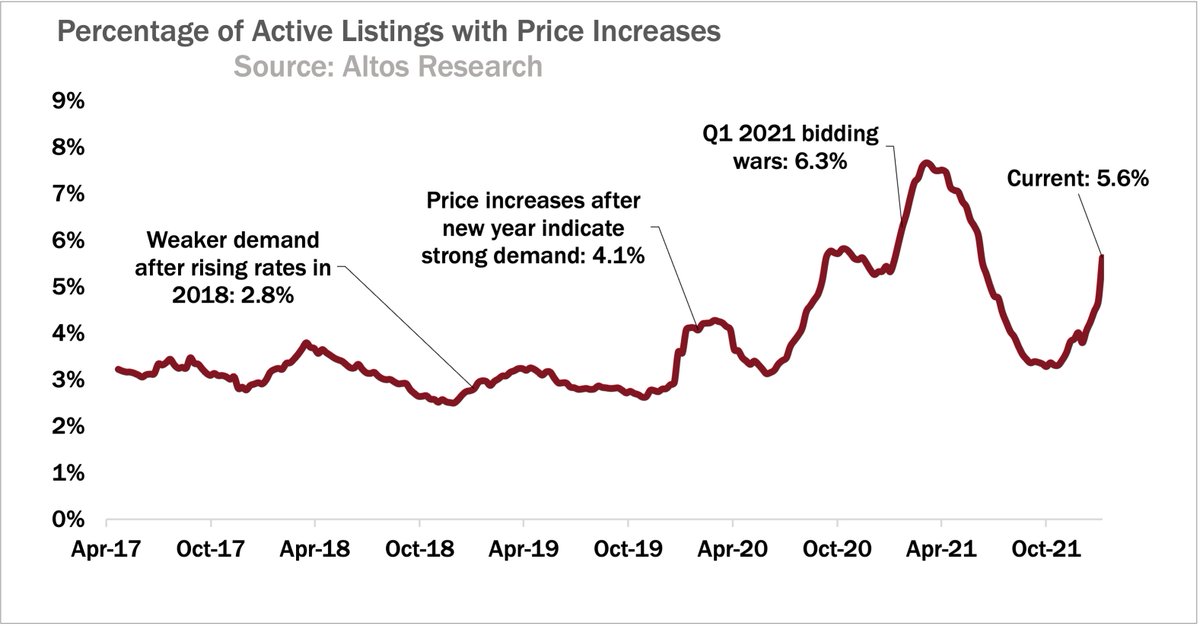

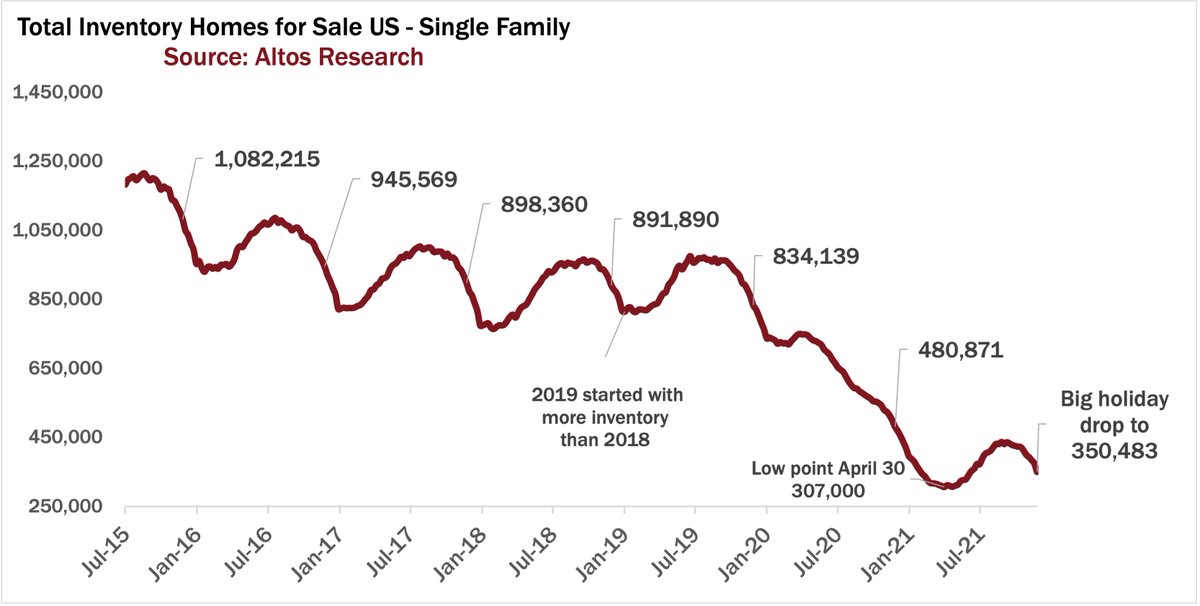

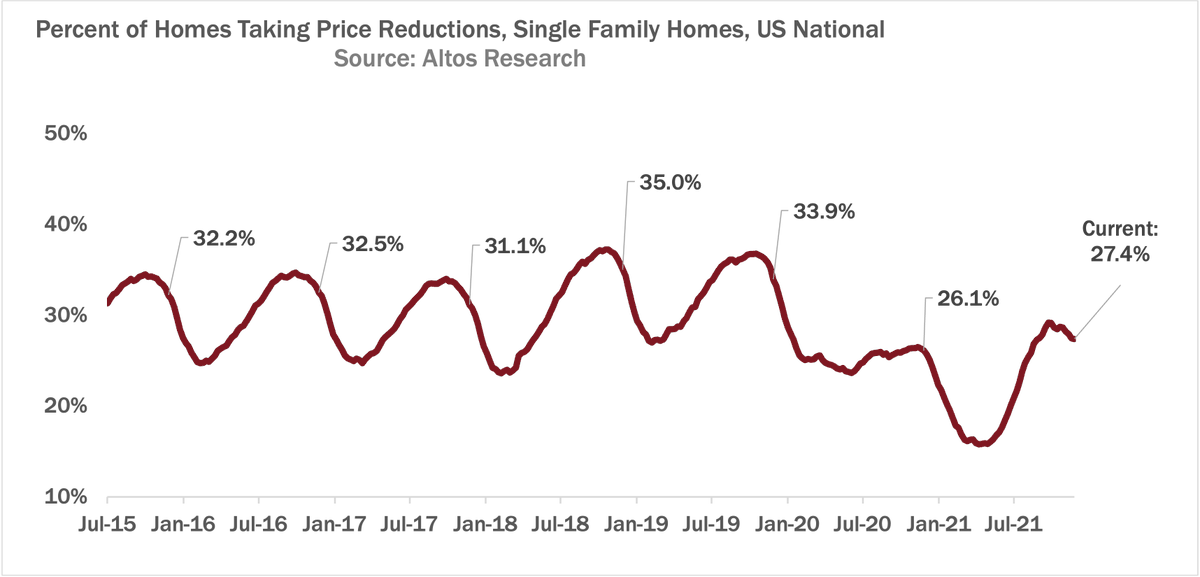

I was peering into Bill's brain to look for risks that might derail this crazy US housing market. What am I missing?

