1/19

One of the first books I read on investing in 2009 was this 💎of a book on Warren Buffett called

HOW BUFFETT DOES IT - 24 SIMPLE INVESTING STRATEGIES.

A great read for investors, given current stock market conditions.

A 🧵

#Investing

#BookSummary

#BookRecommendations

One of the first books I read on investing in 2009 was this 💎of a book on Warren Buffett called

HOW BUFFETT DOES IT - 24 SIMPLE INVESTING STRATEGIES.

A great read for investors, given current stock market conditions.

A 🧵

#Investing

#BookSummary

#BookRecommendations

2/19

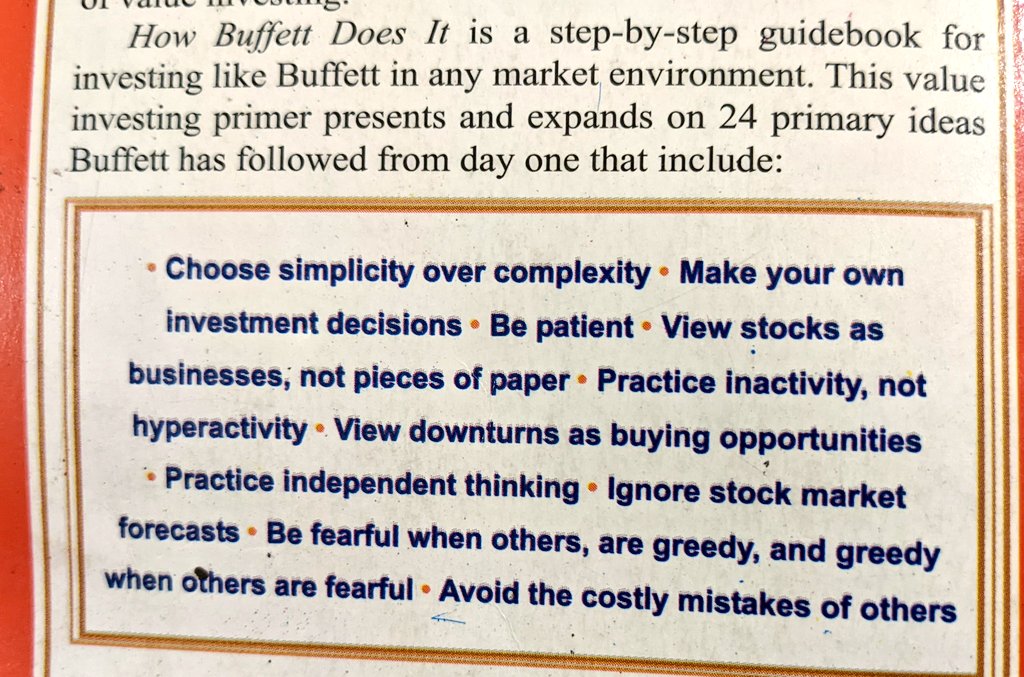

SIMPLICITY OVER COMPLEXITY

Buy an easy to understand business run by honest & capable management with MINIMAL VARIABLE PARAMETERS( Avoid Complex Bus.)

Pay less for your share than what it is actually worth in terms of future earning potential.

Hold onto it patiently !

👇

SIMPLICITY OVER COMPLEXITY

Buy an easy to understand business run by honest & capable management with MINIMAL VARIABLE PARAMETERS( Avoid Complex Bus.)

Pay less for your share than what it is actually worth in terms of future earning potential.

Hold onto it patiently !

👇

3/19

INVESTING IS A ONE MAN JOURNEY

🔸Gain basic knowledge of accounting & financial markets.

🔸Read business Magazines , Periodicals, Annual Reports & Concalls

🔸Get going !

A basic checklist that shall help you figure if you are actually a Long Term Investor or not.

👇

INVESTING IS A ONE MAN JOURNEY

🔸Gain basic knowledge of accounting & financial markets.

🔸Read business Magazines , Periodicals, Annual Reports & Concalls

🔸Get going !

A basic checklist that shall help you figure if you are actually a Long Term Investor or not.

👇

4/19

TEMPERAMENT MATTERS

Your reaction to Greed & Panic shall determine your investing success.

Are you fixated on the LT business fundamentals or on the weekly stock prices ?

You need to have the SKILL to invest correctly & then the CONFIDENCE to hold them through drawdowns.

TEMPERAMENT MATTERS

Your reaction to Greed & Panic shall determine your investing success.

Are you fixated on the LT business fundamentals or on the weekly stock prices ?

You need to have the SKILL to invest correctly & then the CONFIDENCE to hold them through drawdowns.

5/19

PATIENCE IS A CRITICAL COMPONENT

Don't get swept up in others' irrational exuberance.

LEARN TO SEE THROUGH FADS.🧐

A volatile price DOESN'T IMPLY a volatile business!

Focus on the underlying business & it's earning capacity always.

In investing, Inactivity is rewarding.

PATIENCE IS A CRITICAL COMPONENT

Don't get swept up in others' irrational exuberance.

LEARN TO SEE THROUGH FADS.🧐

A volatile price DOESN'T IMPLY a volatile business!

Focus on the underlying business & it's earning capacity always.

In investing, Inactivity is rewarding.

6/19

Buy the RIGHT business & it SHALL ( more often than not) THRIVE !

Buy & Hold WORKS only in the RIGHT business.

Look for PREDICTABLE Cash Flows & Earnings.

CONSISTENCY matters immensely.

So does SCALABILITY.

( Correlate these to newly listed new age businesses & think)

👇

Buy the RIGHT business & it SHALL ( more often than not) THRIVE !

Buy & Hold WORKS only in the RIGHT business.

Look for PREDICTABLE Cash Flows & Earnings.

CONSISTENCY matters immensely.

So does SCALABILITY.

( Correlate these to newly listed new age businesses & think)

👇

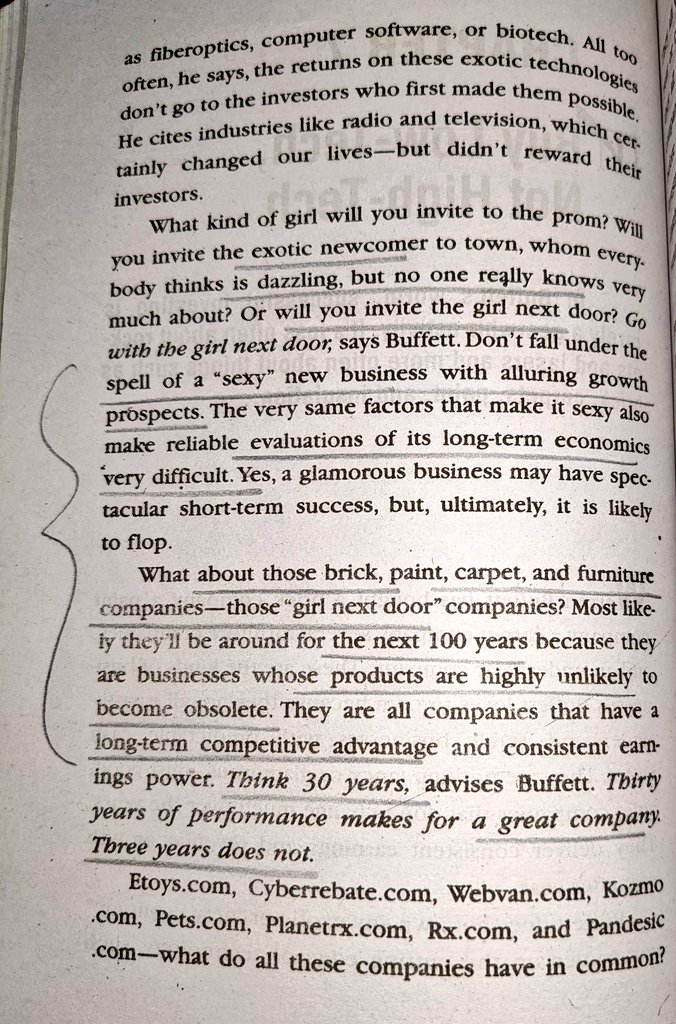

7/19

Owning cutting edge tech businesses is good as long as they CONSTANTLY REINVENT to ensure HEALTHY CASH FLOWS !

