Took me a while to gather thoughts but here we go. I think Calumet Specialty, $CLMT, is one of the better asymmetric special sits plays for 2022/23 left amongst US listed SMID stocks.

Grap a cup of absinthe 😄 and read 👇 to find out why

(DYODD. Not investment advice) 🙏

Grap a cup of absinthe 😄 and read 👇 to find out why

(DYODD. Not investment advice) 🙏

https://twitter.com/puppyeh1/status/1487607135982604289

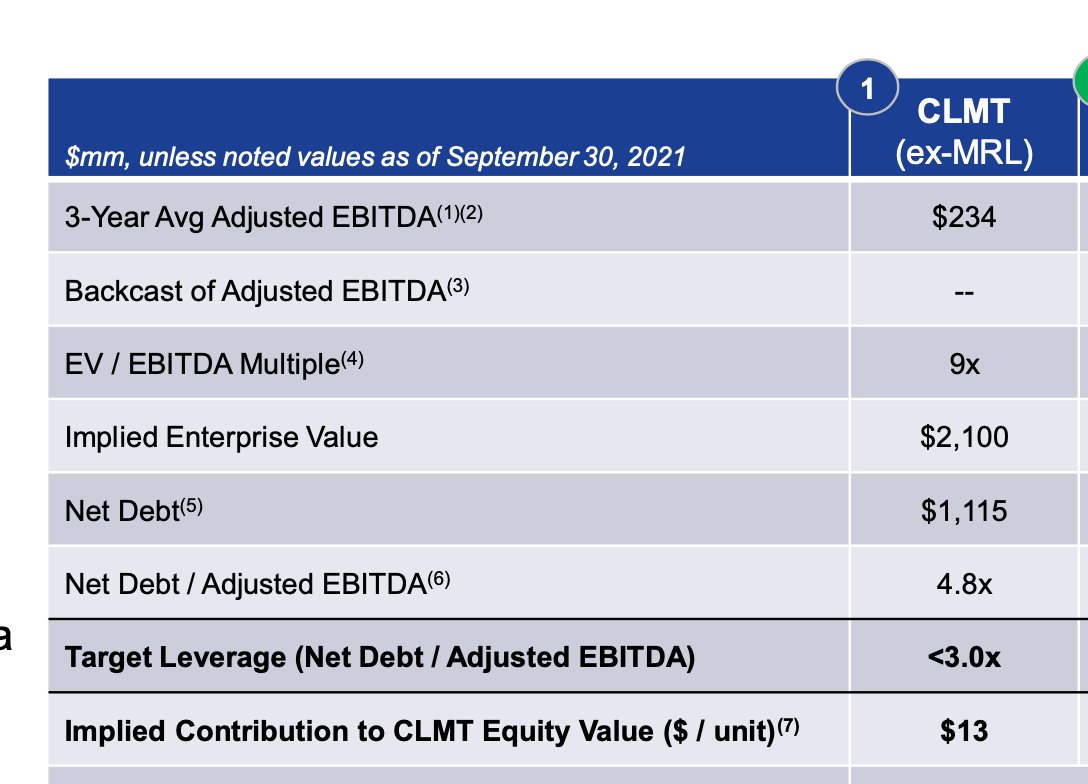

In general I think it makes most sense to throw big $$ at situations where you have not just fundamental inflection but also 'technical' inflection. In other words when not only the mkt is seeing better numbers but also when more, new players can actually buy the stock...

...and in this vein $CLMT is basically a dual threat. Not only is it a typical 'good co/bad co' spin/unlock likely to happen near term; it also checks all the boxes for a whole host of new 💰 to look at the name. Moreover it is coming from a busted structure as well...

...that is, a non-div paying, levered, MLP so the historical investor base able to look at it should go up exponentially as this transition proceeds.

Should mention here - this is a levered equity stub w/ a good deal of beta to the economy, so this is big boy pants only pls 👊

Should mention here - this is a levered equity stub w/ a good deal of beta to the economy, so this is big boy pants only pls 👊

OK so what is $CLMT and why is it interesting?

Historically a 💩 of a biz (and equity), today $CLMT is basically four businesses: a legacy spec chems inputs biz ('Specialty Products & Solutions'); a consumer-facing branded lubricants biz ('Performance Brands')...

Historically a 💩 of a biz (and equity), today $CLMT is basically four businesses: a legacy spec chems inputs biz ('Specialty Products & Solutions'); a consumer-facing branded lubricants biz ('Performance Brands')...

...a residual refining biz producing mostly asphalt cut ('Montana Specialty Asphalt'); and the new jewel, a renewable diesel biz under construction but ramping to operation in 2H'22 ('Montana Renewables').

Will spend a few moments on the legacy stuff now...

Will spend a few moments on the legacy stuff now...

...but most of juice/sex appeal is in the renewable diesel value unlock so these will be high level comments only.

