🟥 Russia and Ukraine at war, should we all care?

Time or a thread🧵 explaining how this impacts you and👇

-The impacts that sanctions are having on Russia

-How the global economy will be affected by this

-Whether an economic crisis could unfold

-How you can prepare!

1/

Time or a thread🧵 explaining how this impacts you and👇

-The impacts that sanctions are having on Russia

-How the global economy will be affected by this

-Whether an economic crisis could unfold

-How you can prepare!

1/

Sanctions have been weaponized by the worlds major superpowers for decades now

Sanctions are rules that punish people or countries

The way that superpowers like the US are able to use sanctions as a foreign policy tool is through their control of the financial system

2/

Sanctions are rules that punish people or countries

The way that superpowers like the US are able to use sanctions as a foreign policy tool is through their control of the financial system

2/

Their control of the financial system comes through their ability to control the global SWIFT settlement system.

SWIFT settles 37 million financial transactions per day and connects 11,000 banks and other organizations in more than 200 countries and territories.

3/

SWIFT settles 37 million financial transactions per day and connects 11,000 banks and other organizations in more than 200 countries and territories.

3/

Iran was fully disconnected from SWIFT in 2012 for their Nuclear weapons program.

The sanctions caused economic chaos for the country.

The SWIFT sanctions caused Iran to lose almost half of its oil export revenues and 30% of its foreign trade.

4/

The sanctions caused economic chaos for the country.

The SWIFT sanctions caused Iran to lose almost half of its oil export revenues and 30% of its foreign trade.

4/

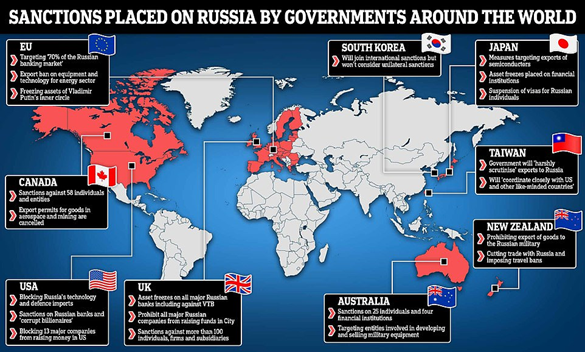

Now, A host of sanctions have already been launched upon Russia by a host of countries from all around the world, in response to the Russian invasion of Ukraine.

The big question is, will these countries go all the way and kick Russia entirely off the SWIFT system?

5/

The big question is, will these countries go all the way and kick Russia entirely off the SWIFT system?

5/

So far the West have only kicked a couple of Russian banks off of the swift system.

Many people don’t understand why only some ‘’selected’’ Russian banks have been cut off from the SWIFT system.

‘’Why not lock them all out of SWIFT?’’

6/

Many people don’t understand why only some ‘’selected’’ Russian banks have been cut off from the SWIFT system.

‘’Why not lock them all out of SWIFT?’’

6/

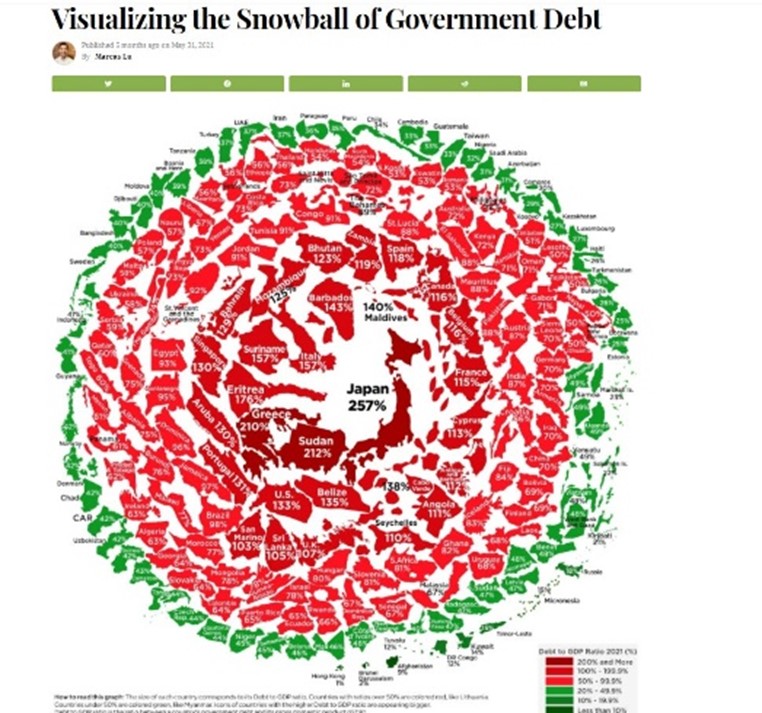

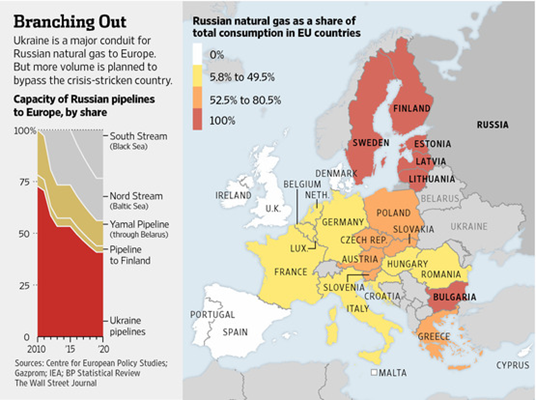

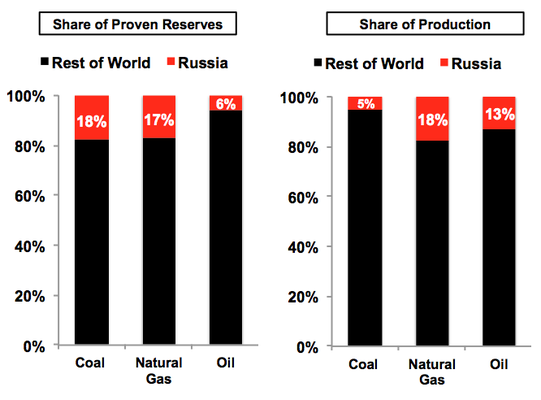

Well, Europe and the entire world is heavily reliant upon Russia for their energy.

The EU gets 40% of its gas from Russia alone

This explains why the west has currently only imposed economic sanctions upon Russia, and NOT any energy related sanctions.

7/

The EU gets 40% of its gas from Russia alone

This explains why the west has currently only imposed economic sanctions upon Russia, and NOT any energy related sanctions.

7/

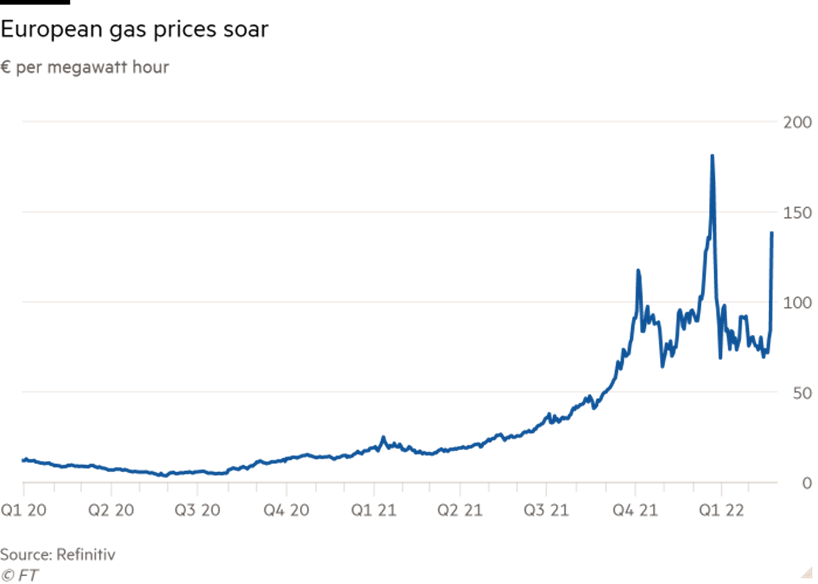

Russia appears to have strategically timed this invasion perfectly, as the US and Europe are currently experiencing the coldest weather of the year

Europe was already experiencing an energy crisis prior to the invasion as gas prices have soared 1000% over the past 6 months

8/

Europe was already experiencing an energy crisis prior to the invasion as gas prices have soared 1000% over the past 6 months

8/

The US is in the same compromised situation as Europe in terms of energy reliance.

As of late 2021 the US is importing 8.5 million barrels of oil per day, with 7% of that coming from Russia.

9/

As of late 2021 the US is importing 8.5 million barrels of oil per day, with 7% of that coming from Russia.

9/

The current crisis puts resource supplies in the west at even further risk

The war has already led to Brent oil prices surging to their highest level since July 2014, up 72% this month alone!

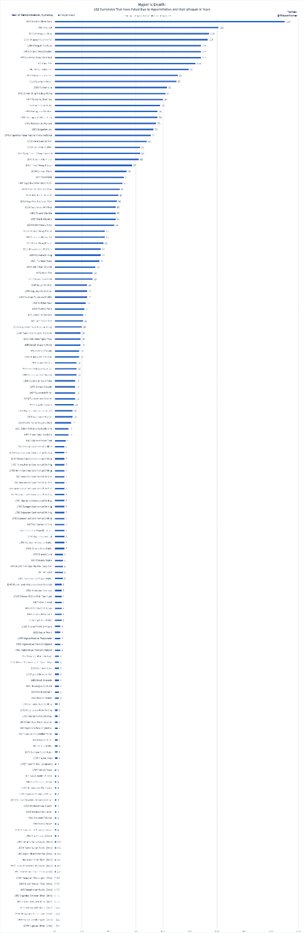

If people can’t afford to heat their homes in winter, people freeze to death!

10/

The war has already led to Brent oil prices surging to their highest level since July 2014, up 72% this month alone!

If people can’t afford to heat their homes in winter, people freeze to death!

10/

Russia holds the trump card in terms of energy, and they know it!

Russia exports 80% of its gas to the West

Russia is also the world's largest exporter of fertilizer which is needed for growing food

Russia has also been a top 3 grain exporter for the past century!

12/

Russia exports 80% of its gas to the West

Russia is also the world's largest exporter of fertilizer which is needed for growing food

Russia has also been a top 3 grain exporter for the past century!

12/

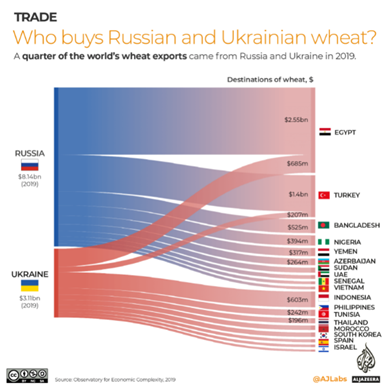

Now that Russia appears to have taken over the entirety of Ukraine, they now also control 25% of the global wheat production.

In 2019, Russia and Ukraine together exported more than 25.4% of the world’s wheat supply.

13/

In 2019, Russia and Ukraine together exported more than 25.4% of the world’s wheat supply.

13/

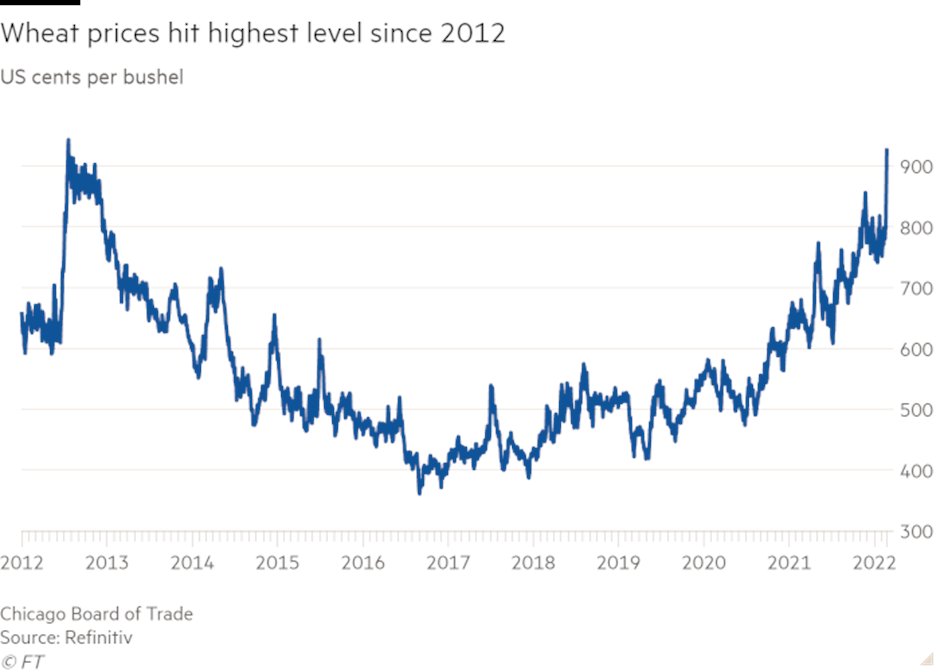

The current crisis in Ukraine has already sent wheat prices soaring to their highest level since 2012.

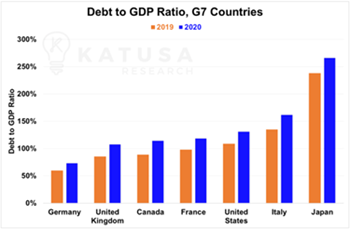

If oil and other commodity prices are allowed to continue rising, it could have ramifications on the global economy.

14/

If oil and other commodity prices are allowed to continue rising, it could have ramifications on the global economy.

14/

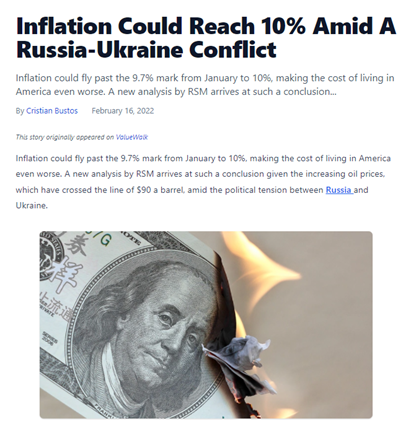

Rising energy prices leads to rising producer prices, which leads to higher consumer prices which could slow the economy and possibly plunge us into a recession

RSM Canada came out this week and warned that the Ukrainian war could cause inflation to soar towards 10%!

15/

RSM Canada came out this week and warned that the Ukrainian war could cause inflation to soar towards 10%!

15/

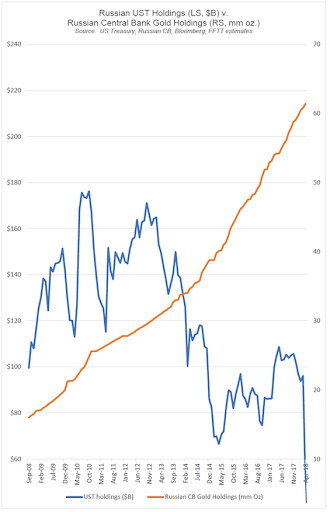

Now, it would appear that Russia had been somewhat preparing for this scenario for some time now.

This chart shows Russia has been heavily accumulating gold while simultaneously selling USD from their treasury reserves.

16/

This chart shows Russia has been heavily accumulating gold while simultaneously selling USD from their treasury reserves.

16/

However, one key mistake they made was trusting third party custodians with their enormous $640 billion of foreign reserves

This once again proves how important it is to hold your own assets in a self sovereign way!!!

17/

This once again proves how important it is to hold your own assets in a self sovereign way!!!

17/

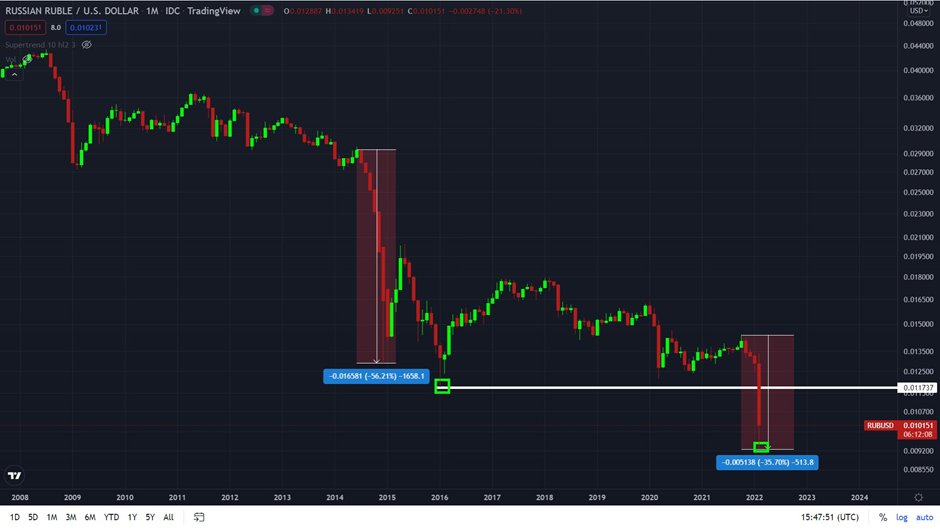

This meant that the Russian CB has been unable to defend the crashing Ruble without access to its currency reserves

The Russian Ruble has declined a whopping 35% since November 2021, cratering to a new all time low!

18/

The Russian Ruble has declined a whopping 35% since November 2021, cratering to a new all time low!

18/

This has subsequently caused inflation to surge in Russia.

Inflation has jumped from 8.4% in November to 70% today as capital flees Russia in search of a safer place.

Remember, capital goes where it's treated best!

19/

Inflation has jumped from 8.4% in November to 70% today as capital flees Russia in search of a safer place.

Remember, capital goes where it's treated best!

19/

These new sanctions are triggering panic in Russia

This video shows bank runs are occurring in the country, as the 145 million Russian's panic, standing in line to get their money

💡 NOTE: by the time there is a line, it's too late!

20/

This video shows bank runs are occurring in the country, as the 145 million Russian's panic, standing in line to get their money

💡 NOTE: by the time there is a line, it's too late!

https://twitter.com/CarlBMenger/status/1497913961194221569?s=20&t=W_YNQqyqyqjfKeV1WrHH3w

20/

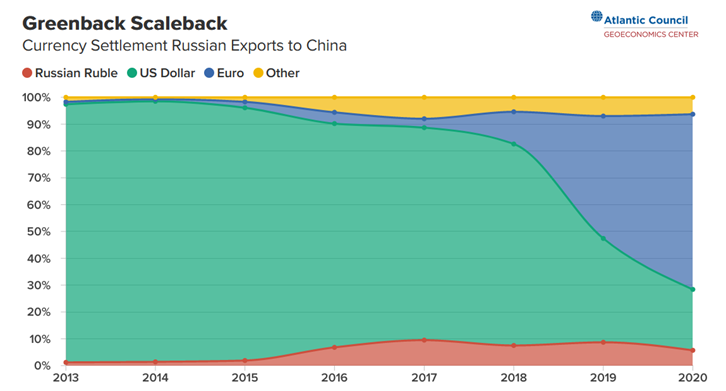

If you sanction enough they'll look for an alternative, so Russia has been doing this for years...

In 2015 90% of their trade was settled in USD

By 2020 46% of their trade was settled in USD

On Feb 4th China & Russia signed a 30yr trade deal for gas settled in Euros

21/

In 2015 90% of their trade was settled in USD

By 2020 46% of their trade was settled in USD

On Feb 4th China & Russia signed a 30yr trade deal for gas settled in Euros

21/

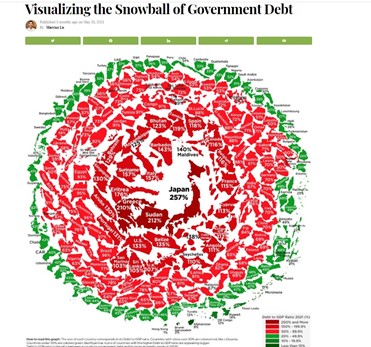

For two of the world's major superpowers to be settling trade deals in another reserve currency other than the US dollar, is enormous!

Other sanctioned countries (Turkey, Iran, Venezuela) are also looking to settle trade denominated outside the USD

22/

Other sanctioned countries (Turkey, Iran, Venezuela) are also looking to settle trade denominated outside the USD

22/

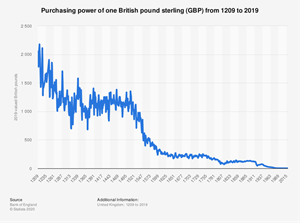

Is this trend an indication the petrodollar is breaking?

Possibly...

The trend of growing economic sanctions is one that we MUST be paying attention to!

In Canada, their government recently targeted its own citizens who attended a freedom convoy with economic sanctions.

23/

Possibly...

The trend of growing economic sanctions is one that we MUST be paying attention to!

In Canada, their government recently targeted its own citizens who attended a freedom convoy with economic sanctions.

23/

Justin Trudeau granted himself emergency powers to allow his government to freeze the bank accounts of anyone who attended the protest and even the accounts of people who merely donated to the campaign.

Did anyone in Canada think this was EVER possible only 2 weeks ago?

24/

Did anyone in Canada think this was EVER possible only 2 weeks ago?

24/

Whether you’re a citizen in a ‘’democratic’’ country like Canada, or whether you’re a global superpower with the largest arsenal of nuclear weapons, it's time to learn how to make yourself sanction proof!

25/

25/

If you enjoyed this thread:

1. Follow me @1MarkMoss for more of these

2. Like and RT this thread

Watch Full Video: HOW to make yourself sanction proof!👇

26/

1. Follow me @1MarkMoss for more of these

2. Like and RT this thread

Watch Full Video: HOW to make yourself sanction proof!👇

26/

• • •

Missing some Tweet in this thread? You can try to

force a refresh