Ever wondered what an ASM framework means or what the T2T segment is when it comes to stocks?

Let's find out!

Time for a thread 🧵🧵🧵

Retweet for educating the masses :)

Let's find out!

Time for a thread 🧵🧵🧵

Retweet for educating the masses :)

A detailed thread on key terms used in stock markets:

A) Trade-to-Trade segment

B) ASM Framework

C) Upper circuit & Lower circuit

(1/n)

A) Trade-to-Trade segment

B) ASM Framework

C) Upper circuit & Lower circuit

(1/n)

What is Trade-to-Trade segment for stocks?

This is also referred to as the T2T segment and this decision to transfer shares to the T2T segment is normally taken by the exchanges in consultation with SEBI.

(2/n)

This is also referred to as the T2T segment and this decision to transfer shares to the T2T segment is normally taken by the exchanges in consultation with SEBI.

(2/n)

The normal idea behind the shifting to T2T is to curb unnecessary speculation in the stock.

(3/n)

(3/n)

T2T represents a segment where any purchase or sale has to result in compulsory delivery.

That means intraday squaring of positions are not permitted on T2T stocks as that could increase speculation in these stocks.

(4/n)

That means intraday squaring of positions are not permitted on T2T stocks as that could increase speculation in these stocks.

(4/n)

What are the criteria for stock going into the T2T segment?

Shifting scripts to/from T2T segment are decided jointly by the stock exchanges in consultation with SEBI. This criterion is listed on their respective websites and reviewed periodically.

(5/n)

Shifting scripts to/from T2T segment are decided jointly by the stock exchanges in consultation with SEBI. This criterion is listed on their respective websites and reviewed periodically.

(5/n)

Can a stock come out of T2T and be put in normal trade again?

Yes, a stock can come out of T2T and be in normal trade again as per the given guideline by the exchanges and SEBI.

(6/n)

Yes, a stock can come out of T2T and be in normal trade again as per the given guideline by the exchanges and SEBI.

(6/n)

Which stocks are in the T2T segment currently?

As of date there are 228 stocks under T2T category some of them are as follows: Forbes & Company Ltd, IL & FS Investment Managers Ltd., Ind-Swift Ltd.

(7/n)

As of date there are 228 stocks under T2T category some of them are as follows: Forbes & Company Ltd, IL & FS Investment Managers Ltd., Ind-Swift Ltd.

(7/n)

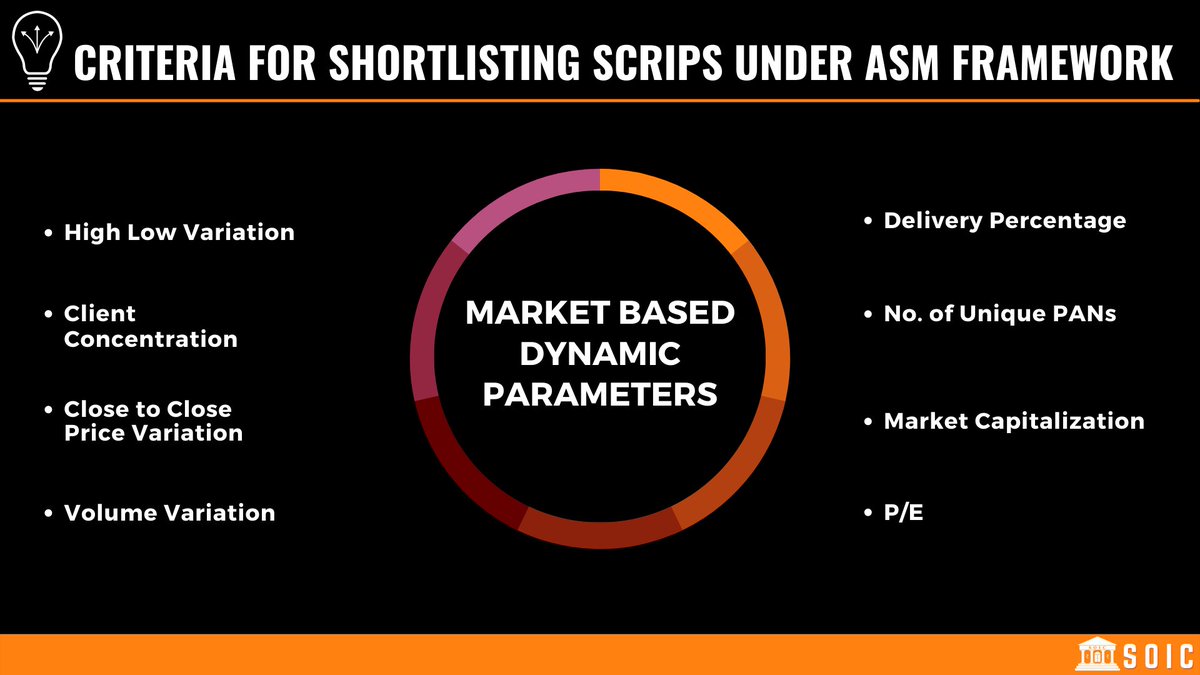

ASM Framework & Various stages of ASM

What is Additional Surveillance Measure (ASM)?

The additional surveillance initiative is part of SEBI and the Exchanges initiative to enhance market integrity and safeguard the interest of investors.

(8/n)

What is Additional Surveillance Measure (ASM)?

The additional surveillance initiative is part of SEBI and the Exchanges initiative to enhance market integrity and safeguard the interest of investors.

(8/n)

The main objective of these measures is to:

1) Alert and advice investors to be extra cautious while dealing in these securities

2) Advise market participants to carry out necessary due diligence while dealing in these securities.

(9/n)

1) Alert and advice investors to be extra cautious while dealing in these securities

2) Advise market participants to carry out necessary due diligence while dealing in these securities.

(9/n)

There are 2 sections of additional margins -

1) Long term additional surveillance measures

2) Short term additional surveillance measures

(10/n)

1) Long term additional surveillance measures

2) Short term additional surveillance measures

(10/n)

What happens under ASM?

The surveillance actions applicable to the shortlisted securities is as under:

1) Securities shall be placed in the price band of 5%

2) Margins shall be levied at the rate of 100%

(12/n)

The surveillance actions applicable to the shortlisted securities is as under:

1) Securities shall be placed in the price band of 5%

2) Margins shall be levied at the rate of 100%

(12/n)

The shortlisted securities shall be further monitored on pre-determined objectives and would be moved into trade-to-trade segment once the criteria get satisfied.

(13/n)

(13/n)

How will investors be impacted?

If one holds a stock that has come under the ASM framework, nothing much will change with respect to trading, but low leverage could reduce volumes on the counter.

(14/n)

If one holds a stock that has come under the ASM framework, nothing much will change with respect to trading, but low leverage could reduce volumes on the counter.

(14/n)

Given the 5 percent price band, the maximum possible uptick or downtick in these scripts will be up to 5 percent which will help reduce volatility.

(15/n)

(15/n)

List of Stocks under ASM:

Currently there are 194 stocks in Long term ASM & 19 stocks in Short term ASM. Some of them are as follows:

PS: You can access the whole list here: nseindia.com/reports/asm

(16/n)

Currently there are 194 stocks in Long term ASM & 19 stocks in Short term ASM. Some of them are as follows:

PS: You can access the whole list here: nseindia.com/reports/asm

(16/n)

What are upper and lower circuits?

Let’s divide our discussion into two parts.

1) Upper and lower circuits for stocks, and

2) Upper and lower circuits for indices.

(17/n)

Let’s divide our discussion into two parts.

1) Upper and lower circuits for stocks, and

2) Upper and lower circuits for indices.

(17/n)

Upper and lower circuits for stocks

When a stock moves sharply in either direction – whether up or down – or reaches its maximum permissible tradable price level for a day, then it’s said to have hit the circuit.

(18/n)

When a stock moves sharply in either direction – whether up or down – or reaches its maximum permissible tradable price level for a day, then it’s said to have hit the circuit.

(18/n)

In case of an upward movement, it hits the Upper Circuit, whereas in case of a fall, the stock hits the Lower Circuit.

The limit may be set at a figure – represented by a percentage – as determined by the stock market. It may be anywhere between 2% and 20%.

(19/n)

The limit may be set at a figure – represented by a percentage – as determined by the stock market. It may be anywhere between 2% and 20%.

(19/n)

Why do stocks hit circuits?

An individual stock may hit the circuit due to various reasons.

For instance, in case of a positive news flow, there could be a high demand for the stock of a particular company, and hence the stock may hit the upper circuit.

(20/n)

An individual stock may hit the circuit due to various reasons.

For instance, in case of a positive news flow, there could be a high demand for the stock of a particular company, and hence the stock may hit the upper circuit.

(20/n)

Likewise, there could be an opposite scenario in case of an adverse news flow.

Higher demand for shares than supply: Upper Circuit

Higher supply of shares than demand: Lower Circuit

(21/n)

Higher demand for shares than supply: Upper Circuit

Higher supply of shares than demand: Lower Circuit

(21/n)

For example,

Eg 1) On 27 Jan 2022, shares of TV18 Broadcast hit the upper circuit because of media reports that Uday Shankar and James Murdoch to pick up 39% stake in Viacom18. After this news, shares of TV18 Broadcast hit 20 per cent upper circuit.

(22/n)

Eg 1) On 27 Jan 2022, shares of TV18 Broadcast hit the upper circuit because of media reports that Uday Shankar and James Murdoch to pick up 39% stake in Viacom18. After this news, shares of TV18 Broadcast hit 20 per cent upper circuit.

(22/n)

Eg 2) On 22 Feb 2022, shares of Dhani Services hit the lower circuit of 20% after the news broke out that ED had conducted raids at the office of its promoters at Indiabulls Finance Center in Mumbai.

(23/n)

(23/n)

• • •

Missing some Tweet in this thread? You can try to

force a refresh