You can look at $CLMT investor deck to get a sense of what the legacy spec chem inputs + branded biz + Montana Asphalt did historically:

You can look at $CLMT investor deck to get a sense of what the legacy spec chem inputs + branded biz + Montana Asphalt did historically:

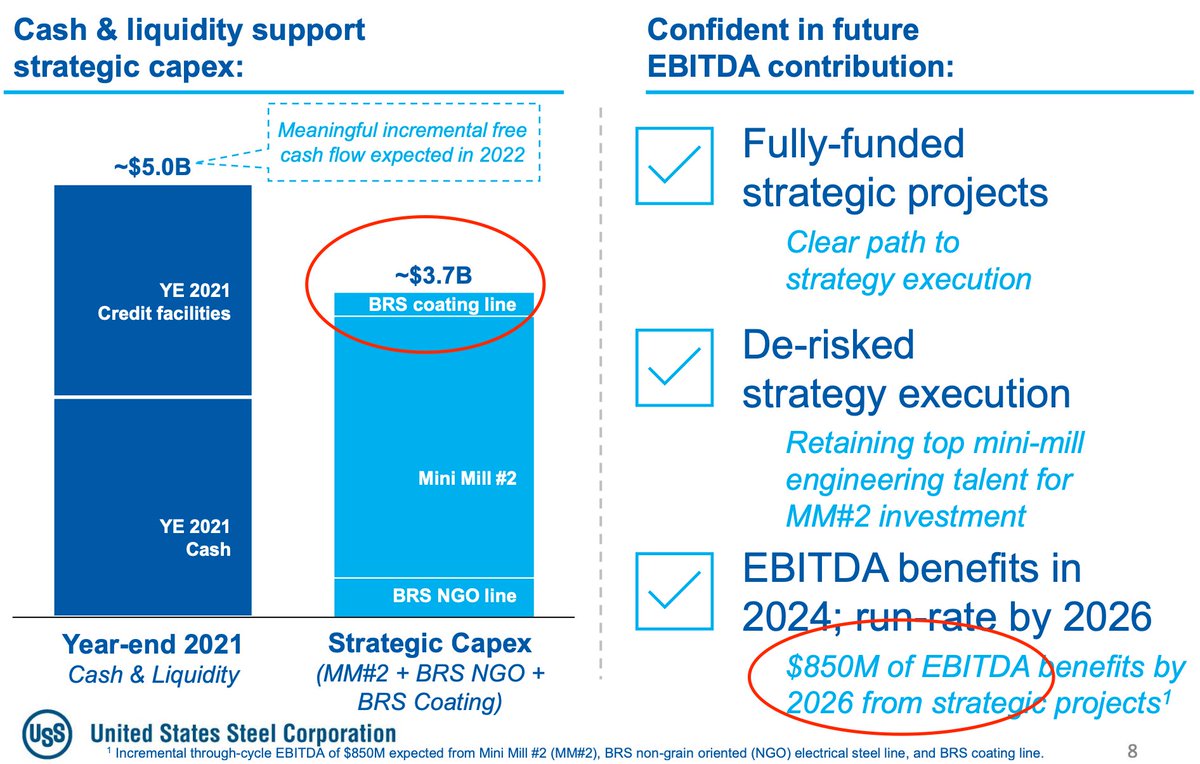

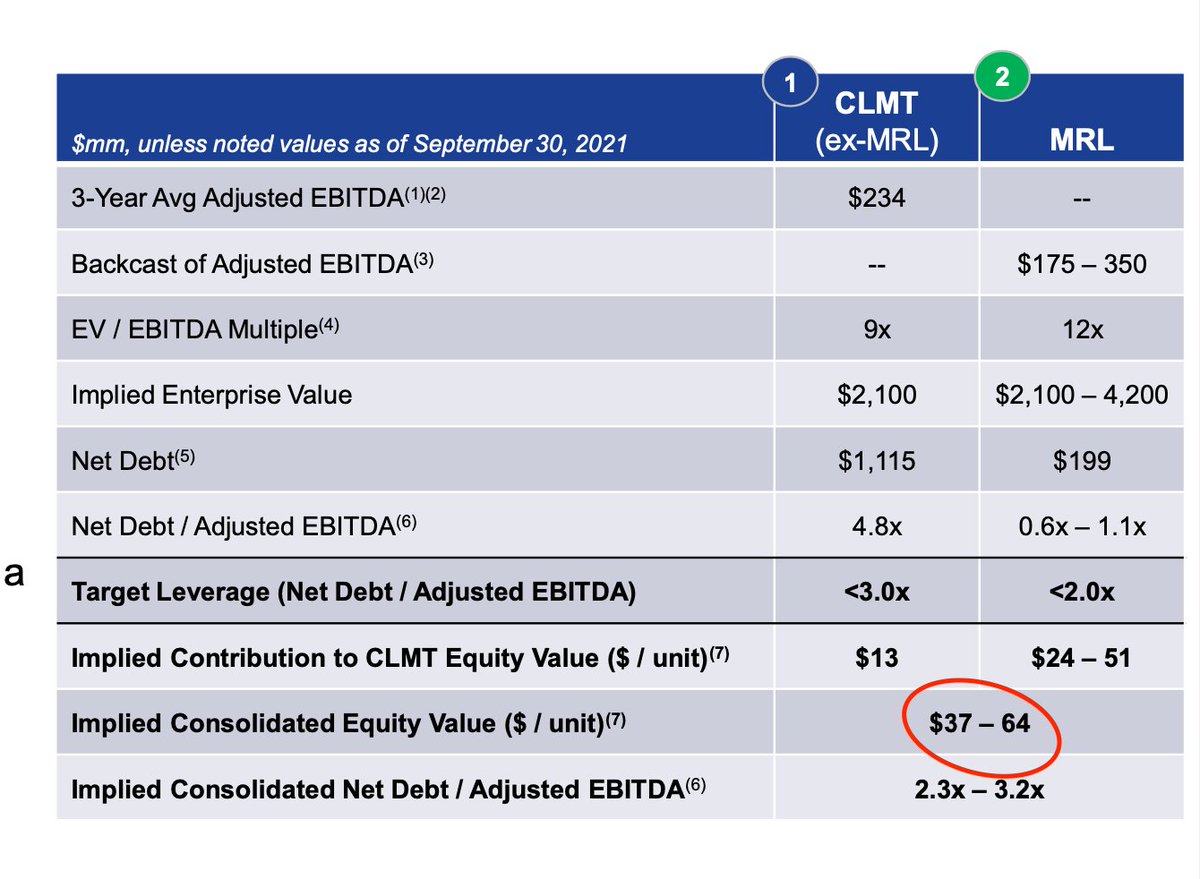

You can see mgmt is pencilling in ~$230mm in EBITDA in a 'normalized' yr for what remains ex the renewables biz and slapping a 9x multiple on it (we can debate both these nos).

