1/X | PETROTAL FEBRUARY REVIEW, 2022 PROJECTION & DIVIDEND ROADMAP

I've been a bit busy with work so haven't had time to tweet in a while. However, since Petrotal is having social issues limiting their production I thought I'd share some insights and dividend calculations

#PTAL

I've been a bit busy with work so haven't had time to tweet in a while. However, since Petrotal is having social issues limiting their production I thought I'd share some insights and dividend calculations

#PTAL

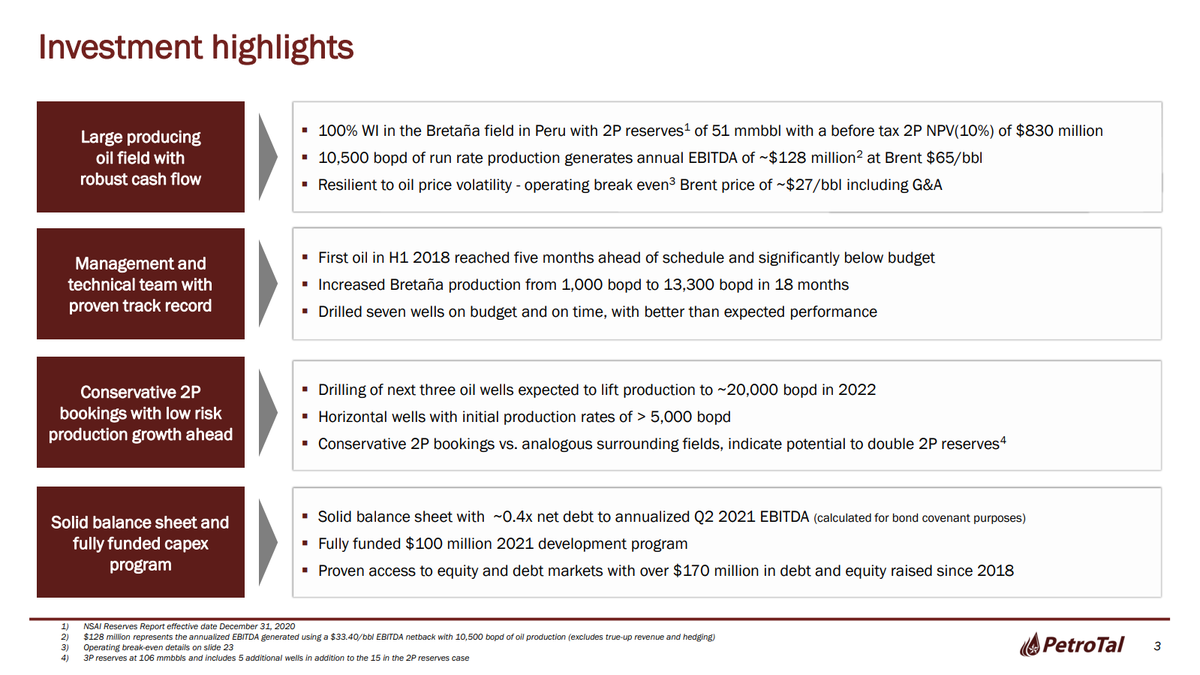

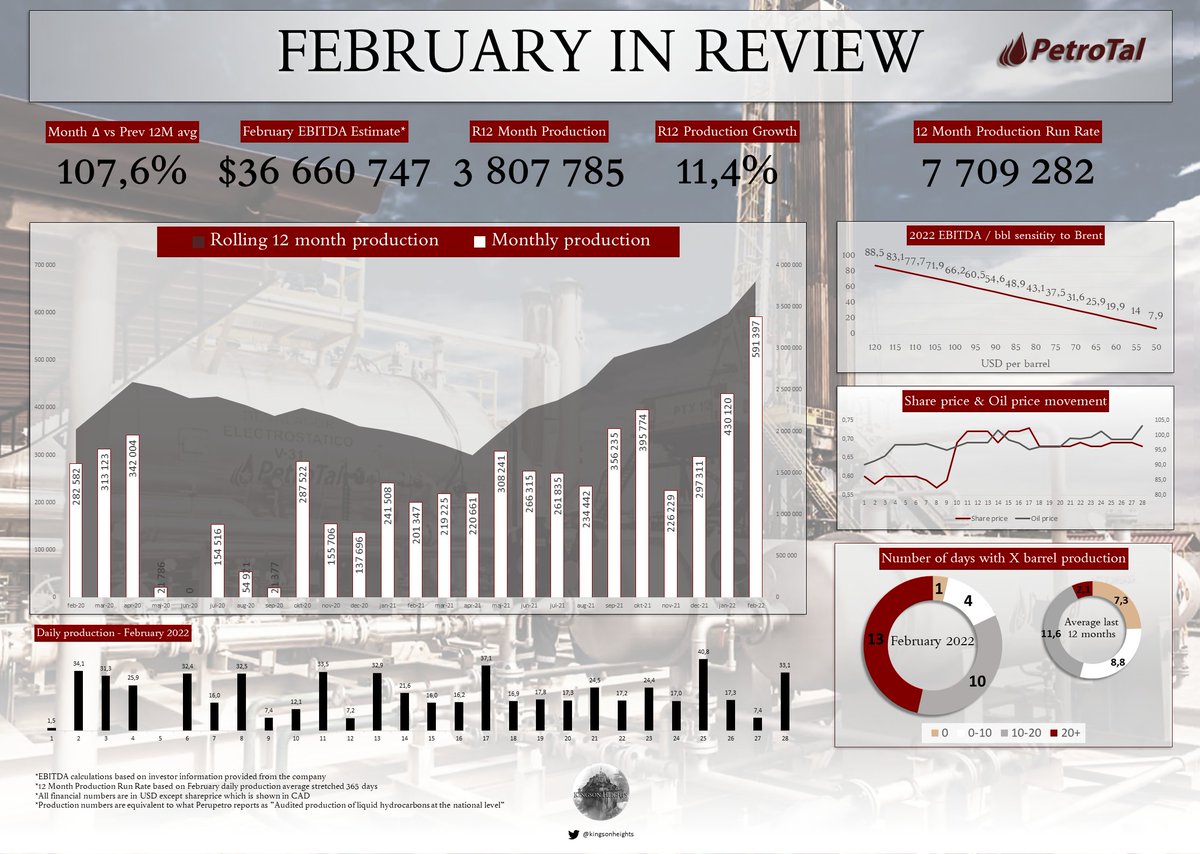

2/X | FEBRUARY IN REVIEW

February was an ATH month outdoing previous 12 month avg production with over 100%.

A calculated EBITDA shows +36,6 MUSD generated over 28 days!

R12 production growth is 11,4% and a calculated 12 month production based on the February run rate...

February was an ATH month outdoing previous 12 month avg production with over 100%.

A calculated EBITDA shows +36,6 MUSD generated over 28 days!

R12 production growth is 11,4% and a calculated 12 month production based on the February run rate...

3/X | FEBRUARY IN REVIEW cont.

shows that Petrotal would produce over 7,7 million barrels if they kept the pace going.

Number of zero-days was only one and the 20+ days were a record high 13 with some real standouts.

Share price increased and brent oil reached around $105.

shows that Petrotal would produce over 7,7 million barrels if they kept the pace going.

Number of zero-days was only one and the 20+ days were a record high 13 with some real standouts.

Share price increased and brent oil reached around $105.

4/X | 2022 PROJECTION

I've calculated 3 scenarios for a 2022 full year production They range from an average daily production of 15 000 - 20 500 bopd (reasoning in picture below), and a Brent price between 80-100 USD, giving a full year EBITDA estimate of between 236-495 M USD.

