1/ Short Squeezes and Their Consequences (Schultz)

"Short squeezes are not unusual for the hardest-to-borrow stocks, and re-establishing short positions is expensive. If a short seller does not reinitiate after a squeeze, he misses out on large returns."

papers.ssrn.com/sol3/papers.cf…

"Short squeezes are not unusual for the hardest-to-borrow stocks, and re-establishing short positions is expensive. If a short seller does not reinitiate after a squeeze, he misses out on large returns."

papers.ssrn.com/sol3/papers.cf…

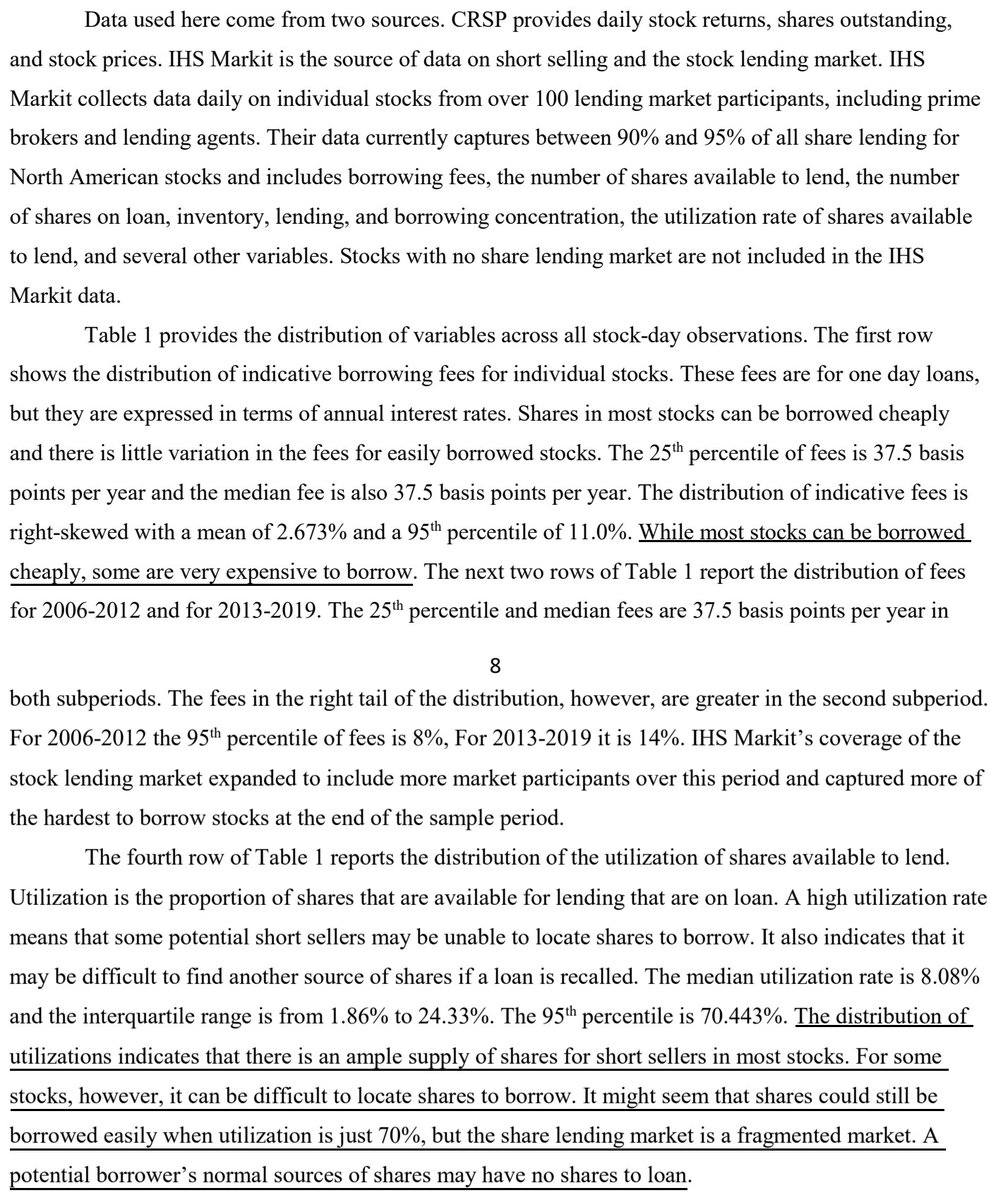

2/ "There is overwhelming evidence in the literature that stocks with binding short sale constraints, as measured by high borrowing fees or short interest, earn poor returns. The abnormal returns suggest that there may also be significant risks to short selling."

3/ "For some stocks, it can be difficult to locate shares to borrow. It might seem that shares could still be borrowed easily when utilization is just 70%, but share lending is a fragmented market. A potential borrower’s normal sources of shares may have no shares to loan."

4/ "0.102% of stock-days are classified as having both an all lender squeeze and a current lender squeeze: more than 100 times as many as would be expected if they were independent events."

5/ "If the equal decrease in shares on loan and available shares is mere coincidence, we would expect to see changes in shares on loan match changes in available shares on surrounding dates just as frequently. That is clearly not true."

6/ "Short squeezes are rare for firms above the median size of $423.4 million.

"For the small number of HTB stocks w/ high utilization & high fees, the likelihood of a squeeze is greater."

Expected decline in shares sold short = % reduction in shares on loan when squeeze occurs

"For the small number of HTB stocks w/ high utilization & high fees, the likelihood of a squeeze is greater."

Expected decline in shares sold short = % reduction in shares on loan when squeeze occurs

7/ "The increase in the proportion of current lender squeezes when utilization is high is not due to decreases in shares available & decreases in shares on loan being more common. Instead, it seems that when utilization is high and a loan is recalled, it is harder to replace it."

8/ "D'Avolio (2002) observes that share turnover is high for stocks with recalled loans. He suggests that high turnover means that it is more likely that a share lender will sell stock and recall his loan. High turnover may be associated with being hard-to-borrow for two reasons.

9/ "First, the only reason why some investors would hold hard-to-borrow shares while others pay large fees to short them is that they disagree strongly about the value of the stock. Disagreement leads to trade and high turnover.

10/ "A second reason, articulated by Cochrane (2002), is that investors may buy stocks they know will provide poor long-run returns for short-term trading. Hence investors who buy hard-to-borrow stocks without lending them may expect to hold them for very short periods of time.

11/ "This, again, means that turnover should be very high for hard-to-borrow stocks."

Table 5: "Short squeezes are indeed associated with high levels of turnover.

"When turnover>500% days are included, the relation between turnover & utilization (or fees) is slightly stronger."

Table 5: "Short squeezes are indeed associated with high levels of turnover.

"When turnover>500% days are included, the relation between turnover & utilization (or fees) is slightly stronger."

12/ "For large firms, the coefficients on fee, size, and turnover are statistically insignificant.

"The #1 determinant of all-lender squeezes is utilization. The likelihood increases at an increasing rate with utilization. Current-lender squeezes are more difficult to predict."

"The #1 determinant of all-lender squeezes is utilization. The likelihood increases at an increasing rate with utilization. Current-lender squeezes are more difficult to predict."

13/ "Trading costs are high on days with short squeezes.

"Changes in shares on loan & available shares are recorded on the settlement date, but the trade may have taken place 3 days before. A short seller may then reestablishes the position several days after it was closed.

"Changes in shares on loan & available shares are recorded on the settlement date, but the trade may have taken place 3 days before. A short seller may then reestablishes the position several days after it was closed.

14/ "Spread estimates 3 days before a squeeze and 5 days afterwards confirm that mean CRSP quoted closing spreads, TAQ time-weighted quoted spreads, effective spreads, and volume weighted effective spreads are all almost exactly the same regardless of when they are measured."

15/ "For hard-to-borrow stocks, defined either by utilization or borrowing fees, the expected trading costs from reestablishing a position can be significant, but it is these hard-to-borrow that seem to offer large returns to short sellers."

16/ "Because of the market convention for existing lenders not to reprice outstanding loans, recalls and fee changes are not independent risks. A share recall can be seen as an extremely high loan fee.

"High levels of utilization are followed by increases in fees.

"High levels of utilization are followed by increases in fees.

17/ "Squeezes in the previous days seem to counteract the regression to the mean of borrowing fees.

"Fees themselves are mean-reverting.

"A short seller who is able to reinitiate a short position after a squeeze is likely to have to pay more to borrow."

"Fees themselves are mean-reverting.

"A short seller who is able to reinitiate a short position after a squeeze is likely to have to pay more to borrow."

18/ "Short squeezes typically occur at the worst time: when fees and utilization are high & hence when short selling is usually most profitable. A short seller who closes a position as a result of a squeeze and doesn’t reopen it is likely to miss those return opportunities."

19/ "For 92.5% of all-lender squeezes, shares available to lend later increases to ≥ shares on loan before the squeeze. The median (mean) time for the available shares to reach the level before the squeeze is 5 (29)days. Short sellers could reestablish positions at that point."

20/ "For each portfolio of stocks that had experienced squeezes, the FF5 alpha is negative. Underperformance is especially strong for portfolios of stocks that have had all-lender squeezes.

"The poor performance of stocks after squeezes appears to last for a long time."

"The poor performance of stocks after squeezes appears to last for a long time."

21/ "This does not suggest that squeezes are a cause of poor stock performance or even that squeezes contain information on future stock performance beyond that which is found in borrowing fees & utilization. The point is that squeezes occur at the wrong time for short sellers."

22/ Related reading

Borrowing Fees and Expected Stock Returns

Short-Selling Risk

Term Structure of Short Selling Costs

Loan Fee Anomaly: A Short Seller's Best Ideas

Borrowing Fees and Expected Stock Returns

https://twitter.com/ReformedTrader/status/1328467331916316674

Short-Selling Risk

https://twitter.com/ReformedTrader/status/1335084455023706113

Term Structure of Short Selling Costs

https://twitter.com/ReformedTrader/status/1345931210439069696

Loan Fee Anomaly: A Short Seller's Best Ideas

https://twitter.com/ReformedTrader/status/1324519224279064576

• • •

Missing some Tweet in this thread? You can try to

force a refresh