Bill has a great hypothesis on where we should look for risks. Hint: 🏘️🏘️🏘️🏘️

2/5

Bill has a great hypothesis on where we should look for risks. Hint: 🏘️🏘️🏘️🏘️

2/5

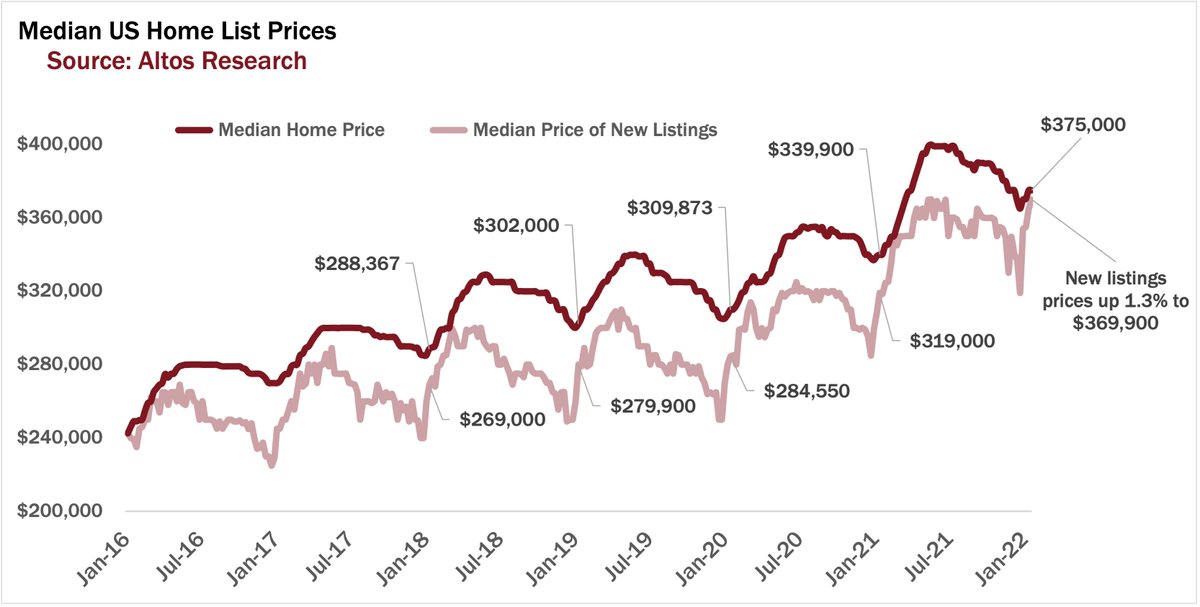

We talked demographics. Bill has been trying to show us for 10 years, the coming Millennial wave. It's why household formation is spiking.

Bill gives us a great framework for planning the next decade of demographics in US real estate. The Next Big Shift.

👶-->👴

3/5

Bill gives us a great framework for planning the next decade of demographics in US real estate. The Next Big Shift.

