After 19 years of ownership Roman Abramovich has announced the “incredibly difficult decision” to sell Chelsea “in the best interest of the club” following Russia’s invasion of Ukraine. This thread will look at the financial state of the club as prospective buyers circle #CFC

Abramovich is surely worried that the government will try to freeze or seize his assets, due to his alleged links to Russian president Vladimir Putin. He is not yet on the list of oligarchs being sanctioned, but if he were added, he would almost certainly be unable to sell #CFC

In truth, this decision has seemed a matter of time ever since British authorities delayed the renewal of his visa in 2018, after which he acquired Israeli and Portuguese citizenship. He attended a match at Stamford Bridge for the first time in three years in November #CFC

He had already attempted to protect #CFC by handing “stewardship and care” to the trustees of the club’s charitable foundation, but it became evident that this was not going to work, as it was a purely symbolic gesture, rather than a genuine transfer of ownership and control.

Many will have forgotten #CFC precarious financial state before Abramovich bought the club from Ken Bates for £140m in June 2003. They had borrowed heavily to fund stadium development and were struggling to make payments on a £75m Eurobond and other loans.

It’s been a very different story since then with Abramovich bankrolling a very successful period. Under the Russian’s ownership #CFC have won 5 Premier League titles, 5 FA Cups, 3 League Cups, 2 Champions Leagues, 2 Europa Leagues, the UEFA Super Cup and FIFA Club World Cup.

Since Abramovich acquired #CFC, he has put £1.5 bln into the club. To highlight their reliance on his financial support, they have benefited from more owner financing £701m than anyone else in the Big Six in the last decade; in the last 5 years their £365m is by far the highest.

The resulting £1.5 bln debt is in #CFC holding company (Fordstam Ltd) with only £30m in the football club. Abramovich “will not be asking for any loans to be repaid”, theoretically making the club more attractive to investors, though he could try to wrap it up in the sale price.

Abramovich is reportedly looking for £3 bln, but this will be difficult to secure, give that this is a “distressed” sale, so it is a buyer’s market. Forbes valued #CFC at £2.4 bln, KPMG £1.7 bln, while the Markham Multivariate Model gives £1.25-1.5 bln, i.e. a wide range.

In reality, the value is whatever anyone will pay for it. #CFC reportedly rejected £2.2 bln in the past, but might have to accept less for a quick sale with talk of as little as £1 bln. On the other hand, Chelsea are a big club, based in London, with high revenue and debt-free.

Abramovich said, “Net proceeds from the sale will be donated” to a charitable foundation, though the wording is a bit vague. On the assumption that legal costs are relatively low, it could be a tidy sum, though unclear what would happen if price is below the £1.5 bln debt.

Abramovich added, “The foundation will be for the benefit of all victims of the war in Ukraine”, which suggests that the money will not just go to Ukrainians, i.e. from the invaded country, but also his fellow countrymen in Russia.

A few potential buyers have already been mentioned, notably a consortium including Swiss billionaire, Hansjörg Wyss, and LA Dodgers owner, Todd Boehly, though it is entirely possible that the final deal will be made with someone whose name is not already in the media.

So what sort of football club would a buyer be getting for his money? We will take a look at #CFC financials under Abramovich, comparing them to the other clubs in the Big Six and identifying some important elements of Chelsea’s business model.

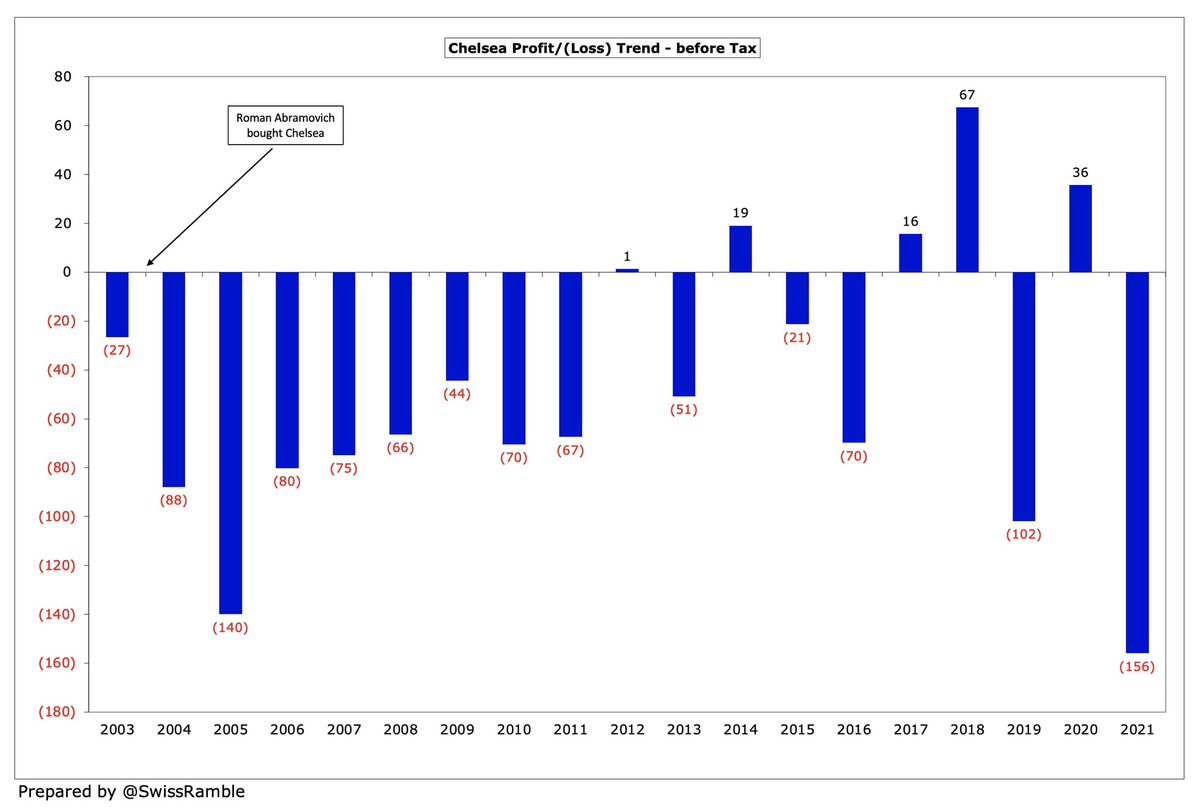

#CFC have lost almost £900m under Abramovich, though most of that came in the initial years as they fought to break the duopoly of #MUFC and #AFC, so £631m between 2004 and 2011, then £260m in the last 10 years. That said, this was the largest loss of the Big Six in that period.

#CFC £156m loss in 2020/21 is the highest reported to date, ahead of #AFC £127m and #THFC £80m, and in stark contrast to #MCFC and #LFC, with £5m profit and £5m loss respectively. In fact, Chelsea have posted no fewer than 10 of the top 25 losses ever in the Premier League.

In fairness, #CFC loss was significantly impacted by COVID with almost all games played behind closed doors. Revenue loss £96m, partly offset by £33m deferred from 2019/20. All clubs hit by the pandemic, though Chelsea loss only “beaten” by Barcelona & the leading Italian clubs.

#CFC business model is far more reliant on player sales than any other major English club. In the last 10 years, they made an astonishing £611m from this activity, a quarter of a billion more than the next highest club

To underline how well #CFC have monetised their “assets”, they have generated six of the 20 largest player trading profits in England, including the highest ever of £143m in 2019/20. This strategy coincided with the implementation of UEFA Financial Fair Play in 2012.

Excluding player sales, #CFC have made £1.4 bln operating losses under Abramovich, including the worst by far in the Premier League in 2020/21 of £159m. In the last 10 years their £769m operating losses are over £300m more than #MCFC £459m, followed by #AFC £261m and #LFC £210m.

#CFC figures have often been adversely impacted by exceptional charges under Abramovich, adding up to over a quarter of a billion, most notably £96m to pay-off the many sacked managers and £93m for early termination of shirt sponsors. Last year included £24m for “legal matters”.

#CFC revenue quadrupled under Abramovich, rising from £110m to £435m, the 4th highest in England, but a fair way below the top 3 clubs. Their £177m growth since 2012 significantly outpaced by #MCFC £339m & #LFC £299m, while #MUFC generated £1.3 bln more revenue in last 10 years.

#CFC were 8th in the 2019/20 Deloitte Money League, which ranks clubs globally by revenue, though the Blues had been as high as 4th in 2006/07. Since then, they have been overtaken by other clubs with substantial new owner money, #MCFC and PSG, plus Bayern Munich and #LFC.

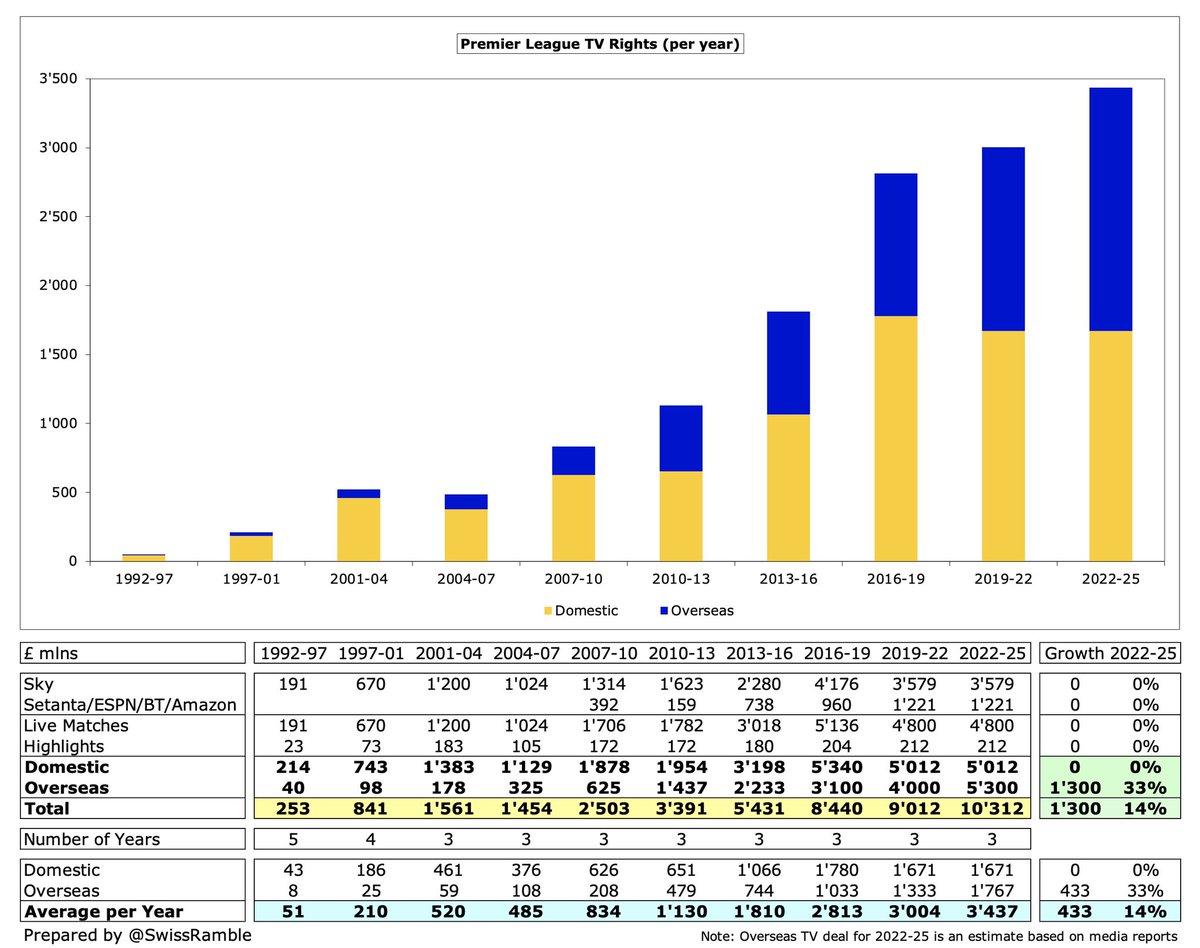

#CFC broadcasting income rose from £56m in 2004 to £274m, though this included £33m from games played after 2019/20 accounting close. They earned 2nd highest of the Big 6 in the last 10 years, with their £1.7 bln only surpassed by #MCFC £1.8 bln.

The Premier League has not published details of TV distributions for the last 2 seasons, but #CFC earned £146m in 2019. The new TV deal for 2022- 25 is up 14% over the current deal to £10.3 bln, based on media reports, thanks to surging overseas deals, especially NBC in USA.

European competition has been very important to #CFC finances, including an estimated €121m for winning 2021 Champions League. Under Abramovich they have earned €869m in Europe, only failing to qualify in 2017. Their €564m in last 10 years is only below #MCFC €644m.

#CFC commercial income rose from £34m in 2004 to £154m (down from pre-pandemic £180m), the 4th highest in England, but far below #MCFC £272m, #MUFC £232m and #LFC £218m. Earned almost £1 bln less than #MUFC in last 10 years, while growth since 2012 is 2nd lowest of Big Six.

#CFC have a long-term £60m kit deal with Nike (15 years 2017-32), while Three UK replaced Yokohama as shirt sponsor in 3-year deal, £40m from 2020/21. Sleeve sponsor is Hyundai £6m, while new £10m training kit deal with Trivago from 2021/22.

While other clubs have made lucrative stadium moves or expansions, #CFC match day income has been more or less flat. In particular, #THFC and #LFC have managed to grow this revenue stream by over £40m a year.

As a result, #CFC match day revenue is far lower than most of the Big Six with their £78m peak around £40m less than #THFC £122m (post-COVID estimate), #MUFC £112m and #AFC £100m. Plans to redevelop Stamford Bridge were shelved after Abramovich’s visa issues.

A complication for #CFC buyers is that the 41,000 capacity stadium freehold is not owned by the club, but Chelsea Pitch Owners, a non-profit organisation, who have to approve any stadium move. Stamford Bridge development is prohibitively expensive, reportedly now up to £2.2 bln.

#CFC £333m wages are 6 times as much as the £56m before Abramovich purchased the club, but since 2012 they have been outpaced by #LFC (£205m growth vs. £157m). In 2021 their £333m wage bill was only behind #MCFC £355m, but ahead of #MUFC £323m and #LFC £314m.

Similarly, #CFC player amortisation, the annual charge to expense transfer fees over the length of a player’s contract, has shot up from £21m to £162m, the highest in the Premier League, as a reflection of Abramovich’s willingness to fund significant player recruitment.

If wages and player amortisation are combined to give total annual cost of a club’s squad, #CFC £495m is almost identical to #MCFC £500m. Both clubs are a fair way ahead of #MUFC £443m, #LFC £422m, #ASFC £355m and #THFC £279m.

#CFC had £2.2 bln gross transfer spend under Abramovich, including £1.6 bln in last 10 years, higher than #MCFC £1.5 bln & #MUFC £1.4 bln. Net spend since the Russian arrived is £1.2 bln with £725m in last 10 years far below #MCFC and #MUFC (both over £1 bln), due to high sales.

#CFC don’t separately report transfer debt, but if we assume this is 90% of Trade Creditors, it would be £147m, which is second highest in the Premier League, only behind #THFC £170m. Chelsea are owed £162m by other clubs, leaving £15m net receivables.

After adding back non-cash items and working capital movements, #CFC had £122m operating cash flow in 18 years under Abramovich, but then spent £1.2 bln on players (purchases £2.1 bln, sales £899m) and only £179m on infrastructure. Funded by £842m loans and £400m share capital.

As Abramovich’s loans are interest-free, #CFC only paid £6m interest in 2021 (mainly on transfer fees), while other clubs have had to make substantial annual payments: #AFC £34m (bond refinancing break fee), #MUFC £21m and #THFC £18m. The new owner might not be so generous.

#CFC are compliant with financial fair play regulations, as the reported loss over the 3-year monitoring period (2020 & 2021 averaged) is offset by allowable deductions & dispensation for COVID impact. Abramovich’s loan write-off will be excluded from FFP break-even calculation.

In summary, #CFC is a club that makes enormous operating losses, partly offset by profits from astute player trading with any remaining deficit funded by Abramovich’s loans. In fairness, Chelsea have required less owner funding in recent years, but still more than other clubs.

#CFC fans will be nervous that a new owner will not be so willing to pay the price of success as Abramovich has by funding huge transfer spend and covering losses. If the club ends up with a regime like the Glazers, it could be burdened with high interest payments on bank loans.

Clearly, the sale of Chelsea football club is unimportant in the wider scheme of things, especially compared to what is happening in Ukraine, but this is likely to be a period of major uncertainty for #CFC players, management and supporters.

• • •

Missing some Tweet in this thread? You can try to

force a refresh