🔴Is Your Money In The Bank In Danger?

From Canada to Ukraine, the world is finding out fast what banks can and will do with your money.

But the historical precedence, new changing laws, and the real plan behind this is much worse

A Short Thread 👇

From Canada to Ukraine, the world is finding out fast what banks can and will do with your money.

But the historical precedence, new changing laws, and the real plan behind this is much worse

A Short Thread 👇

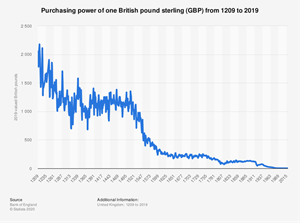

1/ first every fiat currency in history, has failed, the longest-lasting fiat currencies, USD and GBP are still there but have lost 99% of purchasing power.

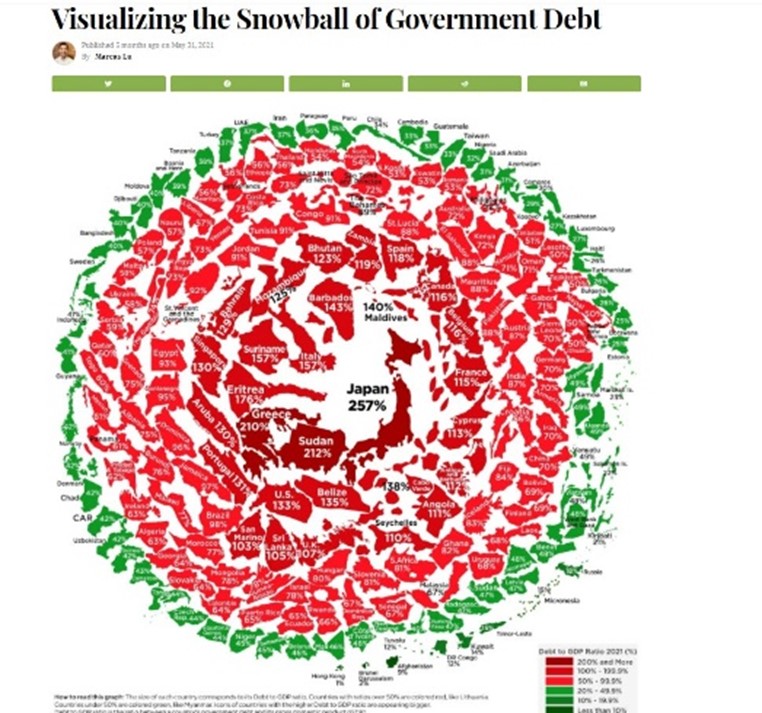

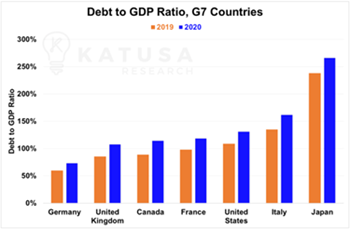

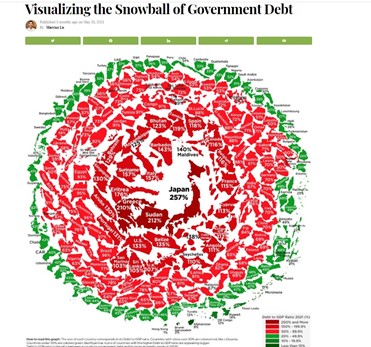

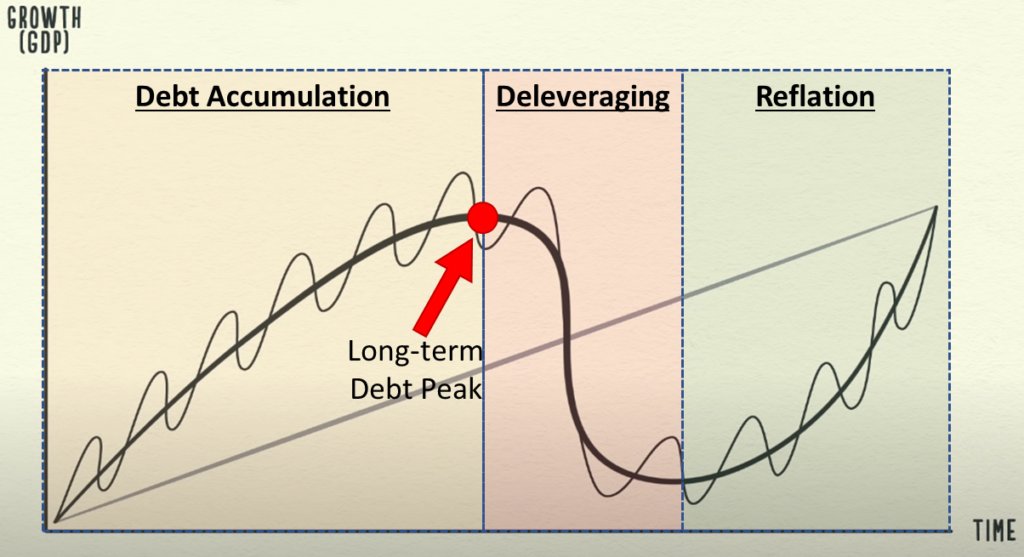

2/ There are 🗝️indicators to watch to know when it's falling apart, which are the debt levels. 51 of 52 nations that have had >130% Debt to GDP have failed, and the US is right on the edge.

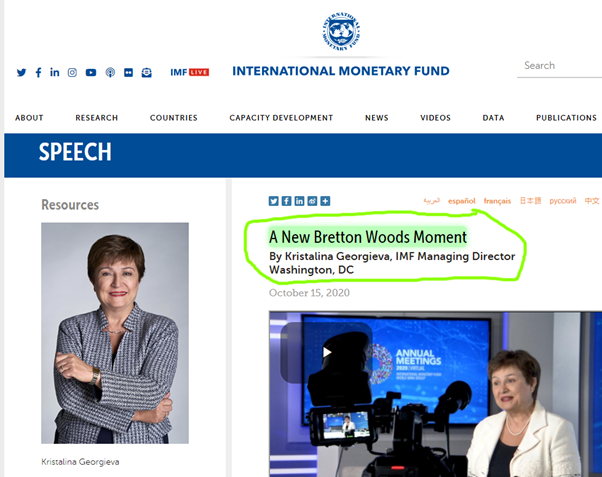

3/ We are also at the peak of an 80yr Financial Revolution cycle. 80yrs ago Bretton Woods "Reset" the entire financial system and a global standard was introduced (gold standard) and today, 80yrs later, the @IMFNews is calling for a "Bretton Woods 2" or another financial reset

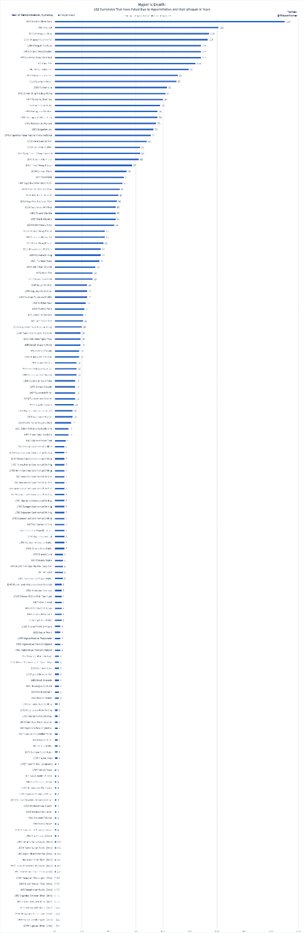

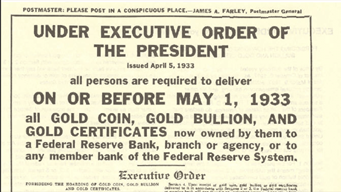

4/ This is when Gov's have a history of taking your money, typically under a "Bank Holiday"

1933 - 6102 the US Seized your gold, and devalued fiat from $20/oz gold to $35/oz gold

