As citizens from Canada, Russia and Ukraine have recently had their money frozen, the importance of self sovereignty has never been higher.

Time for a🧵thread on👇

-Trend of monetary confiscation

-Warning signals to watch

-How to protect yourself from all of this

1/

Time for a🧵thread on👇

-Trend of monetary confiscation

-Warning signals to watch

-How to protect yourself from all of this

1/

Most people are familiar with the movie 300⚔️

A famous battle cry was spawned from that movie that’s become more relevant today than ever before.

King Leonidas screamed ‘’come and take them’’ in response to the demand that his soldiers lay down their weapons.

2/

A famous battle cry was spawned from that movie that’s become more relevant today than ever before.

King Leonidas screamed ‘’come and take them’’ in response to the demand that his soldiers lay down their weapons.

2/

This rally cry that’s become iconic around the world can be applied to current economic events unfolding around the world.

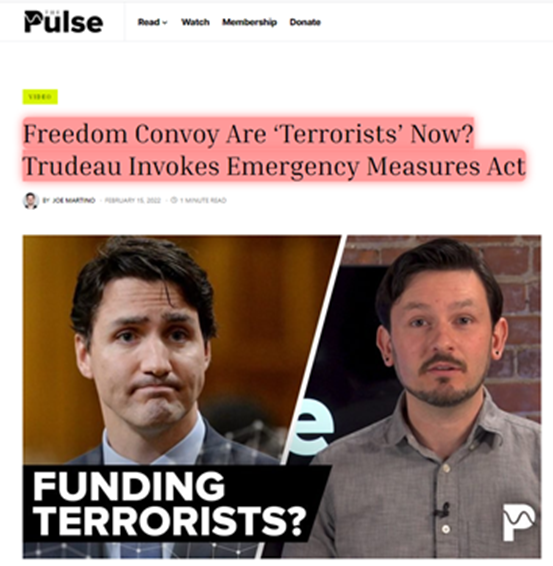

In 2022 we’ve watched Canada seize the money of its citizens

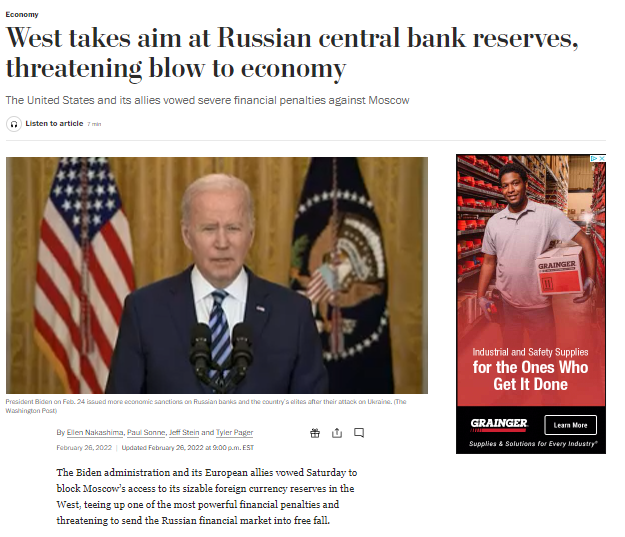

We’ve also watched banks in Russia and Ukraine refuse service to their customers

3/

In 2022 we’ve watched Canada seize the money of its citizens

We’ve also watched banks in Russia and Ukraine refuse service to their customers

3/

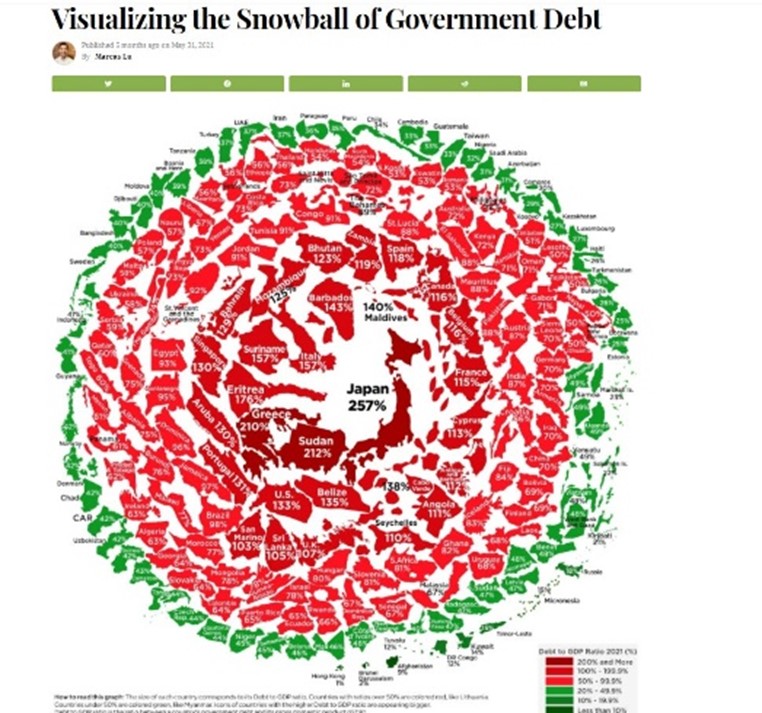

Most concerningly, a global superpower with nuclear weapons has also had their national assets frozen!!

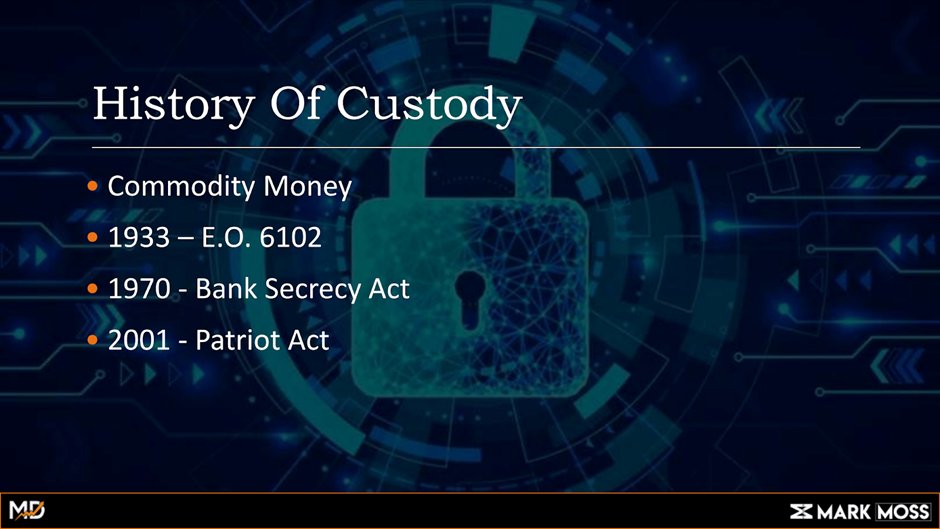

Recent events are just a continuation of a longer trend

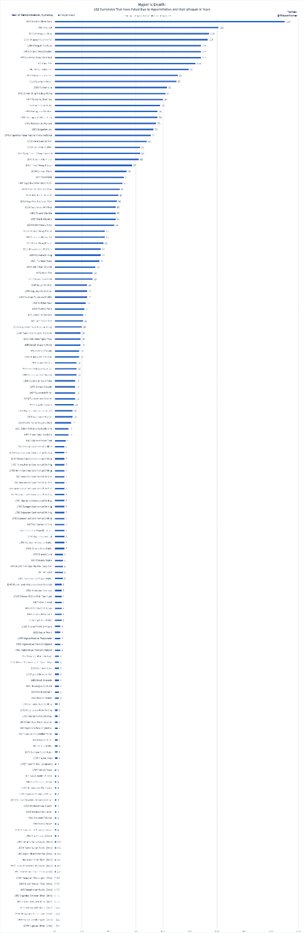

Over the past 100 years our liberty and property rights have been slowly degraded through each event listed below

4/

Recent events are just a continuation of a longer trend

Over the past 100 years our liberty and property rights have been slowly degraded through each event listed below

4/

-In 1933 the US stole it’s citizens gold with executive order 6102

-1970 Bank secrecy act eroded our financial privacy

-The patriot act in 2001 furthered this trend of financial privacy being threatened, allowing governments more authority to spy on our every move

5/

-1970 Bank secrecy act eroded our financial privacy

-The patriot act in 2001 furthered this trend of financial privacy being threatened, allowing governments more authority to spy on our every move

5/

Today as most countries around the world plan on implementing a CBDC, it appears financial sovereignty is only going to be further attacked

Congressman Davidson noticed this and recently put forward a bill to protect BTC self custody and peer to peer transactions in the US

6/

Congressman Davidson noticed this and recently put forward a bill to protect BTC self custody and peer to peer transactions in the US

6/

The US is supposed to have a constitution and laws in place that’s designed to protect the liberty and property rights of its citizens

However it's become clear we can't rely on old laws to protect our money anymore

We need to take self responsibility!

Enter #bitcoin

7/

However it's become clear we can't rely on old laws to protect our money anymore

We need to take self responsibility!

Enter #bitcoin

7/

Satoshi Nakamoto clearly had all this in mind when they created Bitcoin as a solution to all of this as well as the broken financial system

For example, Satoshi Nakamoto’s birthday is April 5th 1975

Is there any significance in this seemingly arbitrary date?

8/

For example, Satoshi Nakamoto’s birthday is April 5th 1975

Is there any significance in this seemingly arbitrary date?

8/

April 5th is important because on April 5 1933, the US outlawed people from owning gold through Executive Order 6102

Then the 1975 component is relevant because that’s the year that the executive order was reversed

9/

Then the 1975 component is relevant because that’s the year that the executive order was reversed

9/

Whoever Satoshi is, they clearly had a 6102 attack in mind when designing the protocol

Satoshi understood this threat and the way #bitcoin is sufficiently decentralized ensures it’s the only crypto that can withstand a nation state level 6102 attack in the future

10/

Satoshi understood this threat and the way #bitcoin is sufficiently decentralized ensures it’s the only crypto that can withstand a nation state level 6102 attack in the future

10/

Governments are trying to control every aspect of our lives.

They’re trying to control the food we consume

They’re trying to control the energy we use

And most importantly they're trying to control our money,

It all starts with the money!!

11/

They’re trying to control the food we consume

They’re trying to control the energy we use

And most importantly they're trying to control our money,

It all starts with the money!!

11/

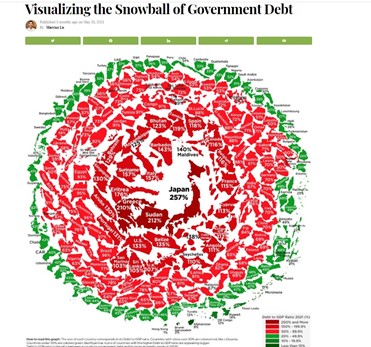

Now where does all this ultimately end if we allow governments to continue their attack on financial sovereignty?

The World economic forum has made it very clear where they plan on taking this trend of confiscation and loss of property rights

According to them by 2030..

12/

The World economic forum has made it very clear where they plan on taking this trend of confiscation and loss of property rights

According to them by 2030..

12/

Don’t waste time on trying to change the old dying system, voting won’t change anything!

Focus on what you CAN control!

If you want to avoid this dystopian nightmare simply opt out and work on building a parallel society.

Home schooling beats state run education

13/

Focus on what you CAN control!

If you want to avoid this dystopian nightmare simply opt out and work on building a parallel society.

Home schooling beats state run education

13/

Growing your own food beats state funded processed sludge

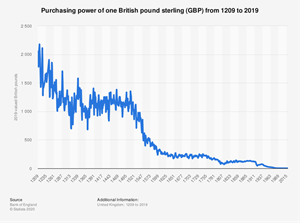

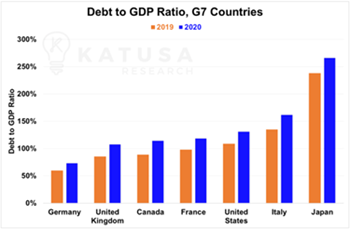

#bitcoin beats highly inflatable and confiscatable fiat

Tune into my recent video for👇

-The full story of the Spartans battle

-The Texas revolution and battle over the Alamo

-Why #bitcoin is the hill to die on

14/

#bitcoin beats highly inflatable and confiscatable fiat

Tune into my recent video for👇

-The full story of the Spartans battle

-The Texas revolution and battle over the Alamo

-Why #bitcoin is the hill to die on

14/

If you enjoyed this thread:

1. Follow me

@1MarkMoss for more of these

2. Like and RT this thread

You can watch my full video where I explain how to protect yourself in this growing environment of theft and confiscation 👇

15/

1. Follow me

@1MarkMoss for more of these

2. Like and RT this thread

You can watch my full video where I explain how to protect yourself in this growing environment of theft and confiscation 👇

15/

• • •

Missing some Tweet in this thread? You can try to

force a refresh