Stay away if you don't know WHEN the industry shall make any money.☠️

Better to go in for boring businesses with PREDICTABLE CF !

Owning cutting edge tech businesses is good as long as they CONSTANTLY REINVENT to ensure HEALTHY CASH FLOWS !

Stay away if you don't know WHEN the industry shall make any money.☠️

Better to go in for boring businesses with PREDICTABLE CF !

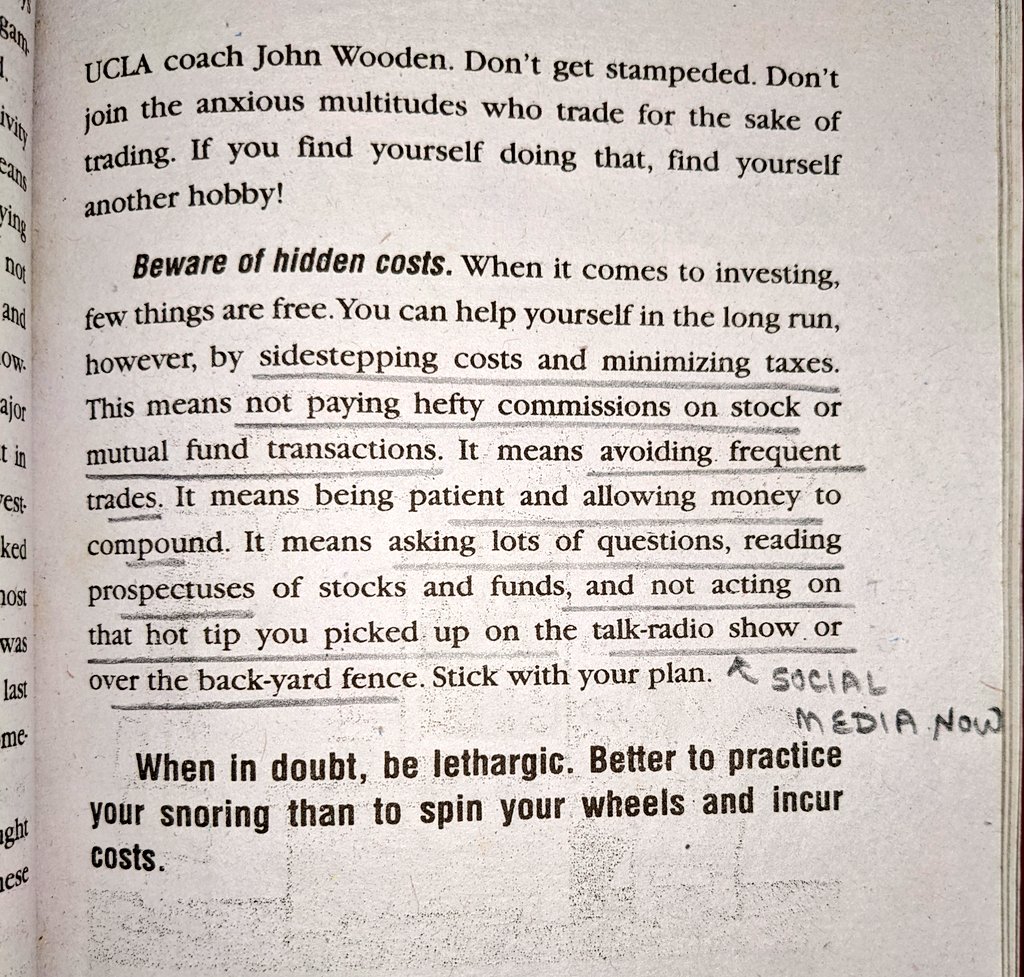

8/19

Do Nothing when Nothing is to be done.

Shun hyperactivity.😴😴

Frequent churn results in frictional costs : Commision , Capital Gains taxes, Hidden costs - Load in MF further reduces our gains ( if any )

Aim to get wealthy over Long Term, not rich !

Do Nothing when Nothing is to be done.

Shun hyperactivity.😴😴

Frequent churn results in frictional costs : Commision , Capital Gains taxes, Hidden costs - Load in MF further reduces our gains ( if any )

Aim to get wealthy over Long Term, not rich !

9/19

My personal fav.

DON'T LOOK AT THE TICKER !

Your life does NOT depend on daily / monthly stock movement.

Checking prices daily can cause exaggerated mood swings, leading to knee jerk decisions.

Ticker is all about the price.

But investing is a lot more than that.

👇

My personal fav.

DON'T LOOK AT THE TICKER !

Your life does NOT depend on daily / monthly stock movement.

Checking prices daily can cause exaggerated mood swings, leading to knee jerk decisions.

Ticker is all about the price.

But investing is a lot more than that.

👇

10/19

If the herd starts running away from a good stock, get ready to run toward it.

Rings any bells ? 🤪

Invest when great businesses are experiencing temporary difficulties

Or during Bear markets when share prices plummet due to overall gloom & underlying business is intact.

If the herd starts running away from a good stock, get ready to run toward it.

Rings any bells ? 🤪

Invest when great businesses are experiencing temporary difficulties

Or during Bear markets when share prices plummet due to overall gloom & underlying business is intact.

11/19

DON'T SWING AT EVERY PITCH!

Be patient, let a good one come by & then swing big !

The sweet spot is

A great business + strong earnings future + ethical management + good stock price.

Mistakes of Omission are alright.

Mistakes of Commission ARE NOT.

DON'T SWING AT EVERY PITCH!

Be patient, let a good one come by & then swing big !

The sweet spot is

A great business + strong earnings future + ethical management + good stock price.

Mistakes of Omission are alright.

Mistakes of Commission ARE NOT.

12/19

V.Imp !!

WHO IS IN CHARGE AT THE HELM ?

Charlie Munger states,

"The opulence at the head office is often inversely proportional to the financial substance of the firm."

"A dirty kitchen rarely has just one cockroach" states Warren Buffett.

Some notes to help know WHY

👇

V.Imp !!

WHO IS IN CHARGE AT THE HELM ?

Charlie Munger states,

"The opulence at the head office is often inversely proportional to the financial substance of the firm."

"A dirty kitchen rarely has just one cockroach" states Warren Buffett.

Some notes to help know WHY

👇

13/19

Too many choices confuse us.

But how many merit themselves ?

Only a few.

We will be bombarded with information & investment strategies by "professionals" - their bread & butter afterall

But is it worth it for us ?

Remember,

The Emperor Wears No Clothes on Wall Street 😬

Too many choices confuse us.

But how many merit themselves ?

Only a few.

We will be bombarded with information & investment strategies by "professionals" - their bread & butter afterall

But is it worth it for us ?

Remember,

The Emperor Wears No Clothes on Wall Street 😬

14/19

"Most men would rather die than think. Many do."

THINK INDEPENDENTLY.

Investing is a one man journey.

Think based on FACTS & REASONING.

Not based on PREVAILING PUBLIC OPINION !

DON'T make a decision just because it is CONTRARY. That isn't being Contrarian ! 😅🤷🏻♀️

👇

"Most men would rather die than think. Many do."

THINK INDEPENDENTLY.

Investing is a one man journey.

Think based on FACTS & REASONING.

Not based on PREVAILING PUBLIC OPINION !

DON'T make a decision just because it is CONTRARY. That isn't being Contrarian ! 😅🤷🏻♀️

