The Ultimate SWIFT and Russia Sanctions explainer

You've probably been reading lots of people explaining SWIFT, but most explainers miss some key details like 👇

1. SWIFT is not a payment system.

SWIFT is a messaging system (like email) used by 11,000 banks in 200+ countries

You've probably been reading lots of people explaining SWIFT, but most explainers miss some key details like 👇

1. SWIFT is not a payment system.

SWIFT is a messaging system (like email) used by 11,000 banks in 200+ countries

2. SWIFT doesn't move money; banks do. Money moves when a bank updates its accounts.

Banks go through a series of messages to say who needs to get paid and for how much. These messages happen instantly but the payments may not get applied immediately because...

Banks go through a series of messages to say who needs to get paid and for how much. These messages happen instantly but the payments may not get applied immediately because...

3. Banks are the police of money.

Banks must follow rules like blocking transactions to entities that governments add to sanctions lists.

Sanctions lists (like OFAC) are a giant naughty list of individuals and entities (companies, charities, etc.)

Banks must follow rules like blocking transactions to entities that governments add to sanctions lists.

Sanctions lists (like OFAC) are a giant naughty list of individuals and entities (companies, charities, etc.)

4. Applying sanctions is hard.

Banks apply sanctions by "knowing their customer." Easy when your customer is a consumer. Hard when its a company owned by a holding company in Panama, owned by a trust company in the Cayman Islands. This "complex hierarchy" means detective work.

Banks apply sanctions by "knowing their customer." Easy when your customer is a consumer. Hard when its a company owned by a holding company in Panama, owned by a trust company in the Cayman Islands. This "complex hierarchy" means detective work.

5. The "pre payment detective work" is why international wires are sometimes slow.

This takes a lot of human and manual effort and is the same process for every payment.

This takes a lot of human and manual effort and is the same process for every payment.

6. The cost of getting it wrong can be massive for banks.

In 2015 BNP Paribas was fined $8.9bn for failings related to Iranian, Sundanese, and Cuban transactions they allowed and facilitated.

In 2015 BNP Paribas was fined $8.9bn for failings related to Iranian, Sundanese, and Cuban transactions they allowed and facilitated.

7. SWIFT is peer to peer.

SWIFT creates a shared rule book, but to move money, banks must build a "correspondent banking relationship." Like getting married to another bank, they do a lot of diligence on that bank, because they rely on that bank to be good at detective work too

SWIFT creates a shared rule book, but to move money, banks must build a "correspondent banking relationship." Like getting married to another bank, they do a lot of diligence on that bank, because they rely on that bank to be good at detective work too

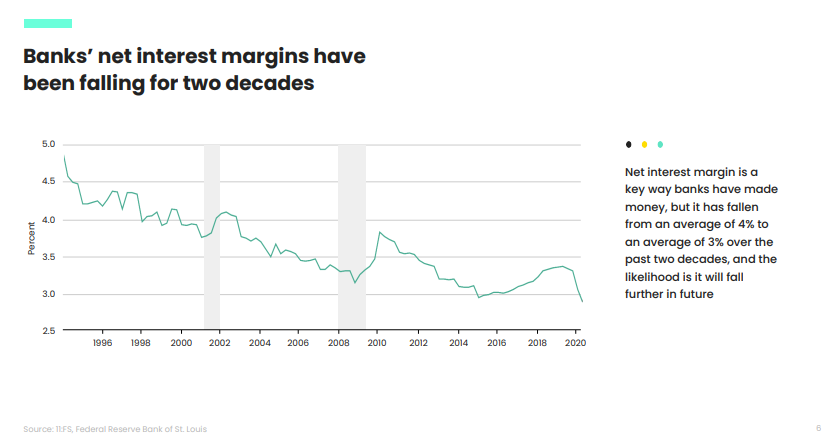

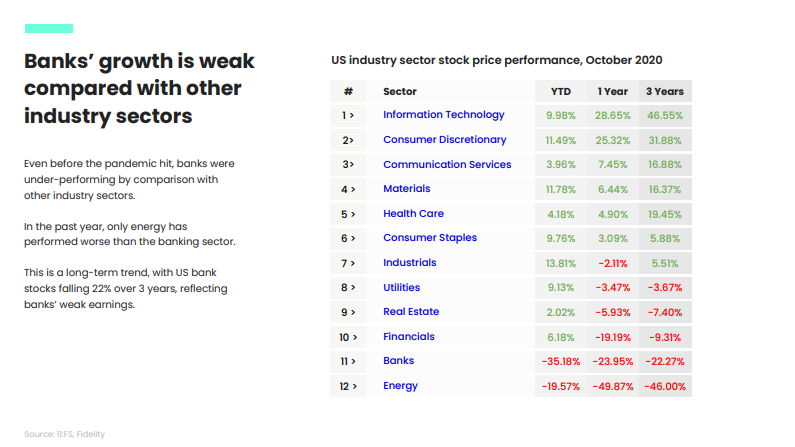

8. All of this detective work also makes international wires via SWIFT expensive

It can cost anywhere between $40 to $120 to make a SWIFT payment and depending on the complexity of the transaction, a settlement can take 3 days to 3 weeks to complete.

It can cost anywhere between $40 to $120 to make a SWIFT payment and depending on the complexity of the transaction, a settlement can take 3 days to 3 weeks to complete.

9. The US Dollar is the dominant currency in SWIFT, which gives the US a dominant influence in the global economy

According to SWIFT, more than 50% of transactions are in US Dollar, 30% in Euros, and 5% in British Pounds

According to SWIFT, more than 50% of transactions are in US Dollar, 30% in Euros, and 5% in British Pounds

10. Applying sanctions to Russia will be an operational nightmare for banks.

Russia is a major trader of oil and gas, which will still be allowed. Many transactions are also "future dated" meaning they were booked months ago to happen soon. What does a bank do with those? etc.

Russia is a major trader of oil and gas, which will still be allowed. Many transactions are also "future dated" meaning they were booked months ago to happen soon. What does a bank do with those? etc.

11. Russia has been preparing for sanctions for years.

Russia's central bank built up foreign reserves to more than $600bn (40% of GDP), and most of that is held in Euros and Gold. Meaning, it may still be able to run for a long time without SWIFT.

Russia's central bank built up foreign reserves to more than $600bn (40% of GDP), and most of that is held in Euros and Gold. Meaning, it may still be able to run for a long time without SWIFT.

12. But, the West is also freezing central bank assets!

This means the reserves can't easily be used.Russia has entered a costly war, that is taking longer than expected. It is burning through reserves it may not be able to spend. Sanctions will likely be effective eventually

This means the reserves can't easily be used.Russia has entered a costly war, that is taking longer than expected. It is burning through reserves it may not be able to spend. Sanctions will likely be effective eventually

13. Over time Russia (and China) may be emboldened to build out alternatives to SWIFT.

China is building an alternative to SWIFT called CIPS (Cross-border Interbank Payment System). Today CIPS is small, but China and Russia could provide a regional alternative to SWIFT

China is building an alternative to SWIFT called CIPS (Cross-border Interbank Payment System). Today CIPS is small, but China and Russia could provide a regional alternative to SWIFT

If you liked this thread, and you want to go further down with questions like

How does SWIFT messaging work?

What does this move mean for Crypto?

+ My thoughts on why Stablecoins would be an upgrade

Check out the full post here 👇

sytaylor.substack.com/p/fintech-food…

How does SWIFT messaging work?

What does this move mean for Crypto?

+ My thoughts on why Stablecoins would be an upgrade

Check out the full post here 👇

sytaylor.substack.com/p/fintech-food…

• • •

Missing some Tweet in this thread? You can try to

force a refresh