New stablecoin strategy for $UST

A way to use aUST as collateral to borrow more aUST

Basically, it's similar to Degenbox, but made for the Terra ecosystem and much easier to use

Let's see how you can 4x your Anchor Protocol yield, and if it's too good to be true

/THREAD

1/26

A way to use aUST as collateral to borrow more aUST

Basically, it's similar to Degenbox, but made for the Terra ecosystem and much easier to use

Let's see how you can 4x your Anchor Protocol yield, and if it's too good to be true

/THREAD

1/26

First of all, I just want to inform people that this is a leverage strategy. Use what I write in this thread as ideas and not as financial advice. DYOR.

Secondly, not everyone is happy about these leverage strategies. It's really a two-edged sword.

/2

Secondly, not everyone is happy about these leverage strategies. It's really a two-edged sword.

/2

The positive: more $UST in circulation (wider adaption of Terra). More $UST = burning of $LUNA --> increased $LUNA price

The negative: Leverage strategies drain the yield reserve of Anchor Protocol faster.

And for the third, $UST is an algorithmic stablecoin.

/3

The negative: Leverage strategies drain the yield reserve of Anchor Protocol faster.

And for the third, $UST is an algorithmic stablecoin.

/3

That may involve risks, so please read more about the mechanisms between $LUNA and $UST if you don't already know them.

The protocol I'm talking about is called @EdgeProtocol, a Terra native protocol that will launch next week (15th Feb).

/4

The protocol I'm talking about is called @EdgeProtocol, a Terra native protocol that will launch next week (15th Feb).

/4

Edge Protocol is a borrow & lending protocol and the interface reminds me of several similar platforms I've seen on $ETH and $AVAX already.

What makes this different is the yield-bearing asset aUST.

/5

What makes this different is the yield-bearing asset aUST.

/5

What we're going to do:

1) Deposit money on Anchor Protocol

2) Supply aUST as a collateral on Edge Protocol

3) Borrow aUST against our aUST

4) Supply more aUST

5) Repeat

Let's do it step-by-step.

I'm using $10,000 as an example.

/6

1) Deposit money on Anchor Protocol

2) Supply aUST as a collateral on Edge Protocol

3) Borrow aUST against our aUST

4) Supply more aUST

5) Repeat

Let's do it step-by-step.

I'm using $10,000 as an example.

/6

Step 1: Go to app.anchorprotocol.com/earn and deposit $10K

Step 2: Go to Edge Protocol (twitter.com/EdgeProtocol)

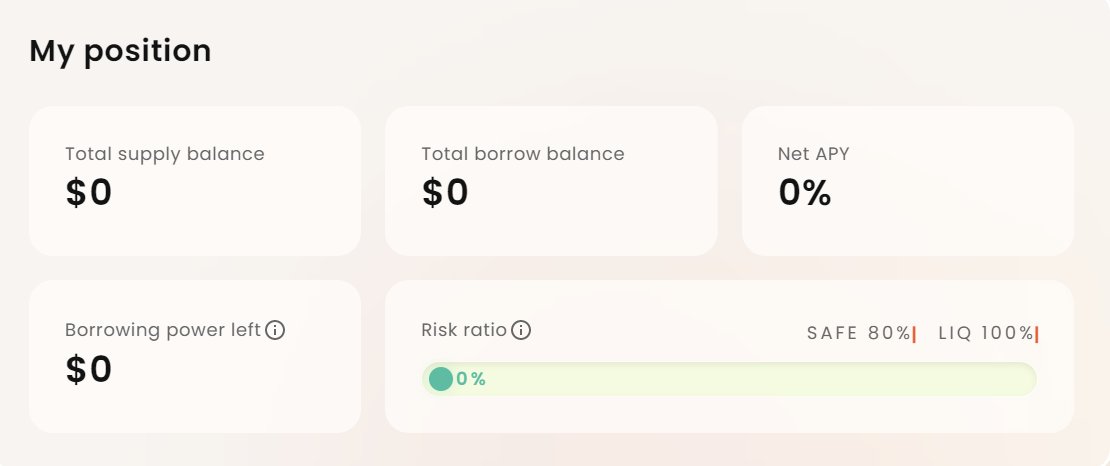

The dashboard looks like this (screenshot below).

