Cosmos - The internet of blockchains

A thread about what Cosmos is, how you should play it, and all the staking opportunities & airdrops.

/THREAD

A thread about what Cosmos is, how you should play it, and all the staking opportunities & airdrops.

/THREAD

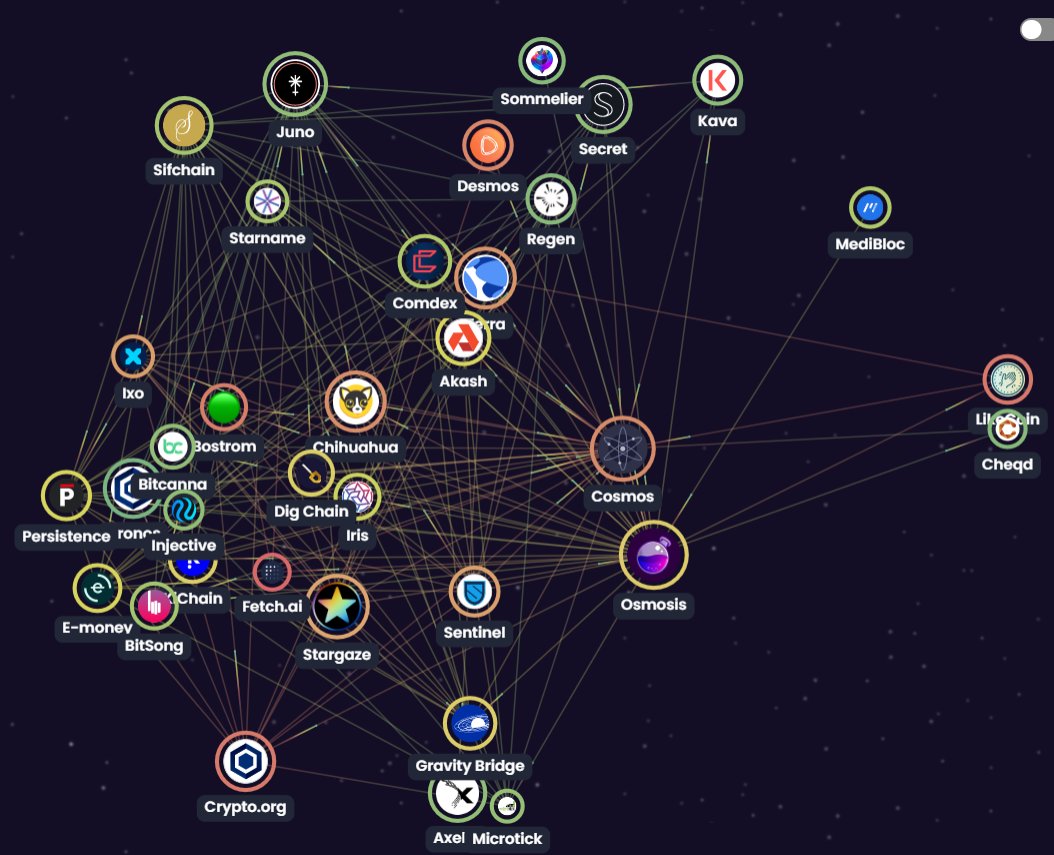

Cosmos is a decentralized network of independent yet interoperable blockchains that are able to exchange information and tokens between each other permissionless.

The first blockchain on the Cosmos network is the Cosmos Hub and $ATOM is the native token of the Cosmos Hub.

The first blockchain on the Cosmos network is the Cosmos Hub and $ATOM is the native token of the Cosmos Hub.

Cosmos (layer 0) itself is not a blockchain but rather a framework for building out independent and sovereign blockchains.

Layer 0 protocols are the ground floor for all blockchain protocols.

Layer 0 protocols are the ground floor for all blockchain protocols.

While Layer 1 projects allow for decentralized applications (dApps) to be built on the blockchain such as Uniswap and Aave being built on top of Ethereum, Layer 0 projects allow for entire blockchains to be built on top of them.

Not only do Layer 0s allow for blockchains to be built on top of them, but also they allow for cross-chain interoperability between these Layer 1 projects.

This means that different blockchains can communicate with each other, a feature typically missing on Layer 1s.

This means that different blockchains can communicate with each other, a feature typically missing on Layer 1s.

One way to think about it is that $ATOM is the main hub and then there are a lot of blockchains connected to the hub called zones.

Zones are regular blockchains while Hubs are blockchains specifically designed to connect Zones together.

Zones are regular blockchains while Hubs are blockchains specifically designed to connect Zones together.

Once a Zone creates an IBC connection with a Hub, it automatically has access to every other Zone that is connected to it.

Cosmos is a decentralized ecosystem comprising many independent blockchains. There are 262 applications and services built on Cosmos.

Cosmos is a decentralized ecosystem comprising many independent blockchains. There are 262 applications and services built on Cosmos.

Did you also know that Terra $LUNA, Binance Smart Chain, and Crypto dot com are built on Cosmos?

