The debate on 🇷🇺 oil & gas ban to #StopFundTheWar & #StandWithUkraine is important. 🇺🇦🌻

I put together a list of arguments against the ban, debunking them 1-by-1 (a "myth buster")

Hope it's constructive & useful 4 all involved.

PDF here:

dropbox.com/s/fvd59j8ksp2t…

16 myths:

I put together a list of arguments against the ban, debunking them 1-by-1 (a "myth buster")

Hope it's constructive & useful 4 all involved.

PDF here:

dropbox.com/s/fvd59j8ksp2t…

16 myths:

MYTH 1:We are not financing Putin’s war (b/c of sanctions, he cannot use the billions of euros/dollars we send him anyway).

FALSE: there’s no doubt that a ban would drastically limit the real resources available for war.

numbers: beyond-coal.eu/russian-fossil…

see links in the PDF

FALSE: there’s no doubt that a ban would drastically limit the real resources available for war.

numbers: beyond-coal.eu/russian-fossil…

see links in the PDF

MYTH 2: Russia can sell oil & gas to China and others, so we’d only be hurting ourselves.

FALSE: a complete substitution towards China is infeasible given the scale of EU imports. If China becomes nearly the sole buyer, it will bargain hard.

eia.gov/todayinenergy/…

FALSE: a complete substitution towards China is infeasible given the scale of EU imports. If China becomes nearly the sole buyer, it will bargain hard.

eia.gov/todayinenergy/…

MYTH 3: Russia would circumvent the sanctions by selling via third parties.

FALSE: secondary sanctions may be employed (Iran provides a recent example). We are already seeing private businesses staying away from Russia in fear of breaching sanctions.

cbsnews.com/news/shell-rus…

FALSE: secondary sanctions may be employed (Iran provides a recent example). We are already seeing private businesses staying away from Russia in fear of breaching sanctions.

cbsnews.com/news/shell-rus…

MYTH 4: A ban would cause “mass poverty” in Europe.

FALSE: Available estimates suggest the impact could be between 0.5-3.5% of GDP, or 200 to 1200 euros per head in Germany, the country most dependent on Russian energy.

benjaminmoll.com/GS_Russian_Gas/

econtribute.de/RePEc/ajk/ajkp…

FALSE: Available estimates suggest the impact could be between 0.5-3.5% of GDP, or 200 to 1200 euros per head in Germany, the country most dependent on Russian energy.

benjaminmoll.com/GS_Russian_Gas/

econtribute.de/RePEc/ajk/ajkp…

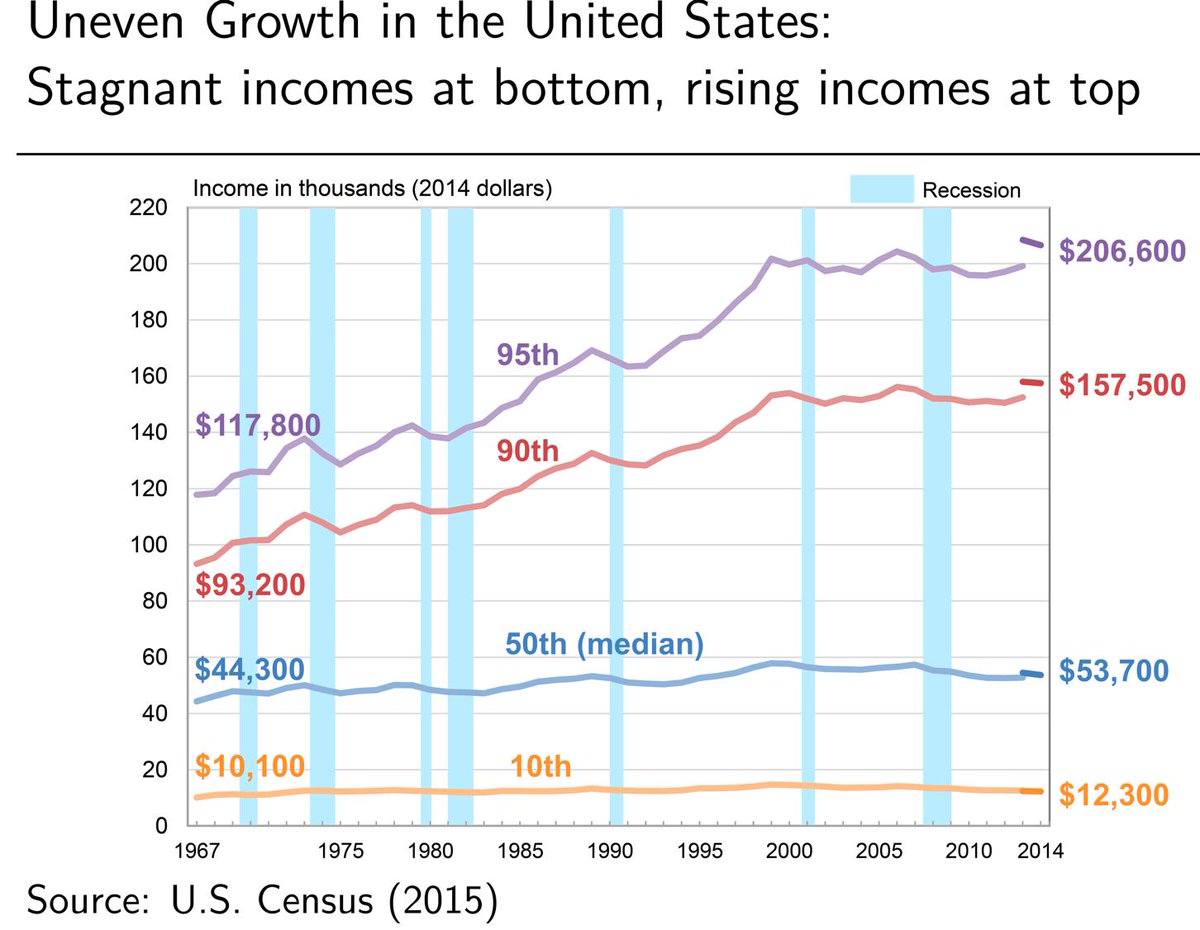

MYTH 5: The less well-off would be hurt the most, b/c of unemployment and higher inflation.

INCOMPLETE: the consequences are indeed likely to be somewhat regressive (but not hugely so). Critically, our governments have the appropriate policy tools to deal with these impacts.

INCOMPLETE: the consequences are indeed likely to be somewhat regressive (but not hugely so). Critically, our governments have the appropriate policy tools to deal with these impacts.

MYTH 6: Business leaders and industry experts say it’s impossible to adjust. Don’t they know best?

NOT NECESSARILY: the marvel of market economy is its adaptability. Incumbents' reactions may be overblown.

E.g. supply:

economist.com/europe/2022/01… and demand (links in PDF) will adj

NOT NECESSARILY: the marvel of market economy is its adaptability. Incumbents' reactions may be overblown.

E.g. supply:

economist.com/europe/2022/01… and demand (links in PDF) will adj

MYTH 7:Even if the estimates of the fallout suggest it is manageable, these estimates are uncertain. Why would you take such a risk?

BECAUSE not acting now comes with even greater risks. Is it prudent to be at the mercy of Putin next winter?

zeit.de/wirtschaft/202…

BECAUSE not acting now comes with even greater risks. Is it prudent to be at the mercy of Putin next winter?

zeit.de/wirtschaft/202…

MYTH 8: Such a ban would be unsustainable in the long-term.

FALSE: The pain is short-term. The adjustment means that the embargo’s cost will decline over time. Ultimately, this policy will speed up our transition towards a greener, cleaner, and more sustainable economy.

FALSE: The pain is short-term. The adjustment means that the embargo’s cost will decline over time. Ultimately, this policy will speed up our transition towards a greener, cleaner, and more sustainable economy.

MYTH 9:People of Europe would never support a costly action.

FALSE: In fact, they do. Despite the campaign of fear, about 60% of Germans support the ban. See links in the PDF.

FALSE: In fact, they do. Despite the campaign of fear, about 60% of Germans support the ban. See links in the PDF.

https://twitter.com/kniggem/status/1502798251220770818

MYTH 10:Come winter, popular opinion would have shifted and we must make a U-turn.

UNLIKELY: We don’t know, but such policy could be the best way to end this war quickly.

And do we really want to assume this?

UNLIKELY: We don’t know, but such policy could be the best way to end this war quickly.

https://twitter.com/sguriev/status/1503029218900381698

And do we really want to assume this?

MYTH 11:Any one country – and in particular Germany - cannot do this by themselves, so there’s no point thinking about it.

UNTRUE: Germany is Europe’s largest economy and most dependent on Russian energy. It is clearly pivotal in these discussions.

UNTRUE: Germany is Europe’s largest economy and most dependent on Russian energy. It is clearly pivotal in these discussions.

https://twitter.com/klaus_adam/status/1503687074431614986

MYTH 12: We need to keep an ace up our sleeve against Putin - we need leverage. And we need a diplomatic solution.

UNLIKELY: This surely is the point of maximum impact. Weakening Putin financially will strengthen Ukraine’s bargaining position.

ft.com/content/a35b04…

UNLIKELY: This surely is the point of maximum impact. Weakening Putin financially will strengthen Ukraine’s bargaining position.

ft.com/content/a35b04…

MYTH 13: Advocates of the ban are too “excited” and “hot-headed”.

FALSE: The advocates are the only ones who have produced clear analysis of the issue, using state-of-the-art methods. But yes, of course, the matter is extremely urgent. Every day lives are destroyed. Act now.

FALSE: The advocates are the only ones who have produced clear analysis of the issue, using state-of-the-art methods. But yes, of course, the matter is extremely urgent. Every day lives are destroyed. Act now.

MYTH 14: We’ve made a historic U-turn on military spending, and that is already a costly policy. Perhaps that is sufficient?

NO: Much more military spending will be needed in the new cold (or hot) war scenario if Putin wins in Ukraine.

NO: Much more military spending will be needed in the new cold (or hot) war scenario if Putin wins in Ukraine.

https://twitter.com/R2Rsquared/status/1499819379621568517

MYTH 15:It is unfortunate that some countries happen to be heavily dependent on Russia.

FALSE: It is not an accident but a direct consequence of the wrong-headed policies that have been pursued.

nytimes.com/2022/03/15/opi…

FALSE: It is not an accident but a direct consequence of the wrong-headed policies that have been pursued.

nytimes.com/2022/03/15/opi…

MYTH 16:If we wait it out, we can go back to the status quo as of mid-Feb 2022.

FALSE: The world has fundamentally changed, there is no going back.

FALSE: The world has fundamentally changed, there is no going back.

https://twitter.com/BachmannRudi/status/1502833929224691718

with links to analysis by @ben_moll @MSchularick @kuhnmo @BachmannRudi @R2Rsquared @DBaqaee @klaus_adam @sguriev @itskhoki @paulkrugman @MESandbu @kniggem @FabioGhironi @t0nyyates @lugaricano @christianbaye13 @APeichl

cc @YGorodnichenko @Noahpinion @gideonrachman @BMWK

cc @YGorodnichenko @Noahpinion @gideonrachman @BMWK

cc @MarkusEconomist @drhelmutsoul @wpaczos @napokolenia @Bundeskanzler @mdoepke @BrzezinskiMich @HannoLustig @Lars_Feld @ben_golub @stroebel_econ @FlorinBilbiie @Mylovanov @KLeikert @arodnyansky @ThomasPHI2 @MichalBoni @tom_krebs_

• • •

Missing some Tweet in this thread? You can try to

force a refresh