Long Thread on investing in #Chemical Sector 🧪🧪

Like & Retweet for better reach !

While researching on the chemical company there are many factors taken into consideration, but a few of them play a crucial role in the future developments of the company.

Like & Retweet for better reach !

While researching on the chemical company there are many factors taken into consideration, but a few of them play a crucial role in the future developments of the company.

The growth of any business is dependent on the income generation and profit expansion. This could be met through increasing the capacity or operating in low volume high value products.

Similarly in the chemical industry, scaling up plays a crucial role in determining the growth of revenues, however working in niche chemistry with high expertise results in margin expansion.

The key drivers for growth in the chemical industry are as follows

1. Execution capabilities

2. Process innovation

3. Handling hazardous chemicals

1. Execution capabilities

2. Process innovation

3. Handling hazardous chemicals

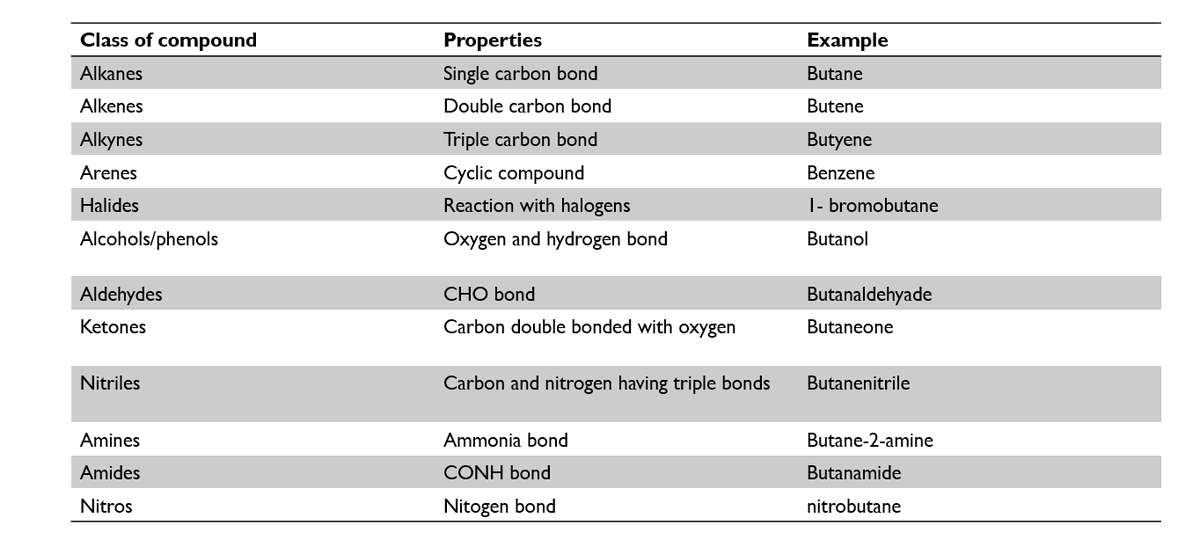

To understand the products of the company, it is important to understand the chemistry it operates in. Chemistry is the study of matter.

Matter could be made of elements or compounds which are further classified into metals (iron, copper, magnesium) , non-metals (carbon, nitrogen) and halogens (fluorine, chlorine, bromine).

The different types of chemistry which is performed in the industry are

1. Organic chemistry

2. Inorganic chemistry

3. Biochemistry

1. Organic chemistry

2. Inorganic chemistry

3. Biochemistry

In layman’s terms, organic chemistry has carbon and hydrogen chains whereas there is no presence of these elements in inorganic chemistry, however there are a few exceptions.

Biochemistry is the study of reaction in the living organism ,for eg: enzyme chemistry. The chemistry of any chemical company involves-

Element/ Compound + Functional group —> Reaction products

Element/ Compound + Functional group —> Reaction products

The functional groups are chains of carbon and hydrogen atoms in different compositions which helps in determining the properties of the final product.

The company selects an element or functional groups and uses that to make a chain of forward integrated products.

The company selects an element or functional groups and uses that to make a chain of forward integrated products.

Operating leverage plays when the capacity is scaled up because the raw material used is the same and the value chain of the products keeps on increasing.

Aarti industries ltd have developed the value chain from the benzene element and forward integrated it into value added products by using other functional groups.

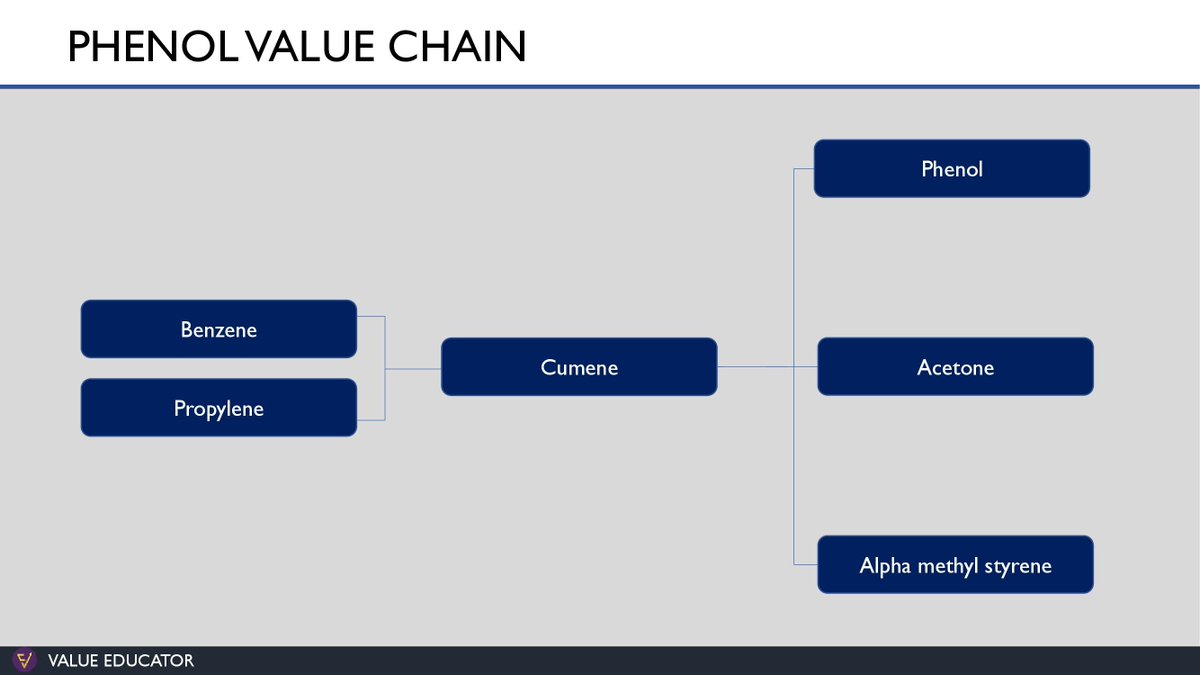

Similarly companies like Deepak nitrite ltd have selected the functional group of phenols and developed the value chain by using the functional group with other elements such as benzene, toluene, xylene etc.

Balaji amines ltd and Alkyl amines ltd have developed the functional group value chain of amines and its derivatives.

The companies are in the continuous process of developing new chemistry. This chemistry is performed by scientists and PhD’s for development of new molecules.

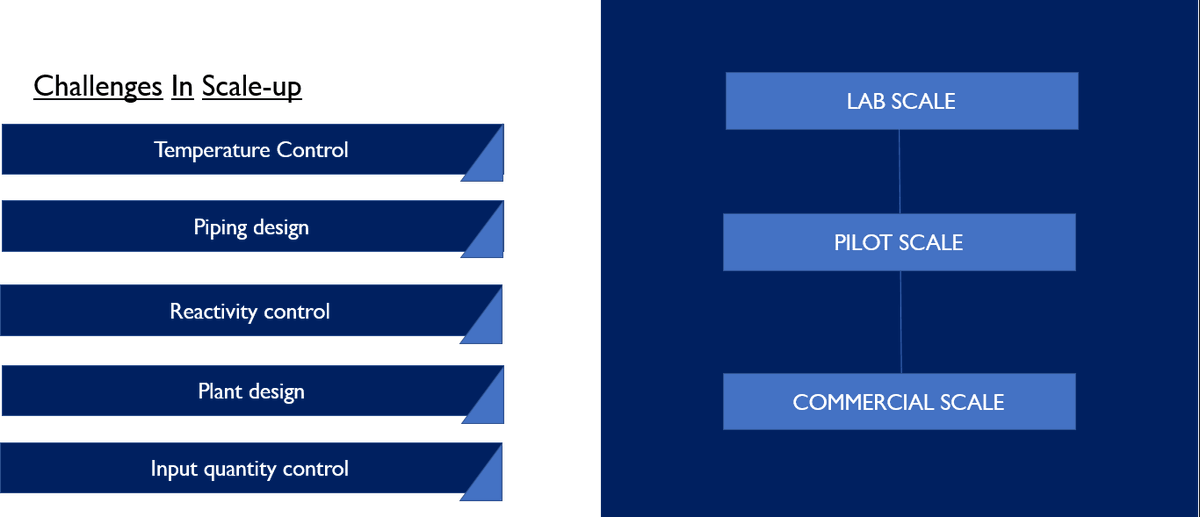

However it is the chemical engineers job to determine the factors responsible for mass production of this developed product. The product development in the chemical industry undergoes three steps.

It begins from

Lab scale- The products chemistry is developed by scientists using R&D technology in the labs of the chemical companies. Once the desired product is achieved, it is then sent to the next step of manufacturing

Lab scale- The products chemistry is developed by scientists using R&D technology in the labs of the chemical companies. Once the desired product is achieved, it is then sent to the next step of manufacturing

Pilot Scale- The products developed in the lab scale are sent to the pilot lab where they are manufactured in low volume batches to determine the scalability problems and overcome the challenges of mass production.

Commercial scale- Once the consistent quality is met at lab scale, it is further moved to large scale reactors and begins the commercial production. The initial batches are sent for customer approvals and when the quality is met, mass production begins.

However moving from lab scale to commercial scale is where the company faces actual challenges. The challenges for scaling up in the chemical industry are temperature control, piping design, reactivity control, plant design, control of feedstock quantity and many more.

These challenges are overcome by the expertise of management and technology personnel involved in the company. Thus development of chemistry is not sufficient unless and until the company is able to manufacture it on larger economies of scale.

Vinati organics ltd had developed their blockbuster ATBS molecule on lab scale in 2002, however the desired quality was not met while scaling up the process.

The company finally achieved the desired quality after the period of five years and from then on ATBS has been on steep growth.

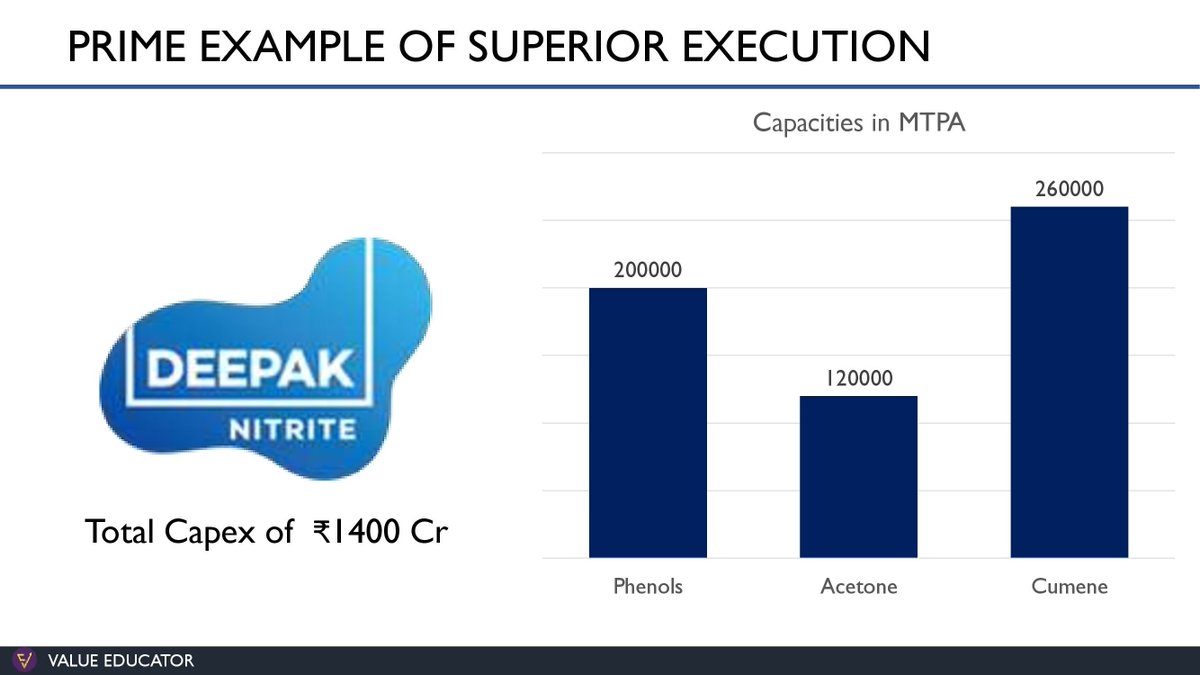

Deepak Nitrite ltd sets the prime example for execution capabilities as it has scaled up the capacities of phenols to 2,00,000 MTPA, Acetone to 1,20,000 MTPA and Cumene to 2,60,000 MTPA.

It is further undergoing a capex of 1400 Cr for forward integrated derivatives of phenol and acetone.

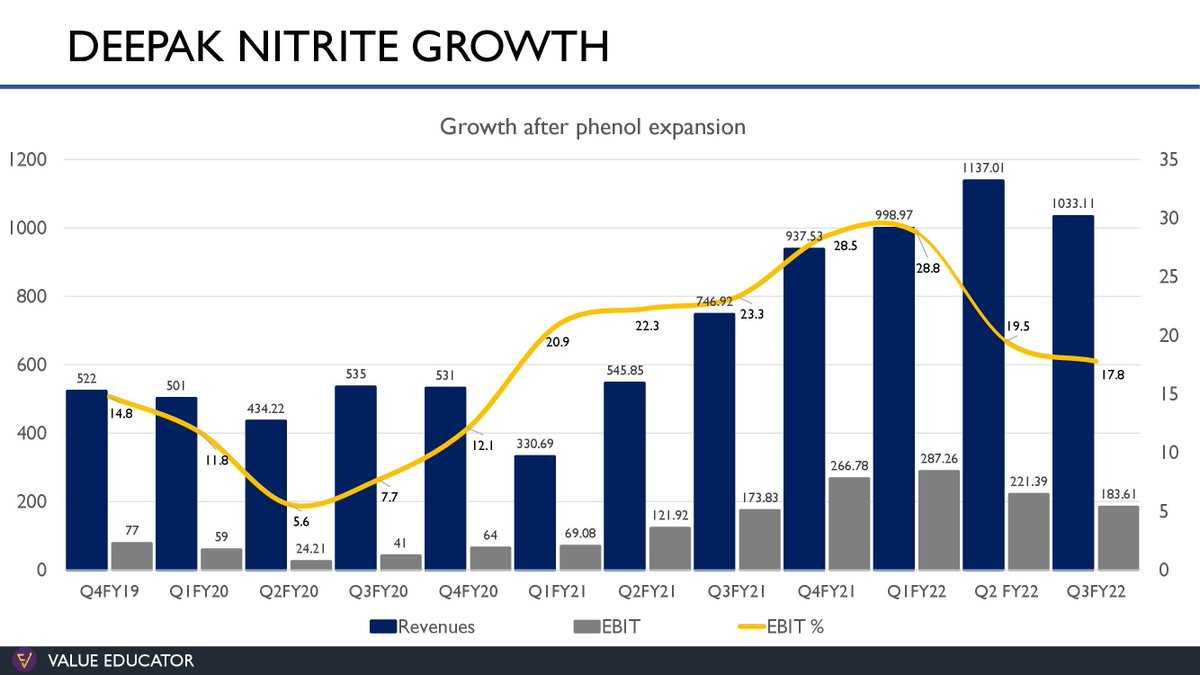

The growth of the company after the expansion stood robust with revenues expanding from 545 Crs in Q2FY21 to 1137 Crs in Q2FY22. Due to the larger capacities, the company is able to retain higher profits with expansion in profitability.

Debt incurred for the capex has been continuously reducing followed by the interest cost. The reduction allows the company to further leverage their position for the new capex.

However, margins in high volume low value products are retained only when the capacities are highly scaled up with optimum utilisation.

To further expand the margins, the company develops process innovation technology to improvise the existing chemistry and develop higher yields. The scale up of new process innovation will result in higher margins.

The case study for PAP will help in understanding the process innovation scale up.

PAP or Para amino phenol is used as an API for manufacturing of paracetamol drugs. This PAP is conventionally manufactured from two methods.

PAP or Para amino phenol is used as an API for manufacturing of paracetamol drugs. This PAP is conventionally manufactured from two methods.

One is from the PNCB route, where it is reduced to PNP and then converted to PAP and another is the phenol route where phenol is reduced to PNP and then converted to PAP.

The PNCB route is used more by Indian companies and phenol route is used more by the Chinese chemical companies. Both the reactions are two step reactions which result in the same purity of the PAP molecule.

Another method to manufacture PAP is through the Nitrobenzene route. Nitro benzene is hydrogenated and directly converted to PAP. This resulted in a one step reaction with the similar purity for the PAP molecule.

Vinati organics ltd were working on the nitrobenzene route for PAP at their pilot plant, however the project was stopped due to technical challenges relating to the catalyst which led to poor project economics.

Sadhana nitrochem ltd have developed the technology to manufacture PAP from nitro benzene route and has set up the capacities of 36,000 MT.

In the aroma industry, Privi specialty chemicals ltd is also under the process of innovation for manufacturing l-menthol products from the di-pentenes value chain. Menthol was traditionally extracted from the "mentha arvensis” plant.

Before the development of synthetic menthol these essential oils were used in the F & F industry for menthol flavouring and aromas. However in 2004, BASF synthesised menthol from petrochemicals by using the citral route which is still being used to synthesise menthol.

Privi specialty chemicals ltd have developed the proprietary technology to manufacture l-menthol from the di-pentens of pinene molecule. This technology is developed for the first time in the world and the future expansion of privi will be more for menthol.

As the dipentenes are byproducts in pinene molecules, so if the company successfully scales up this process, the product derived will be cheaper than other menthol products.

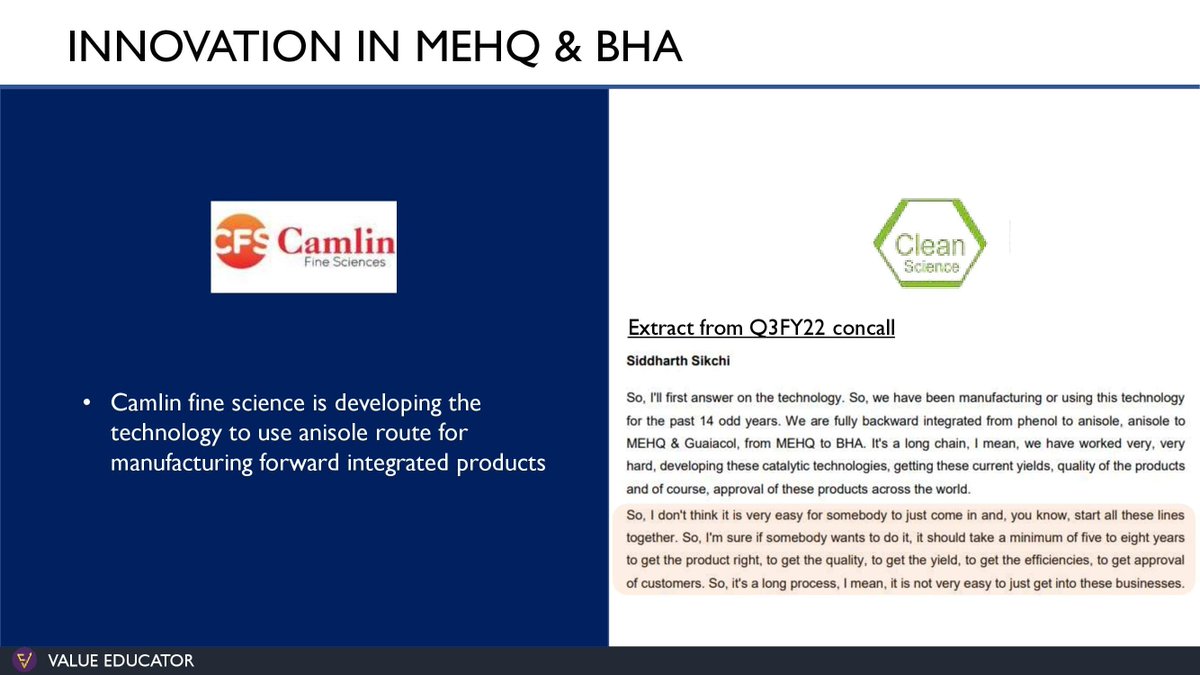

Clean science and technology is well known for their process innovation technologies.

Clean science and technology is well known for their process innovation technologies.

Unlike other peers who use hydroquinone to manufacture food antioxidant chemicals like MEHQ, TBHQ and BHA, Clean sciences uses vapour phase technology to manufacture anisole and then it is forward integrated to antioxidant products.

This process innovation has resulted in higher profit margin and pricing power compared to other players in the industry. It is also difficult for peer industries to implement this technology as it requires the necessary expertise and could take 4-5 years to scale

up the productions. However the management of Camlin fine sciences ltd in Q3FY22 Concall were confident on implementing the anisole route for manufacturing existing products.

The risk of safety is high in the chemical industry as some of the chemicals could be flammable and highly toxic when reacting with other elements, thus such highly reactive chemicals require expertise and knowledge to handle their chemistry.

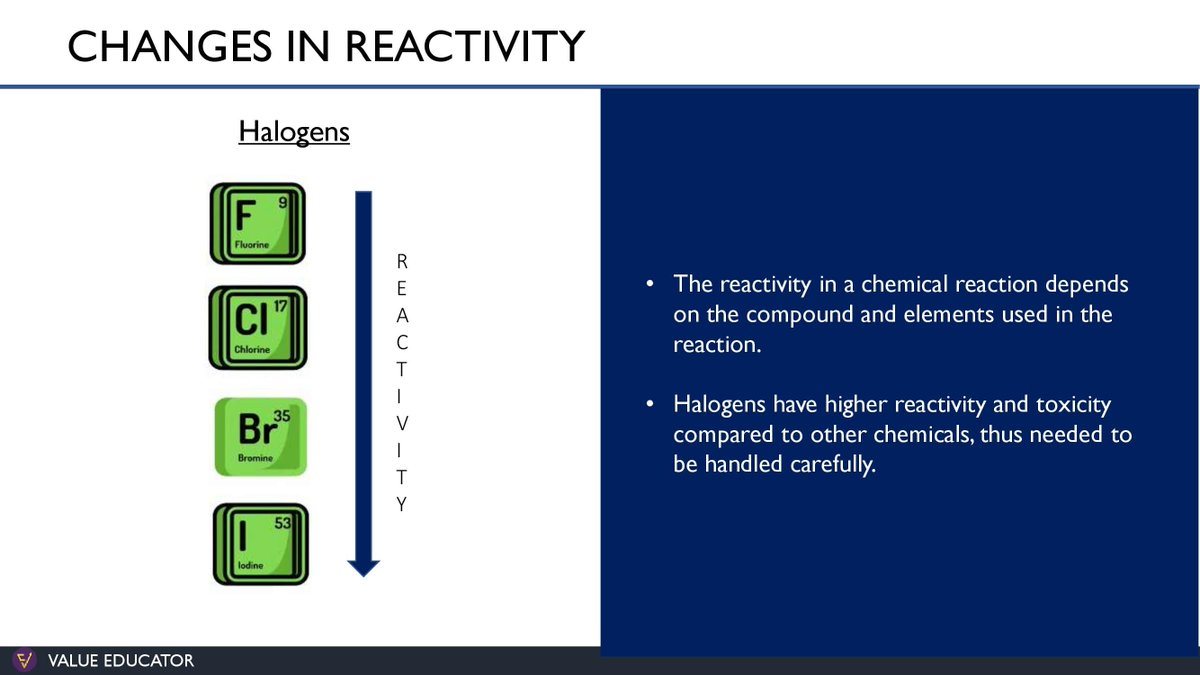

Halogens such Fluorine, Chlorine, Bromine and Iodine have reactivity in the descending order with fluorine being the highest on the reactivity table.

Companies like Navin fluorine international ltd, Gujarat fluorochemicals ltd and SRF ltd have high expertise to handle the hazardous chemistry.

Chlorine follows fluorine in the toxicity levels. Chlorine gas was one of the chemical weapons used in world war one.

Chlorine follows fluorine in the toxicity levels. Chlorine gas was one of the chemical weapons used in world war one.

Chlorine in the presence of carbon monoxide gives phosgene. Paushak is the only manufacturer of phosgene and its derivatives in India.

The company expanded their capacity to 3x in the period of 33 years i.e from 1981 to 2014, however from 2014- present the company’s capacity increased by 3x within the 5 year period.

Bromine chemistry is performed by Neogen chemicals ltd. It is the only company in India with high capacities of bromine along with other lithium products. The company is under a huge capex cycle with capacities coming online prior to the estimated timeline.

This resembles the exclusive execution of management and efficiently scaling up the capacities of the highly reactive chemistry.

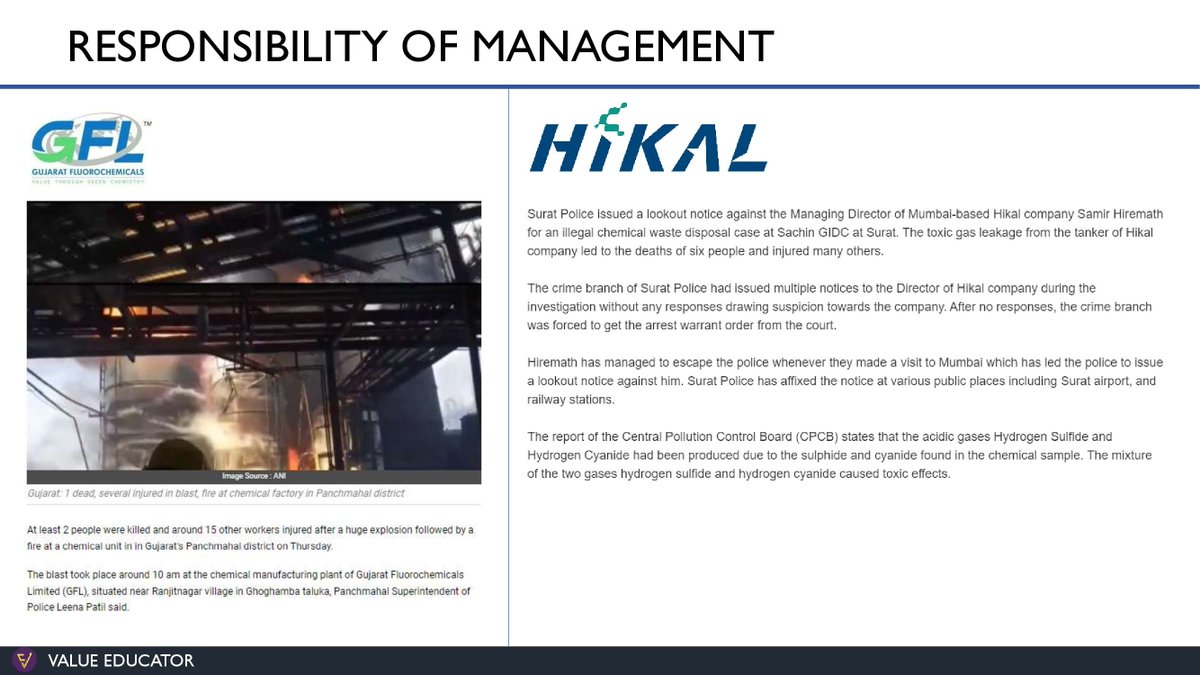

Due to high toxicity and environment hazards, the chemical companies have a standard set of safety practices. Lack of safety standards will result in unexpected circumstances, thus the company certifies themselves with safety accreditations.

The fall of the Chinese chemical industry was because of not practising the required safety standards which resulted in multiple blasts across the region.

Most of the companies like Tata chemicals, Navin fluorine international, SRF, UPL, Deepak nitrite, Rallis india,

Most of the companies like Tata chemicals, Navin fluorine international, SRF, UPL, Deepak nitrite, Rallis india,

Thirumalai chemicals, Jubilant ingrevia, Paushak, Aarti industries, Deepak fertilisers, Alkyl amines and many others have the responsible care logo which acts as a metric for rating the safety standards followed by the company.

The Gujarat fluorochemicals factory explosion resulted in the death of at least 2 people. Recently Hikal ltd Managing directors are on the run for dumping the illegal chemicals waste in Sachin GIDC.

The gas leak from the dumping of chemicals resulted in the death of 6 people. Such accidents question the integrity and competency of management.

These few factors help in identifying the potential candidates in the chemical industry which will outgrow their peers.

These few factors help in identifying the potential candidates in the chemical industry which will outgrow their peers.

• • •

Missing some Tweet in this thread? You can try to

force a refresh