LIC, India’s crown jewel is set to have the biggest IPO ever. Currently at 18,300 crores, Paytm was the biggest IPO yet followed by Coal India at 15,159 crores. LIC is expected to be at least 50,000 crores.

Few interesting facts about LIC. A 🧵

#LICIPO

Few interesting facts about LIC. A 🧵

#LICIPO

1) LIC is more than 65 years old. In 5 years it will be ineligible for its own policies 🙂

2) Persistency ratio - This is the amount of policies that are getting renewed after the 13th month of purchase. How does LIC compare to top private insurers like HDFC life and ICICI pru life?

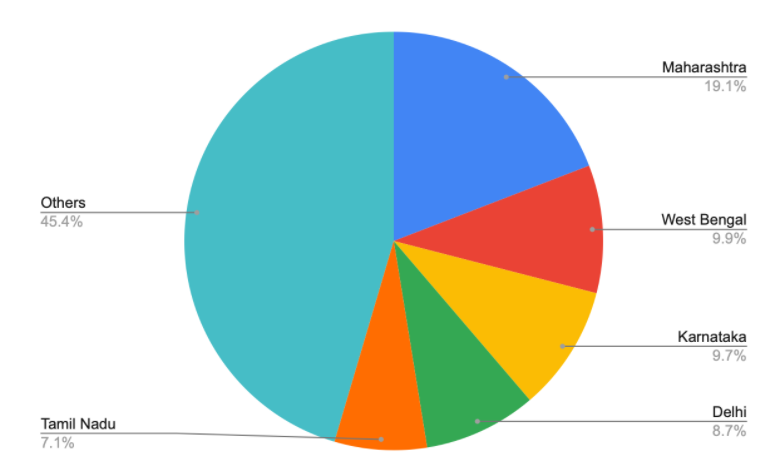

4) While private insurers are taking market share, LIC has 63.6% New Business Premium (out of all the new policies written 63.6% of them are sold by LIC), in life insurance.

It still commands a lot of trust in the market. If you ask someone if they have a term plan, there is a good chance that they will ask “do you mean LIC?”

5) The Indian army has 1.4 million active personnel. LIC has 1.34 million agents of which nearly 900,000 were active (sold at least one policy in the past year) even during the pandemic.

6) Maybe that LIC uncle isn’t one in a million. Closer to 1 in a 1000. Yes, 0.1% of India’s population is an LIC agent.

7) Just like a bank will fall into trouble if a lot of people demand their money back at the same time, if a lot of people lose confidence in the insurer and surrender their policies, LIC may suffer losses since it will have to redeem its investments below market price.

8) Other risks - a) Economic deterioration can lead to policyholders being unable to pay their premiums. b) An insurance company ultimately makes money from investing the money. If that underperforms, it may have to either increase premiums or suffer losses.

10) In insurance, the investments are matched with the maturity of the policy. Since life insurance is a minimum 10-20 years game, the maturity of investments is very high. This means a lot of interest rate risk. A rise in rates by 1% can mean a drop of 5-10% in the portfolio.

11) Returns earned by ULIP portfolio of LIC - 11.89%, Non-participating portfolio - 7.06%, Participating - 9.27%.

What does a participating and non-participating policy mean? A participating policy means that you as a policyholder get to participate in the profits of LIC.

What does a participating and non-participating policy mean? A participating policy means that you as a policyholder get to participate in the profits of LIC.

Till now 95% of profits have been shared with policyholders in participating policies, this % will go to 90% over time. This will benefit shareholders at the expense of policyholders.

12) LIC was formed by merging and nationalising over 245 private life insurers in 1956.

13) LIC has a larger AUM than the entire mutual fund industry put together (mutual fund industry AUM - 31,000 billion, while LIC had an AUM of 36,000 billion as on FY21) making it the largest asset manager in India.

14) Globally, LIC is the fifth largest insurer in terms of total assets. (Over 500,000 Million USD in 2020)

16) LIC is one of the largest holder of central government securities. Total outstanding liabilities of the central government in 2021 was 102 lakh crores. Out of that, LIC holds securities worth 14 lakh crores.

17) LIC’s average NBP per individual policy was ₹26,892 compared to the NBP per individual policy of the median of the top five private players of ₹96,619 for FY21.

Few tertiary impact of LIC IPO :

a) New demat accounts - 10% of the IPO will be reserved for the Policyholders of LIC. There are currently 8 crore active demat accounts in India. LIC has 25 crore policyholders.

a) New demat accounts - 10% of the IPO will be reserved for the Policyholders of LIC. There are currently 8 crore active demat accounts in India. LIC has 25 crore policyholders.

There will be many first time investors who will open their 1st demat account due to the LIC IPO

b) Due to quantum of the IPO (expected to be more than 50000 Cr), there may be a liquidity crunch. (If IPO is subscribed even 2-3x, the money blocked would be more than one lk cr).

b) Due to quantum of the IPO (expected to be more than 50000 Cr), there may be a liquidity crunch. (If IPO is subscribed even 2-3x, the money blocked would be more than one lk cr).

c) Having a listed entity with such large market cap can help govt meet its annual disinvestment targets. Just one percent dilution every year can potentially raise 10,000 Cr 😀

• • •

Missing some Tweet in this thread? You can try to

force a refresh