2/

What is @mars_protocol?

Mars is a lending and borrowing protocol on @terra_money.

Okay, so how is it different from @anchor_protocol (see below) or others?

What is @mars_protocol?

Mars is a lending and borrowing protocol on @terra_money.

Okay, so how is it different from @anchor_protocol (see below) or others?

https://twitter.com/shivsakhuja/status/1474870079682609153?s=20

3/

@mars_protocol will have 2 forms of borrowing:

1. Contract-to-Borrower (C2B)

2. Contract-to-Contract (C2C)

@mars_protocol will have 2 forms of borrowing:

1. Contract-to-Borrower (C2B)

2. Contract-to-Contract (C2C)

4/

Contract-to-Borrower (C2B) is regular non-custodial over-collateralized borrowing.

This is basically the same as other lending & borrowing platforms like @anchor_protocol, @AaveAave, @screamdotsh, @HundredFinance, etc.

Here's how C2B borrowing works..

Contract-to-Borrower (C2B) is regular non-custodial over-collateralized borrowing.

This is basically the same as other lending & borrowing platforms like @anchor_protocol, @AaveAave, @screamdotsh, @HundredFinance, etc.

Here's how C2B borrowing works..

5/

In most #DeFi lending and borrowing platforms, you provide collateral to the protocol in order to borrow funds.

Borrowed funds can be used for anything you want (usually used to farm elsewhere).

In most #DeFi lending and borrowing platforms, you provide collateral to the protocol in order to borrow funds.

Borrowed funds can be used for anything you want (usually used to farm elsewhere).

6/

1. Deposit collateral.

2. Borrow approved assets from the protocol.

Borrowed funds must be less than Collateral Value * LTV.

Ex: if Collateral = $100 of $LUNA & LTV = 80%, you can borrow $80 of $UST.

3. If collateral value falls and LTV > 80%, you get liquidated.

1. Deposit collateral.

2. Borrow approved assets from the protocol.

Borrowed funds must be less than Collateral Value * LTV.

Ex: if Collateral = $100 of $LUNA & LTV = 80%, you can borrow $80 of $UST.

3. If collateral value falls and LTV > 80%, you get liquidated.

7/

If you're unfamiliar, this 🧵 should explain the general mechanics of liquidations (not specific to @mars_protocol).

If you're unfamiliar, this 🧵 should explain the general mechanics of liquidations (not specific to @mars_protocol).

https://twitter.com/shivsakhuja/status/1468635649473331206?s=20

8/

Now, let's talk about Contract-to-Contract borrowing (C2C). This is where Mars really stands out.

Suppose you borrow funds from @mars_protocol, and use the borrowed funds to provide liquidity on @terraswap_io.

Now, let's talk about Contract-to-Contract borrowing (C2C). This is where Mars really stands out.

Suppose you borrow funds from @mars_protocol, and use the borrowed funds to provide liquidity on @terraswap_io.

9/

What if you could use the @terraswap_io LP tokens as collateral instead of requiring separate collateral deposits to enable borrowing?

Then you wouldn't need to provide collateral in the first place.

What if you could use the @terraswap_io LP tokens as collateral instead of requiring separate collateral deposits to enable borrowing?

Then you wouldn't need to provide collateral in the first place.

10/

This solves a big problem with #DeFi borrowing.

When you deposit collateral in order to borrow funds, the deposited collateral is tied up, and can't be used elsewhere.

But if you can use LP tokens or other contracts as collateral, it opens up a lot of possibilities.

This solves a big problem with #DeFi borrowing.

When you deposit collateral in order to borrow funds, the deposited collateral is tied up, and can't be used elsewhere.

But if you can use LP tokens or other contracts as collateral, it opens up a lot of possibilities.

11/

This is similar to a mortgage. 🏡

When you borrow money for a mortgage:

• You put a 20% down payment on a house.

• Bank gives you 80% as a loan. They can foreclose on the house if you default.

