Edge Protocol is launching its beta today.

Let's look at 4 different strategies you can use to maximize your gains:

1) Degenbox (borrow $UST - loop)

2) $LUNA leverage

3) $LUNAx leverage

4) The $LUNA shortooor

/THREAD

1/12

Let's look at 4 different strategies you can use to maximize your gains:

1) Degenbox (borrow $UST - loop)

2) $LUNA leverage

3) $LUNAx leverage

4) The $LUNA shortooor

/THREAD

1/12

1. The Degenbox:

How you play it:

1) Deposit money on Anchor

2) Supply aUST on Edge

3) Borrow $UST on Edge

4) Deposit on Anchor

5) Supply aUST on Edge

6) Borrow $UST on Edge

7) Deposit on Anchor

8) Repeat

I've already written a thread here:

2/

How you play it:

1) Deposit money on Anchor

2) Supply aUST on Edge

3) Borrow $UST on Edge

4) Deposit on Anchor

5) Supply aUST on Edge

6) Borrow $UST on Edge

7) Deposit on Anchor

8) Repeat

I've already written a thread here:

https://twitter.com/Route2FI/status/1492456965775273985

2/

2. $LUNA leverage:

1) Supply $LUNA on @EdgeProtocol

2) Borrow $UST against $LUNA

3) Swap $UST to $LUNA at terraswap.io

4) Repeat

3/

1) Supply $LUNA on @EdgeProtocol

2) Borrow $UST against $LUNA

3) Swap $UST to $LUNA at terraswap.io

4) Repeat

3/

3. $LUNAx leverage:

1) Stake $LUNA on Staderlabs (10,2% APY)

2) You get the liquid token $LUNAx which you supply on Edge

3) Borrow $UST on Edge

4) Deposit the borrowed $UST on Anchor

5) Supply aUST on Edge

6) Borrow more $UST

7) Or you could get more $LUNA instead of $UST

/4

1) Stake $LUNA on Staderlabs (10,2% APY)

2) You get the liquid token $LUNAx which you supply on Edge

3) Borrow $UST on Edge

4) Deposit the borrowed $UST on Anchor

5) Supply aUST on Edge

6) Borrow more $UST

7) Or you could get more $LUNA instead of $UST

/4

4. The $LUNA shortooor

1) Supply $UST

2) Borrow $LUNA against $UST

3) Swap $LUNA back to $UST at terraswap.io

4) Repeat

5) You now owe Edge Protocol x number of $LUNA that you have to pay back

6) PS! Probably better to short on a CEX

/5

1) Supply $UST

2) Borrow $LUNA against $UST

3) Swap $LUNA back to $UST at terraswap.io

4) Repeat

5) You now owe Edge Protocol x number of $LUNA that you have to pay back

6) PS! Probably better to short on a CEX

/5

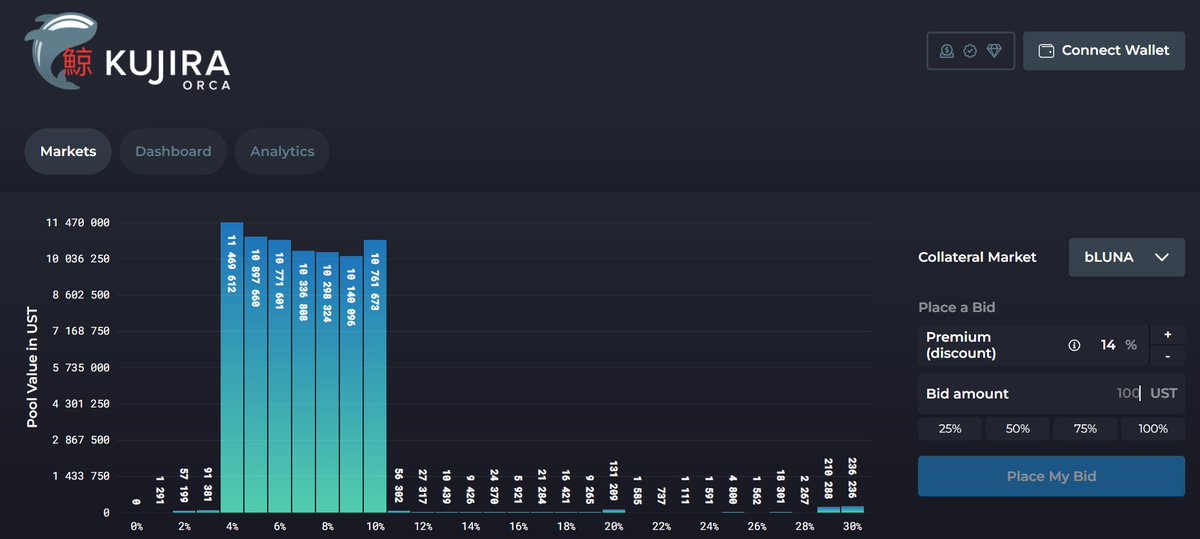

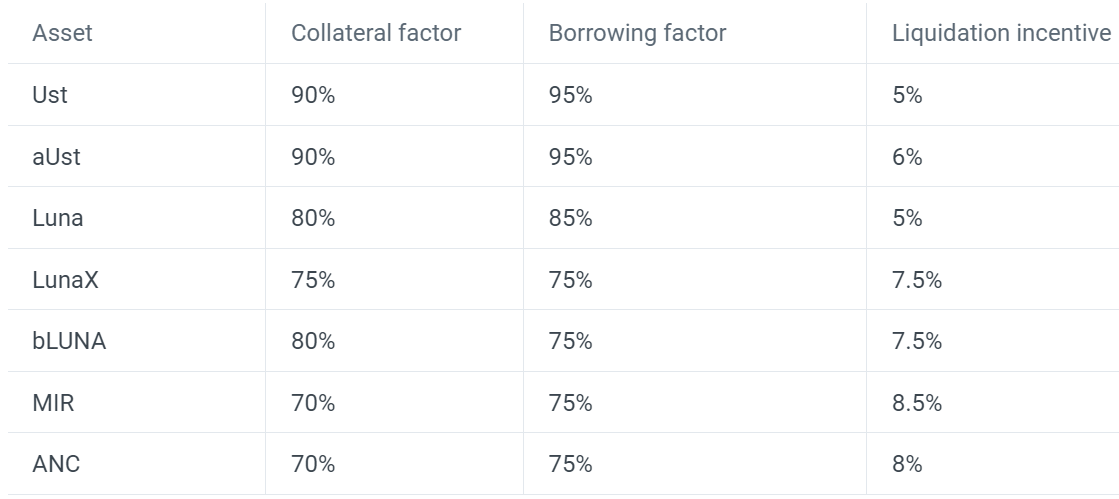

If you're wondering how much you can borrow each time, check the screenshot below.

Since the protocol is launching today, I advise you to go slow with very small amounts.

Personally, I will wait a little to see how this works out.

/6

Since the protocol is launching today, I advise you to go slow with very small amounts.

Personally, I will wait a little to see how this works out.

/6

The main questions I have that make me a little anxious is:

1) How is it possible to borrow $UST for eg. 5% when the lender instead could've recieved 19,5% by depositing it directly in Anchor?

2) Audit by The Z Institute (a good auditing company?)

/7

1) How is it possible to borrow $UST for eg. 5% when the lender instead could've recieved 19,5% by depositing it directly in Anchor?

2) Audit by The Z Institute (a good auditing company?)

/7

The beta is capped at $10M max, so it's nothing like the Abracadabra Degenbox yet ($1,100M at the top in January, now $735M).

If you'd like to try Edge Protocol, promise me that you read the documents first here:

docs.edgeprotocol.io/overview/

/8

If you'd like to try Edge Protocol, promise me that you read the documents first here:

docs.edgeprotocol.io/overview/

/8

Be aware of risks with protocols in beta.

Some risks that Edge Protocol listed themselves here:

/9

Some risks that Edge Protocol listed themselves here:

https://twitter.com/EdgeProtocol/status/1493531839063281664

/9

I also wrote about some risks by using Edge here:

/10

https://twitter.com/Route2FI/status/1492457070301437961

/10

If you liked this thread, you’ll also like my weekly newsletter:

getrevue.co/profile/route2…

It's free and my goal with the newsletter is to break down DeFi and crypto in an easy way.

/11

getrevue.co/profile/route2…

It's free and my goal with the newsletter is to break down DeFi and crypto in an easy way.

/11

Follow me on @Route2FI for more threads about DeFi.

I would also love it if you could share this thread by retweeting the first tweet below

👇

/12

I would also love it if you could share this thread by retweeting the first tweet below

👇

https://twitter.com/Route2FI/status/1493551657631854597

/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh