#ReadingFC 2020/21 financial results covered a season when the #Royals finished 7th in the Championship, just missing out on the play-offs under Veljko Paunovic, since replaced by Paul Ince and Michael Gilkes (interim managers). Some thoughts in the following thread.

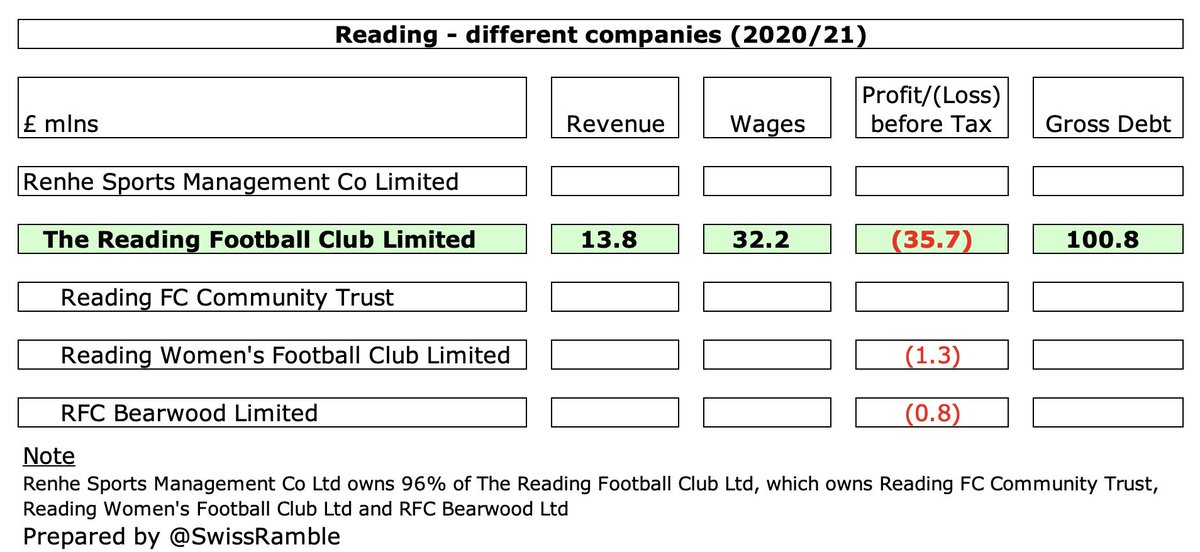

This was the fourth season that #ReadingFC were under the control of Chinese businessman Dai Yongge (and his sister Dai Xiu Li), who own 96% via Renhe Sports Management Co Ltd. However, in that time the club has struggled both on the pitch and with Financial Fair Play rules.

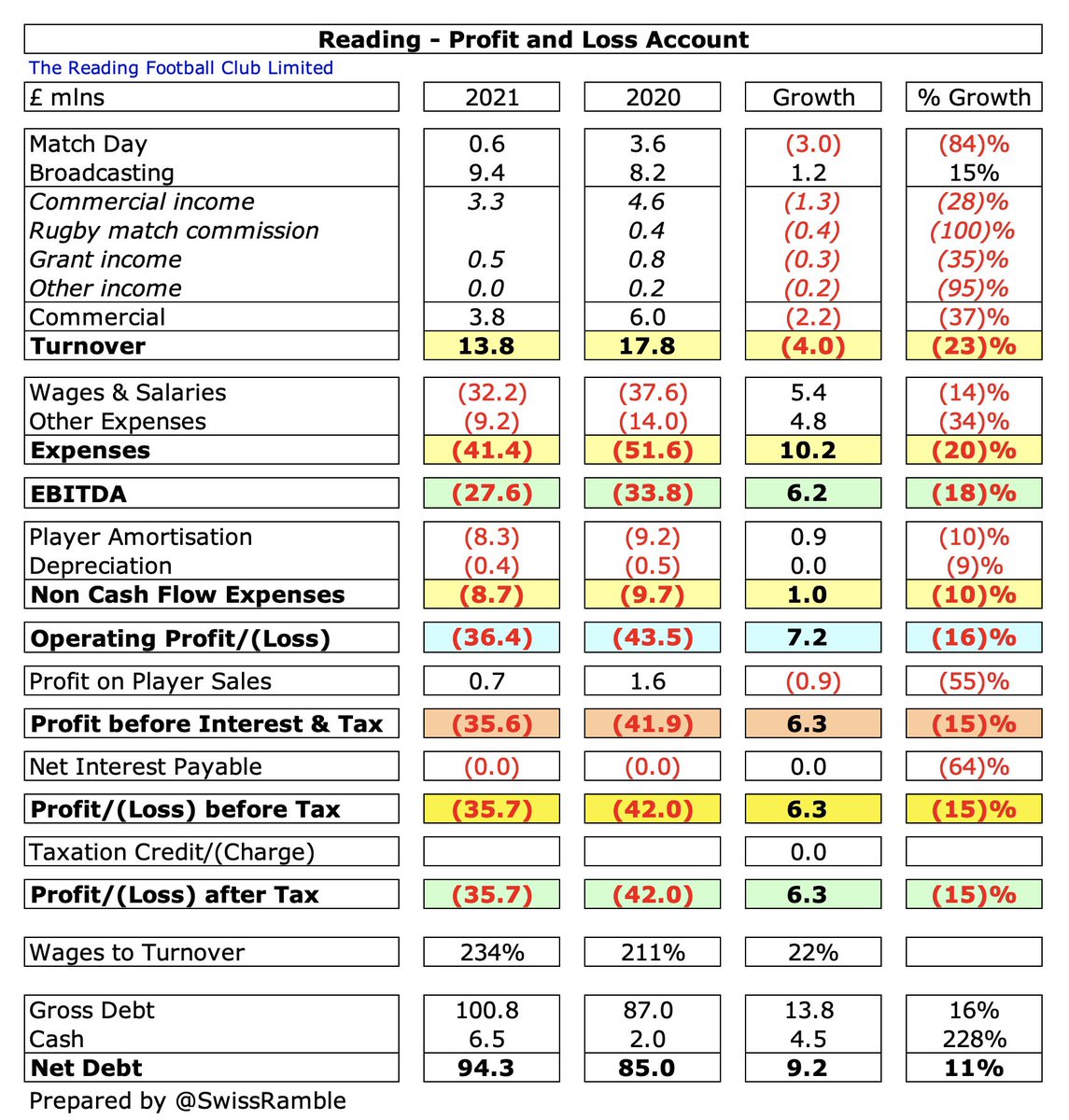

#ReadingFC loss narrowed from £42m to £36m, despite revenue dropping £4.0m (23%) from £17.8m to £13.8m and profit on player sales falling £0.9m to £0.7m, thanks to an £11.2m (18%) reduction in operating expenses from £61.3m to £50.2m.