👇

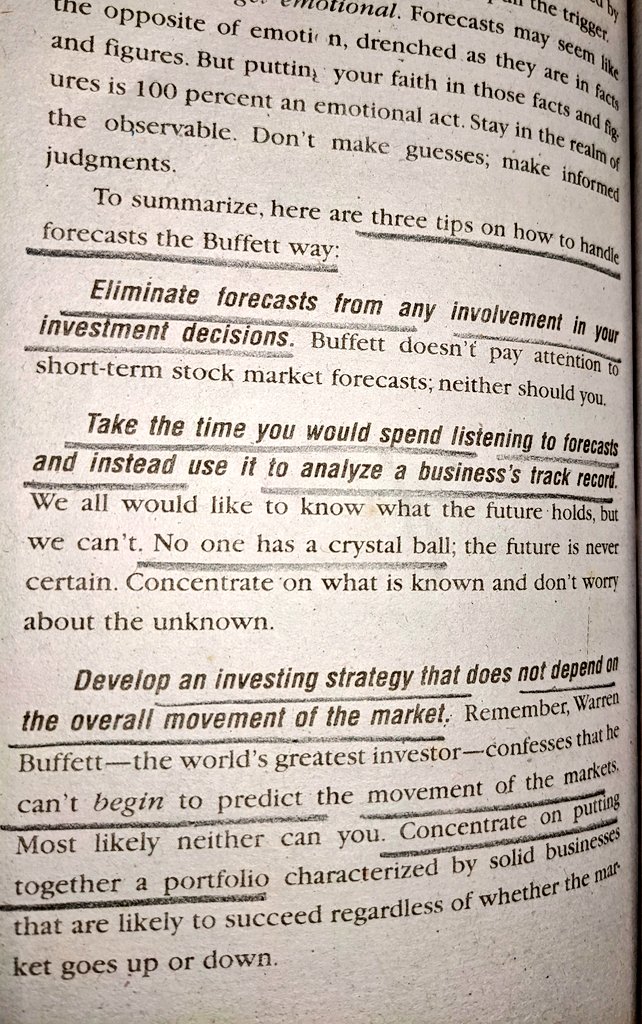

15/19

Short term forecasts tell us more about the forecaster than the future, states Buffett.

Social media is filled with such forecasters !

These are NOISE because they create an illusion of precision.

Look at proven performance instead,

as the future is obscure.

Short term forecasts tell us more about the forecaster than the future, states Buffett.

Social media is filled with such forecasters !

These are NOISE because they create an illusion of precision.

Look at proven performance instead,

as the future is obscure.

16/19

EQUANIMITY IS THE KEY

Paraphrasing Benjamin Graham,

"Never fall under the influence of Mr. Market.

His gloom can fill the room.

His euphoria can be intoxicating."

Read the mood & act.But don't get swept in the mood yourself.

Aggressive opportunism when pessimism is MAX.

EQUANIMITY IS THE KEY

Paraphrasing Benjamin Graham,

"Never fall under the influence of Mr. Market.

His gloom can fill the room.

His euphoria can be intoxicating."

Read the mood & act.But don't get swept in the mood yourself.

Aggressive opportunism when pessimism is MAX.

17/19

READ , READ & READ SOME MORE.

BUT READ , SELECTIVELY* !

Then sit in isolation & THINK

Over the years, a pattern emerges and you start identifying businesses that are fluff and are able to differentiate between value and noise.

*Explained in Notes 👇

READ , READ & READ SOME MORE.

BUT READ , SELECTIVELY* !

Then sit in isolation & THINK

Over the years, a pattern emerges and you start identifying businesses that are fluff and are able to differentiate between value and noise.

*Explained in Notes 👇

18/19

"All I want to know is where I'm going to die. So I'll never go there."

- Charlie Munger

Aka

Avoid the costly mistakes of others !

Don't get enticed with pitches of professionals ( 25%CAGR or Assured returns) & become victims of unsound investing.

Nuggets of wisdom

👇

"All I want to know is where I'm going to die. So I'll never go there."

- Charlie Munger

Aka

Avoid the costly mistakes of others !

Don't get enticed with pitches of professionals ( 25%CAGR or Assured returns) & become victims of unsound investing.

Nuggets of wisdom

👇

19/19

🔸Keep things simple

🔸Stick to what you understand, else outsource

🔸There will always be distractions - Ignore them.Focus on underlying business

🔸Write your investment approach & stick to it

🔸Rule no 1 : Never lose money

Rule no 2 : Never forget Rule no 1

Lastly , 😬

🔸Keep things simple

🔸Stick to what you understand, else outsource

🔸There will always be distractions - Ignore them.Focus on underlying business

🔸Write your investment approach & stick to it

🔸Rule no 1 : Never lose money

Rule no 2 : Never forget Rule no 1

Lastly , 😬

• • •

Missing some Tweet in this thread? You can try to

force a refresh