It's time to give an update about Mirror Protocol and my strategy going forward in terms of the bearish market.

Let's look at why I'm considering shorting S&P500 with the yield-bearing stablecoin aUST.

APY: 20-70% (depending on the market)

/THREAD

Let's look at why I'm considering shorting S&P500 with the yield-bearing stablecoin aUST.

APY: 20-70% (depending on the market)

/THREAD

This is not financial advice. Always do your own research. These are just my ideas.

Have in the back of your mind that I'm not a financial advisor and that my calculations may be wrong.

/1

Have in the back of your mind that I'm not a financial advisor and that my calculations may be wrong.

/1

These strategies are long-term strategies, you should not use them if you don't have a minimum of 6-12 months perspective (due to fees, premium, and market risk).

If you're not here for long-term games, find another strategy.

/2

If you're not here for long-term games, find another strategy.

/2

Mirror Protocol is a synthetic asset platform where you can buy stocks, commodities, and crypto-assets.

The assets are mirrored which means that they're tracking the price of the underlying asset 1:1.

/3

The assets are mirrored which means that they're tracking the price of the underlying asset 1:1.

/3

I've written about 3 different @mirror_protocol strategies earlier:

1) Mirror Delta Neutral strategy:

2) Short mSLV/mIAU with leverage strategy:

3) Short mKO with 4x leverage:

/4

1) Mirror Delta Neutral strategy:

https://twitter.com/Route2FI/status/1454065822515830787

2) Short mSLV/mIAU with leverage strategy:

https://twitter.com/Route2FI/status/1473626708314136585

3) Short mKO with 4x leverage:

https://twitter.com/Route2FI/status/1488557950423732225

/4

This thread will discuss some improvements and what I'm personally doing myself with Mirror at the moment

I'm not using any delta-neutral strategies atm, the rewards are much lower now compared to what they were when I wrote the first thread about Mirror Protocol in October.

/5

I'm not using any delta-neutral strategies atm, the rewards are much lower now compared to what they were when I wrote the first thread about Mirror Protocol in October.

/5

Since the rewards were lower, I started to play around with short leverage strategies instead

Why short silver/gold? From a historical perspective, these assets have been relatively stable

Why short Cola? This was the only asset that you could short with 110% collateral

/6

Why short silver/gold? From a historical perspective, these assets have been relatively stable

Why short Cola? This was the only asset that you could short with 110% collateral

/6

The less collateral you have to put down, the more leverage you can use.

Just to recap what we're doing in a short leverage strategy:

1) Deposit money on Anchor Protocol

2) Borrow mKO with aUST with eg. 130% collateral (if you hit 110% you'll be liquidated)

/7

Just to recap what we're doing in a short leverage strategy:

1) Deposit money on Anchor Protocol

2) Borrow mKO with aUST with eg. 130% collateral (if you hit 110% you'll be liquidated)

/7

3) Sell mKO immediately at terraswap.io

4) Deposit the new money in Anchor

5) Repeat the steps above

Until recently mKO was the only asset that you could short with a minimum of 110% collateral.

/8

4) Deposit the new money in Anchor

5) Repeat the steps above

Until recently mKO was the only asset that you could short with a minimum of 110% collateral.

/8

But this changed when the governance poll of mSPY was voted for: mirrorprotocol.app/#/gov/poll/244

From Monday 21st of February mSPY (S&P500) will be possible to short with 110% collateral.

Due to this, I'm going to rebuy the mKO I owe and get rid of my position. I want to...

/9

From Monday 21st of February mSPY (S&P500) will be possible to short with 110% collateral.

Due to this, I'm going to rebuy the mKO I owe and get rid of my position. I want to...

/9

borrow mSPY instead.

Two reasons for that:

1) By definition mKO is riskier than mSPY having a higher beta with both systematic and asystematic risk. mSPY on the other hand only has systematic risk.

/10

Two reasons for that:

1) By definition mKO is riskier than mSPY having a higher beta with both systematic and asystematic risk. mSPY on the other hand only has systematic risk.

