#RussiaUkraineConflict begins, and markets are crashing the world over. Wars come with an irreparable human cost. But what about the impact on us far away? If your portfolio looks red and you are worried, this is for you. A #thread 🧵

#sensex #stockmarketcrash

#sensex #stockmarketcrash

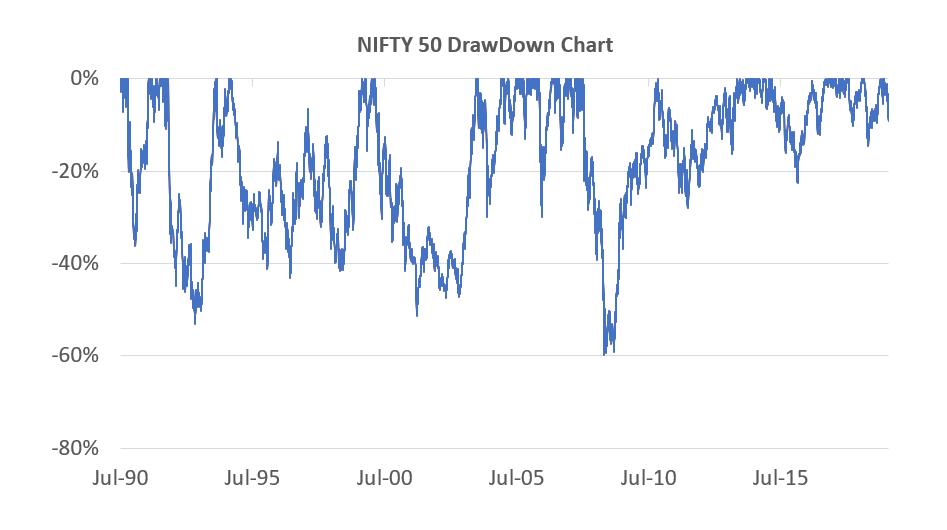

Let’s travel back in time to see how wars have affected the markets. We'll look at the largest #drawdowns because of war, and use the movement of S&P 500 index to track impact. 2/n

March 1939, Nazi Germany enters former Czechoslovakia. Markets go down🔻 -20.5% in 22 days. And how long did it take to recover⬆️? About 12 months. Within a year, the drop was eliminated. 3/n

December 1941, Pearl Harbour Attack.

Markets🔻-19.8%

Time for recovery ⬆️ 307 days.

4/n

Markets🔻-19.8%

Time for recovery ⬆️ 307 days.

4/n

Oct 1973, North Korea invades South Korea

Markets 🔻 -12.9%

Time to recovery ⬆️ 82 days.

5/n

Markets 🔻 -12.9%

Time to recovery ⬆️ 82 days.

5/n

Oct 1973, Oil Crisis

Markets🔻 -17% within the month and continue falling for many months.

Time to recovery ⬆️14 years. That was the slowest recovery since the WWII.

6/n

Markets🔻 -17% within the month and continue falling for many months.

Time to recovery ⬆️14 years. That was the slowest recovery since the WWII.

6/n

Aug 1990, Iraq invades Kuwait

Markets🔻-16.9%

Time to recovery ⬆️ 189 days.

7/n

Markets🔻-16.9%

Time to recovery ⬆️ 189 days.

7/n

Sep 2011, US Terrorist Attack

Markets🔻 -11.6%

Time to recovery⬆️ 31 days.

What does this tell us?

8/n

Markets🔻 -11.6%

Time to recovery⬆️ 31 days.

What does this tell us?

8/n

2 things:

1. Wars lead to sudden crashes, each different in their degree, depending on many factors.

2. On an average, the S&P 500 goes🔻-6.5% in 3 months following the conflict.

However...

Markets recover 💹and gain upto +13% by ~12 months after the event.

9/n

1. Wars lead to sudden crashes, each different in their degree, depending on many factors.

2. On an average, the S&P 500 goes🔻-6.5% in 3 months following the conflict.

However...

Markets recover 💹and gain upto +13% by ~12 months after the event.

9/n

Lesson?

Stay invested for the long term. Because in the long run, it doesn’t matter.

Like we said in the beginning though. Any war is a human tragedy, and that cost is a very different thing altogether.

Source: @SeekingAlpha, LPL Research, S&P Dow Jones Indices, CFRA

10/10

Stay invested for the long term. Because in the long run, it doesn’t matter.

Like we said in the beginning though. Any war is a human tragedy, and that cost is a very different thing altogether.

Source: @SeekingAlpha, LPL Research, S&P Dow Jones Indices, CFRA

10/10

Correction: June 1950, N Korea invades S Korea.

• • •

Missing some Tweet in this thread? You can try to

force a refresh