🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮

Global Macro Review 03/13/22

1/11

Focus on what’s working - long #inflation 🛢, #vol 🌊, and long USD 💵

Nothing says these will continue to work, given the geopolitical risk 💥☮️

But, what choice do you have? Fade it?

Let’s dig into the 🧮!

Global Macro Review 03/13/22

1/11

Focus on what’s working - long #inflation 🛢, #vol 🌊, and long USD 💵

Nothing says these will continue to work, given the geopolitical risk 💥☮️

But, what choice do you have? Fade it?

Let’s dig into the 🧮!

2/11

Metals ↔️ on the week but ♉️ -

giving you opportunity long side

$COPPER -6.3%

$PLAT -2.55%

$GOLD +0.95%

$SILVER +1.45%

Chart: $SILVER +11.95% t, +17.85% T, vol 53 (3.3%)🔻

Metals ↔️ on the week but ♉️ -

giving you opportunity long side

$COPPER -6.3%

$PLAT -2.55%

$GOLD +0.95%

$SILVER +1.45%

Chart: $SILVER +11.95% t, +17.85% T, vol 53 (3.3%)🔻

3/11

Hydrocarbons ♉️ pulled back sharply = more opportunity long 🛢⛽️

$GASO -7.35%

$NATGAS -6.0%

$WTIC -5.5%

$BRENT -4.2%

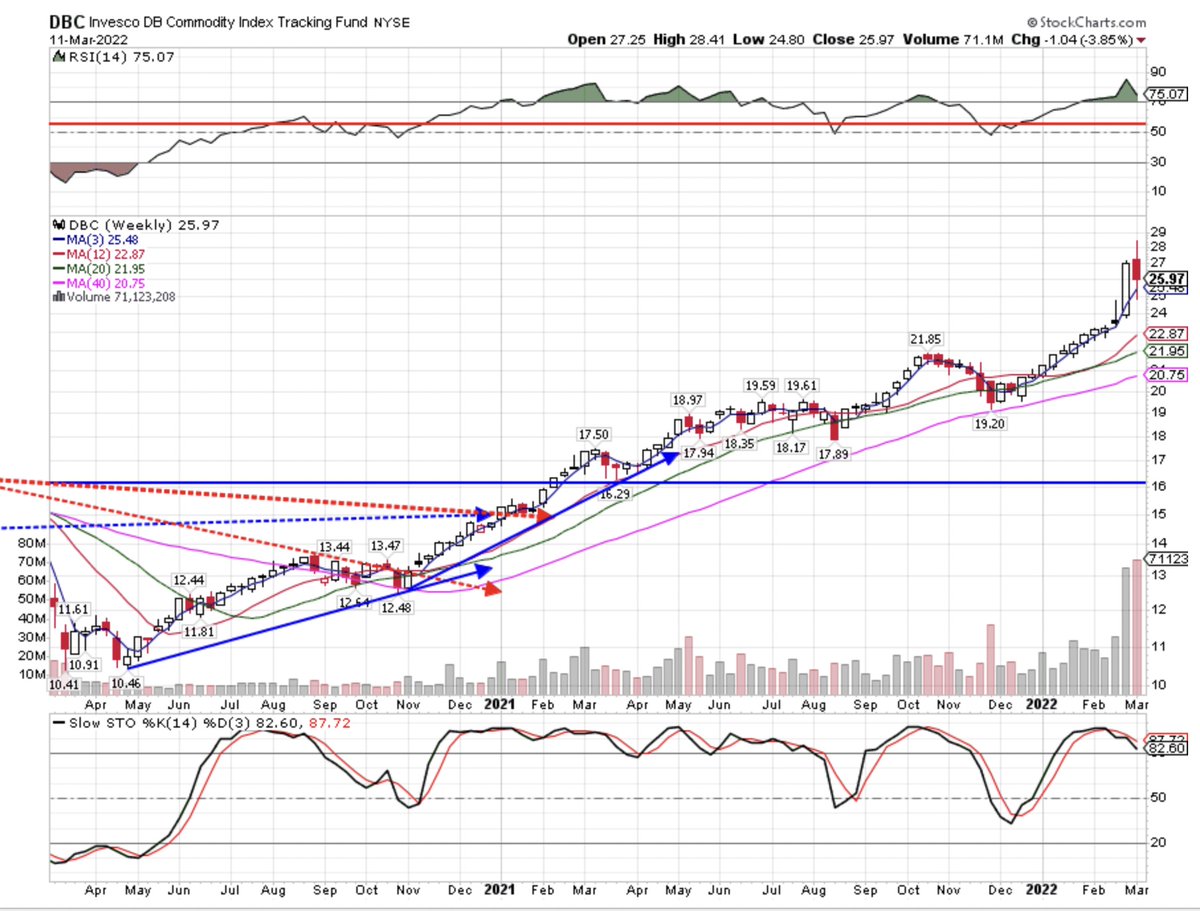

Chart: $DBC +12.28% t, +27.75% (T), vol 50 (3.1%) is over extended but a lower vol way to play commodities

Hydrocarbons ♉️ pulled back sharply = more opportunity long 🛢⛽️

$GASO -7.35%

$NATGAS -6.0%

$WTIC -5.5%

$BRENT -4.2%

Chart: $DBC +12.28% t, +27.75% (T), vol 50 (3.1%) is over extended but a lower vol way to play commodities

4/11

Grains were ↔️ with 🌾 ↘️ sharply and 🍭 back to 🐻 (T)

$WHEAT -8.35% 🌾

$SUGAR -0.3% 🍭

$SOYB +0.95%

$CORN +1.1%

$COFFEE -0.9% ☕️ 🐻

Chart: $DBA +3.5% (t), +10.75% (T), 30 vol (1.89%)

Grains were ↔️ with 🌾 ↘️ sharply and 🍭 back to 🐻 (T)

$WHEAT -8.35% 🌾

$SUGAR -0.3% 🍭

$SOYB +0.95%

$CORN +1.1%

$COFFEE -0.9% ☕️ 🐻

Chart: $DBA +3.5% (t), +10.75% (T), 30 vol (1.89%)

5/11

The $USD 💪 particularly vs 🇨🇭 and 🇯🇵

$USD +0.47%

$AUD -1.22% ♉️ (t) + (T)

$EUR -0.24%

$GBP -1.6%

$USDCAD +0.08%

$USDCHF +1.95% 🇨🇭

$USDJPY +2.12% 🇯🇵

Chart: $USDJPY +1.69% (t) +3.46% (T) vol 9 (.56%)

The $USD 💪 particularly vs 🇨🇭 and 🇯🇵

$USD +0.47%

$AUD -1.22% ♉️ (t) + (T)

$EUR -0.24%

$GBP -1.6%

$USDCAD +0.08%

$USDCHF +1.95% 🇨🇭

$USDJPY +2.12% 🇯🇵

Chart: $USDJPY +1.69% (t) +3.46% (T) vol 9 (.56%)

6/11

Except for TIPs, you got pounded in bond ETFs

Again, #inflation working; duration? not so much

$TIP +0.51%

$BND -1.82%

$HYG -1.95%

$BNDD -2.7%

$LQD -2.8%

$TLT -3.8%

Chart: $TIP +3.6% (t) -0.06% (T), vol 12 (0.77%)

Except for TIPs, you got pounded in bond ETFs

Again, #inflation working; duration? not so much

$TIP +0.51%

$BND -1.82%

$HYG -1.95%

$BNDD -2.7%

$LQD -2.8%

$TLT -3.8%

Chart: $TIP +3.6% (t) -0.06% (T), vol 12 (0.77%)

7/11

US equities working 🩳 side (= long vol) with small caps outperforming

$IWM -0.95%

$SPX -2.9%

$COMPQ -3.55%

Chart: $IWM -2.3% (t), -10.55% (T), vol 45 (2.8%

US equities working 🩳 side (= long vol) with small caps outperforming

$IWM -0.95%

$SPX -2.9%

$COMPQ -3.55%

Chart: $IWM -2.3% (t), -10.55% (T), vol 45 (2.8%

8/11

Very little working long side in US sectors

$XLE +2.15%

$XLU -0.65%

$XME -1.25%

Both $XLP -5.85% and $XLV -2.7% broke (T) this week 🐻

Chart: $XLE +9.15% (t), +34.25% (T), vol 50 (3.15%)

Very little working long side in US sectors

$XLE +2.15%

$XLU -0.65%

$XME -1.25%

Both $XLP -5.85% and $XLV -2.7% broke (T) this week 🐻

Chart: $XLE +9.15% (t), +34.25% (T), vol 50 (3.15%)

9/11

Big 🍾 in European indices this week as Asia played catch ↘️

$CAC +3.3%

$DAX +1.35%

$HSI -6.15%

$KOPSI -1.9%

$NIKK -3.15%

$SSEC -4.0%

Chart: The “safety” trade, $SSEC -4.4% (t), -9.75% (T), vol 29 (1.8%)

Big 🍾 in European indices this week as Asia played catch ↘️

$CAC +3.3%

$DAX +1.35%

$HSI -6.15%

$KOPSI -1.9%

$NIKK -3.15%

$SSEC -4.0%

Chart: The “safety” trade, $SSEC -4.4% (t), -9.75% (T), vol 29 (1.8%)

10/11

Top country ETFs - all 🐻 all 🩳

$EWD +5.0%

$ENFL +4.7%

$EWP +3.6%

$EWG +3.15%

Weakest

$FXI -11.85%

$VNM -5.65%

EWJ -4.3%

Top country ETFs - all 🐻 all 🩳

$EWD +5.0%

$ENFL +4.7%

$EWP +3.6%

$EWG +3.15%

Weakest

$FXI -11.85%

$VNM -5.65%

EWJ -4.3%

11/11

#CPI 7.9%

Anyone who tells you the #inflation trade is because of 🪆 is full of 💩, though 💥 did catalyze a big move ↗️

Use the $CRB ↘️ to #BTFD

Use equity ↗️ to #STFR

The trend 📊 is your friend until further notice

Have a super profitable 💰 week!

#CPI 7.9%

Anyone who tells you the #inflation trade is because of 🪆 is full of 💩, though 💥 did catalyze a big move ↗️

Use the $CRB ↘️ to #BTFD

Use equity ↗️ to #STFR

The trend 📊 is your friend until further notice

Have a super profitable 💰 week!

• • •

Missing some Tweet in this thread? You can try to

force a refresh