I've calculated 3 scenarios for a 2022 full year production They range from an average daily production of 15 000 - 20 500 bopd (reasoning in picture below), and a Brent price between 80-100 USD, giving a full year EBITDA estimate of between 236-495 M USD.

5/X | 2022 PROJECTION cont.

Brent Crude Futures* chart included to support the 80-100 USD range.

10H well already brought online but we have another 4 Horizontal wells coming online between early May and early December which will boost production and investor interest (IMO)...

Brent Crude Futures* chart included to support the 80-100 USD range.

10H well already brought online but we have another 4 Horizontal wells coming online between early May and early December which will boost production and investor interest (IMO)...

6/X | 2022 PROJECTION cont.

The recent success with production from the latest 3 wells gives me reason to think that it won't be impossible for Petrotal to, yet again, outperform their production estimates.

2021 production (white color) are inserted in the bottom to give..

The recent success with production from the latest 3 wells gives me reason to think that it won't be impossible for Petrotal to, yet again, outperform their production estimates.

2021 production (white color) are inserted in the bottom to give..

7/X | 2022 PROJECTION cont.

an appreciation of how far Petrotal has come, even if the 30% "nightmare" scenario would come true.

This company has such a huge upside to it and will only continue to improve in 2023.

an appreciation of how far Petrotal has come, even if the 30% "nightmare" scenario would come true.

This company has such a huge upside to it and will only continue to improve in 2023.

8/X | DIVIDEND ROADMAP

So the company announced it attention to distribute its cash to us shareholdes. Based on my 2022 production estimates, I've translated it into a Dividend Roadmap.

The company presents a 350 M EBITDA as a mid-case and it's based on $88 Brent. This gives...

So the company announced it attention to distribute its cash to us shareholdes. Based on my 2022 production estimates, I've translated it into a Dividend Roadmap.

The company presents a 350 M EBITDA as a mid-case and it's based on $88 Brent. This gives...

9/X | DIVIDEND ROADMAP cont.

a possible room for buybacks/dividends of up to $50 MUSD.

Pareto recently published an updated research note with a target price of 1,25 CAD. This includes a 30% discount to it. This is the 236 M EBITDA case...

a possible room for buybacks/dividends of up to $50 MUSD.

Pareto recently published an updated research note with a target price of 1,25 CAD. This includes a 30% discount to it. This is the 236 M EBITDA case...

10/X | DIVIDEND ROADMAP cont.

where production averages at 15 000 bopd and Brent is priced at $80 in 2022

This case wouldn't give any room for buybacks/dividends and it's pricing in almost 110 days of no production, which in my opinion, is steep.

where production averages at 15 000 bopd and Brent is priced at $80 in 2022

This case wouldn't give any room for buybacks/dividends and it's pricing in almost 110 days of no production, which in my opinion, is steep.

11/X | DIVIDEND ROADMAP cont.

And of course when calculating a "nightmare" case, I have to provide you with the "Hail Mary" case, which in my opinion is more likely to occur. Here I've calculated Brent at an 100 USD average and production at 20 500 bopd...

And of course when calculating a "nightmare" case, I have to provide you with the "Hail Mary" case, which in my opinion is more likely to occur. Here I've calculated Brent at an 100 USD average and production at 20 500 bopd...

11/X | DIVIDEND ROADMAP cont.

According to Petrotal's provided information this would equate to a 495 M EBITDA for 2022 which would allow up to 195 MUSD for shareholder distribition. This translates to a dividend of ~0,28 CAD (fully diluted).

According to Petrotal's provided information this would equate to a 495 M EBITDA for 2022 which would allow up to 195 MUSD for shareholder distribition. This translates to a dividend of ~0,28 CAD (fully diluted).

12/X | DIVIDEND ROADMAP cont.

I'm not saying that the 495 M case is rock solid going to happen. I think that we will find ourselves somewhere between the "mid-case" and this case when we reach year end.

What I would like to point out is that Petrotal, when producing, is...

I'm not saying that the 495 M case is rock solid going to happen. I think that we will find ourselves somewhere between the "mid-case" and this case when we reach year end.

What I would like to point out is that Petrotal, when producing, is...

13/X | DIVIDEND ROADMAP cont.

taking full advantage of the current Brent price. And I would like to ask you to think about at what levels you see Brent oil price going forward? Is 100 USD really that high? To me it's not at all.

There's obviously lots of room for shareholder...

taking full advantage of the current Brent price. And I would like to ask you to think about at what levels you see Brent oil price going forward? Is 100 USD really that high? To me it's not at all.

There's obviously lots of room for shareholder...

14/X | DIVIDEND ROADMAP cont.

returns going forward. And at that point there won't be any bonds to repay, and the company should have a stable working capital in place from 2022.

returns going forward. And at that point there won't be any bonds to repay, and the company should have a stable working capital in place from 2022.

15/X | ROUNDING OFF

As usual I'm writing too much. I'd just like to comment on the social issues going on right now. I see it as noise but I am seeing a positive change in what is happening where the real locals are standing up against the protestors, saying they should leave...

As usual I'm writing too much. I'd just like to comment on the social issues going on right now. I see it as noise but I am seeing a positive change in what is happening where the real locals are standing up against the protestors, saying they should leave...

16/X | ROUNDING OFF cont.

Petrotal alone. The social trust is the key enabler and to my knowing a meeting is scheduled for tomorrow which will hopefully settle things this time.

Petrotal alone. The social trust is the key enabler and to my knowing a meeting is scheduled for tomorrow which will hopefully settle things this time.

17/X | DISCLAIMER

All numbers and calculations are based on information I've found on the company website. Please read the small text in the pictures to get more info on how I have based my assumptions/calculations.

If you see any apparent mistakes in my numbers, please...

All numbers and calculations are based on information I've found on the company website. Please read the small text in the pictures to get more info on how I have based my assumptions/calculations.

If you see any apparent mistakes in my numbers, please...

17/X | DISCLAIMER cont.

give me a shout! I would appreciate it.

Thanks to all of you who gave me suggestions for improvements in my January review. I have incorporated some in this update and will continue to develop this post which will appear again in March.

give me a shout! I would appreciate it.

Thanks to all of you who gave me suggestions for improvements in my January review. I have incorporated some in this update and will continue to develop this post which will appear again in March.

• • •

Missing some Tweet in this thread? You can try to

force a refresh