High-level takeaway tho is w/ stock at $14 today they are arguing basically nothing is pxed in for MR.

High-level takeaway tho is w/ stock at $14 today they are arguing basically nothing is pxed in for MR.

In reality we should be more punitive. $CLMT has been on a strong run in 2021, largely due to MR story unfolding and '21 was a poor yr for most of their other segments. They got dinged (and still suffer) from supply chain issues in Performance Brands...

...and Polar Vortex hurt them bigly too.

But I would quibble w the right multiple to put on pieces of this biz. Performance Brands is a real jewel - three best-in-breed consumer facing lubricant brands, would def command a double-digit EBITDA multiple - no prob there...

But I would quibble w the right multiple to put on pieces of this biz. Performance Brands is a real jewel - three best-in-breed consumer facing lubricant brands, would def command a double-digit EBITDA multiple - no prob there...

normalized EBITDA there (w/ nothing for low-hanging growth investments) is prob $50-60mm, hence $500-700mm is defensible for this segment.

But the other legacy pieces are tougher to value. Montana Asphalt is basically a vanilla refining asset that relies on the WCS/WTI spread...

But the other legacy pieces are tougher to value. Montana Asphalt is basically a vanilla refining asset that relies on the WCS/WTI spread...

...which has tightened a lot (given overall rally in crude) , neg affecting profitability. the asset has a high asphalt cut and should be a beneficiary of infra demand/etc given this but you would still think a low multiple (4x?) on something like $40-45mm of EBITDA gets you...

$160-180mm of value. That leaves Specialty Products, which is somewhere between spec chems (high multiple) and commodity chems (low multiple) w a high degree of econ sensitivity and limited disclosures around how good a biz it actually is 🤔

At 6x this segment is worth something like $800-850mm meaning all up - before the Renewables biz - I have the three 'bad co' pieces at ~$1.6bn vs an all-in EV today of ~$2.25bn ($1.1bn equity ref $14, $1.15bn net debt at $CLMT).

So the mkt is pricing renewables at ~$650mm...

So the mkt is pricing renewables at ~$650mm...

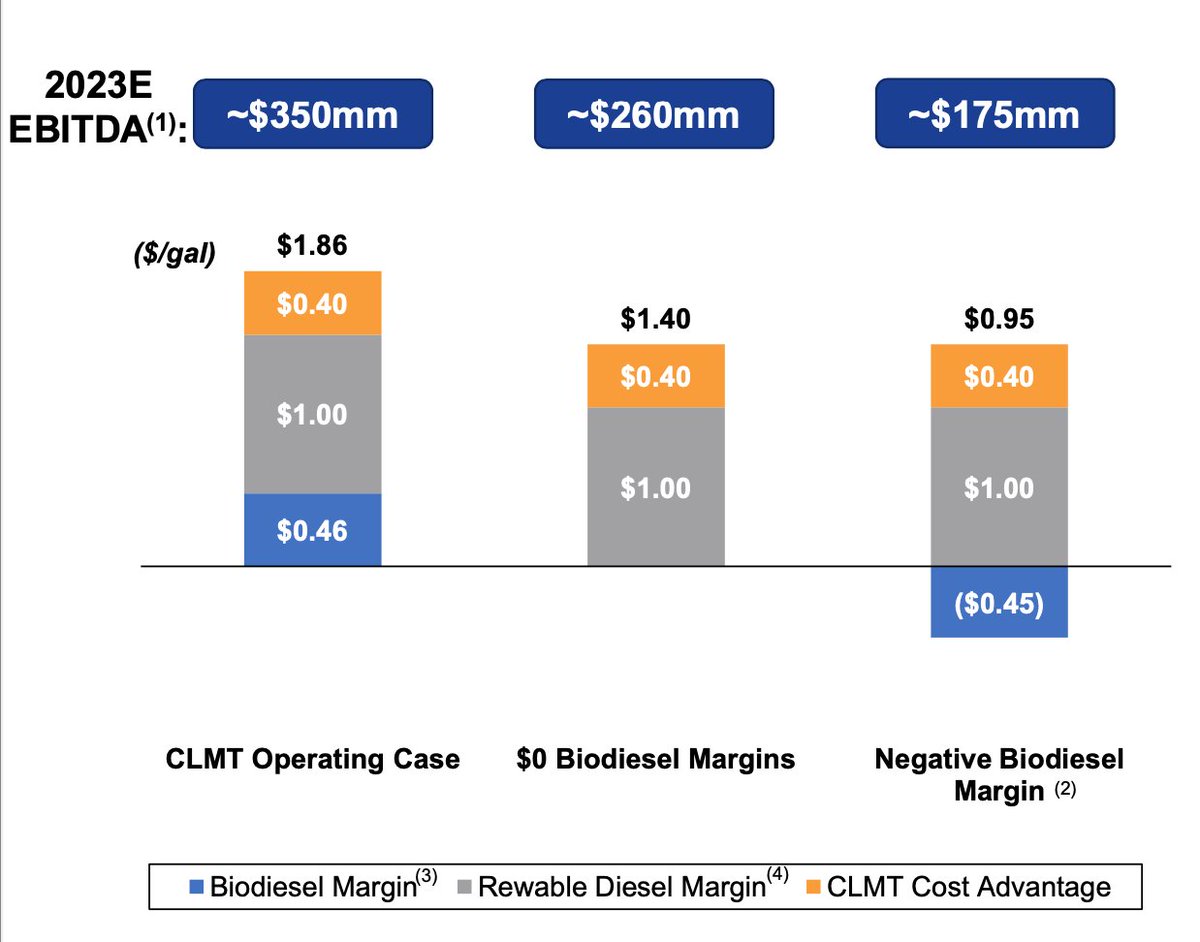

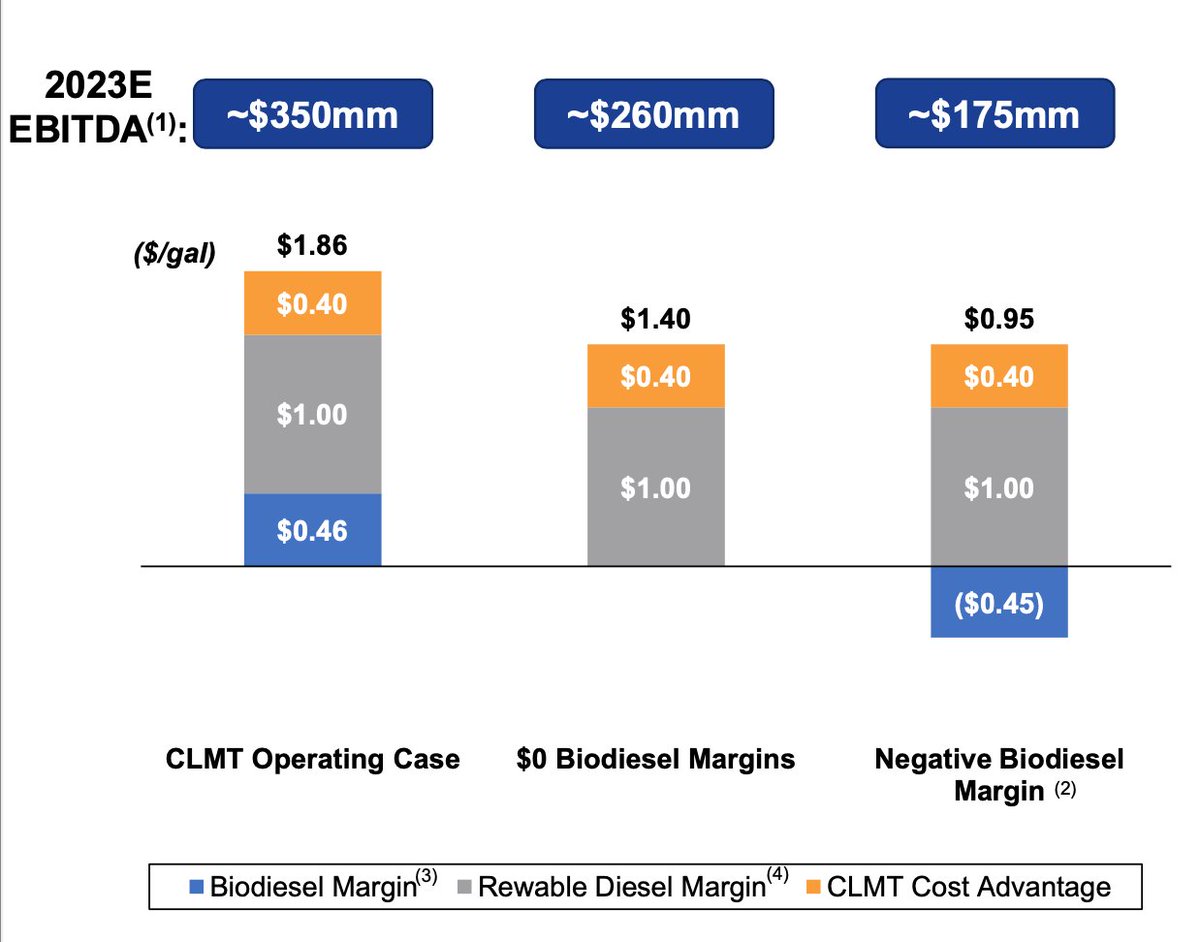

The core of the thesis is this $650mm woefully understates the near-term earnings power at Montana Renewables. The co has specifically guided to $175-350mm in EBITDA from 23E:

Remember there's $300mm of non-recourse debt at Montana now (post a transaction in November, to bring in Oaktree), so we need to deduct this from whatever EV we think MR is worth to $CLMT but obviously even if they just put up $175mm in EBITDA (ie low low end)...

...the equity is worth oodles more than $600mm.

There are really two questions worth asking: 1) can this new start-up asset really generate this kind of earnings power? and 2) how will $CLMT get the market to care?

Let's take 1) first.

There are really two questions worth asking: 1) can this new start-up asset really generate this kind of earnings power? and 2) how will $CLMT get the market to care?

Let's take 1) first.

There is a v long rabbit hole to go down on renewable diesel (basically, diesel generated from seeds/corn/etc, not fossil fuels). Prob not the place here and I'm hardly an expert. But the main benefit (vs say ethanol) is no need to change engines (you can just pour it in)...

...so v superior real world usage than say ethanol.

Regional govts are handing out HUGE subsidies bec they want to encourage renewable diesel uptake. Facilities like MR are being repurposed in many places (look at Valero $VLO, Neste, $VTNR, etc) essentially to monetize these.

Regional govts are handing out HUGE subsidies bec they want to encourage renewable diesel uptake. Facilities like MR are being repurposed in many places (look at Valero $VLO, Neste, $VTNR, etc) essentially to monetize these.

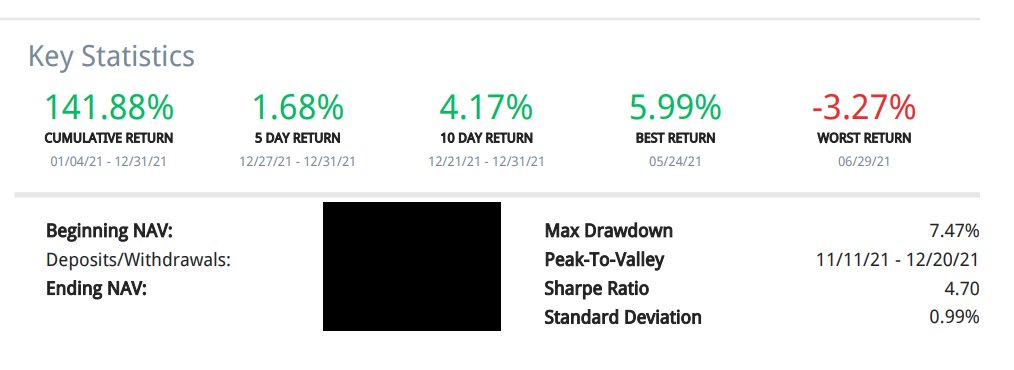

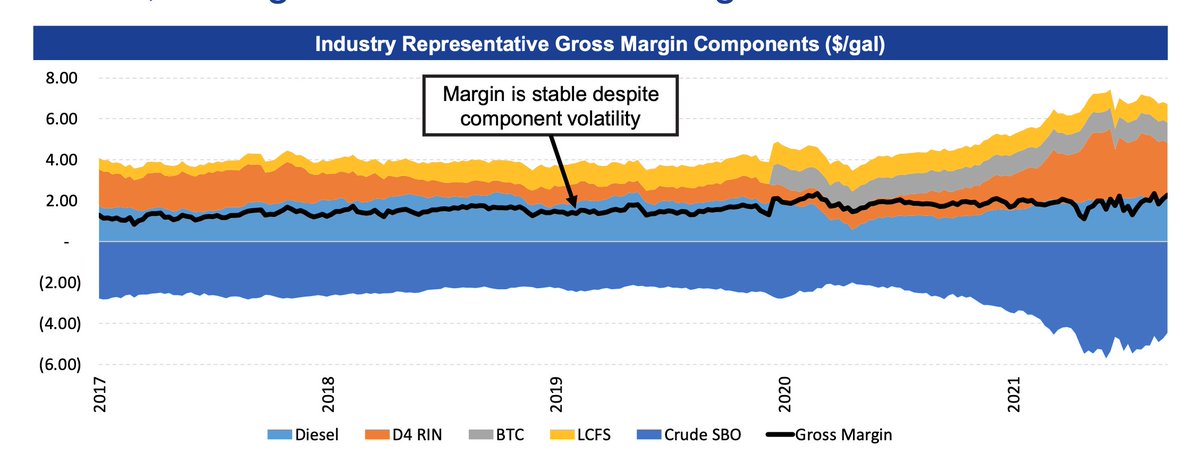

The economics of RD are pretty straightforward: take through-the-cycle biodiesel margins and add a spread (because RD gets even more subsidies, higher RINs, slightly lower opex, etc). This is an industry chart, NOT specific to $CLMT:

Basically the above means if you produce RD you should be earning $2/gallon gross margins, give or take, w/ input costs (crude soybean oil here) offset by all these govt subsidies.

To this we must add $CLMT specific cost advantages, which is how we got the following slide:

To this we must add $CLMT specific cost advantages, which is how we got the following slide:

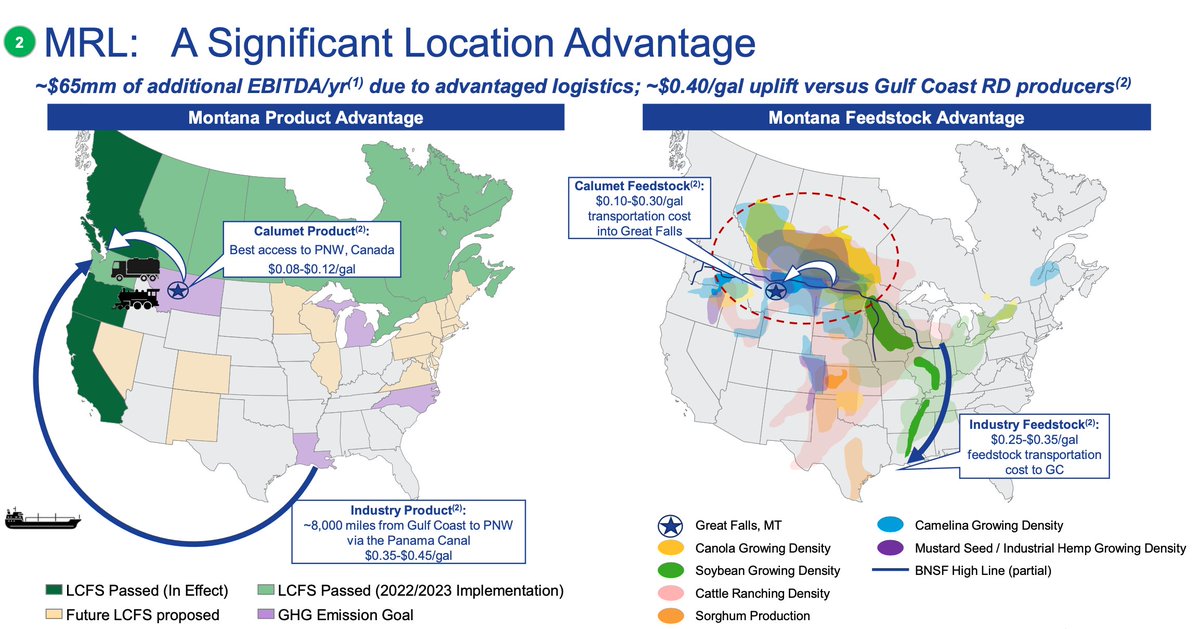

$CLMT is saying they should earn whatever the industry earns, plus an extra 40c/gallon given their facility is a) much closer to the key feedstocks (Northwest cornbelt) AND much closer to highest-subsidy end-markets (California, Oregon, and soon to be Canada).

This is KEY.

This is KEY.

Most all $CLMT competing facilities are near the gulf coast (traditional refining region) meaning feedstock rail cost to the Gulf - and then rail cost to West coast end-markets - is essentially a structural cost advantage for $CLMT.

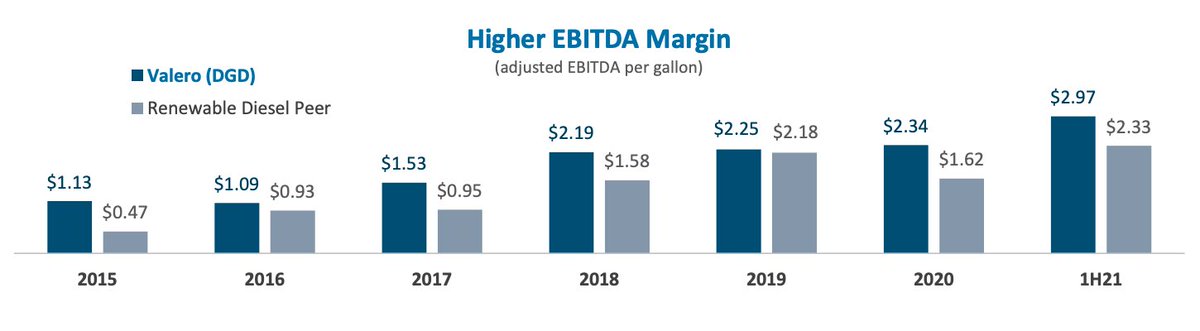

How about the overall profitability? Well $CLMT's MR in phase one is guided to do $1.4-$1.9/gall of EBITDA, versus say a mature, superior operator like $VLO doing current EBITDA of ~$3/gal. Note that market incentives for RD (RIN prices etc) are much higher now than 5+ yrs ago:

Ie I don't think $1.5-$2/gall is that aggressive, esp given the structural logistics advantage of the asset. Ofc execution is another issue...but keep in mind also that Sustainable Aviation Fuel (SAF) subsidies are even higher and mid-term MR will likely attack this mkt too...

Still the point is if $CLMT can get MR up and running and doing even the low end of what they say, this thing should be really valuable.