I won't spend more time talking about fundamentals in the Cosmos ecosystem for now, but if you want to learn more check out this thread by @sandraaleow

I won't spend more time talking about fundamentals in the Cosmos ecosystem for now, but if you want to learn more check out this thread by @sandraaleow

https://twitter.com/sandraaleow/status/1490348328038506496

But if you're a degen that wants yield, what are your best opportunities in the Cosmos Ecosystem?

The biggest incentive to be bullish on this ecosystem is all the juicy airdrops that are coming. New projects launch all the time and they're giving airdrops...

The biggest incentive to be bullish on this ecosystem is all the juicy airdrops that are coming. New projects launch all the time and they're giving airdrops...

to people who are staking $ATOM and other tokens.

The new tokens you receive most often have great staking rewards, which leads to stability of the network and happy stakers because of the high yield.

Let's talk more about staking and airdrops:

The purpose of staking...

The new tokens you receive most often have great staking rewards, which leads to stability of the network and happy stakers because of the high yield.

Let's talk more about staking and airdrops:

The purpose of staking...

is to secure the coin’s network.

In return, you receive rewards in the form of the coin, based on a variable APR.

APR changes based on percent of coins staked, as rewards are split. More staked tokens means less rewards per coin.

In return, you receive rewards in the form of the coin, based on a variable APR.

APR changes based on percent of coins staked, as rewards are split. More staked tokens means less rewards per coin.

I recommend staking in the Keplr wallet: @keplrwallet

You can also use Cosmostation.

When you want to stake you have to choose a validator.

Check out this Reddit-post on what to think of before you choose a validator:

reddit.com/r/cosmosnetwor…

You can also use Cosmostation.

When you want to stake you have to choose a validator.

Check out this Reddit-post on what to think of before you choose a validator:

reddit.com/r/cosmosnetwor…

There is also a 21-day unbonding period when you decide to unstake. This is a network security feature common across Cosmos chains.

Which tokens in the Cosmos ecosystem do you stake if you want airdrops?

If you only choose two tokens, choose $ATOM and $JUNO.

Which tokens in the Cosmos ecosystem do you stake if you want airdrops?

If you only choose two tokens, choose $ATOM and $JUNO.

The third best option is $OSMO, then $SCRT.

Some airdrops are based on how many tokens you have, but in other airdrops you're only qualified if you meet the minimum criteria of X number of tokens.

If you have a bag with 20 $ATOM, 20 $JUNO, 50 $OSMO, and 50 $SCRT, you...

Some airdrops are based on how many tokens you have, but in other airdrops you're only qualified if you meet the minimum criteria of X number of tokens.

If you have a bag with 20 $ATOM, 20 $JUNO, 50 $OSMO, and 50 $SCRT, you...

can be relatively sure to be eligible for almost all airdrops in the Cosmos ecosystem.

If you want the full details about how to play the airdrop game in the best way, check out this great thread by @cryptolikemo

If you want the full details about how to play the airdrop game in the best way, check out this great thread by @cryptolikemo

https://twitter.com/cryptolikemo/status/1497780470318354440

Here is a shortlist thread of upcoming Cosmos airdrops:

And this is an app where you can see the current & upcoming airdrops for the Cosmos Ecosystem:

airdrop.glideapp.io

https://twitter.com/NicolasVnghe/status/1496438783172042762

And this is an app where you can see the current & upcoming airdrops for the Cosmos Ecosystem:

airdrop.glideapp.io

And the staking rewards for the 4 main tokens are high too:

https://twitter.com/Route2FI/status/1498381094865022982

Let's take a look at some of the other opportunities in the Cosmos ecosystem:

$OSMO:

Osmosis is an AMM protocol that allows users to launch their own liquidity pools or participate in some of the existing pools eg. $ATOM / $OSMO, $ATOM / $JUNO etc.

$OSMO:

Osmosis is an AMM protocol that allows users to launch their own liquidity pools or participate in some of the existing pools eg. $ATOM / $OSMO, $ATOM / $JUNO etc.

Good yield, but personally I prefer staking over yield farming because of impermanent loss.

You also got to ask yourself if the yield farm APR is good enough vs. the staking rewards.

A good $OSMO thread for staking and yield farmers:

You also got to ask yourself if the yield farm APR is good enough vs. the staking rewards.

A good $OSMO thread for staking and yield farmers:

https://twitter.com/cryptolikemo/status/1465107483626811393?s=20&t=EYUIjSTm8V5b01JfTEiisg

$JUNO:

Juno is a Layer 1 platform on built on top of Cosmos.

It brings interoperable smart contracts together thanks to CosmWasm.

This allows smart contracts on the Juno network to function across multiple different chains.

Juno is a Layer 1 platform on built on top of Cosmos.

It brings interoperable smart contracts together thanks to CosmWasm.

This allows smart contracts on the Juno network to function across multiple different chains.

@JunoNetwork is a 100% community-owned and operated smart contract platform.

There was no seed, public or private sales. The team tokens are locked for 12 years.

You're getting lots of good airdrops for holding it and the staking APR is over 100%. What's not to like...

There was no seed, public or private sales. The team tokens are locked for 12 years.

You're getting lots of good airdrops for holding it and the staking APR is over 100%. What's not to like...

about that? No wonder why it's growing rapidly and already is #66 on Coingecko sorted by mcap

So what do you do with $JUNO? Stake it or have it in a yield farm on Osmosis.

A good thread about $JUNO to understand more of the gigabrain-stuff going on:

So what do you do with $JUNO? Stake it or have it in a yield farm on Osmosis.

A good thread about $JUNO to understand more of the gigabrain-stuff going on:

https://twitter.com/willdphan/status/1498017486150803467?s=20&t=EYUIjSTm8V5b01JfTEiisg

$SCRT:

Secret is a decentralized network that finally solves the problem of privacy, helping to secure and scale the decentralized web.

You can see all the dApps that are built on Secret here:

scrt.network/ecosystem/over…

Secret is a decentralized network that finally solves the problem of privacy, helping to secure and scale the decentralized web.

You can see all the dApps that are built on Secret here:

scrt.network/ecosystem/over…

Some of my personal favorites:

NFT's: @StashhApp

Shade Protocol : An algo stablecoin that focuses on privacy: @Shade_Protocol

Check out this amazing writeup on Shade Protocol here:

rainandcoffee.substack.com/p/shade-protoc… by @0xRainandCoffee and @intern_mikey

NFT's: @StashhApp

Shade Protocol : An algo stablecoin that focuses on privacy: @Shade_Protocol

Check out this amazing writeup on Shade Protocol here:

rainandcoffee.substack.com/p/shade-protoc… by @0xRainandCoffee and @intern_mikey

There are loads of interesting tokens between $50M - $1B market cap in the Cosmos Ecosystem:

$KAVA, $OKT, $XPRT, $AKT, $REGEN, $CTK, $EROWAN, $NGM ++

On top of that we have Terra $LUNA and all their dApps, $RUNE and Thorchain (which I will make a thread on)...

$KAVA, $OKT, $XPRT, $AKT, $REGEN, $CTK, $EROWAN, $NGM ++

On top of that we have Terra $LUNA and all their dApps, $RUNE and Thorchain (which I will make a thread on)...

$ROSE aka. @OasisProtocol and $KDA (Kadena) which all are a part of the Cosmos ecosystem.

Wonder what else is a part of Cosmos? Check here:coingecko.com/en/categories/…

I have to admit that this thread was maybe the hardest thing I've ever written. Basically, because...

Wonder what else is a part of Cosmos? Check here:coingecko.com/en/categories/…

I have to admit that this thread was maybe the hardest thing I've ever written. Basically, because...

the ecosystem is so complex and advanced, but also because of the endless opportunities on Cosmos.

To end this, how should you play the Cosmos Ecosystem?

1. Stake the 4 tokens $ATOM, $JUNO, $OSMO & $SCRT

2. Follow this page @Cosmos_Airdrops to get all the airdrops. Upcoming airdrops I've heard about: $EVMOS, $KING, $EX, $VERSE, $RAW ++.

1. Stake the 4 tokens $ATOM, $JUNO, $OSMO & $SCRT

2. Follow this page @Cosmos_Airdrops to get all the airdrops. Upcoming airdrops I've heard about: $EVMOS, $KING, $EX, $VERSE, $RAW ++.

There's a quote in the community that goes like this: "New day, different airdrop" that fits very well

3. Make some LP's on @osmosiszone

4. Follow Cosmos-brains for alpha: @GreaveJake @cryptodanvans @Cryptocito @L1am_Crypto @cryptolikemo @RunAwayInvestor @0x_Hank @bullishbish

3. Make some LP's on @osmosiszone

4. Follow Cosmos-brains for alpha: @GreaveJake @cryptodanvans @Cryptocito @L1am_Crypto @cryptolikemo @RunAwayInvestor @0x_Hank @bullishbish

@johnniecosmos @davey_0602

5. Try the different dApps in the system:

cosmos.network/ecosystem/apps (I'll probably deep dive into several of them in threads later)

5. Try the different dApps in the system:

cosmos.network/ecosystem/apps (I'll probably deep dive into several of them in threads later)

I am sure there are lots of other good plays for the Cosmos ecosystem, so if any of you want to mention the best ones, I'd check them out and could add them to the thread.

That was it!

If you liked this thread, make sure to follow me @Route2FI for more DeFi-threads like this.

I also have a free newsletter where I break down DeFi protocols & crypto concepts once per week:

getrevue.co/profile/route2…

If you liked this thread, make sure to follow me @Route2FI for more DeFi-threads like this.

I also have a free newsletter where I break down DeFi protocols & crypto concepts once per week:

getrevue.co/profile/route2…

If you liked this thread I would love it if you could retweet the first tweet so that more people can see it

👇

👇

https://twitter.com/Route2FI/status/1499039471437713410

• • •

Missing some Tweet in this thread? You can try to

force a refresh