/10

2) The premium on mKO is negative now (-7,40%), which means that I can rebuy mKO for $57.86 UST. The oracle price (real price) is $62.49 UST.

/11

/11

You should always monitor the premium on Mirror.

You always pay the oracle price for shorting/borrowing.

For buying the asset/going long you pay the pool price.

/12

You always pay the oracle price for shorting/borrowing.

For buying the asset/going long you pay the pool price.

/12

If the premium is positive --> good time to short because you pay the oracle price to borrow, and sell immediately afterward at the pool price at Terraswap.

If the premium is negative --> good time to go long or rebuy what you owe to close a short because

/13

If the premium is negative --> good time to go long or rebuy what you owe to close a short because

/13

you pay the pool price (which is lower than the oracle price).

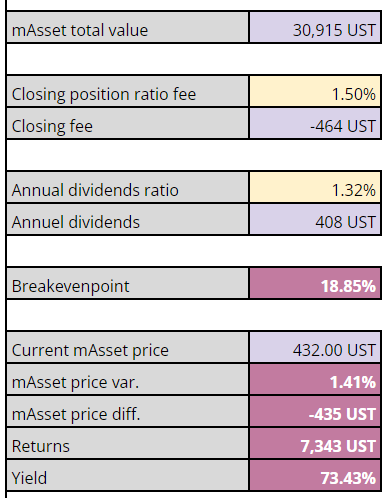

One of my readers made this spreadsheet calculator for seeing how profitable each short strategy is.

You can try it for yourself here (could be errors in the spreadsheet:

docs.google.com/spreadsheets/d…

/14

One of my readers made this spreadsheet calculator for seeing how profitable each short strategy is.

You can try it for yourself here (could be errors in the spreadsheet:

docs.google.com/spreadsheets/d…

/14

mSPY is paying a 1,3% dividend per year. This is perfect for shorting.

Why? Because when the dividends are paid out the oracle price will go lower as the real price goes lower.

No, the dividends are not paid out in Mirror, but they're reflected in the oracle price.

/15

Why? Because when the dividends are paid out the oracle price will go lower as the real price goes lower.

No, the dividends are not paid out in Mirror, but they're reflected in the oracle price.

/15

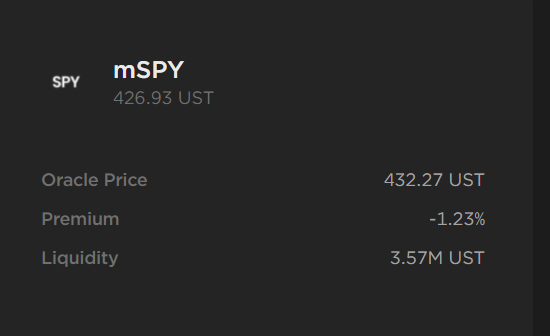

The drawback about mSPY is that the premium at the moment is negative.

So if I borrow 1 mSPY I pay effectively $432.27.

But when I sell it at Mirror I'm only getting 426.93 UST (a 1.23% loss).

So that's why I want to wait to borrow mSPY until it has a positive premium.

/16

So if I borrow 1 mSPY I pay effectively $432.27.

But when I sell it at Mirror I'm only getting 426.93 UST (a 1.23% loss).

So that's why I want to wait to borrow mSPY until it has a positive premium.

/16

Just to recap:

If the price of mSPY trades at a discount to the oracle price, minters are incentivized to purchase and burn it, thereby profiting by paying back their debt at a discount.

Conversely, if the price of mSPY trades...

/17

If the price of mSPY trades at a discount to the oracle price, minters are incentivized to purchase and burn it, thereby profiting by paying back their debt at a discount.

Conversely, if the price of mSPY trades...

/17

at a premium to the oracle price, market participants are incentivized to mint and sell it at the premium price, thereby profiting from the difference.

In both cases, a drift of the mSPY price away from the price of the real-world asset creates arbitrage...

/18

In both cases, a drift of the mSPY price away from the price of the real-world asset creates arbitrage...

/18

that market participants will exploit until the peg is restored. The peg should be 1:1 (oracle price = pool price).

If you have a $10K and use this strategy you could potentially get a 73% APY.

That's if mSPY (S&P500) return 0%.

/19

If you have a $10K and use this strategy you could potentially get a 73% APY.

That's if mSPY (S&P500) return 0%.

/19

As you can see from the table below breakeven is at 18.85% (mSPY has to increase by 18.85%) and you would have earned a total of 19.5%.

In other words, breakeven means that you could have your money in Anchor Protocol instead (in both cases you would earn 19,5%).

/20

In other words, breakeven means that you could have your money in Anchor Protocol instead (in both cases you would earn 19,5%).

/20

If S&P500 has a negative return this year you could potentially earn way more than 73% APY.

If you find these principles interesting I recommend you to study this thread about how to do it:

/21

If you find these principles interesting I recommend you to study this thread about how to do it:

https://twitter.com/Route2FI/status/1488557950423732225

/21

Risks:

1) Premium: I have already discussed this, but make sure that you understand the difference between positive/negative premium and how it influences your ROI.

It is not guaranteed that you'll be able to buy back mSPY at a 0% or negative premium.

/22

1) Premium: I have already discussed this, but make sure that you understand the difference between positive/negative premium and how it influences your ROI.

It is not guaranteed that you'll be able to buy back mSPY at a 0% or negative premium.

/22

If there are incentives to mint and hold the asset, you may see a prolonged premium period, and be unable to close at a profit.

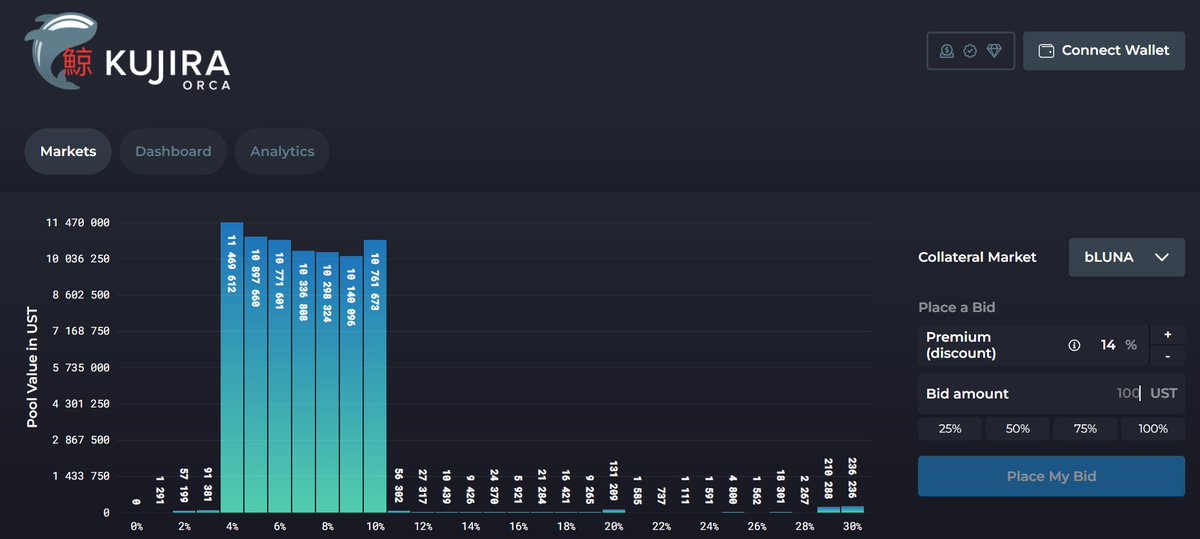

2) Liquidity: Due to low liquidity this strategy is not for the big money. To understand this, go to terraswap.io and look at...

/23

2) Liquidity: Due to low liquidity this strategy is not for the big money. To understand this, go to terraswap.io and look at...

/23

the spread difference between selling 1, 10 and 100 mSPY shares.

3) Price risk: Using this example of a 4x leverage, your exposure to mSPY price increases by the amount of leverage that you are using.

A 1% move upwards = 4% increase in the repayment amount. 2% is 8% etc.

/24

3) Price risk: Using this example of a 4x leverage, your exposure to mSPY price increases by the amount of leverage that you are using.

A 1% move upwards = 4% increase in the repayment amount. 2% is 8% etc.

/24

You can see how the return changes quickly. If mSPY increases by 6% your APY would be 59%.

But if mSPY increases 22% your APY will be reduced to 9.78% (which is 10% lower compared to being in Anchor Protocol).

/25

But if mSPY increases 22% your APY will be reduced to 9.78% (which is 10% lower compared to being in Anchor Protocol).

/25

4) Mirror Fees: You will be paying more fees than the usual mirror short fees because you are looping your borrow (i.e. borrowing more than your original position allows

Instead of paying 1.5% of your initial capital, you're paying 1.5% of your TOTAL BORROW. At 4x that's 6%

/26

Instead of paying 1.5% of your initial capital, you're paying 1.5% of your TOTAL BORROW. At 4x that's 6%

/26

5) Not a short-term rotator strategy: If you want to try this strategy, have at least a 6-month period in mid before dedicating money for this. Otherwise, the fees can outpace your rewards.

6) Liquidation risk: You're borrowing mSPY at 130% collateral, which...

/27

6) Liquidation risk: You're borrowing mSPY at 130% collateral, which...

/27

means that if mSPY goes up by 15% in one day, you'll be liquidated. Always monitor your collateral ratio on "My Page" on Mirror.

7) Smart contract risk and $UST peg risk: Obvious risks, but worth mentioning. You're reliant on two smart contracts (Anchor and Mirror).

/28

7) Smart contract risk and $UST peg risk: Obvious risks, but worth mentioning. You're reliant on two smart contracts (Anchor and Mirror).

/28

And also remember that $UST is an algorithmic stablecoin, if you don't know what that is, I recommend you to read this:

getrevue.co/profile/route2…

/29

getrevue.co/profile/route2…

/29

This thread is about to become very long (as always), and if you want more reading and want to try an even more advanced strategy, check out the mastermind @drcle4n new strategy here:

/31

https://twitter.com/DrCle4n/status/1494128678883979264

/31

PS! It's very likely that both mSLV and mIAU will have their collateral reduced to 110% as well.

Voting ends Saturday: mirrorprotocol.app/#/gov

/32

Voting ends Saturday: mirrorprotocol.app/#/gov

/32

PS2! I've been thinking about another strategy where you short both mVIXY and mSPY at the same time with these principles.

Correlation is approx. 0.8, so I don't know if it will work.

If you're a math genius and want to help me out with a potential strategy, send me a DM

/33

Correlation is approx. 0.8, so I don't know if it will work.

If you're a math genius and want to help me out with a potential strategy, send me a DM

/33

If you liked this thread, make sure to follow me at @route2fi for more DeFi strategies.

I also have a free newsletter where I break down DeFi concepts every week:

getrevue.co/profile/route2…

/34

I also have a free newsletter where I break down DeFi concepts every week:

getrevue.co/profile/route2…

/34

I would love it if you could help me retweeting the first tweet so that more people can see it

👇

Thank you!

/35

👇

https://twitter.com/Route2FI/status/1495435206664335360

Thank you!

/35

"But you presume S&P500 will go lower for this to be profitable... in the long run, S&P500 will for sure go upward, so it's such a short-term strategy, isn't it?"

That's where you are wrong.

The strategy is profitable if S&P500 returns less than 18,8% per year.

/36

That's where you are wrong.

The strategy is profitable if S&P500 returns less than 18,8% per year.

/36

• • •

Missing some Tweet in this thread? You can try to

force a refresh