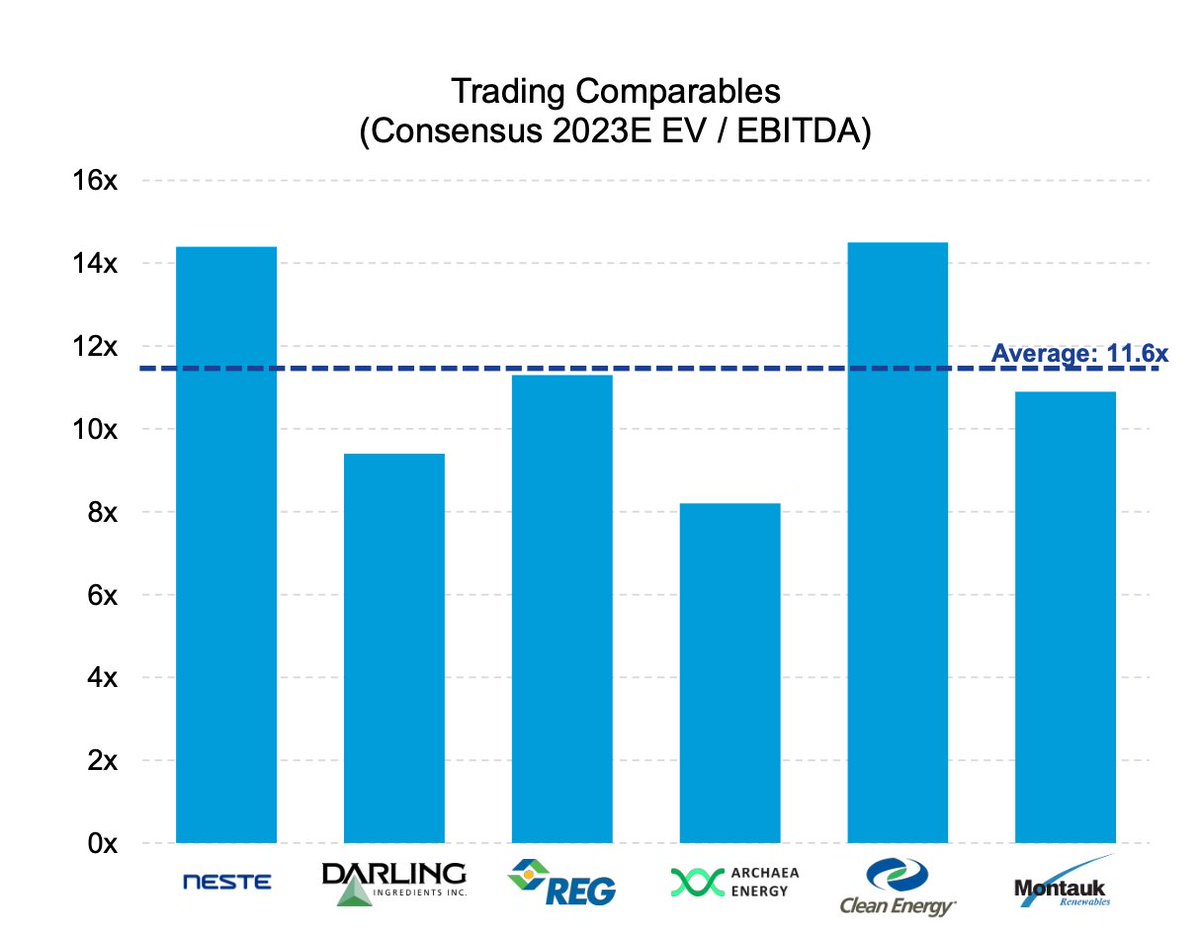

Pure-play, ESG-friendly assets like this don't trade at low multiples. Even muddled/non-pure play comps are invariably much more expensive:

Pure-play, ESG-friendly assets like this don't trade at low multiples. Even muddled/non-pure play comps are invariably much more expensive:

point is even low end of comps/earnings power, this asset/biz should be worth a huge amount to $CLMT equity.

This is why $CLMT kept all the equity (under the Oaktree debt/convert) for themselves. This is also how they get to a slide like this saying $CLMT is worth ~$40-60+:

This is why $CLMT kept all the equity (under the Oaktree debt/convert) for themselves. This is also how they get to a slide like this saying $CLMT is worth ~$40-60+:

Just penciling out my SoTP further. At $1.6bn or so for the legacy biz and say 8x $200mm EBITDA for MR, I get an equity worth ~$22.5. If they hit their f'casts ($300mm+ EBITDA in MR) and get a proper pure-play multiple (low teens) this is easily a $50+ stock.

Not bad from $14...

Not bad from $14...

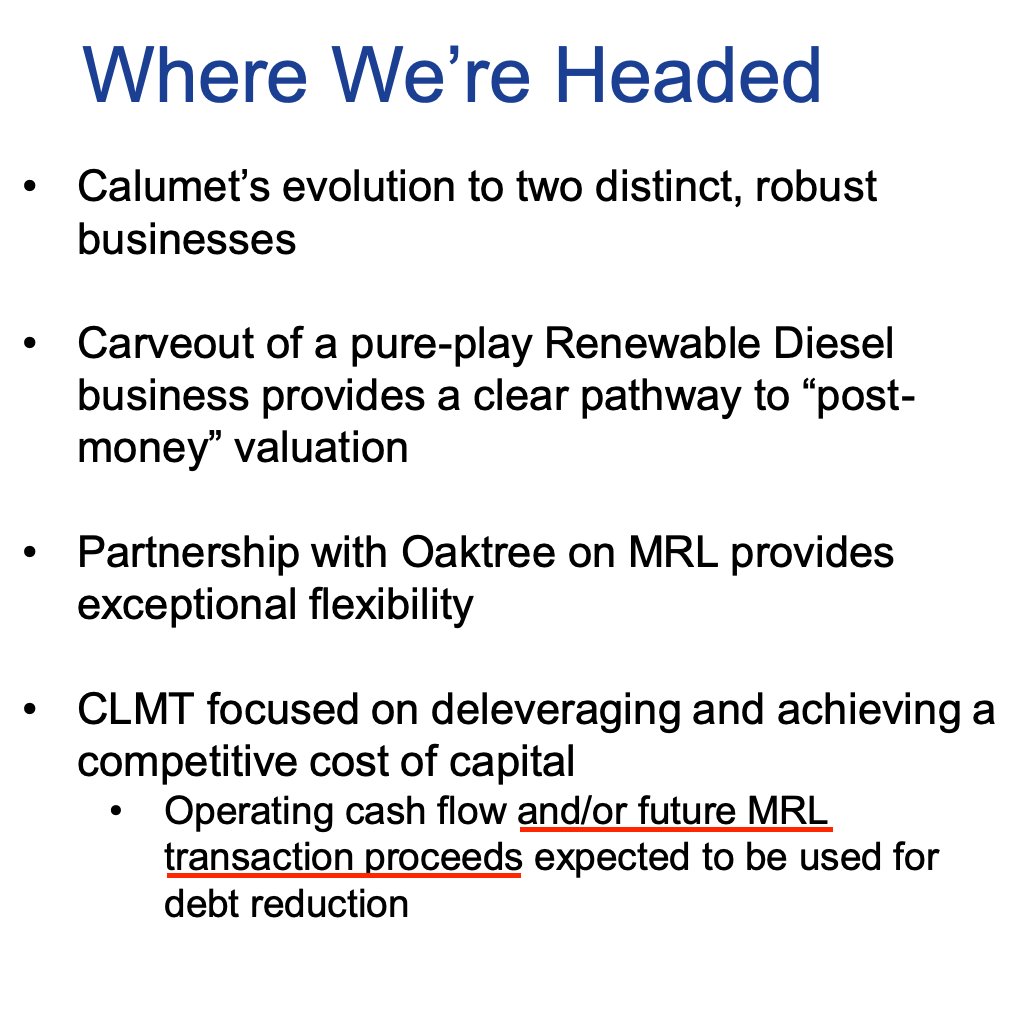

But as I said at the outset, it's not just 'is it cheap?' but 'how will we close the discount?'