👶-->👴

3/5

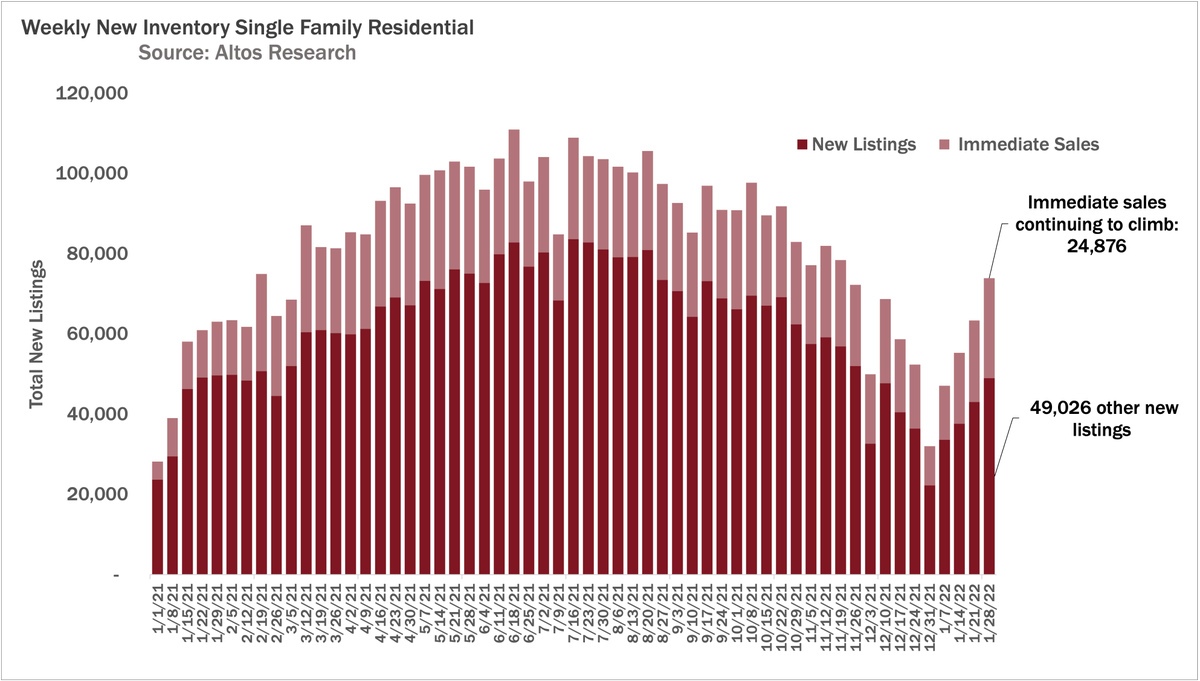

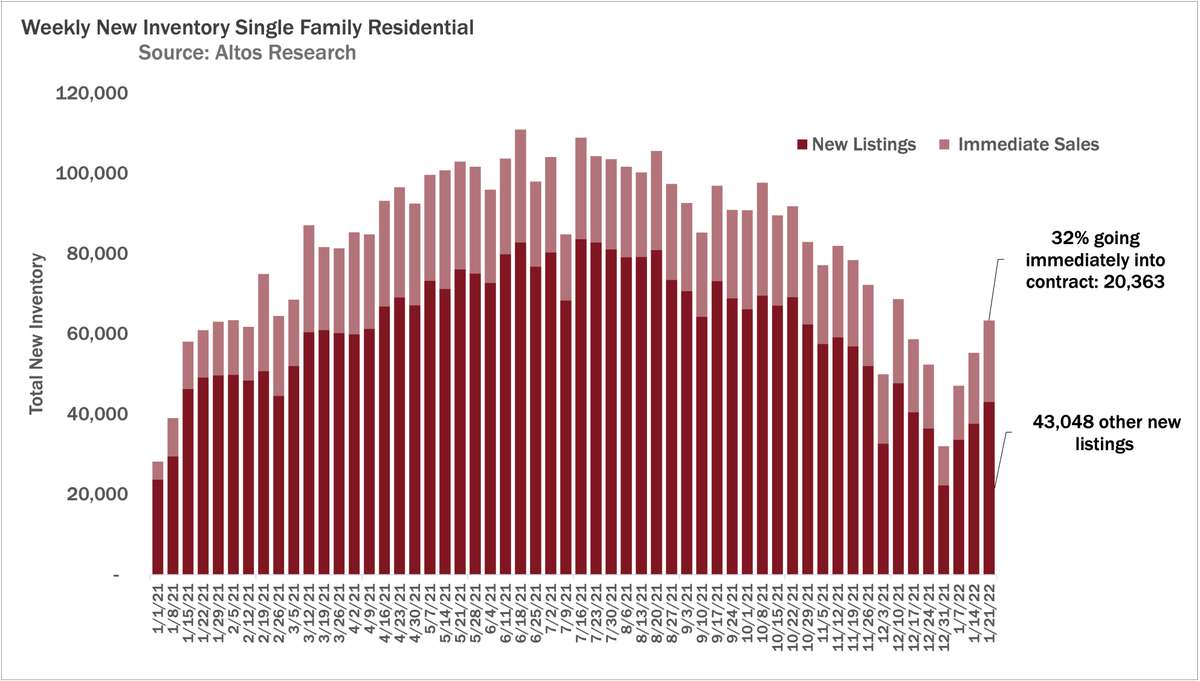

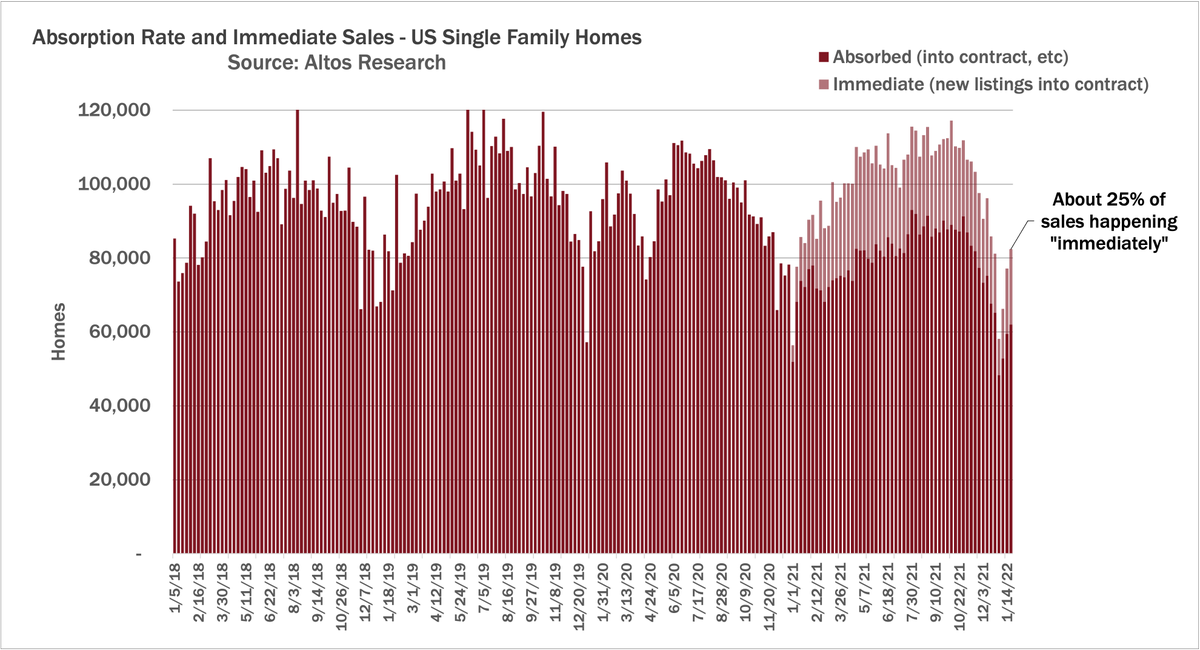

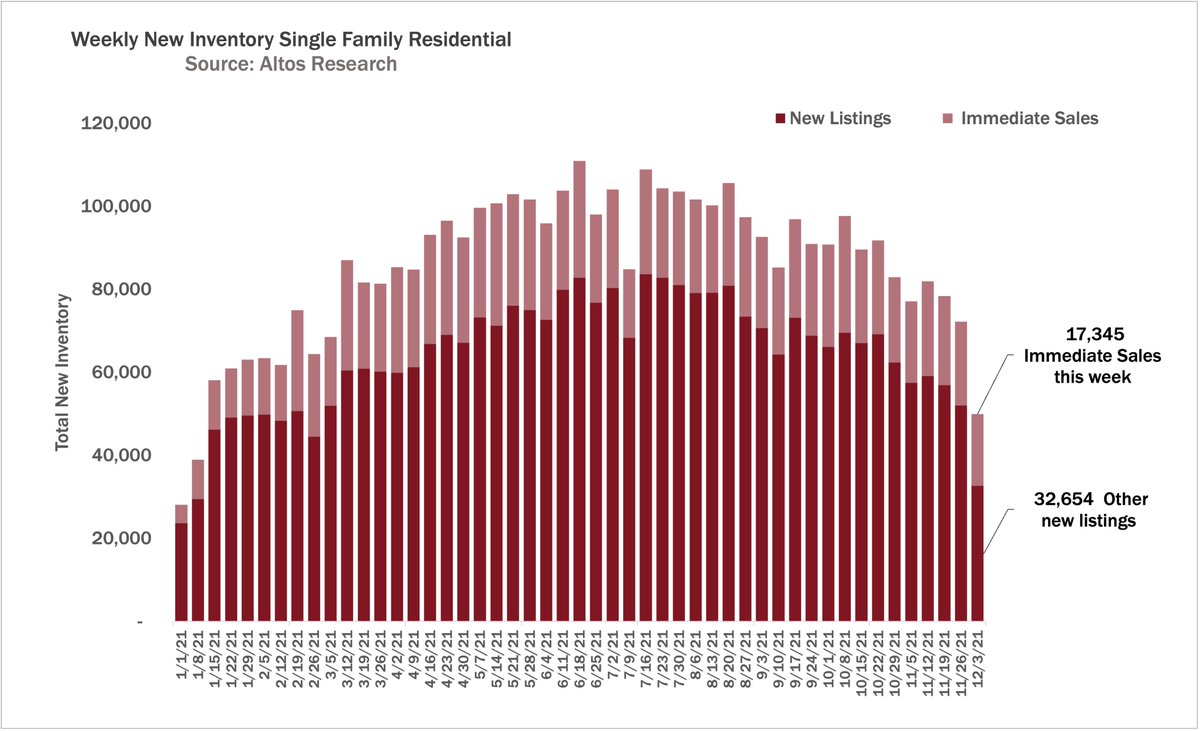

We talked about the "immediate sales" phenomenon and pocket listings and the impact on the consumer.

💸💸💸

4/5

💸💸💸

4/5

Full transcript plus all the links to your favorite podcast apps are on the Altos blog.

Don't miss the inimitable, Bill McBride @calculatedrisk on this week's Top of Mind podcast!

blog.altosresearch.com/looking-for-ri…

Don't miss the inimitable, Bill McBride @calculatedrisk on this week's Top of Mind podcast!

blog.altosresearch.com/looking-for-ri…

• • •

Missing some Tweet in this thread? You can try to

force a refresh