🚨 The Governments Trap For Your Money

the Gov and Central Bank policies created a trap for your money and more power and control for themselves

The Trap and How To Protect Yourself...

Time For A Thread 👇

the Gov and Central Bank policies created a trap for your money and more power and control for themselves

The Trap and How To Protect Yourself...

Time For A Thread 👇

/1 The primary "Trap" for your money Govs use are Capital Controls which all nations eventually use as their money begins to fail.

This traps you inside a currency or country with no way to enter or exit.

This traps you inside a currency or country with no way to enter or exit.

2/ Its happened countless times throughout recent history.

The most famous was when the US Gov shut down the banks and stole the people's Gold. Or more recently, a similar example is what happened in Greece in 2015

The most famous was when the US Gov shut down the banks and stole the people's Gold. Or more recently, a similar example is what happened in Greece in 2015

3/ There are many reasons and methods why Govs and CB's will trap your money.

Understanding the Mundell-Flemming Trilemma will help you get a better understanding as to why nations like China would ban #Bitcoin and #Crypto

Understanding the Mundell-Flemming Trilemma will help you get a better understanding as to why nations like China would ban #Bitcoin and #Crypto

https://twitter.com/1MarkMoss/status/1442508745360216066

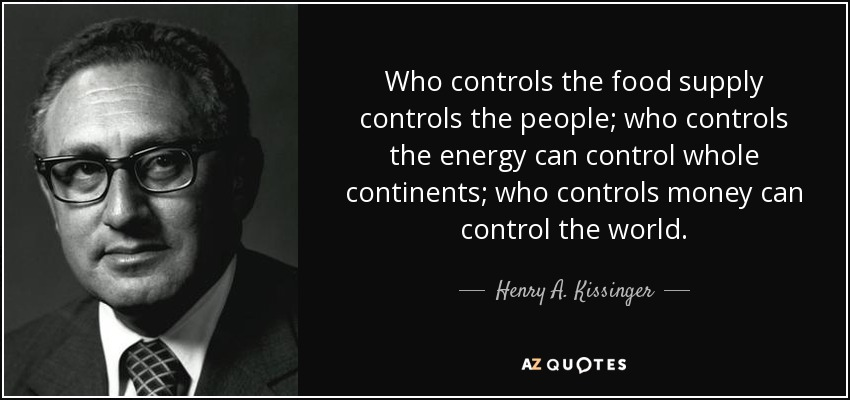

4/ The Govs impose Capital Controls is so they can trap and then "STEAL" your wealth.

The main way Govs steal your wealth is Inflation

"inflation is the arbitrary increases in the supply of fiat" which then diminishes or devalues your value.

The main way Govs steal your wealth is Inflation

"inflation is the arbitrary increases in the supply of fiat" which then diminishes or devalues your value.

5/ There are more hidden and dangerous traps the Gov uses to steal your wealth

This was outlined in a 2015 IMF paper titled "The Liquidation Of Gov Debt" where they stated

"Financial repression is most successful in liquidating debt when accompanied by inflation"

This was outlined in a 2015 IMF paper titled "The Liquidation Of Gov Debt" where they stated

"Financial repression is most successful in liquidating debt when accompanied by inflation"

6/ Is Wall Street another trap?

Main street mostly stayed out of Wall street until the 70s-80s when the Gov created programs pushing and trapping people in.

ERISA launched in 1974, and Vanguard, the creator of Funds and the 60/40 portfolio started in 1976

Main street mostly stayed out of Wall street until the 70s-80s when the Gov created programs pushing and trapping people in.

ERISA launched in 1974, and Vanguard, the creator of Funds and the 60/40 portfolio started in 1976

7/ While most reading this are aware the Gov is stealing wealth through Inflating the money supply, most are not aware of the theft through Bonds. The public is holding over $22 T in bonds or gov debt and this theft or "regression" comes through negative real rates

8/ This means the yield or return the bond pays you for holding the bond is less than the Gov targeted inflation rate, which means the return you receive from holding their debt is actually losing money when factoring in inflation.

9/ This Is A Trap!

The Gov steals from your earnings, purchasing power and savings, through Inflation & money printing

The Gov steals from your wealth & investments in Bonds through negative real yields

and uses retirement programs & managers to keep you trapped in the system

The Gov steals from your earnings, purchasing power and savings, through Inflation & money printing

The Gov steals from your wealth & investments in Bonds through negative real yields

and uses retirement programs & managers to keep you trapped in the system

10/ To beat this, stay away from the trap and get out of the trap of the Inflationary Fiat system and Bond programs

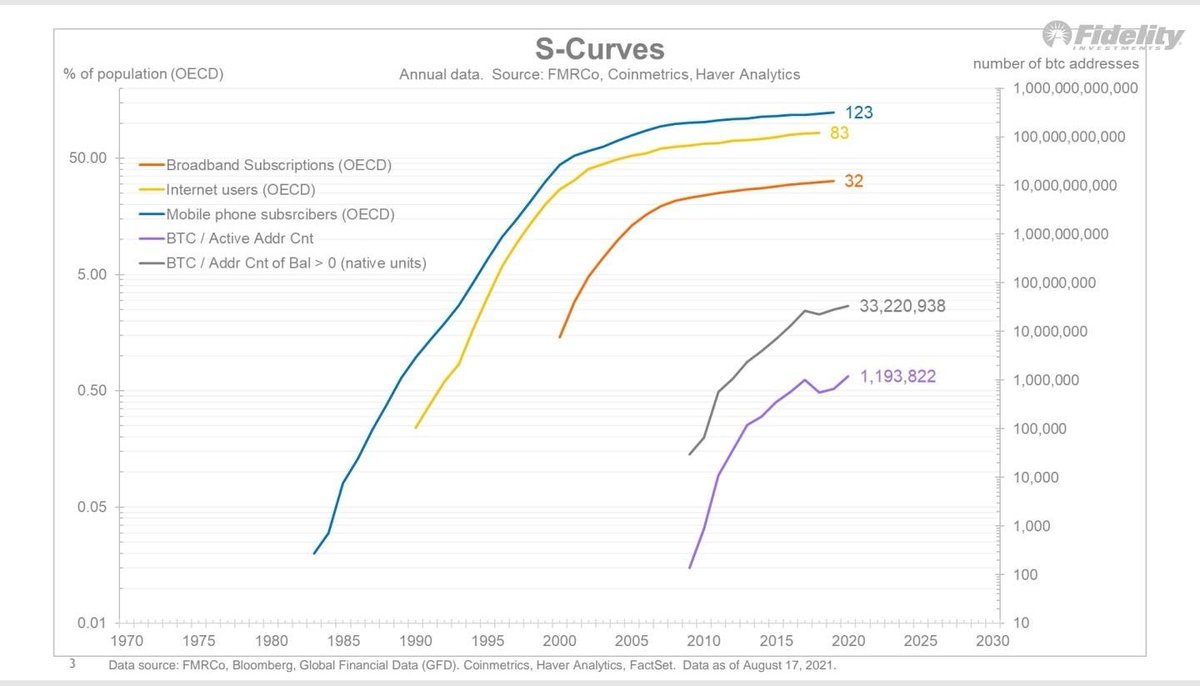

Storing your wealth in #Bitcoin allows you to do that

Please Comment, Like, and ReTweet 🙏

Watch the full video here: 👇

Storing your wealth in #Bitcoin allows you to do that

Please Comment, Like, and ReTweet 🙏

Watch the full video here: 👇

h/t to @JasonPLowery for conversations we had that sparked this, specifically #'s 4 and 5

• • •

Missing some Tweet in this thread? You can try to

force a refresh