The house (which you bought with the borrowed funds) is the collateral.

This is similar to a mortgage. 🏡

When you borrow money for a mortgage:

• You put a 20% down payment on a house.

• Bank gives you 80% as a loan. They can foreclose on the house if you default.

The house (which you bought with the borrowed funds) is the collateral.

12/

Side note: I wrote a 🧵 about how real-estate can get tokenized using smart contracts.

I think it's an interesting concept to open up your mind to the different use cases unlocked by smart contracts and #DeFi.

Side note: I wrote a 🧵 about how real-estate can get tokenized using smart contracts.

I think it's an interesting concept to open up your mind to the different use cases unlocked by smart contracts and #DeFi.

https://twitter.com/shivsakhuja/status/1489569464181948417?s=21

13/

Back to Mars.

Just as a house can be collateral, the @terraswap_io LP tokens you acquire with borrowed funds could be used as collateral for @mars_protocol.

Mars is enabling other protocols to allow their contracts to be used as collateral in exchange for a credit line.

Back to Mars.

Just as a house can be collateral, the @terraswap_io LP tokens you acquire with borrowed funds could be used as collateral for @mars_protocol.

Mars is enabling other protocols to allow their contracts to be used as collateral in exchange for a credit line.

14/

This form of lending is much more powerful than over-collateralized lending.

You can borrow funds without depositing collateral, provided the funds are being used by a pre-approved smart contract.

(@mars_protocol has to approve what it can accept as collateral)

This form of lending is much more powerful than over-collateralized lending.

You can borrow funds without depositing collateral, provided the funds are being used by a pre-approved smart contract.

(@mars_protocol has to approve what it can accept as collateral)

15/

@mars_protocol will start by enabling simple leveraged yield farming strategies for C2C borrowing, with the goal of eventually allowing all contracts the community votes for.

Example: to start, Mars will allow borrowed funds to be used for leveraged LPs.

@mars_protocol will start by enabling simple leveraged yield farming strategies for C2C borrowing, with the goal of eventually allowing all contracts the community votes for.

Example: to start, Mars will allow borrowed funds to be used for leveraged LPs.

16/

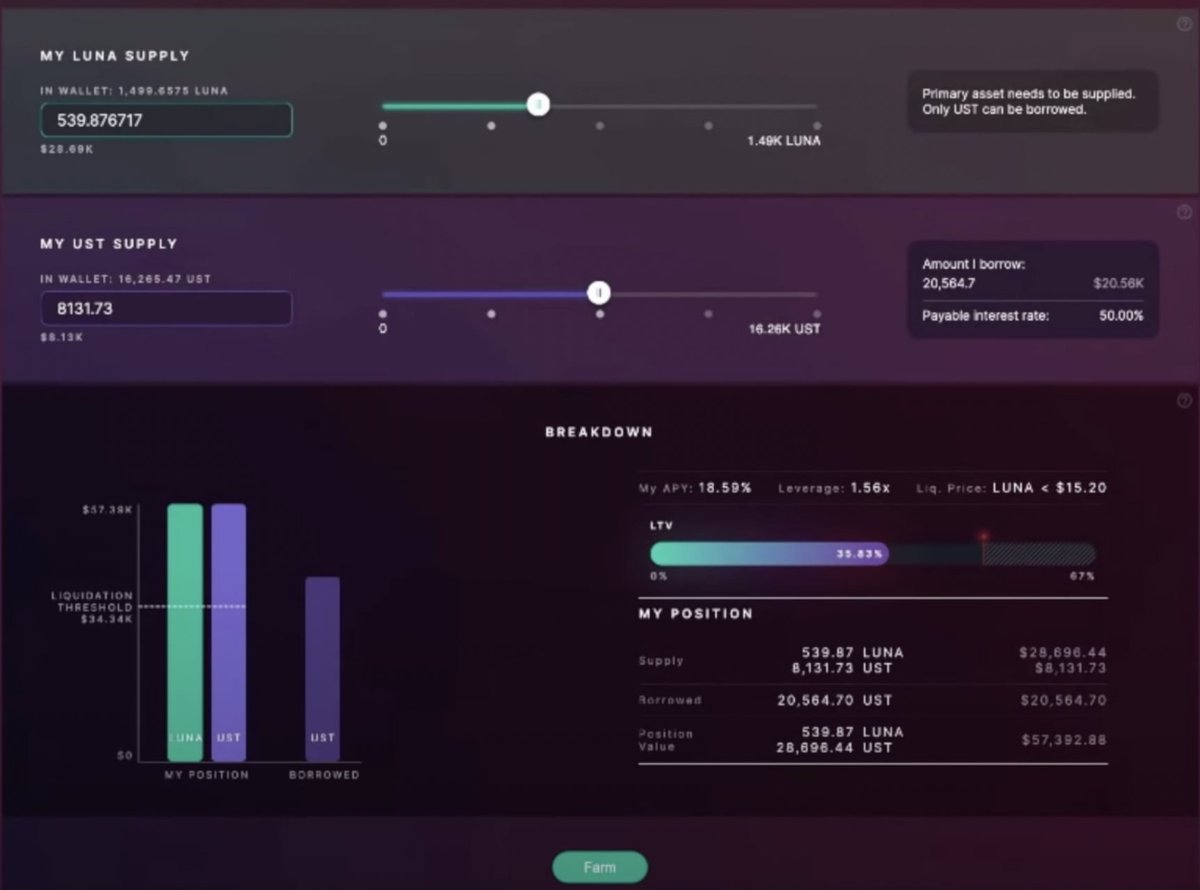

Example of leveraged yield farming through $MARS.

1. Supply a primary asset - ex: $LUNA

2. Borrow a secondary asset - ex: $UST

3. Farm $LUNA-$UST LP

Example of leveraged yield farming through $MARS.

1. Supply a primary asset - ex: $LUNA

2. Borrow a secondary asset - ex: $UST

3. Farm $LUNA-$UST LP

17/

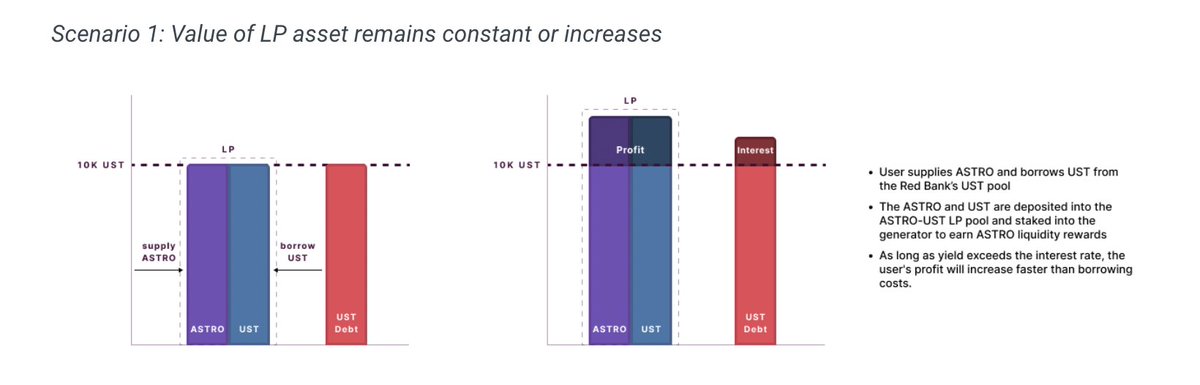

When you borrow funds for a leveraged LP strategy, there are 2 situations you need to prepare for.

Case 1: The value of LP assets increases:

If rewards from the LP + price appreciation is greater than interest accrued from borrowing, you are in profit. 🤑

When you borrow funds for a leveraged LP strategy, there are 2 situations you need to prepare for.

Case 1: The value of LP assets increases:

If rewards from the LP + price appreciation is greater than interest accrued from borrowing, you are in profit. 🤑

18/

Case 2: The value of LP assets decreases

If the price of $LUNA falls, and your value of your LP tokens decreases to a value below the liquidation threshold, you will be immediately liquidated.

Case 2: The value of LP assets decreases

If the price of $LUNA falls, and your value of your LP tokens decreases to a value below the liquidation threshold, you will be immediately liquidated.

19/

In the event of liquidation, borrowed $UST will be returned to @mars_protocol, the liquidator will take a fee, and any remaining $LUNA would be returned to you.

This application is just like leveraged farming on @TarotFinance or Alpha Homora.

In the event of liquidation, borrowed $UST will be returned to @mars_protocol, the liquidator will take a fee, and any remaining $LUNA would be returned to you.

This application is just like leveraged farming on @TarotFinance or Alpha Homora.

20/

But with @mars_protocol, leveraged LPs are just one application.

The Mars lending pools can be used by borrowers for all kinds of smart contract applications in the future, as long as they were approved by the DAO.

But with @mars_protocol, leveraged LPs are just one application.

The Mars lending pools can be used by borrowers for all kinds of smart contract applications in the future, as long as they were approved by the DAO.

21/

Some other potential future applications of @mars_protocol:

• @NexusProtocol integration to lever up on $nLUNA

• Integration with @ApolloDAO or @SpecProtocol for leveraged LPs

• Margin trading

• Insurance products

• Flash Loans

+++

Some other potential future applications of @mars_protocol:

• @NexusProtocol integration to lever up on $nLUNA

• Integration with @ApolloDAO or @SpecProtocol for leveraged LPs

• Margin trading

• Insurance products

• Flash Loans

+++

https://twitter.com/shivsakhuja/status/1478879414553231362?s=20

22/

All kinds of smart contracts can plug into Mars' C2C borrowing protocol, as long as they are approved by the community.

Approval for granting credit lines to contracts will be determined by the Martian Council, a DAO of $xMARS holders. 👽

All kinds of smart contracts can plug into Mars' C2C borrowing protocol, as long as they are approved by the community.

Approval for granting credit lines to contracts will be determined by the Martian Council, a DAO of $xMARS holders. 👽

23/

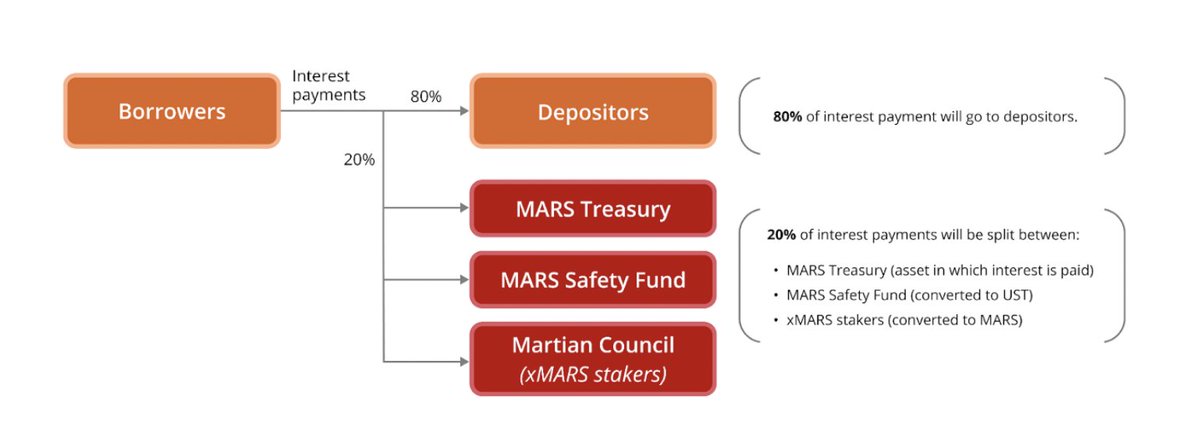

$MARS can be staked for $xMARS.

$xMARS holders receive protocol fees, and can participate in governance.

From docs, "Initially, 80% of all interest payments will go to lenders, with the remaining 20% being split amongst the Mars Treasury, Safety Fund and xMARS stakers."

$MARS can be staked for $xMARS.

$xMARS holders receive protocol fees, and can participate in governance.

From docs, "Initially, 80% of all interest payments will go to lenders, with the remaining 20% being split amongst the Mars Treasury, Safety Fund and xMARS stakers."

24/

You can read more about the tokenomics and details in the docs: docs.marsprotocol.io/mars-protocol/

@mars_protocol is launching in around 2 weeks.

You can read more about the tokenomics and details in the docs: docs.marsprotocol.io/mars-protocol/

@mars_protocol is launching in around 2 weeks.

25/

So where can you buy some $MARS?

You can't yet... but here's how you can get in on the $MARS lockdrop:

1. Lock $UST into Mars' Red Bank for 3-18 months. (open for 5 days)

2. $MARS governance tokens will be airdropped to you in a few weeks when @mars_protocol launches.

So where can you buy some $MARS?

You can't yet... but here's how you can get in on the $MARS lockdrop:

1. Lock $UST into Mars' Red Bank for 3-18 months. (open for 5 days)

2. $MARS governance tokens will be airdropped to you in a few weeks when @mars_protocol launches.

26/

Some more information about the lockdrop:

• 50M $MARS tokens will be available for airdrop to lockdrop participants

• That's 5% of total supply (1B).

• Longer lockup / more $ locked = more $MARS

Some more information about the lockdrop:

• 50M $MARS tokens will be available for airdrop to lockdrop participants

• That's 5% of total supply (1B).

• Longer lockup / more $ locked = more $MARS

27/

The lockup boosts significantly incentivize longer time locks.

1x boost for 3 months, but 8x for 12 months.

So instead of locking up $8k for 3 months, you could lock up $1k $UST for 12 months, and get the same amount $MARS tokens 🤔

(If I'm understanding this correctly)

The lockup boosts significantly incentivize longer time locks.

1x boost for 3 months, but 8x for 12 months.

So instead of locking up $8k for 3 months, you could lock up $1k $UST for 12 months, and get the same amount $MARS tokens 🤔

(If I'm understanding this correctly)

28/

All details of the lockdrop:

All details of the lockdrop:

https://twitter.com/mars_protocol/status/1495729110190116870?s=20&t=mBEsbVMmpNe2Ttj-y3qhZw

29/

Huge shoutout to @danku_r - he invited some folks from the @mars_protocol team to his YouTube channel to discuss the Fields of Mars (C2C borrowing).

danku_r is a big 🧠 (especially for Terra) - I learned much of this information from his video here:

Huge shoutout to @danku_r - he invited some folks from the @mars_protocol team to his YouTube channel to discuss the Fields of Mars (C2C borrowing).

danku_r is a big 🧠 (especially for Terra) - I learned much of this information from his video here:

30/

I write a few 🧵s about #DeFi and #crypto every week where I explain protocols, concepts and yield strategies.

Follow along for more 🤝

I write a few 🧵s about #DeFi and #crypto every week where I explain protocols, concepts and yield strategies.

Follow along for more 🤝

https://twitter.com/shivsakhuja/status/1470898910218440708?s=20

31/

If you found this content helpful, I'd greatly appreciate a ❤️ / ♻️ on the original post 👇

If you found this content helpful, I'd greatly appreciate a ❤️ / ♻️ on the original post 👇

https://twitter.com/shivsakhuja/status/1495887280925339648?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh