Sona BLW Precision Forgings Ltd. (SONA COMSTAR)

#SONACOMS

Annual Report 2021 Elec-thread ⚡🧵

RETWEET FOR MAX REACH

Let’s put the plug into 5 sockets: 🔌

1. Company

2. Industry

3. Products

4. Strategy

5. Risks

(Not a Recommendation)

#SONACOMS

Annual Report 2021 Elec-thread ⚡🧵

RETWEET FOR MAX REACH

Let’s put the plug into 5 sockets: 🔌

1. Company

2. Industry

3. Products

4. Strategy

5. Risks

(Not a Recommendation)

First, let’s understand a mental model called VALUE MIGRATION. Simply put it means the migration of value from obsolete businesses to new more effective businesses. This was first introduced by Adrian Slywotzky, an American professor of Ukrainian descent in his book by the same

name ‘Value Migration’.There are numerous examples of industries or businesses where value has migrated to new or better business or product. One which all can relate to is the music industry. From gramophone to streaming online, we have migrated far & so has VALUE.

Sona Comstar is another beneficiary of the value migration trend. Let’s dive into their Annual Report:-

1. COMPANY: Acquiring capabilities

Incorporated in 1995 as ‘Sona Okegawa Precision Forgings Ltd.’, a JV with Mitsubishi Materials Corp,

1. COMPANY: Acquiring capabilities

Incorporated in 1995 as ‘Sona Okegawa Precision Forgings Ltd.’, a JV with Mitsubishi Materials Corp,

embarked on the production of differential bevel gears at their 1st plant in Gurugram. In the journey of 25 years business has transformed & evolved. From acquiring Thyssen Krupp’s precision forging business in 2008 to Blackstone taking over the reins in 2019 & acquiring Comstar

Automotive Tech Pvt. Ltd., we see it in its current avatar as Sona Comstar.

Humble beginning with 1 plant has turned into a gigantic cavalcade having 9 state-of-the-art manufacturing facilities across India, USA, Mexico & China.

Humble beginning with 1 plant has turned into a gigantic cavalcade having 9 state-of-the-art manufacturing facilities across India, USA, Mexico & China.

Diversity isn’t limited to geography, co can boast of its wide product range of differential assemblies, differential gears, conventional & micro-hybrid starter motors, BSG systems, EV traction motors (BLDC & PMSM) & motor control units having application across all vehicle

categories, including conventional passenger & commercial vehicles, off-highway vehicles, electric cars, electric light commercial vehicles & electric 2-3 wheelers. With such diversity comes the need to do constant R&D.

Being a technology & innovation-driven organization,

Sona Comstar has 3 focused R&D centres in Gurugram & Chennai.

Sona Comstar has 3 focused R&D centres in Gurugram & Chennai.

Steering a ship of this size requires able hands. At the helm of affairs is MD & Group CEO - Mr Vivek Vikram Singh

Very few cos carry accolades like the ones Sona Comstar can take pride in. Ever since the co has been in active production their EBITDA margins have never dipped below 20% & they have never lost a client in the differential gears segment in the last 15-20 years.

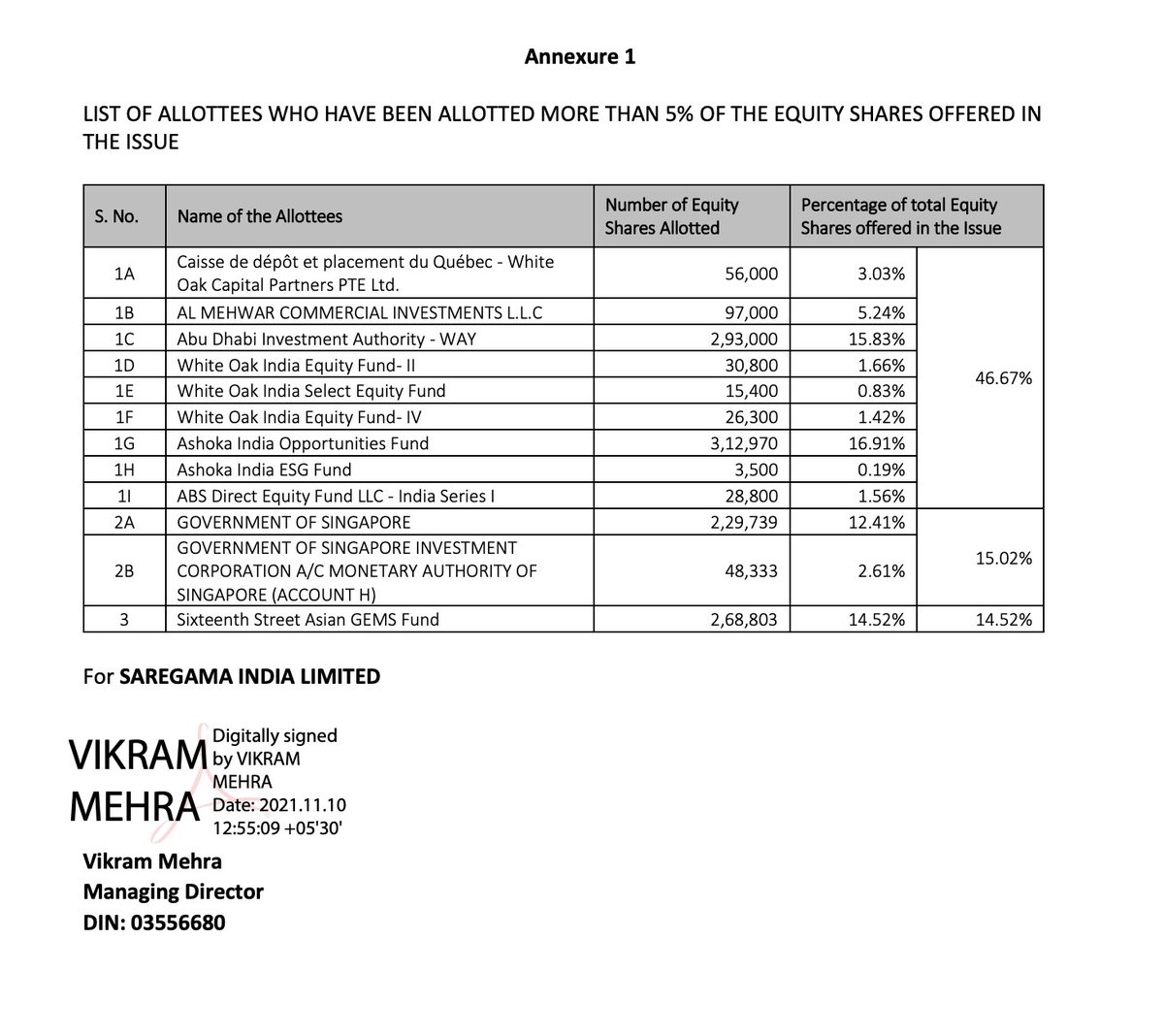

2. INDUSTRY: Electrification - Emerging trend

Electrification is emerging as the biggest trend in the automobile industry. Broadly there are 5 propulsions available for vehicles to run on. 1-ICE (Internal Combustion Engine) 2-Mild/full hybrid 3-BEV (Battery Electric Vehicle)

Electrification is emerging as the biggest trend in the automobile industry. Broadly there are 5 propulsions available for vehicles to run on. 1-ICE (Internal Combustion Engine) 2-Mild/full hybrid 3-BEV (Battery Electric Vehicle)

4-Fuel Electric Cell (Hydrogen) 5-PHEV (Plug-in hybrid electric vehicle). Driven by stringent emission norms - Corporate Average Fuel Economy (CAFE) across the globe, pure ICE vehicles would no longer be a viable propulsion for passenger vehicles.

Share of pure ICE will continue to decline & according to Ricardo Report it will be ~18% of total global production in CY2025.

Mild & full hybrids will account for ~32% of the propulsion share in CY2025. Mild hybrids will dominate among these 2 propulsions. As mild hybrids offer the quickest route to electrification with limited complexity & high fuel

economy benefits. Approx 80% of mild hybrid volumes in CY2025 will be in Europe & China.

BEV, among the available propulsions, has been fastest growing at a CAGR of 46% between CY 2015-2025. The proportion of BEVs will increase over time, expected to grow at ~36% CAGR between

BEV, among the available propulsions, has been fastest growing at a CAGR of 46% between CY 2015-2025. The proportion of BEVs will increase over time, expected to grow at ~36% CAGR between

CY 2020-2025. In CY 2025 Ricardo expects BEVs to account for ~12% (~11 mln units) of global production.

Electrification in India is expected to be driven by 3 wheelers & 2 wheelers. Electric 2 wheelers are expected to clock a staggering 70-74% CAGR between FY 2021-26 &

Electrification in India is expected to be driven by 3 wheelers & 2 wheelers. Electric 2 wheelers are expected to clock a staggering 70-74% CAGR between FY 2021-26 &

electric 3 wheelers to grow at a CAGR of ~46% between CY 2021-25. Favorable Govt initiatives like FAME II subsidies of up to ₹3 lakh for EVs in commercial use, reduction of GST rate to 5%, waiver of road tax & registration in several states & income tax benefits of up to

₹1.5 lakh for individuals are projected to drive the demand for EVs over the foreseeable future.

Another interesting trend in the industry is growing market preference for multiple axle vehicles in passenger vehicles, commercial vehicles & tractors. A light commercial vehicle (LCV) has 6 differential gears in a 2 wheel drive configuration whereas an M&HCV

( Mid & Heavy Commercial Vehicle) has 2 sets of 6 differential gears each, along with an inter-axle differential consisting of 9 gears in a 4 wheel drive configuration to support the torque requirement of respective vehicle segments.

This trend will increase the demand for differential gears.

3. PRODUCTS: One-Stop Shop

A diversified product portfolio catering to mission-critical needs of all types of electric, passenger, commercial & off highway vehicles makes Sona Comstar a one-stop solution provider

3. PRODUCTS: One-Stop Shop

A diversified product portfolio catering to mission-critical needs of all types of electric, passenger, commercial & off highway vehicles makes Sona Comstar a one-stop solution provider

globally. Sona Comstar is the largest manufacturer of differential gears for passenger vehicles, commercial vehicles & tractor OEMs in India with market share of 55-60%, 80-90% & 75-85% respectively.

It is among the top 2 exporters of starter motors from India & top 10 global suppliers in CY 2020. Globally they have 5% market share in differential gears & 3% market share in starter motors, CY 2020.

Today it serves 6 of the world’s top 10 car makers; 3 of the top 10 truck makers & 8 of the top 10 tractor makers. Co has been supplying differential gears & differential assemblies to global EV manufacturers since 2016 & 2018 respectively.

It also designs & manufactures state-of-the-art traction motors & motor control units including Brushless DC motor (BLDC) & Permanent magnet synchronous motors (PMSM) for electric 2 wheelers & 3 wheelers. It is ranked among the leading suppliers of BLDC motors in the Indian 2-3

wheeler EV market. Also, co has a strong foothold in making controllers for all electric & hybrid vehicles. Under the EV market, it commands 8.7% global market share in battery EV differential assemblies, CY 2020.

With such long strides co has to constantly update & evolve in R&D. Differential gears for electric cars must be much stronger, precise & power-denser than those used in ICE vehicles. The electric motor of EV is mounted on the axle to provide the entire power of the motor to

differential gears immediately. Unlike ICE vehicles, EV can attain its full torque at almost zero speed. Thanks to the precision forming technology of Sona Comstar, it can provide differential drive units to OEMs that are stronger, quieter & light in weight.

In the driveline division, their main product is differential bevel gears. They were the 1st co in India to use precision forming technology giving them higher material yields. Gear teeth are formed in this tech & not cut from a blank.

They have developed in-house proprietary gear design software to create gear tooth profiles optimized for specific customer needs. In FY 2020-21 their R&D spends increased ~126% compared to previous year, this includes Comstar.

4. STRATEGY: EV - inevitable, immutable, irreversible

A strategy is a device to fulfill aspirations. Sona Comstar has no dearth of aspirations, aiming to be the leading EV component supplier globally. With this huge aspiration comes the burden to strategize for the same.

A strategy is a device to fulfill aspirations. Sona Comstar has no dearth of aspirations, aiming to be the leading EV component supplier globally. With this huge aspiration comes the burden to strategize for the same.

Keeping these global aspirations at the forefront it has diversified in all sense possible. From having geographical presence to being present in all product segments to catering to all vehicle segments in the market.

Being a technology & research driven enterprise it has implemented digitalization to the extent possible to reach the optimum levels of manufacturing efficiency across manufacturing units. The R&D spends for the FY 2020-21 were 5.8% of the revenue.

This is a rare feat for an auto component manufacturer. Their spending on R&D is close to pharmaceutical corporations in India.

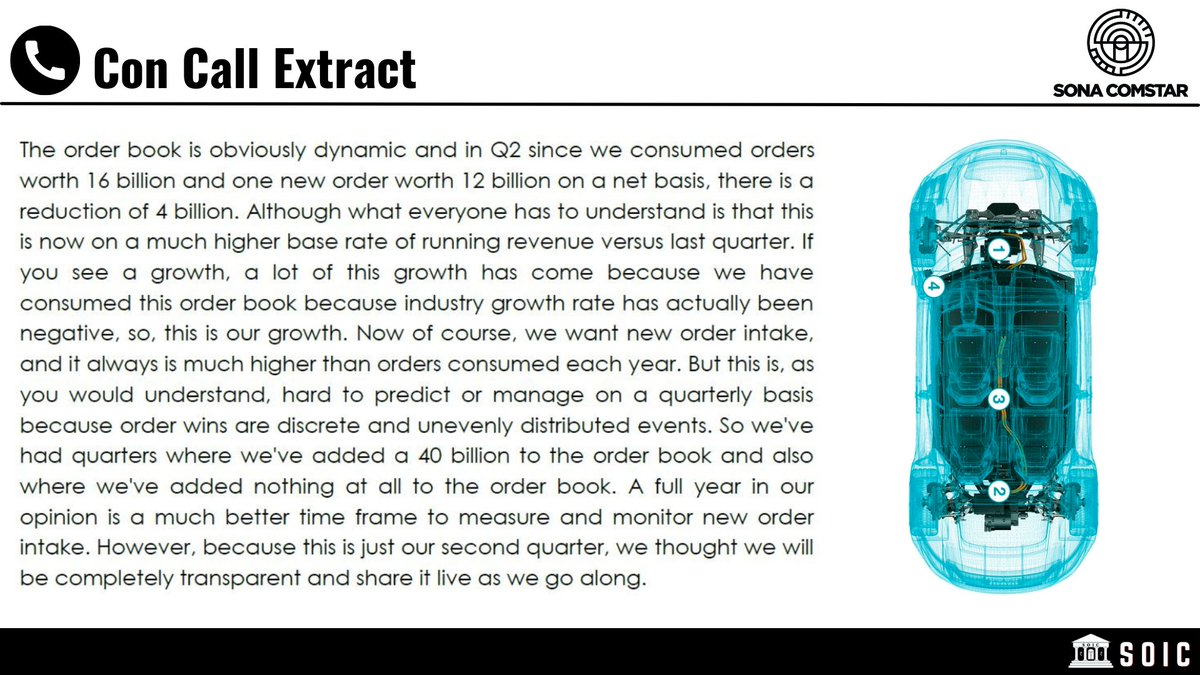

To be big you need to have a big size of opportunity. With the increasing trend to electrification of vehicles, Sona Comstar is well poised to take advantage. It is sitting on a large net order book of 13,600 cr+ which is 8.7x of the FY21 revenue.

Management seems transparent with regards to explaining what this order book entails. Please check the concall snippet for details. Revenue share from BEV has grown 16x over 3 years, with absolute BEV revenue growth at 25x.

Revenue dependence on ICE is on a constant decline from 35% in FY19 to 19% in H1FY22 & BEV & Hybrid has been rising from 1% & 17% in FY19 to 21% & 30% in H1FY22. Seizing the EV opportunity is the core focus of the company.

Another interesting feat shared by MD was that “1 out of every 8 BEV differential assemblies sold in the world today, are made in our Manesar plant at Sona”.

Further, Sona Comstar looks to gain greater market share by catering to the needs of EV OEMs in 3 product groups, 1- Differential assemblies & gears; 2- 48V BSG motor; 3- EV traction motors (BLDC & PMSM) & motor control units.

Differential assemblies & gears is projected to pose the most attractive opportunities across the entire automotive supply chain. Slated to reach a market value of US$ 56 bn by 2025, 4x growth vs US$14 bn in 2018. Global hybrid market is projected to grow nearly 4x by 2025 &

account for 21% of the propulsion split for passenger vehicles. To meet this opportunity Sona Comstar has developed a 48V BSG motor for hybrid PVs, which will lead to reduction in fuel consumption & CO₂ emissions. They have successfully completed demonstrations with several OEMs

With the significant increase in demand for electric 2-3 wheelers, co looks to leverage their market dominant position & lead in the supply of traction motors (BLDC & PMSM) & motor control units.

5. RISKS: Trend reversal

For each & every opportunity we must analyze gory risks & consequences attached. 1st & foremost risk in today’s world is the risk of COVID19 induced lockdowns & supply chain disruptions. If such problems keep resurfacing & disruptions become frequent,

For each & every opportunity we must analyze gory risks & consequences attached. 1st & foremost risk in today’s world is the risk of COVID19 induced lockdowns & supply chain disruptions. If such problems keep resurfacing & disruptions become frequent,

it leads to problems for manufacturers & may even bring a slowdown in the auto industry. 2nd risk is the risk that may arise out of regulations. As the auto sector is always in the eyes of environmentalists, moreover Sona requires magnets that are obtained by doing

neodymium mining which is a very polluting activity. So a risk of regulation persists along with supply chain security, it mainly comes from China. The 3rd big risk is the risk of technology. As is the case with any tech driven business, tech is evolving at a rapid pace.

Sona Comstar being a R&D driven business needs to stay abreast with the needs of the industry. Any loophole left unplugged could hurt business big time. Lastly, the risk of EV trend getting displaced. As the co is building its thesis around the electrification theme, any dent or

disruption in trend could play out as an antithesis.

Hope to have added value.

Hope to have added value.

• • •

Missing some Tweet in this thread? You can try to

force a refresh