Market Trend of last 5 years

A thread and a graph

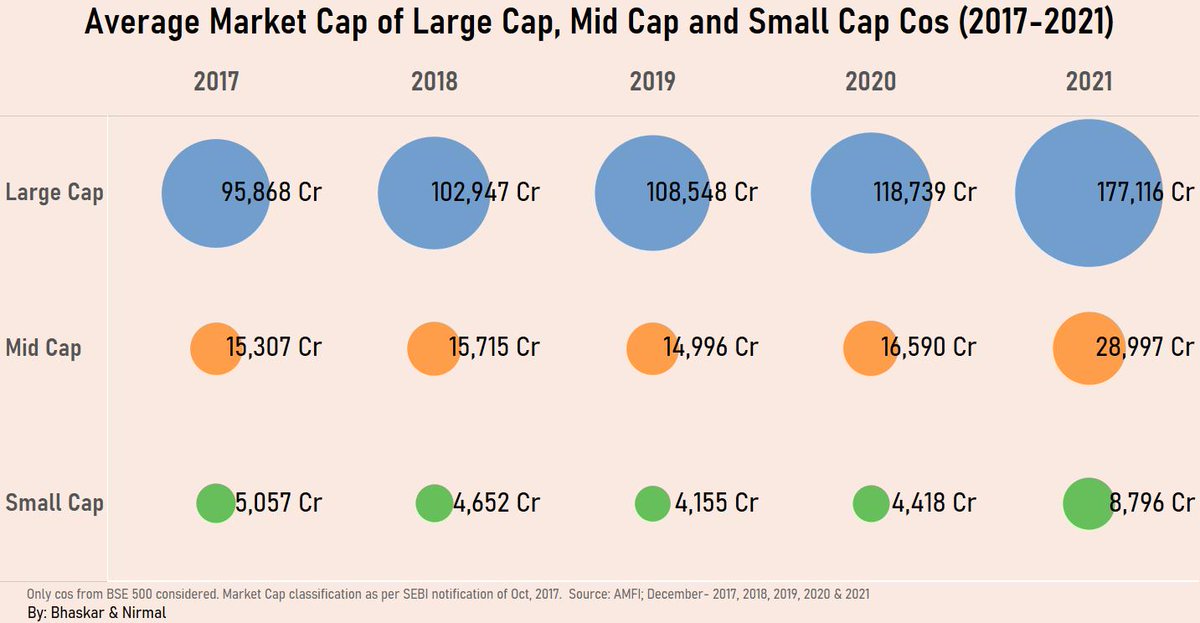

The Indian equity market is broadly classified under large-cap, mid-cap, small-cap, and now the newly introduced micro-cap segments.

1/n

#investing #nifty50 #personalfinance #sensex

A thread and a graph

The Indian equity market is broadly classified under large-cap, mid-cap, small-cap, and now the newly introduced micro-cap segments.

1/n

#investing #nifty50 #personalfinance #sensex

Large-cap: top 100 cos as per market capitalization (mcap)

Mid-cap: 101st to 250th company

Small-cap: 250th to 500th company

Micro-cap: 501st company & beyond (NSE-lnkd.in/gTHK28mq)

A rapidly growing economy is a result of rapidly growing companies.

2/n

Mid-cap: 101st to 250th company

Small-cap: 250th to 500th company

Micro-cap: 501st company & beyond (NSE-lnkd.in/gTHK28mq)

A rapidly growing economy is a result of rapidly growing companies.

2/n

With growing demand, and increasing revenues, tiny companies grow into big ones, mid-sized companies into large companies and large companies become huge.

3/n

3/n

This transition is one of the metrics of size and the underlying value of the Indian equity market, which the average market capitalization of companies can depict.

4/n

4/n

Bhaskar and I created this interesting graph which shows the trend of avg mcap of Indian cos over the last 5 years.

5/n

5/n

Key observations-

1. The average market cap of BSE 500 companies increased from ~Rs 26,000 Cr to ~Rs 36,000 Cr, roughly ~40% increase in 5 years.

2. The avg mcap of large-cap cos increased by 84%, mid-cap by 89% and small-cap by 73% in the past 5 years.

6/n

1. The average market cap of BSE 500 companies increased from ~Rs 26,000 Cr to ~Rs 36,000 Cr, roughly ~40% increase in 5 years.

2. The avg mcap of large-cap cos increased by 84%, mid-cap by 89% and small-cap by 73% in the past 5 years.

6/n

3. Since mid-cap and small-cap companies witnessed correction post-2018, the avg mcap for mid-cap companies decreased by 5% in 2019. And avg mcap of small-cap companies decreased by 18% during 2018 and 2019.

7/n

7/n

4. There was a spurt in valuations of the companies across the BSE 500 where the avg mcap of large-cap, mid-cap and small-cap cos increased (Y-o-Y) by 49%, 75% and 99%, respectively.

8/n

8/n

To mitigate the valuation volatility, we have taken the market cap data provided by AMFI (December of each year), which calculates the market cap basis avg of trailing six months.

Do share your thoughts in the comments.

#economy #finance #investing #nifty50

n/n

Do share your thoughts in the comments.

#economy #finance #investing #nifty50

n/n

@threadreaderapp unroll.

• • •

Missing some Tweet in this thread? You can try to

force a refresh