/7

Step 2: Go to Edge Protocol (twitter.com/EdgeProtocol)

The dashboard looks like this (screenshot below).

/7

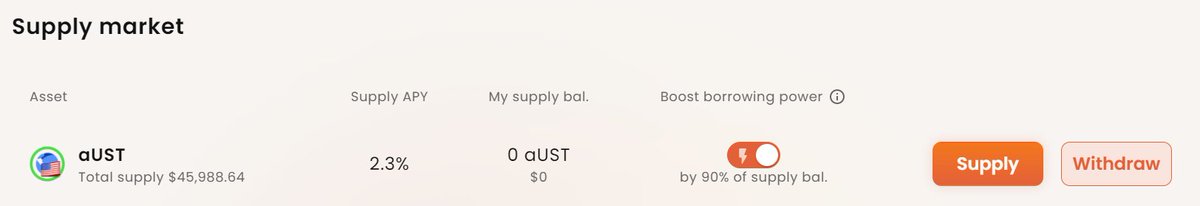

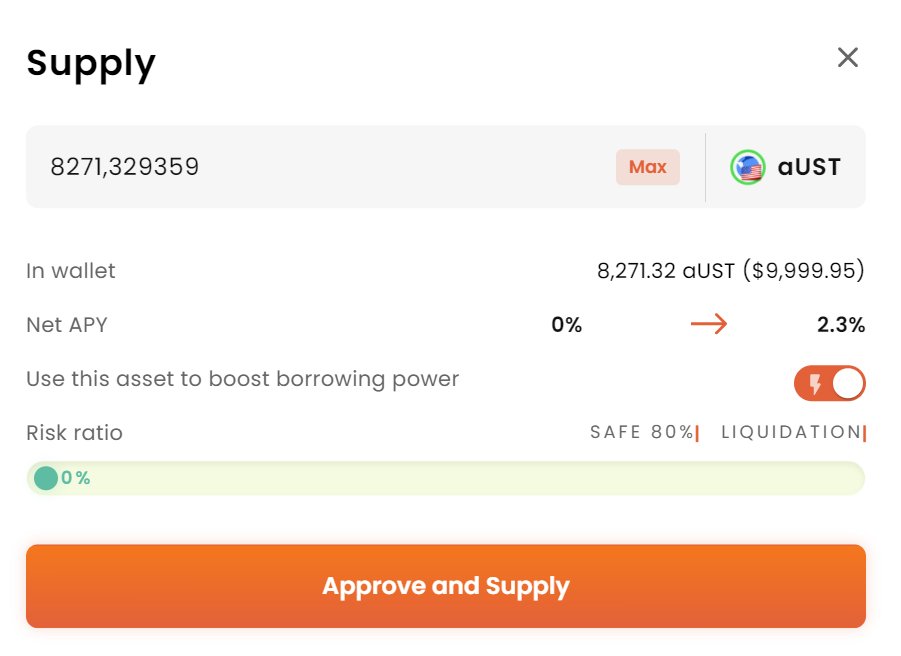

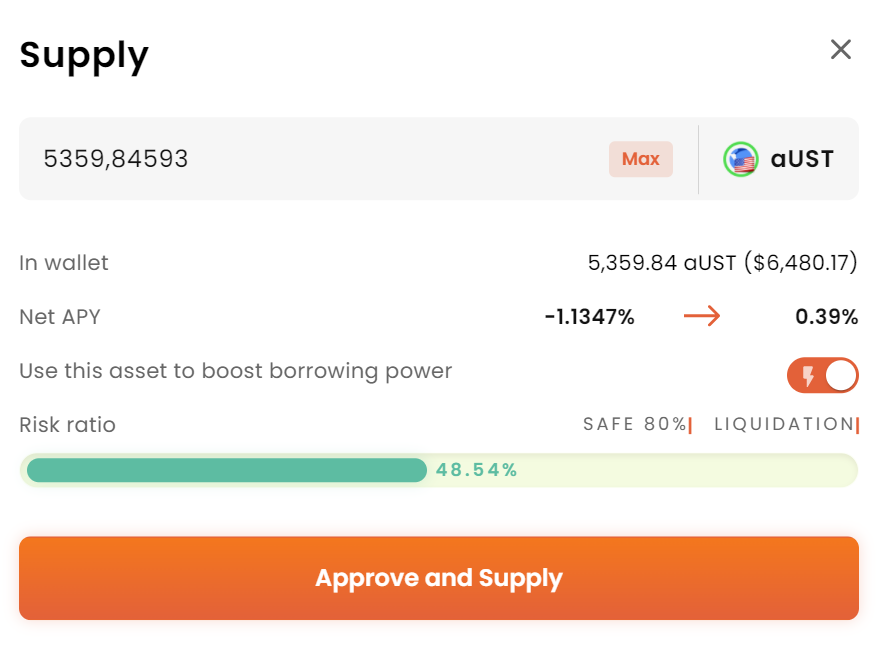

Now we're going to supply aUST.

As you can see it's 2,3% APY for supply atm.

I'm supplying 8,271 aUST (equal to 10,000 UST).

After you've approved the money will disappear from Anchor (the money is in Edge Protocol now). But you still earn interest because we have aUST).

/8

As you can see it's 2,3% APY for supply atm.

I'm supplying 8,271 aUST (equal to 10,000 UST).

After you've approved the money will disappear from Anchor (the money is in Edge Protocol now). But you still earn interest because we have aUST).

/8

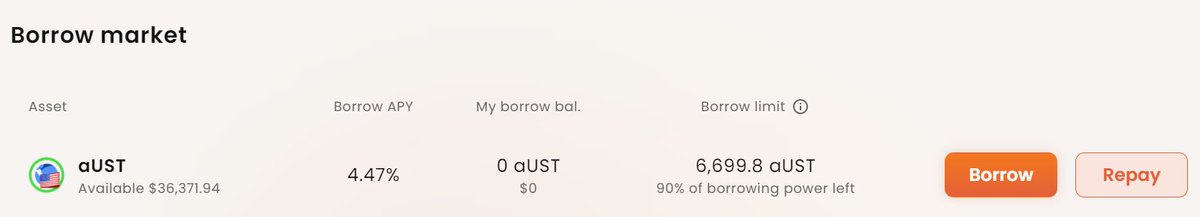

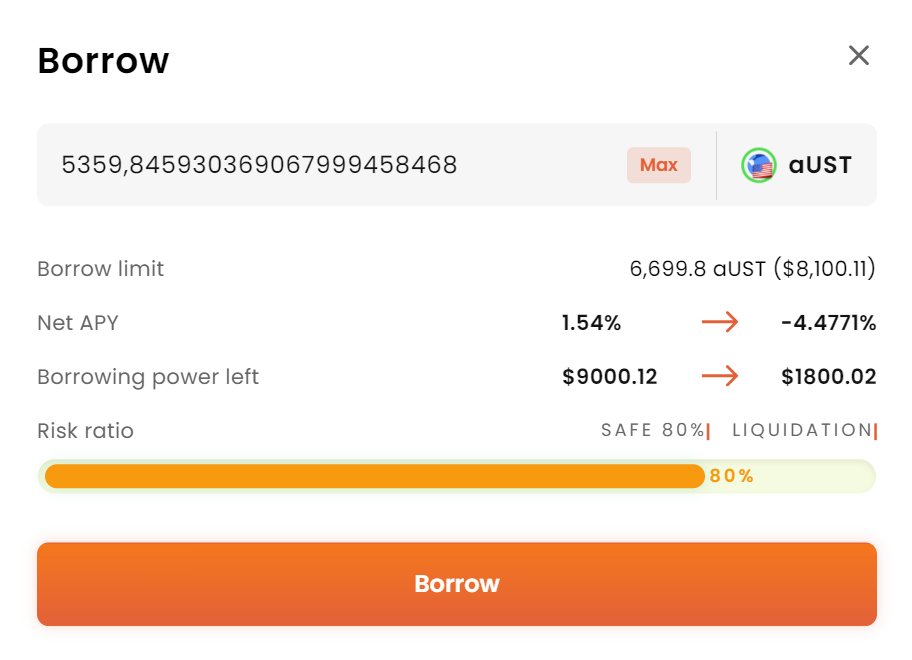

Step 3: Go to borrow on Edge Protocol

In this example, we're going to borrow the maximum amount which is 80% of a 90% utilization. And then 90% of that for extra safety.

That's $10,000 x 0,8 x 0,9 x 0,9 = 6,480 UST (5,359 aUST)

/9

In this example, we're going to borrow the maximum amount which is 80% of a 90% utilization. And then 90% of that for extra safety.

That's $10,000 x 0,8 x 0,9 x 0,9 = 6,480 UST (5,359 aUST)

/9

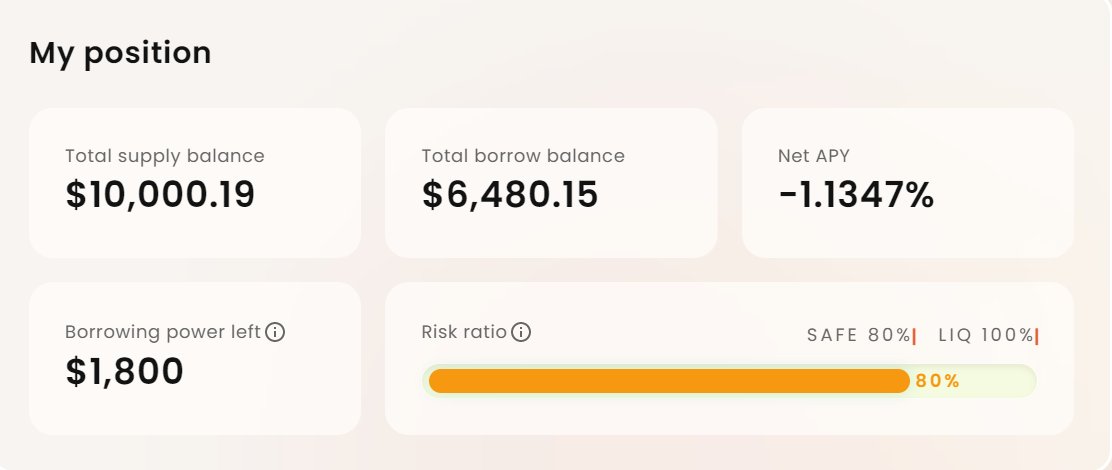

All right. Our dashboard now looks like this.

We started with $10,000 (which was what we supplied). Then we borrowed $6,480 UST.

If we didn't want to do anything more than that we would earn Anchor Protocol APY (19,5%) on 10,000 + 6,480 = 16,480 UST

/10

We started with $10,000 (which was what we supplied). Then we borrowed $6,480 UST.

If we didn't want to do anything more than that we would earn Anchor Protocol APY (19,5%) on 10,000 + 6,480 = 16,480 UST

/10

We're going to maximize this, but before we do that let's talk a little bit about the costs of the strategy.

We have a supply rate and a borrow rate.

You can expect to get a small APR for supplying your asset on Edge Protocol.

/11

We have a supply rate and a borrow rate.

You can expect to get a small APR for supplying your asset on Edge Protocol.

/11

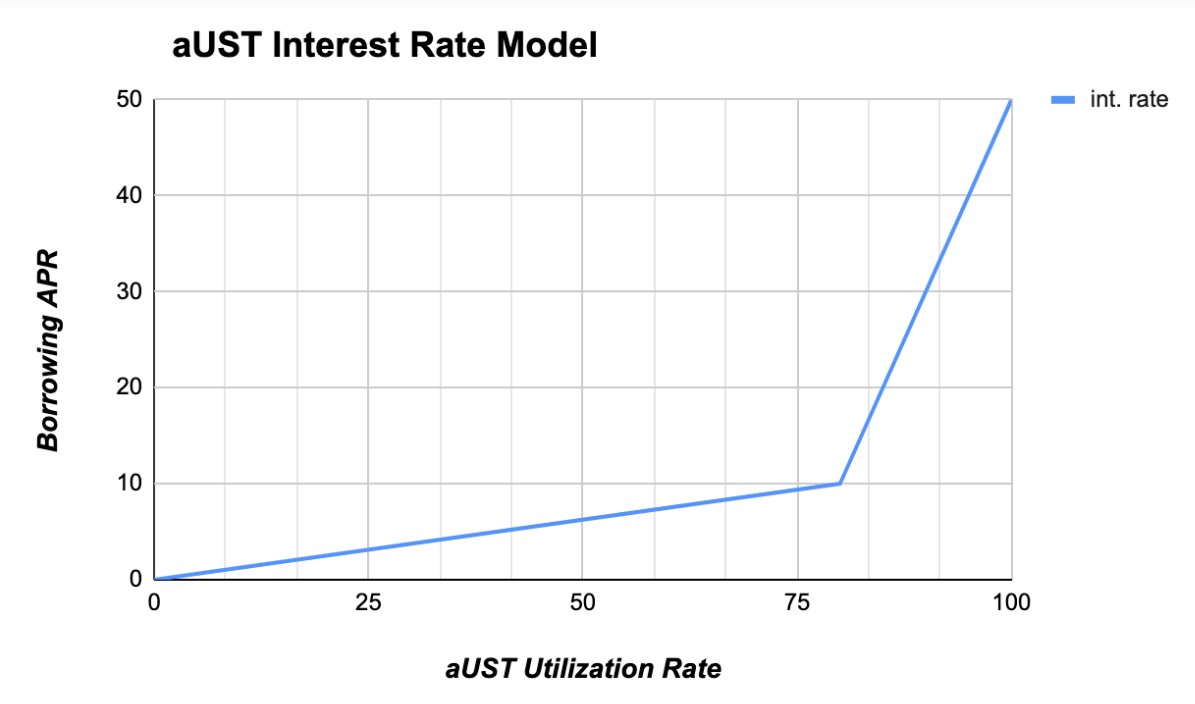

And if you want to borrow you have to pay a borrow APR.

How much?

The utilization rate determines the percentage of total liquidity supplied of an asset that is being borrowed.

Since it won't be possible to borrow more than 80% of the total supply, the borrow...

/12

How much?

The utilization rate determines the percentage of total liquidity supplied of an asset that is being borrowed.

Since it won't be possible to borrow more than 80% of the total supply, the borrow...

/12

rate should never go higher than 10%.

And since not everyone who supplies aUST in the platform is going to borrow the maximum, most likely it will be lower than 10%. My guess would be around 4-6% most of the time.

/13

And since not everyone who supplies aUST in the platform is going to borrow the maximum, most likely it will be lower than 10%. My guess would be around 4-6% most of the time.

/13

But if the borrow rate is 6%, the supply rate should be 2,86% (6% x 0,9 x 0,53).

Summarized a 3,14% net borrow rate. Read the docs for Edge Protocol and you will understand how I calculated this.

/14

Summarized a 3,14% net borrow rate. Read the docs for Edge Protocol and you will understand how I calculated this.

/14

Step 4: Now that we successfully borrowed $6,480 in the last step, let's supply it again on Edge.

We supply everything which is $6,480 UST.

Step 5: Now we're going to borrow again. And then supply. And borrow. You can repeat until it's not possible anymore.

/15

We supply everything which is $6,480 UST.

Step 5: Now we're going to borrow again. And then supply. And borrow. You can repeat until it's not possible anymore.