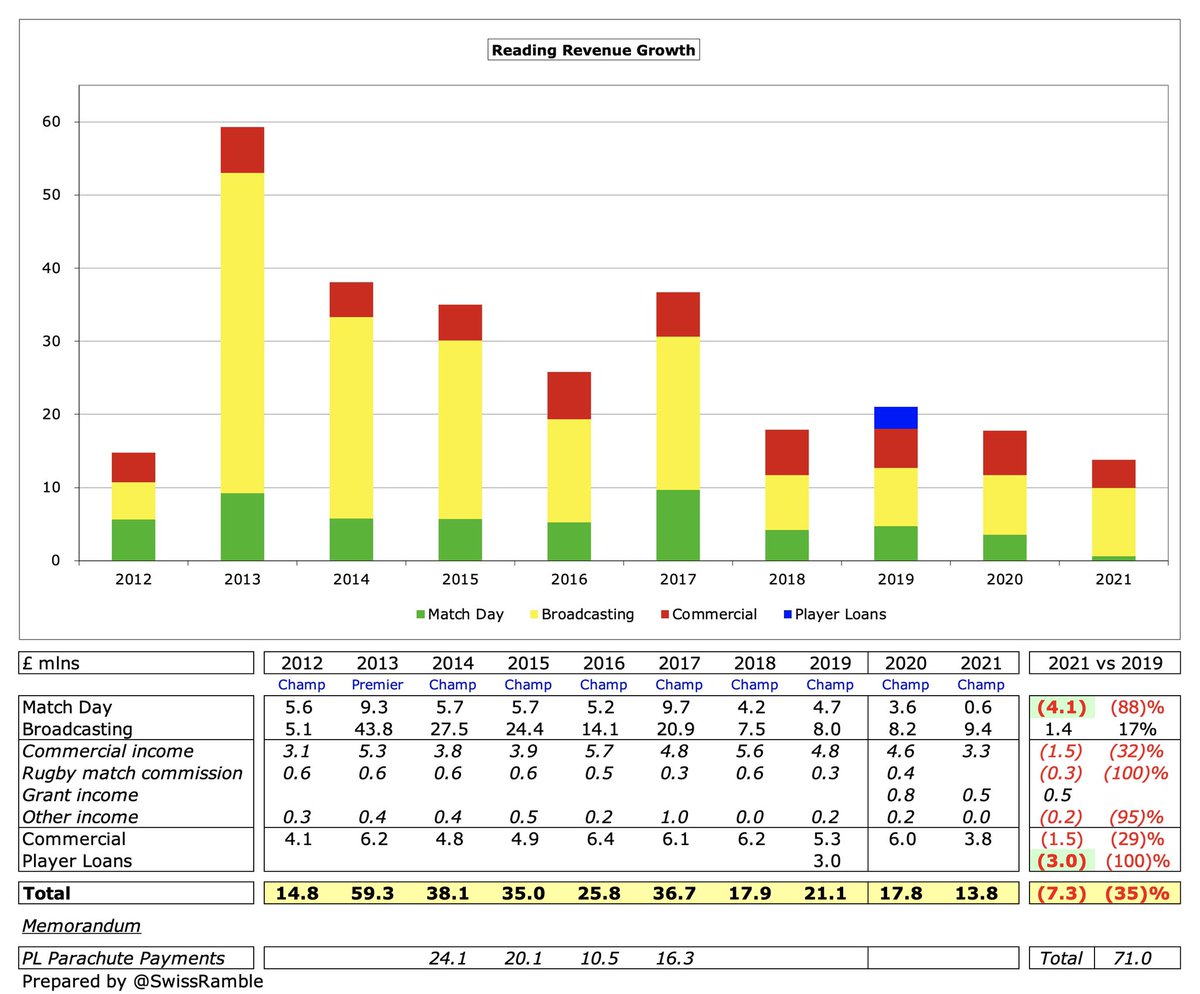

#ReadingFC £4.0m revenue decrease was largely due to COVID driven reductions in match day, down £3.0m (84%) from £3.6m to just £580k, and commercial, down £2.2m (37%) from £6.0m to £3.8m. Broadcasting rose £1.2m (15%) from £8.2m to £9.4m, including iFollow streaming income.

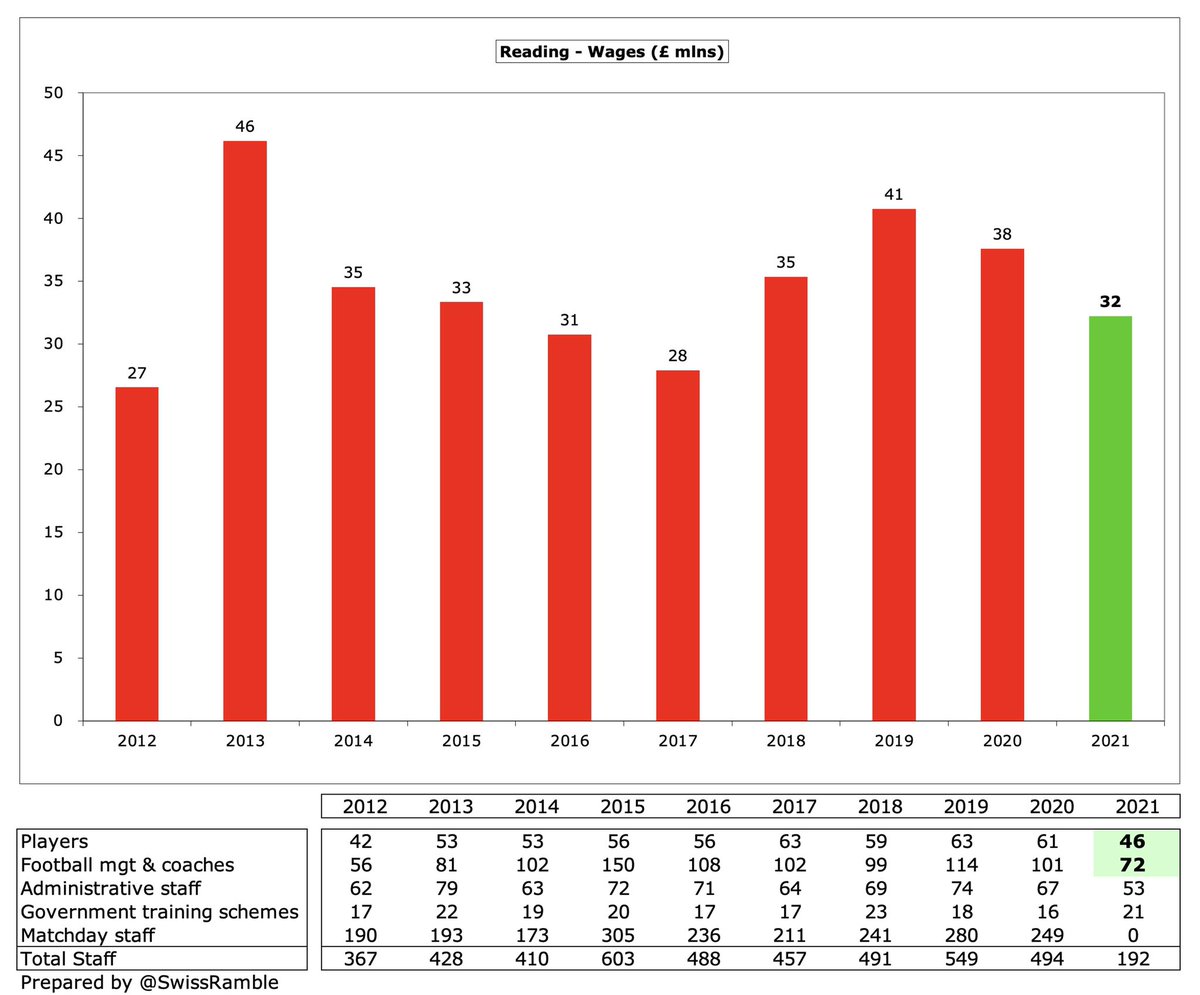

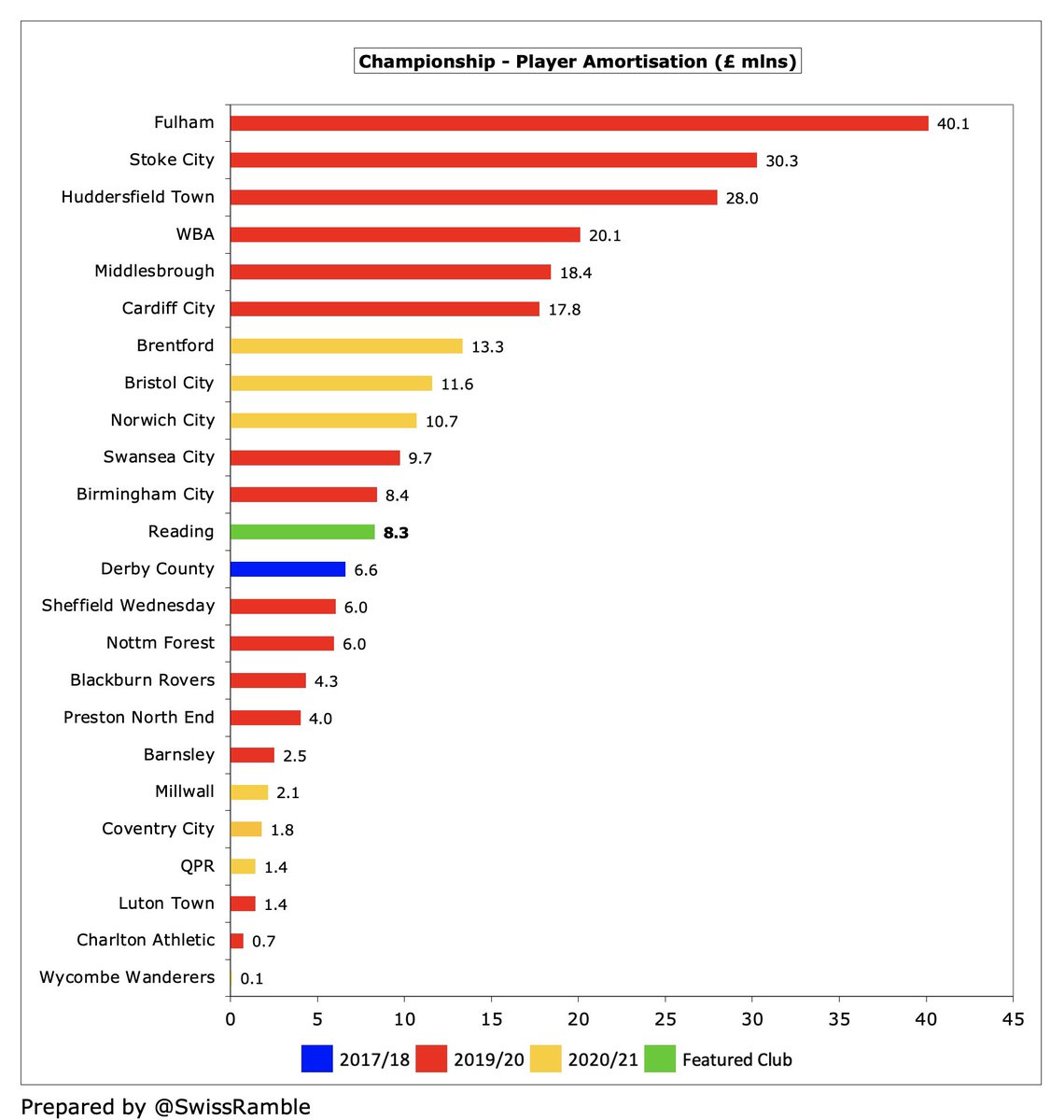

#ReadingFC cut staff costs, as wages fell £5.4m (14%) from £37.6m to £32.2m and player amortisation decreased £0.9m (10%) from £9.2m to £8.3m. In addition, other expenses dropped £4.8m (34%) from £14.0m to £9.2m, partly due to reduced costs of staging games.

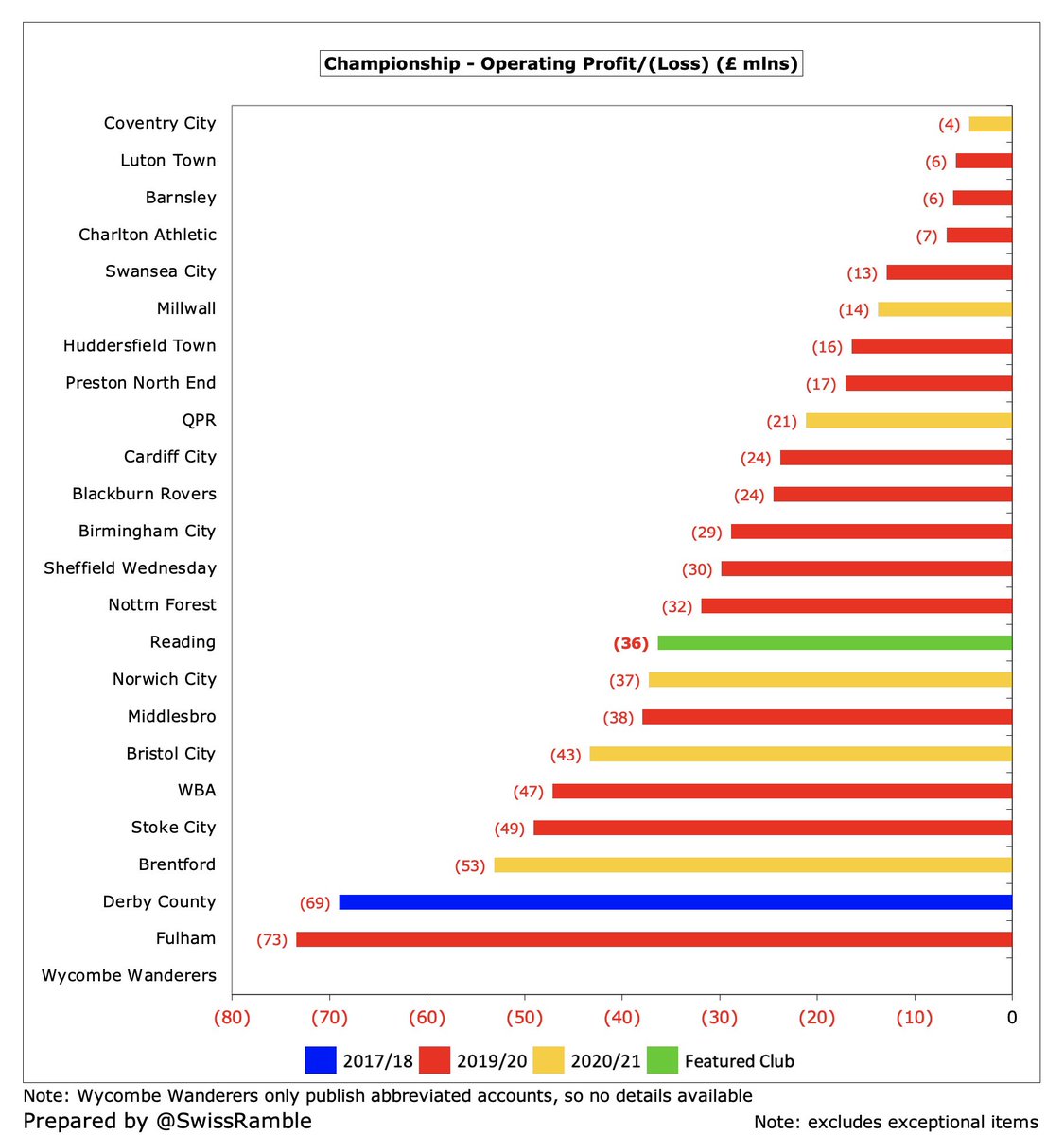

Despite the improvement, #ReadingFC £36m loss is still one of the worst in the Championship, only surpassed by Bristol City £38m to date in 2020/21. Many clubs post large losses in this division, though some have been relatively low this season, e.g. QPR and Coventry City £5m.

#ReadingFC did not detail the impact of the COVID-19 pandemic on these financials, though I would estimate this as around £6m in 2020/21: match day £4.1m (games played without fans), commercial income £1.5m, rugby match commission £0.3m and other income £0.2m.

#ReadingFC only made £0.7m profit on player sales including sell-on fees, down from £1.6m, as many players were released for nothing. Highest sale likely to be Mo Barrow to South Korea. One of the lowest player gains in the Championship, far below #NCFC £60m and Brentford £44m.

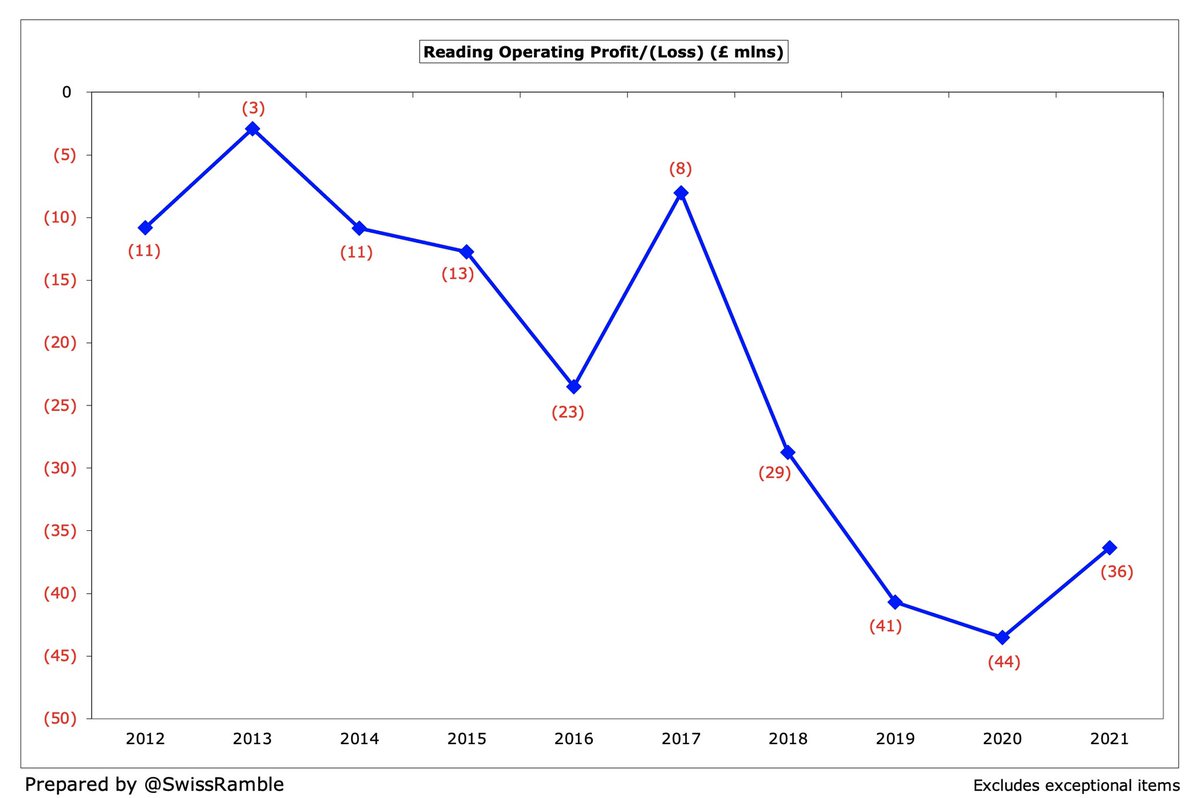

#ReadingFC have reported losses in 8 of the last 10 years, even managing to lose money in the Premier League in 2013. Their annual losses have been particularly high in the last 4 years (2018 £21m, 2019 £30m, 2020 £42m and 2021 £36m), amounting to an amazing £129m in this period.

Moreover, #ReadingFC losses would have been even higher without £51m once-off gains in the past 7 years, including property £26m (stadium sale £7m, training ground sale £8m and land revaluation £11m), grants received £10m, loan write-off £9m and investment disposals £8m.

Renhe Sports now owns the stadium, though leased back to the football club for £1.5m annual rent, while the training ground is owned by Sun Elegant Group. The sales are within EFL rules (and price lower than others), but this is still some fancy financial footwork by #ReadingFC.

#ReadingFC have made very little from player sales, averaging only £1.5m a year since 2017. Poor recruitment has resulted in numerous free transfers in order to get players with high wages off the books. However 2021/22 will be better with the £8m sale of Michael Olise to #CPFC.

#ReadingFC operating loss reduced from £44m to £36m, though still much worse than £8m before parachute payments ended in 2017. This is obviously not great, but in fairness almost every club in the Championship posts substantial operating losses, i.e. over half above £30m.

#ReadingFC revenue has dropped £7.3m (35%) in last 2 years from £21.1m to £13.8m, partly because of COVID, which has driven reductions in match day £4.1m & commercial £1.5m, but also due to £3m player loan in 2019 to Chinese club controlled by owner. Lowest since £12.3m in 2006.

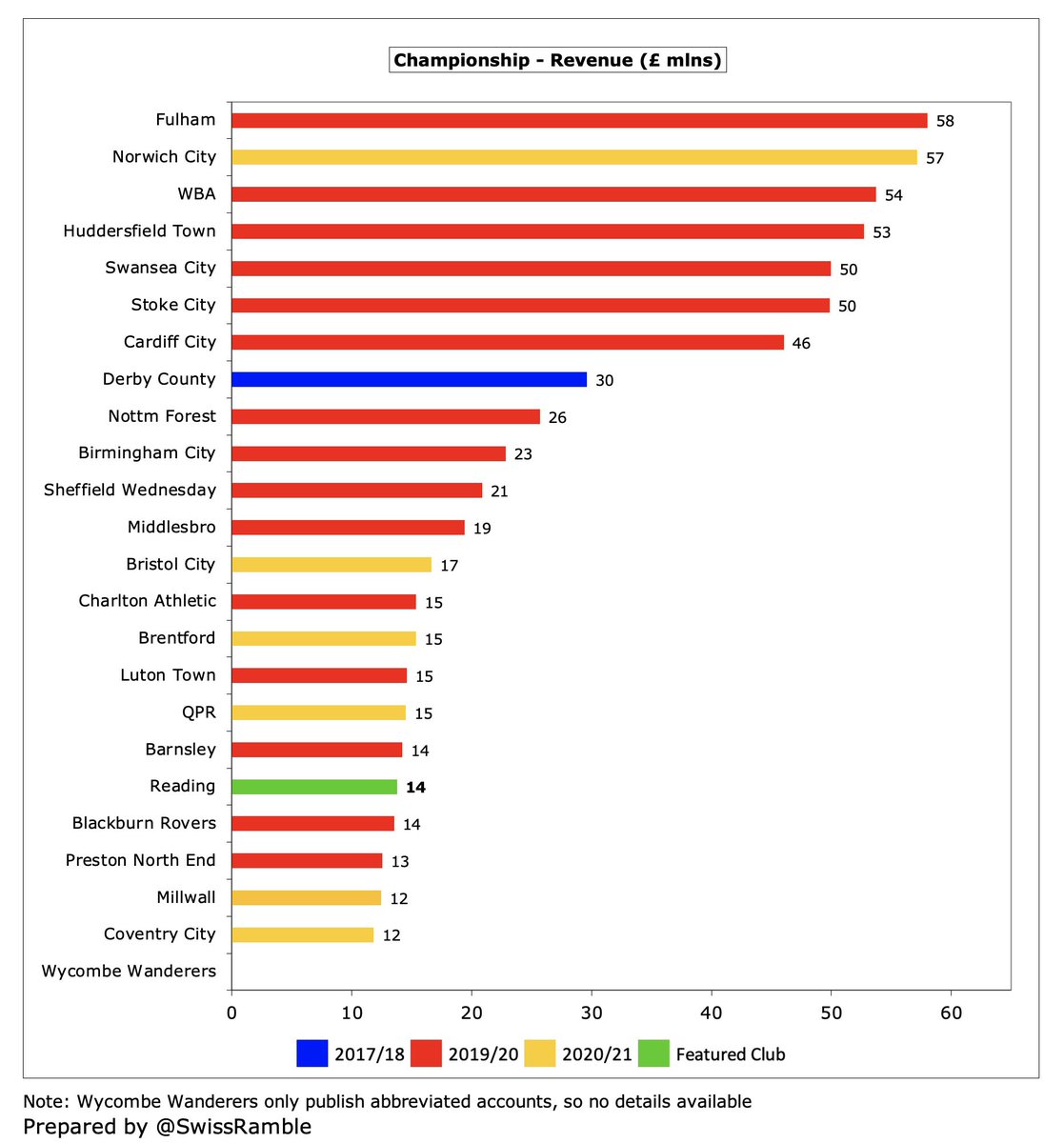

#ReadingFC £13.8m revenue is now firmly in the bottom half of the Championship. To highlight the magnitude of their challenge, this is around a quarter of the revenue of clubs receiving parachute payments after relegation from the Premier League, e.g. #NCFC £57m in 2020/21.

#ReadingFC no longer benefit from parachute payments, having received £71m in the 4 years up to 2017. These are so significant that they make it difficult for others to compete, e.g. in 2019/20 a relegated club received £42m in year one, £34m in year two and £15m in year three.

#ReadingFC broadcasting income rose £1.2m (15%) from £8.2m to £9.4m, including live iFollow streaming. Less than half of £20.9m in 2017 (last year of parachute payments). Most Championship clubs earn £7-9m, but there is a massive gap to clubs with parachutes.

#ReadingFC match day income fell £3.0m (84%) from £3.6m to just £580k, as all home games were played behind closed doors (except three in December with severely restricted capacity of 2,000). The 2017 peak of £9.7m included money from the play-off final at Wembley.

#ReadingFC average attendance (for games played with fans) was 14,407 in 2019/20, which was in the bottom half of the Championship. This is around 9,500 lower than the 24,000 crowds they attracted the last time they were in the Premier League.

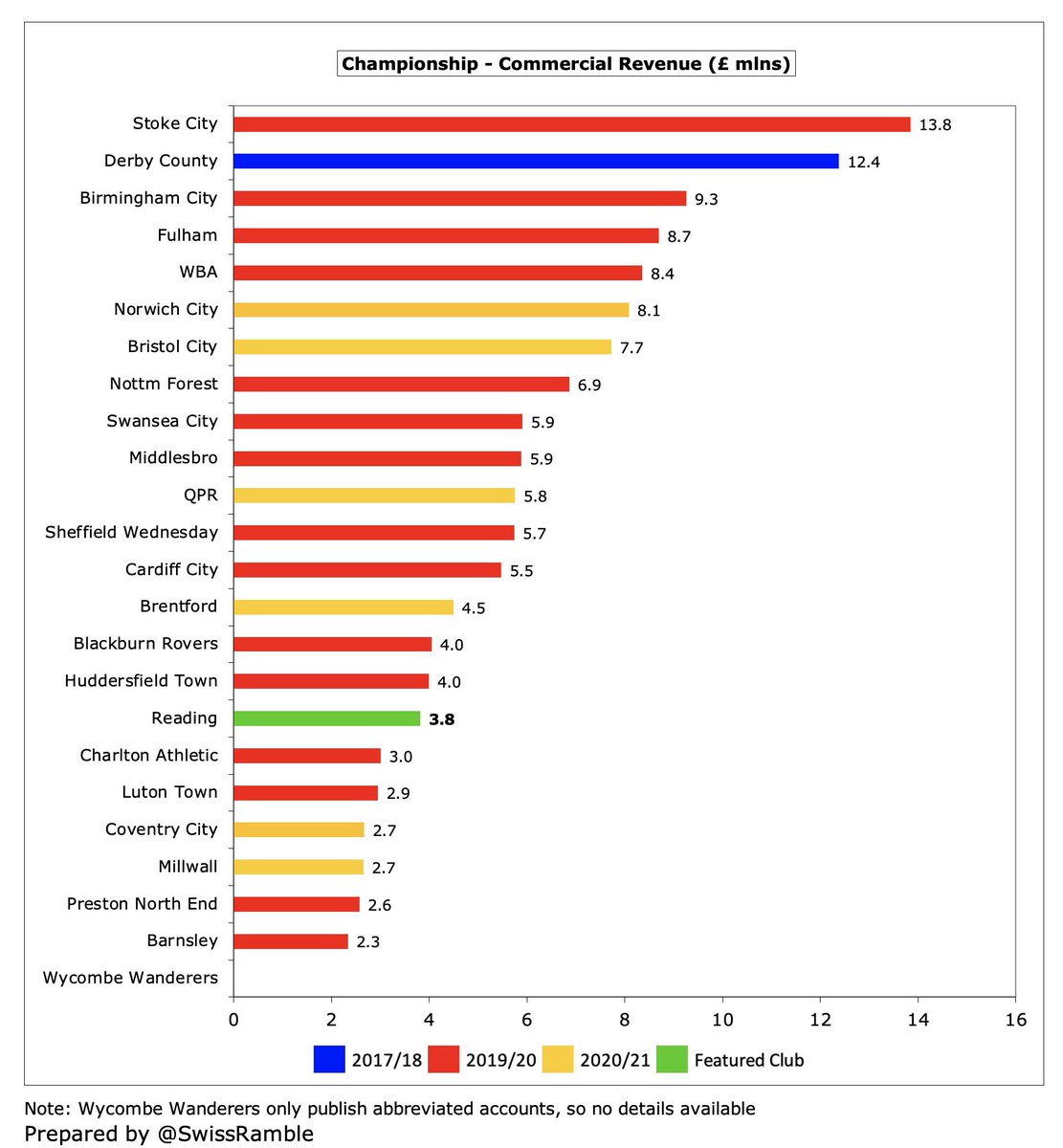

#ReadingFC commercial income fell £2.2m (37%) from £6.0m to £3.8m, including £0.5m furlough grant. No income from the ground share agreement with London Irish rugby club. Firmly in the bottom half of the Championship, far below Stoke City £14m.

#ReadingFC shirt sponsor in 2020/21 was online casino operator Casumo, but they were replaced this season by a three-year deal with local company, Select Car Leasing, who also signed 10-year stadium naming rights. Kit supplier deal is with Macron.

Many clubs reported government furlough payments as Other Operating Income, but #ReadingFC included their £0.5m within commercial income. Other elements sometimes classified here are player loans, e.g. main reason for #HTAFC £6.3m in 2019/20.

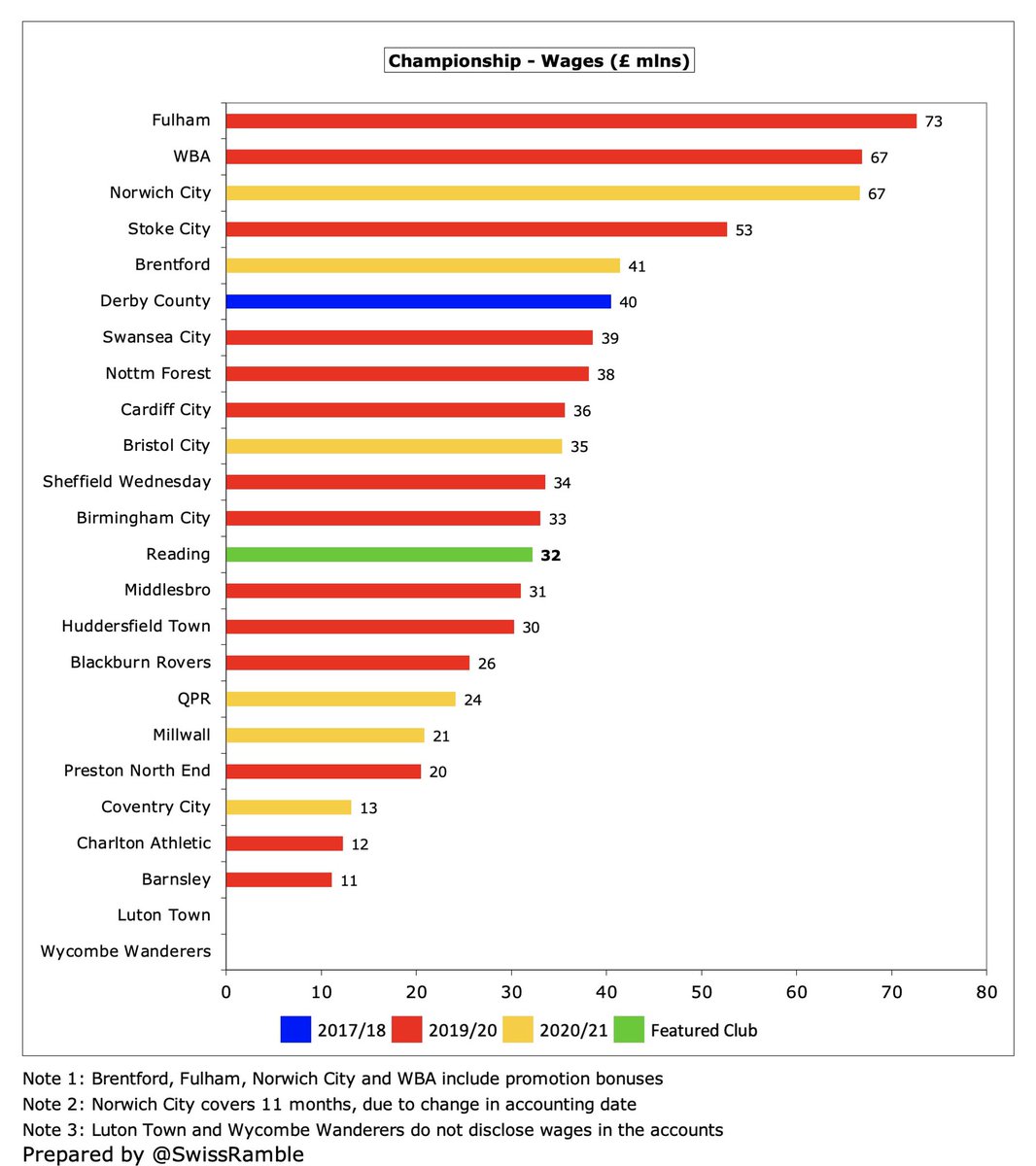

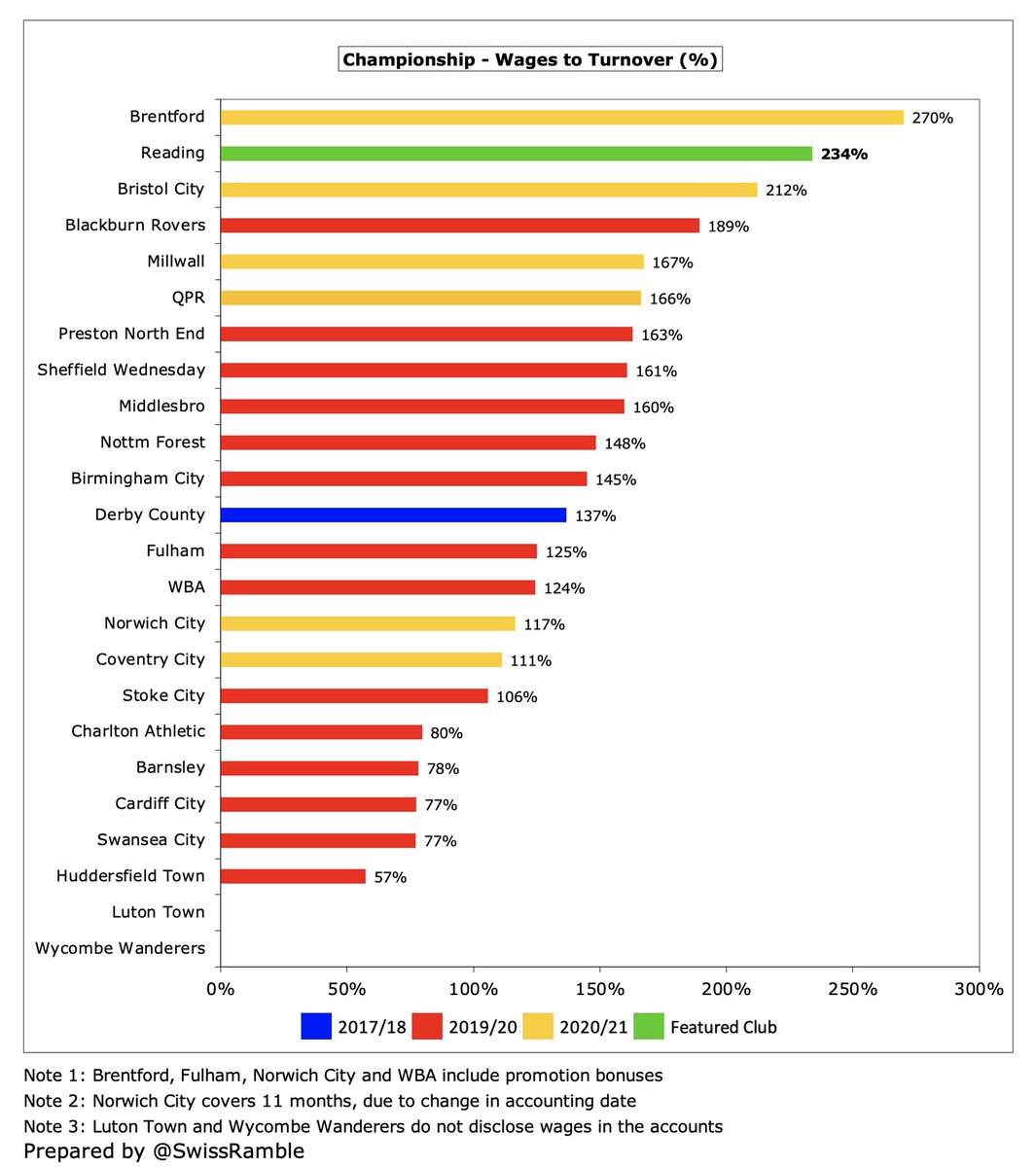

#ReadingFC wage bill fell £5.4m (14%) from £37.6m to £32.2m. Down from £40.7m two years ago, though this was still higher than the £27.9m when they last received parachute payments in 2017, which highlights how much the owners have invested (wasted).

Following the decrease, #ReadingFC £32m wage bill is mid-table in the Championship, less than half of the clubs with parachutes. Will further fall in line with business plan agreed with EFL as part of FFP punishment: player salaries down to £21m this season, £16m next season.

#ReadingFC wages to turnover ratio increased from 211% to 234%, only surpassed by Brentford (impacted by hefty promotion bonuses). Even before the pandemic, most clubs in the very competitive Championship had ratios above 100%, but Reading have averaged over 200% in last 4 years.

Despite the awful state of #ReadingFC finances, directors’ remuneration still rose 28% from £583k to £745k, the highest to date in the 2020/21 Championship and only surpassed by 3 clubs in the previous season. The highest paid director earned £541k, up from £497k.

#ReadingFC player amortisation, the annual charge to write-off transfer fees over a player’s contract, fell £0.9m (10%) from £9.2m to £8.3m, mid-table in the Championship, but less than a quarter of big-spending Fulham. Nevertheless, has doubled since Mr. Dai’s arrival.

#ReadingFC only spent £2.8m on player purchases in 2020/21, the club’s lowest outlay since 2014, mainly on Ovie Ejaria from #LFC. They have been under a transfer embargo since last summer as a result of their breach of EFL profitability and sustainability rules.

In last 5 years #ReadingFC gross transfer spend was £54m, much of which has involved Kia Joorabchian as “advisor”. Big money purchases included George Puscas from Inter, Lucas Joao from #SWFC, Sone Aluko from #FFC & Sam Baldock from #BHAFC, none of whom has set the world alight.

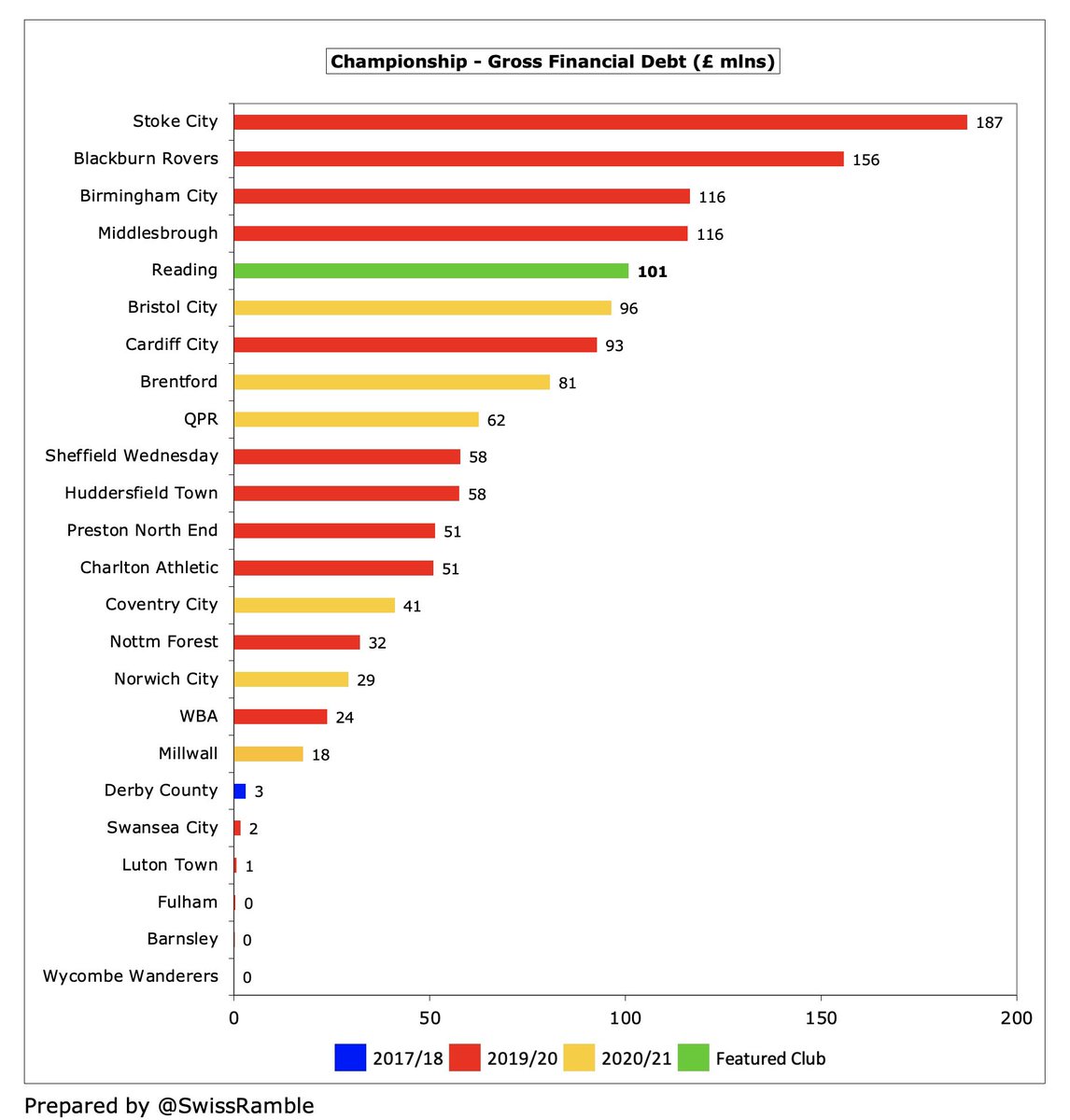

#ReadingFC gross debt rose £14m from £87m to £101m, almost entirely owed to the club’s owners. This has quadrupled from £25m in 2011. In fact, it would have been as high as £143m if the owners had not converted £42m of loans into capital in last two years.

Nevertheless, #ReadingFC £101m gross financial debt is still 5th highest in the Championship, only below Stoke City £187m, #BRFC £156m, Birmingham City £116m and #Boro £116m.

However, #ReadingFC owner loans have been provided interest-free, so the club only paid £16k interest. Although many Championship clubs have a lot of debt, very little interest is actually paid, e.g. only 3 clubs had payments over £1m in 2019/20.

#ReadingFC transfer debt (for remaining stage payments on transfer fees) decreased from prior season’s club record £9.7m to £3.6m, much lower than clubs like #FFC £86m, #NCFC £23m and Brentford £19m.

#ReadingFC £36m operating loss converted to £37m negative cash flow after adding back £9m amortisation/depreciation, offset by £1m adverse working capital movements. Spent £1m net on players (purchases £3m, sales £2m). Funded by £43m new loans from owners.

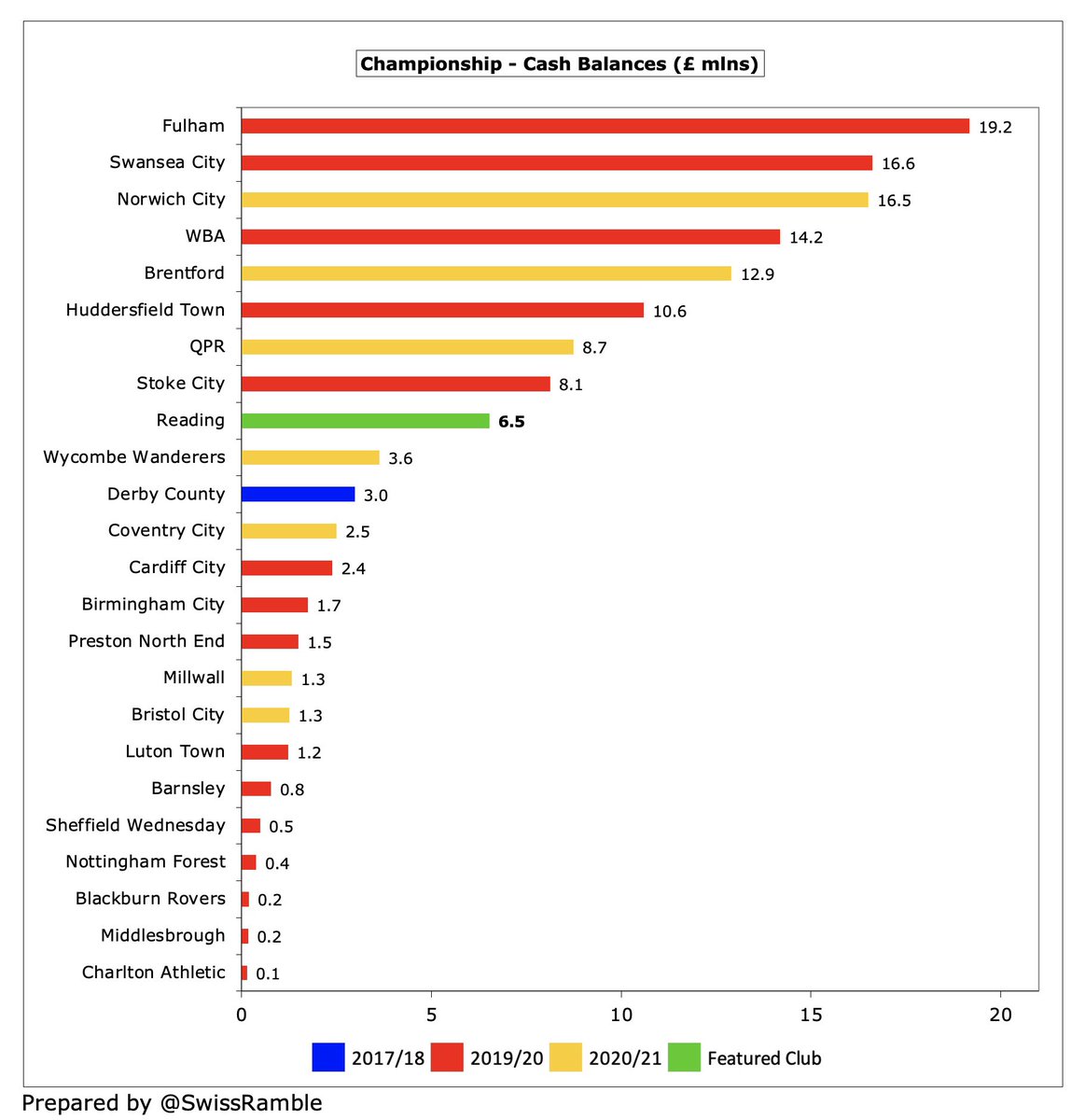

As a result, #ReadingFC cash balance increased from £2.0m to £6.5m. This is not too bad for the Championship, though is a little misleading, as much of this will be required to cover operating shortfalls over the next 12 months.

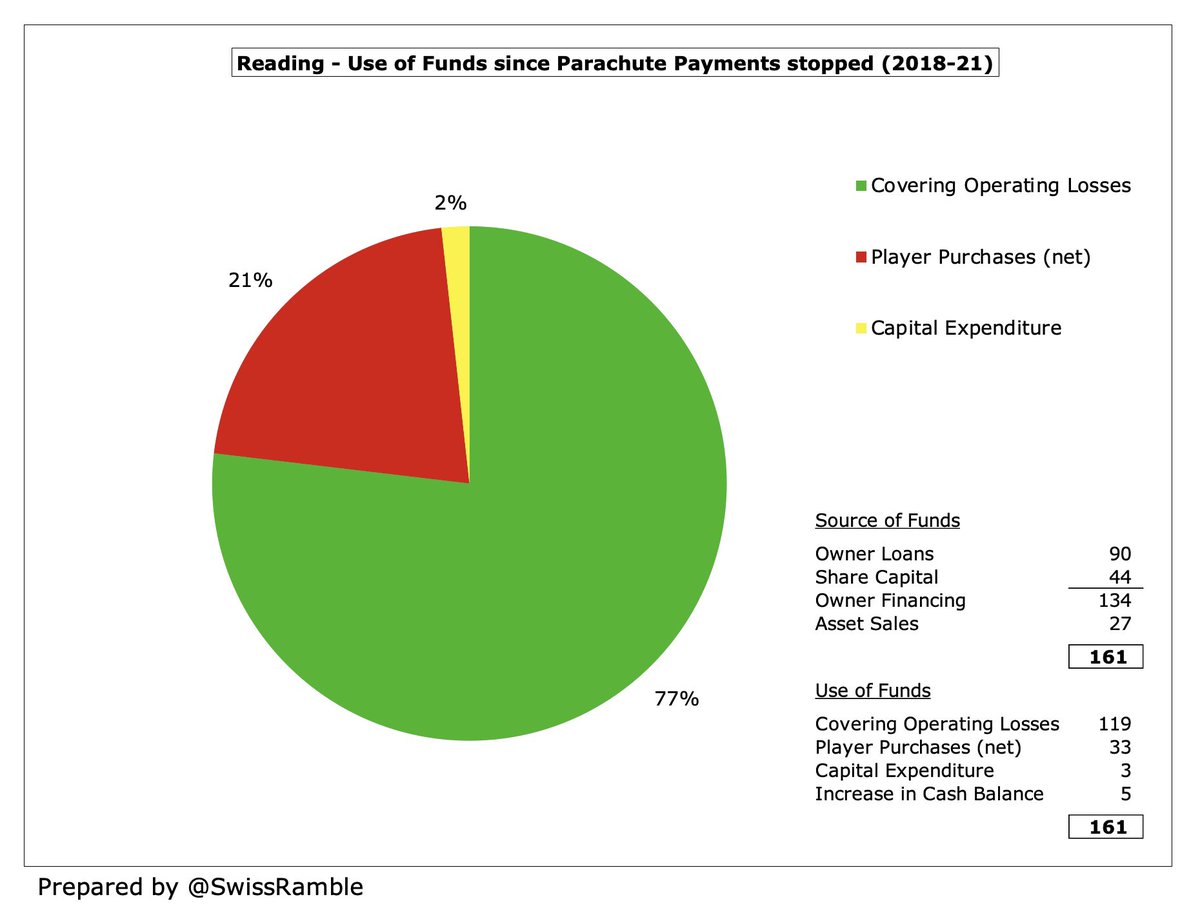

Since parachute payments stopped in 2017, #ReadingFC cash has largely come from the owners £134m (loans £90m, share capital £44m), boosted by asset sales £27m. Mainly used to cover operating losses £119m and player purchases £33m (net), with only £3m infrastructure investment.

Former #ReadingFC owner John Madejski said, “Mr. Dai has certainly put his money where his mouth is”, evidenced by the Chinese businessman providing £134m in the last 4 years. In fact, owners past and present have put £150m into the Royals since 2011.

The Championship is a division that has an endless appetite for owner funding, so #ReadingFC £106m in the 20 years up to 2020 was actually only mid-table, much lower than the likes of Fulham £315m, QPR £285m and Stoke City £185m.

#ReadingFC were deducted 6 points for breaching financial rules, as EFL said their FFP loss was £58m for the reporting period (2018 to 2021), compared to £39m limit. No details provided, but this is in line with my calculation after allowable deductions and COVID impact.

A further 6-point deduction is suspended until the end of next season, provided #ReadingFC comply with a business plan agreed with the EFL, including much lower player wages.

#ReadingFC auditors have noted a “material uncertainty” which casts “significant doubt” on #the club’s ability to continue as a going concern, so the owners’ support remains very important, though losses should fall in line with lower wages.

#ReadingFC gamble on spending their way out of the division has clearly not worked with the club struggling at the wrong end of the table. While the owners’ financial commitment cannot be faulted, their football knowledge has been lacking, not helped by poor advice from others.

• • •

Missing some Tweet in this thread? You can try to

force a refresh