2013 - Cyrus seized up to 45% of your $$ in banks

2015 - Greece closed banks and limited withdrawals

1933 - 6102 the US Seized your gold, and devalued fiat from $20/oz gold to $35/oz gold

2013 - Cyrus seized up to 45% of your $$ in banks

2015 - Greece closed banks and limited withdrawals

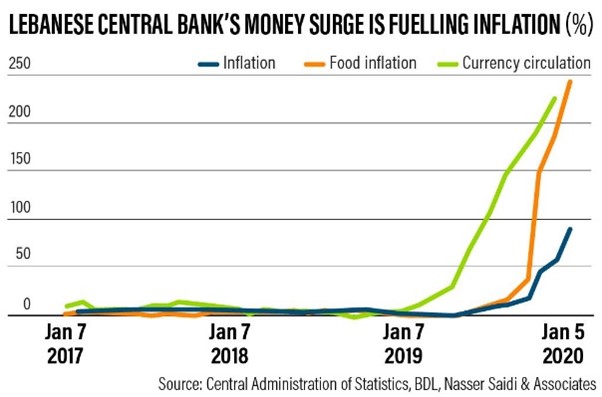

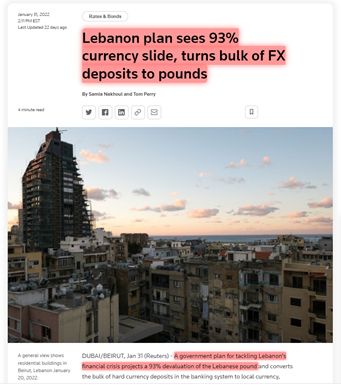

5/ In 1933 the US took your gold and gave you devalued fake fiat in return. 2021, we saw banks in Lebanon do the same. High debt levels led to a devaluation of >93%, a "bank holiday" ended with them replacing deposits with a different currency altogether

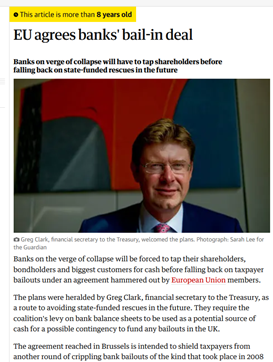

6/ With all nations reaching unsustainable debt levels, they are getting ready to take your funds. "Bail-In" laws have been re-written in Aus and throughout EU to make this much easier for them to "legally" get their hands on your money

7/ In the US, many think the FDIC will protect them, but, if they backstop the banks, printing trillions, at best you receive all your deposit back but purchasing power is crushed, more likely, you don't get your cash, instead you get their new surveillance CBDC in exchange

8/ history proves the playbook. High debt levels lead to financial reset, and of course "War" is the perfect cover that comes every time to hide or run cover for their mistakes, and "emergency powers" gives them all the control they need

9/ Canada is the most recent example of this. A 4 block peaceful protest led to Emergency Powers, seizing of private property and bank accounts, causing a permanent loss of trust, and bank runs, it's the beginning of the spiral

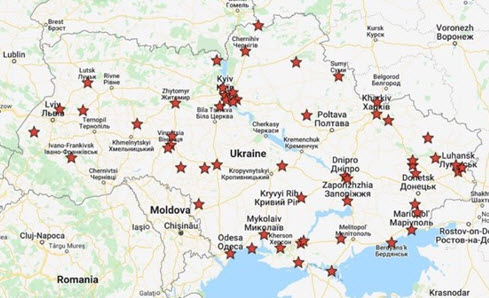

10/ Russia / Ukraine conflict will lead to mass sanctions, depending on where you are in the world, you might be caught in the crossfire. Expect disruptions in SWIFT, the USD, EU, GPB, YEN, etc

11/ History warns us to flip the old axiom:

"Only Keep 💰In The Bank You Can Afford To Lose" Be prepared for bank holidays, devaluation, and seizures

#Bitcoin is the perfect way to do these things

Please Like and RT 🙏

Watch the full video 👇

"Only Keep 💰In The Bank You Can Afford To Lose" Be prepared for bank holidays, devaluation, and seizures

#Bitcoin is the perfect way to do these things

Please Like and RT 🙏

Watch the full video 👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh