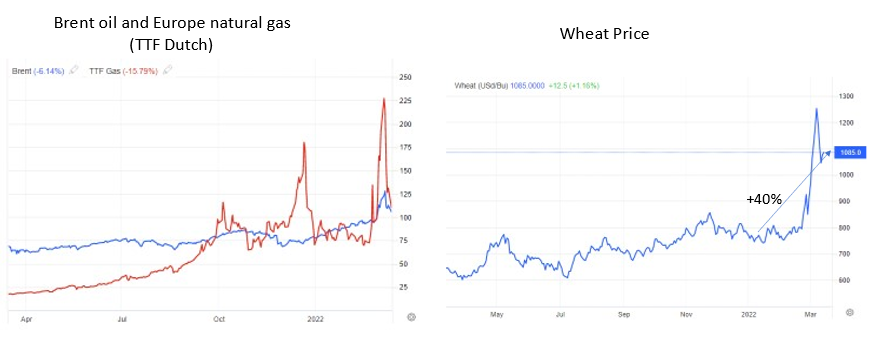

Europe will be highly affected by the Russian war on Ukraine. We´re the theatre of war, millions of refugees to welcome, high prices of energy and cereals or even shortages, possibly accompanied by rationing. Governments are already trying to dispel the rumours about rationing 1/

The war made clear the need for Europe to achieve strategic autonomy in defence and energy. Heavy investments are required. Europe must not delude itself because of the present US commitment to NATO, as that may change in 2024 with GOP Trumpism wining 2/

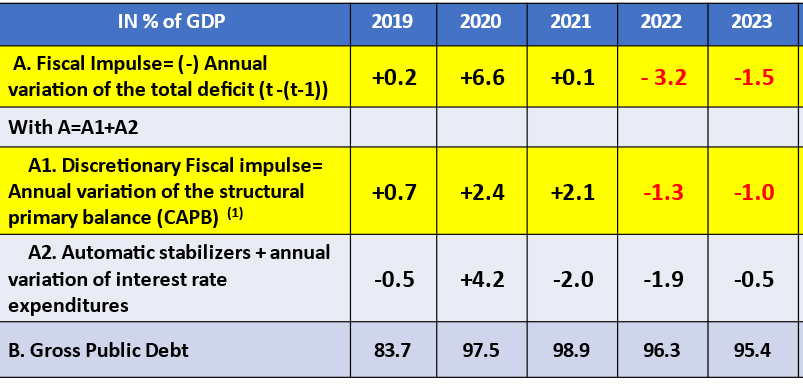

The new shocks imply a considerable deceleration in economic growth this year (-1/-1.5 p.p.). Energy supply quantitative reductions could even cause a recession. Macroeconomic policies are pushing in that direction. The fiscal impulse will become negative in the next few years.3/

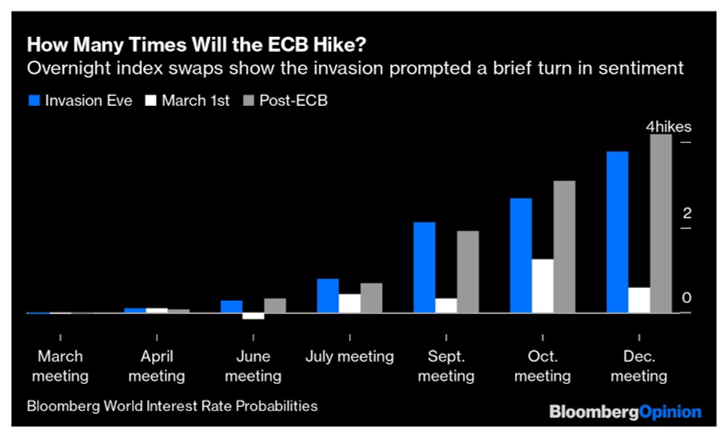

Putting aside the recessionary aspect of the new shock, the ECB prepared the conditions for policy rate increases. Markets logically concluded that the ECB chose to start fighting the new supply-side Inflation with rate hikes, and they priced-in 4 of them until December 4/

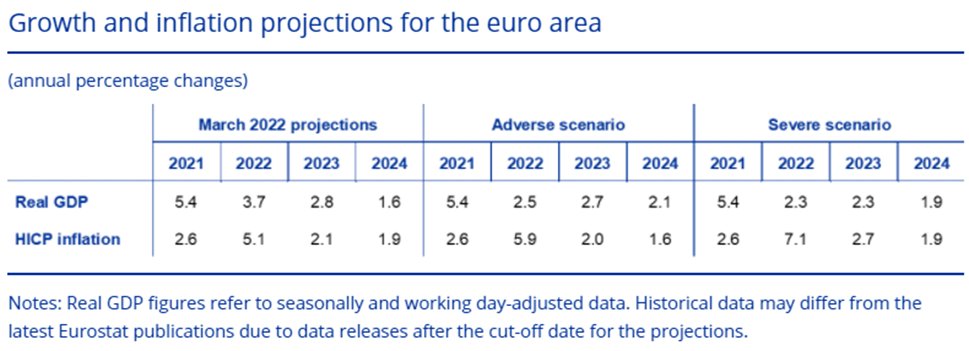

It is surely odd that in the three scenarios on Inflation and growth that the ECB published, their current definition of price stability (2% in the medium-term) was respected without a change in policy (see Table). No surprise, markets were startled. Expect adjustments in June.5/

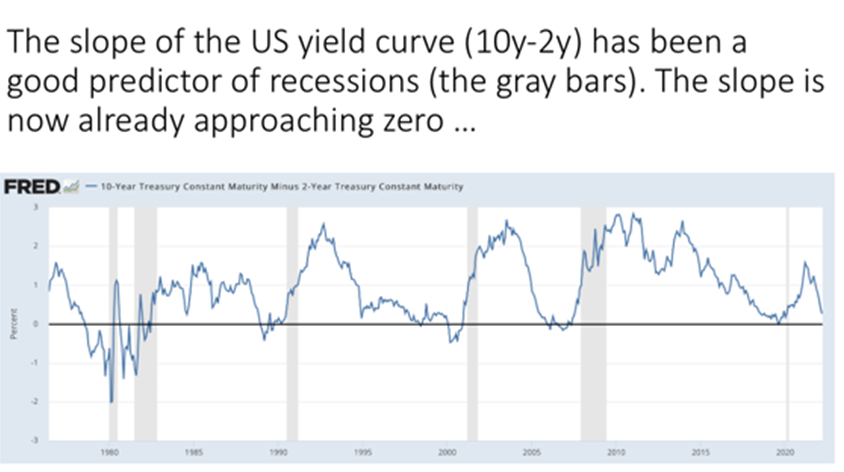

External price shocks have a recessionary effect as they reduce income to buy other things. The stance of both macro-economic policies will now add to that. Some US hawkish economists stated recently that if the expected 7-8 hikes would happen now, a recession could ensue, 6/

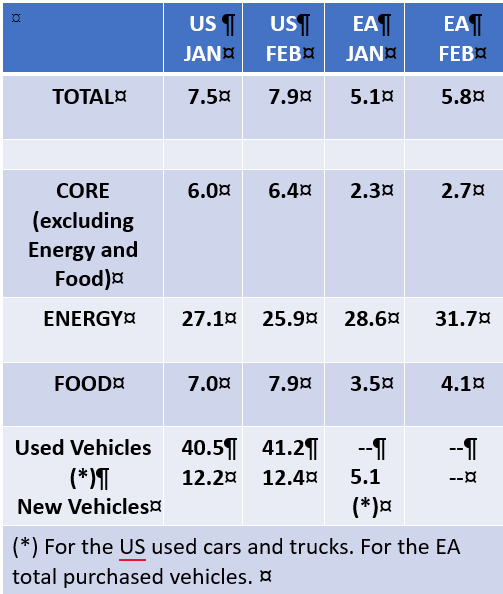

Inflation in the US has been higher and broader than in the EA, and the FED is justified in raising rates several times. The US will suffer a smaller shock from the Russian war than Europe. Inflation affected a much broader range of items compared with the EA (see Table), 7/

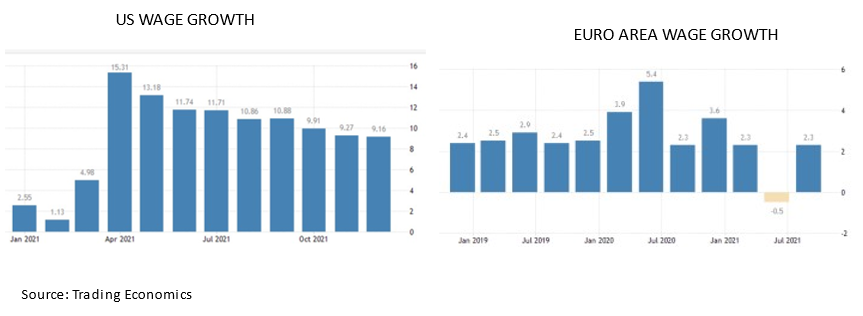

Regarding second-round effects on wages, they have been strong in the US and non-visible in the Euro Area (see chart). Negotiated nominal wages up to January 2022 in the EA have increased only by 1.5% in Germany, 2.5% in the Netherlands and 2.3% in Spain. 8/

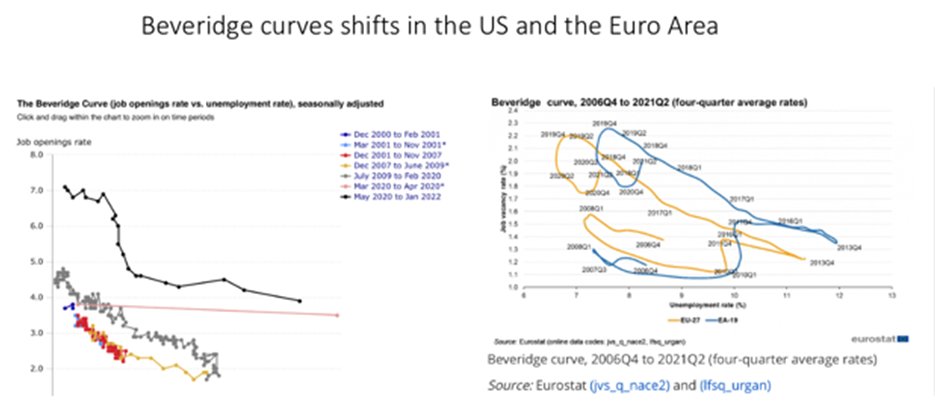

Beveridge curve shifts illustrate how the labour market in the US became recently less efficient, contrary to the Euro area. The puzzle of the so-called “great resignation” in the US, now finished, was the cause of many unfulfilled jobs offers, pressuring wages.9/

Everyone knows that monetary policy does not respond effectively initially to Inflation coming from external supply shocks. Monetary policy is about managing demand and becomes essential later when the external shock abates and persistence affects other prices and wages. 10/

It can be asked whether doing 4 hikes of 25bp, bringing the policy rate to +0.5% in the EA, or doing 7 hikes and getting the policy rate to 1.75% in the FED´s case, would have significant effects on aggregate demand. Rates in real terms would even stay negative.11/

Housing loans are the more sensitive item to interest rates, whereas loans to consumer non-durables and business investment are less so. Recently, firms were still using two-digit hurdle return rates to decide on investments, and financing costs didn´t count, naturally.12/

A simple accelerator model of relating business investment with GDP growth fits well in the euro area. Even textbooks (e.g. Blanchard´s) highlight that expected sales and profits, and consequently aggregate demand expectations, are the more relevant driving variables. 13/

This implies that a perspective of slowing growth is important in affecting all economic agents´ behaviour. Besides being risk managers of last resort in downturns, central banks are also crucial coordinating institutions of decentralised expectations and decisions. 14/

Financial market conditions usually follow the direction signalled by the central banks. If CBs point to reduced demand and growth, they will oblige by amplifying the restrictive impact of increased rates that a cold economic calculus might not see as so significant.15/

Everything about economic developments in Europe will depend on the terms the Russian war ends. If Putin manages to make Ukraine a vassal State or a Russian province, sanctions will stay in place and be effective, including in their blowback to our economies. 16/

If a peace settlement involves the present Ukrainian leadership and its survival, sanctions may still stay, but they will become weaker and weaker. Such is business… Macroeconomic policies should remain cautious and gradual until the endgame in Europe becomes clearer 17/17

• • •

Missing some Tweet in this thread? You can try to

force a refresh