VLCC scrubber saving 9k

Eco saving 15ton x750usd= 11k

In motion 80% (hidden additional advantage is that Eco's will have less standstill)

16k usd daily advantage

Advantage increases in a better market with speed causing higher consumption

Means less bleeding while wait for upturn

Eco saving 15ton x750usd= 11k

In motion 80% (hidden additional advantage is that Eco's will have less standstill)

16k usd daily advantage

Advantage increases in a better market with speed causing higher consumption

Means less bleeding while wait for upturn

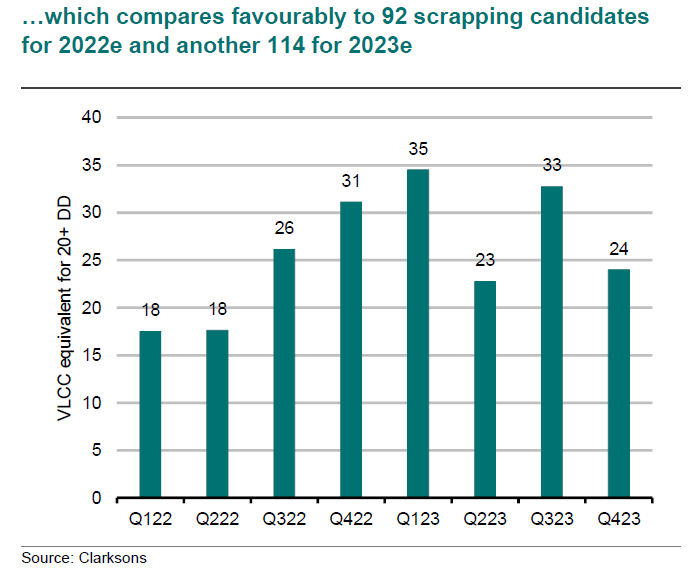

This chart is more than VLCCs it is "tankers" but it illustrates the point where we soon have no orderbook and beyond "old tankers savior Iran" faces this every quarter. And this is +20y, that is really scrapping material. Y-day we saw 2 Capes 19y scrap in arguably a good market

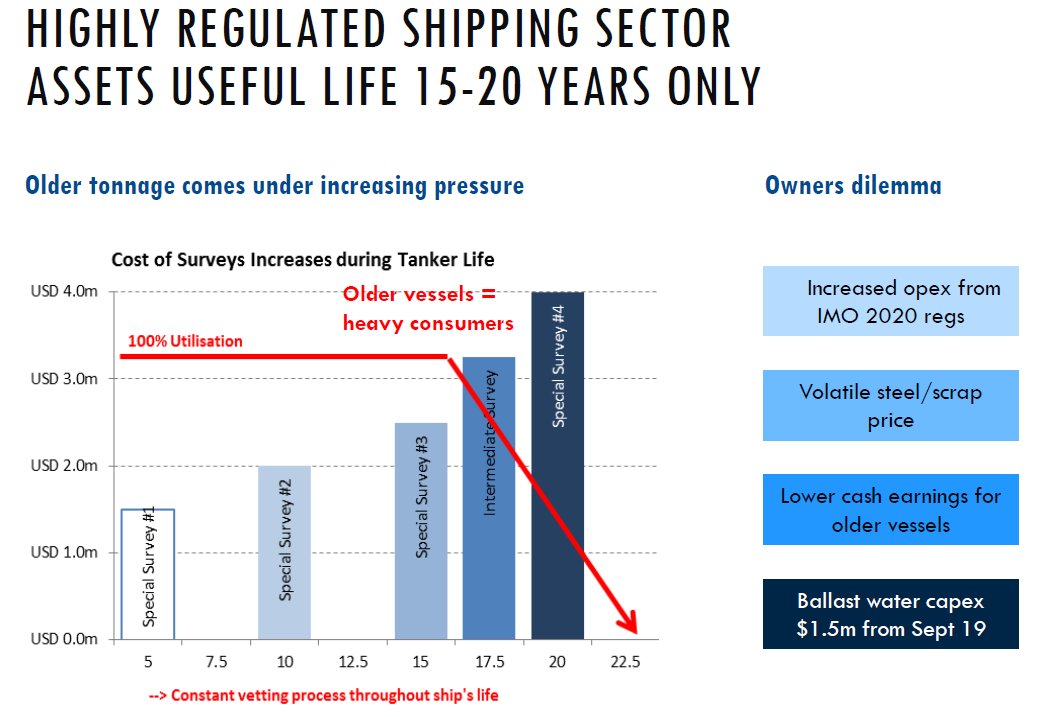

The above is a chart showing when and number of tankers that have to do what is a very expensive dry dock. A very natural end date for a +20y tanker if you do not have the Biden trade anymore.

Compares to the orderbook post this year:

VLCC & Suezmax being basically nothing and with re-sales and ECOs being much cheaper than yard prices, we will soon have a zero for 2025 as well.

VLCC & Suezmax being basically nothing and with re-sales and ECOs being much cheaper than yard prices, we will soon have a zero for 2025 as well.

Biden's policy of Sanctions Without Enforcement is not normal. We very likely have a situation where huge old environmental threats currently do not do these normal yard visits or insurance. Tanker bears ignore this and think the vessels post sanctions are normal vessels.

As I understand it, these vessels are not accepted in China. What they do are instead secret huge offshore oil transfers to acceptable vessels that then go to the end customer.

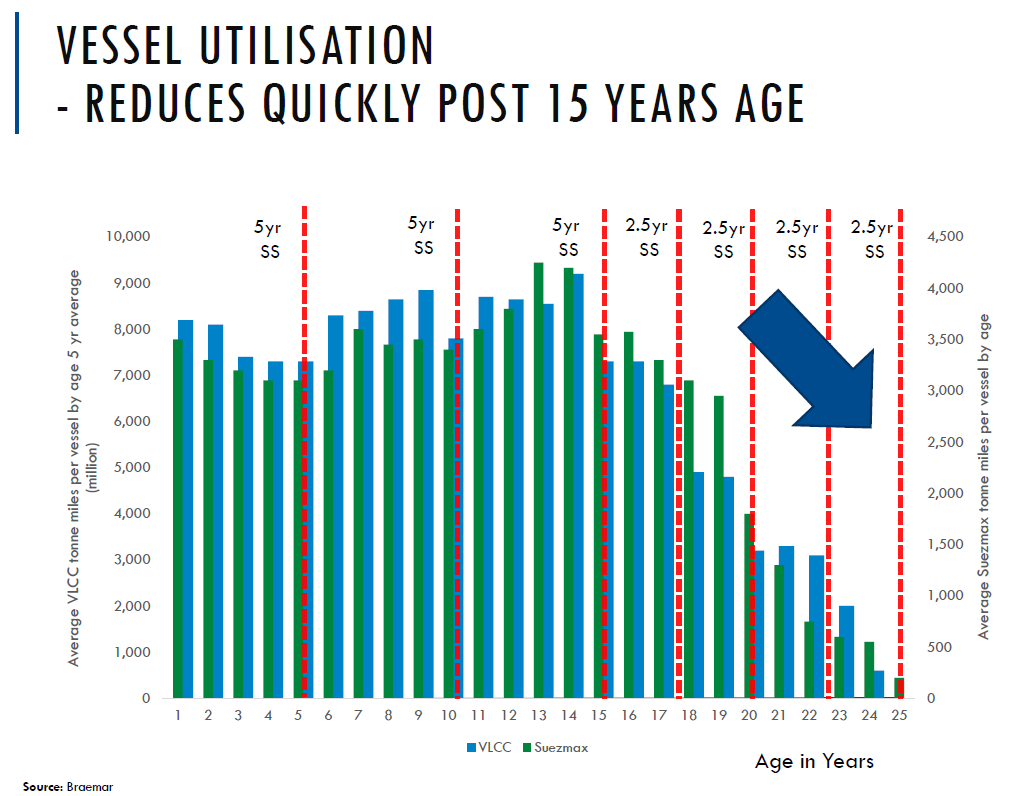

Tanker bears still think these +20y vessels are a normal accepted part of the fleet going forward.

Tanker bears still think these +20y vessels are a normal accepted part of the fleet going forward.

"If they have not scrapped at 20 we must be in a new normal and they will not scrap at 22 either. The fleet has grown!"

That is the logic that is used.

I instead argue the only new that is coming is even harder pressure on old ships with IMO2023.

Biden trade is the key.

That is the logic that is used.

I instead argue the only new that is coming is even harder pressure on old ships with IMO2023.

Biden trade is the key.

• • •

Missing some Tweet in this thread? You can try to

force a refresh