/15

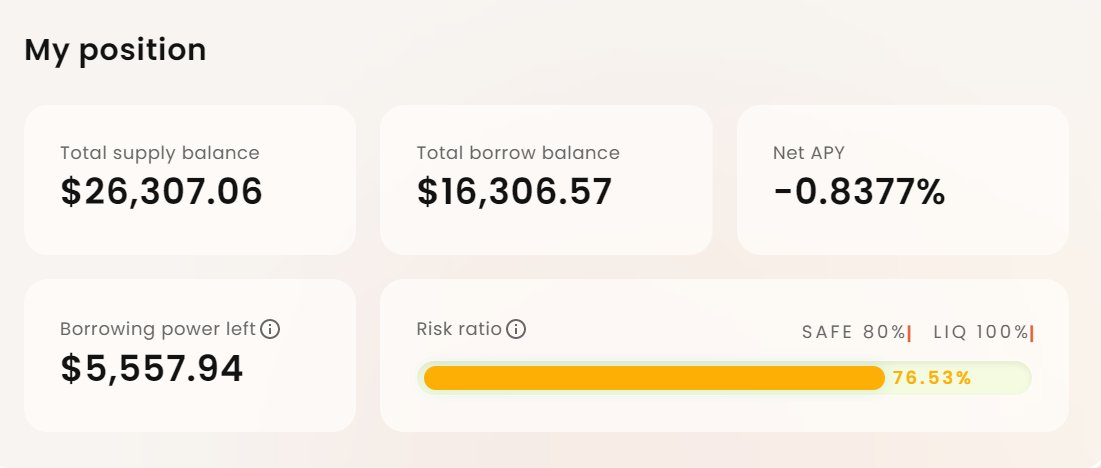

Step 6: After doing the looping 6 times you can see that I now have $26,307 supplied and $16,306 borrowed.

Let's do some calculations for the real APY:

Money that earns 19,5% APY: $26,307 + $16,306 = $42,613. This equals a 83% APY.

/16

Let's do some calculations for the real APY:

Money that earns 19,5% APY: $26,307 + $16,306 = $42,613. This equals a 83% APY.

/16

Supply APR (2.86%): $26,307

Borrow APR (-6%): $16,306

This equals a net APY of -0,83% APY. So our real APY is approx. 82%.

However, this may change. The real APY may go down more due to supply/demand.

/17

Borrow APR (-6%): $16,306

This equals a net APY of -0,83% APY. So our real APY is approx. 82%.

However, this may change. The real APY may go down more due to supply/demand.

/17

If you want out of the strategy you just do the same process as described above in reverse.

What are the risks?

1) Oracle and price discovery risks: The worst-case scenario is where oracles get manipulated. Then the assets in the pool are at risk of getting drained

/18

What are the risks?

1) Oracle and price discovery risks: The worst-case scenario is where oracles get manipulated. Then the assets in the pool are at risk of getting drained

/18

2) Smart contract risk: @the_z_institute has officially audited Edge protocol, but there's always the possibility of a bug or vulnerability that compromises participants' funds.

Personally, I have never heard about the Z Institue. For all I know they can be top-notch.

/19

Personally, I have never heard about the Z Institue. For all I know they can be top-notch.

/19

3) Illiquidity Risk: If there is a bank run and all lenders come to withdraw their deposit from the pool simultaneously then Edge Protocol has to pause the operation since they can't give all the capital out simultaneously.

4) Liquidation Risk: Liquidation risk means...

/20

4) Liquidation Risk: Liquidation risk means...

/20

that borrowers will lose some of their collateral. The pool will expose users' position for liquidation once the users' risk ratio is > 100%

There are three ways to manage the debt position when it is at risk of liquidation:

1) Close position

2) Repay a part of the loan

/21

There are three ways to manage the debt position when it is at risk of liquidation:

1) Close position

2) Repay a part of the loan

/21

3) Add more collateral

There will be an initial max supply cap of $10M in total at launch (similar to Degenbox at Abracadabra).

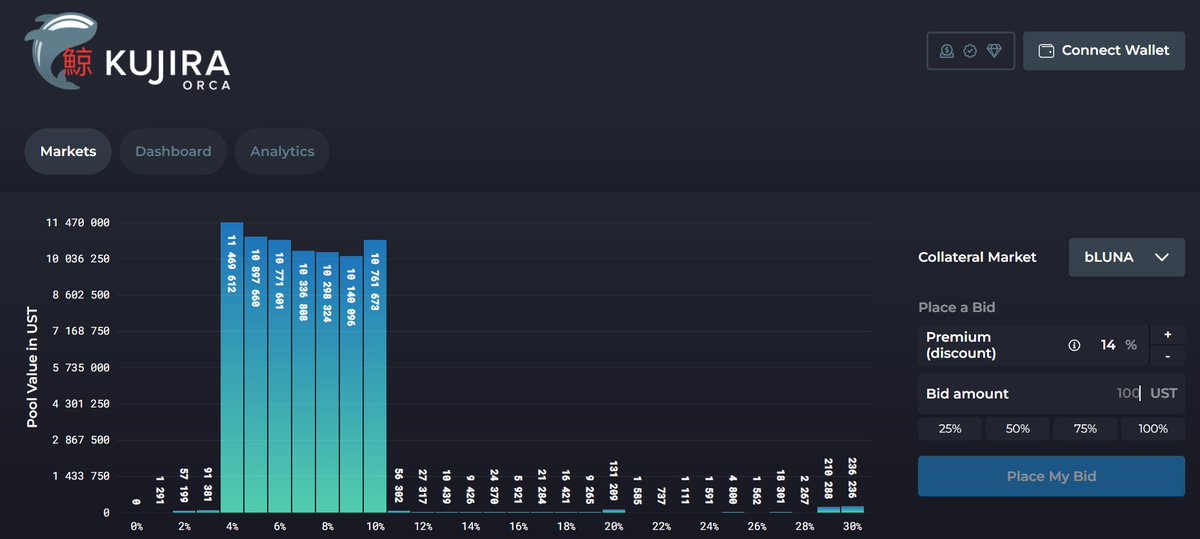

There will be lots of strategies to use on the platform. You can supply $LUNA, bLUNA, LUNAx, MIR, ANC, UST, and aUST.

/22

There will be an initial max supply cap of $10M in total at launch (similar to Degenbox at Abracadabra).

There will be lots of strategies to use on the platform. You can supply $LUNA, bLUNA, LUNAx, MIR, ANC, UST, and aUST.

/22

What's my personal take on Edge Protocol?

I find it extremely interesting, but I'm not going to allocate huge amounts of money to this strategy.

I want it to be battle-tested before I decide to allocate more.

/23

I find it extremely interesting, but I'm not going to allocate huge amounts of money to this strategy.

I want it to be battle-tested before I decide to allocate more.

/23

Maybe I'm ignorant, but when you can get 80% APY so easily, it's good to take a step back and just wait it out a little bit before seeing how it works for a couple of months.

Remember, we're in crypto for the long run. You don't have to hop on every new shining diamond.

/24

Remember, we're in crypto for the long run. You don't have to hop on every new shining diamond.

/24

If you liked this thread, you’ll also like my weekly newsletter:

getrevue.co/profile/route2…

It's free and my goal with the newsletter is to break down DeFi and crypto in an easy way.

/25

getrevue.co/profile/route2…

It's free and my goal with the newsletter is to break down DeFi and crypto in an easy way.

/25

Follow me on @route2fi for more threads about DeFi.

I would also love it if you could share this thread by retweeting the first tweet below

👇

/26

I would also love it if you could share this thread by retweeting the first tweet below

👇

https://twitter.com/Route2FI/status/1492456965775273985

/26

Getting some questions in DM's.

Just to clarify what we're doing in the strategy (summarized):

1) Deposit on Anchor

2) supply aUST on Edge

3) borrow $UST on Edge

4) deposit on Anchor

5) supply aUST on Edge

6) borrow $UST on Edge

7) deposit on Anchor

8 repeat

/27

Just to clarify what we're doing in the strategy (summarized):

1) Deposit on Anchor

2) supply aUST on Edge

3) borrow $UST on Edge

4) deposit on Anchor

5) supply aUST on Edge

6) borrow $UST on Edge

7) deposit on Anchor

8 repeat

/27

• • •

Missing some Tweet in this thread? You can try to

force a refresh