this is really where the rubber meets the road for a guy like me (catalyst-driven). luckily in this case $CLMT mgmt has been razor clear on what they're going to do...

this is really where the rubber meets the road for a guy like me (catalyst-driven). luckily in this case $CLMT mgmt has been razor clear on what they're going to do...

As I said at the outset, the problem for $CLMT is the good biz sits alongside an OK-but-so-so other business and all within a horrible cap structure (levered, busted MLP).

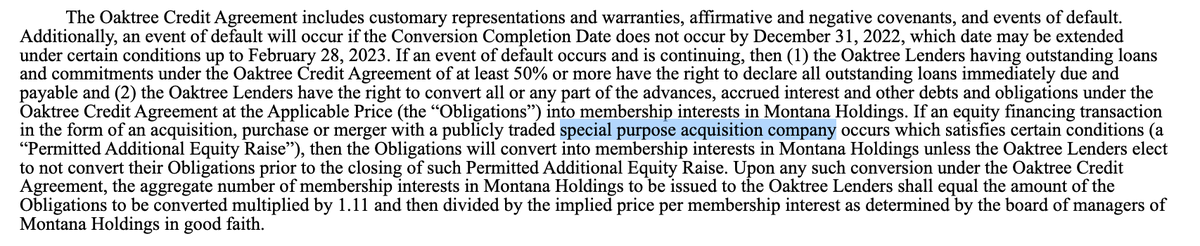

Step 1 is separate the pieces. This has been done via the Oaktree financing last Nov:

Step 1 is separate the pieces. This has been done via the Oaktree financing last Nov:

This now means $CLMT can pursue step 2: monetize equity in MR at a much higher valuation, via partial sale to, eg, a strategic, PE, or a SPAC.

This is not idle speculation. Multiple $CLMT filed documents suggest strongly a secondary monetization transaction will occur.

This is not idle speculation. Multiple $CLMT filed documents suggest strongly a secondary monetization transaction will occur.

For example, the loan agreement with Oaktree makes specific mention of a SPAC partner as one of the potential triggers for turning the Oaktree loan into equity, or allowing early repayment:

I have never seen this specific labeling of a SPAC transaction in a credit agreement before. I can only surmise multiple negotiations are ongoing w SPACs looking for an ESG-friendly target, and this one has actual real near-term earnings power (2022E/23E)...

Elsewhere $CLMT mgmt has made numerous mention of the desire and ability to further monetize MR to pay down holdco debt and demonstrate latent equity value of MR. See here, for example:

SPAC capital remains hungry, and I believe would pay a good price (>$1.5bn implied) for a minority stake in MR. This tool suggests 41 SPACs looking for a 'sustainable' (ie ESG) focused biz without a target. Only one of these needs to come to the party...

spactrack.io/spacs/

spactrack.io/spacs/

Alternately we could see MR up and running then IPO directly as an ESG play w/ full marketing, etc. What is the right price then? Given subsidies are more likely higher than lower; that renewable fuel mandates prob only going up; there's no reason this can't be a growth biz.

In any case IF $CLMT can print say 25% of MR at say $2bn (ie $500mm proceeds) then all of a sudden PF net debt as holdco looks almost low ($600mm give or take), still have 75% of MR, and a listed mark on the new biz.

Another way of thinking about valn is look-through FCF...

Another way of thinking about valn is look-through FCF...

If legacy biz normalized EBITDA is $230mm (net corp costs) and FCF is $90mm (horrendous int expense, will come to this), then MR FCF (assuming 100% equity) is something like $200mm or higher, this could be ~$300mm of FCF on a $1.1bn mkt cap today, out 1.5yrs. So call it <4x...

Yes I'm generalizing and this is run-rate not 22E (or even 23E) given ramp + growth projects (MR will move to phase 2 and increase production once pre-treater built) but this gives you an idea of the opportunity.

Here's what I actually THINK happens...

Here's what I actually THINK happens...

1) SPAC transaction to get mark for MR biz. A good price, but prob not a killer price (given current mkt in SPACs, etc). I expect still >$1.5bn implied meaning a $250mm+ check to $CLMT, and a look-through equity px DAY ONE in low $20s, ie +50-60% vs spot.

2) Strategic interest returns in pieces of $CLMT remainco - probably performance brands (which saw PE interest in the past). Indeed the whole structure may potentially be unwound/up for sale post MR split...

3) Strategic/PE interest in MR (now listed), once it gets to nameplate capacity and earnings power (ie, near end 2023), at something closer to fair value ($3bn++). This gets $CLMT stock (if still around) to $40+ (depending on how much they still own, etc etc).

That's basically it. This being Twitter I left out tons of specifics. This is still a levered equity stub w/ above-average risk (operational + financial), but the even set-up and rewards upon crystallization are pretty clear. A few bucks of downside vs ~30-40$ upside💰💰

GLTA 🙏

GLTA 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh