Taking a Look at $NTLA:

An updated look at Intellia.

An updated look at Intellia.

1/ Management

I have only been in Intellia for a very short time. I think the new CEO, John Leonard, is doing a fantastic job. They have really expanding their pipeline and jumped into developing their own base editing program.

I have only been in Intellia for a very short time. I think the new CEO, John Leonard, is doing a fantastic job. They have really expanding their pipeline and jumped into developing their own base editing program.

2/ They seem to be very ambitious now toward advancing the pipeline. They are staying on the innovation side of the science and not falling behind.

3/ Science

They are one of the original CAS9 companies using CRISPR technology to do in-vivo editing in the liver and ex-vivo for cell therapies. They are focused on doing gene knockouts where mutations have little or no effects.

They are one of the original CAS9 companies using CRISPR technology to do in-vivo editing in the liver and ex-vivo for cell therapies. They are focused on doing gene knockouts where mutations have little or no effects.

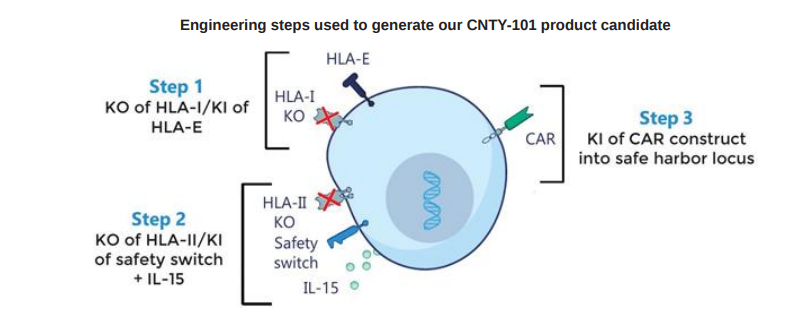

4/ This is a far safer place to start over insertions which are the most difficult. Their cell therapies for CAR-T and TCR are pretty much in line with all the other CRISPR companies. They are in the mix, but none of them are really leading the science.

5/ They are all easy, highly validated targets using the most basic cell edits. Their recent entry into trying to develop their own form of base editing with the purchase of Rewrite gives them the advantage over all the other first generation CRISPR companies.

6/ Potential

There is a lot of potential for them in the liver diseases which is where they are focused for now as they work on delivery to other tissues. The ATTR indication is about 50,000 patient depending on how much market share they can get.

There is a lot of potential for them in the liver diseases which is where they are focused for now as they work on delivery to other tissues. The ATTR indication is about 50,000 patient depending on how much market share they can get.

7/ It could be worth $2 billion or more. Half of that would go to their partner Regeneron. The HAE indication is really small. That will be their second program. The TCR programs for AML and Lymphoma don't seem to be big winners.

8/ They are smaller indications that will be restricted by HLA type for AML and very competitive for CD30. I do think this company can continue to develop and grow over time.

9/ It has a lot of long term potential for all the indications assuming they can continue to move into new delivery for different organs beyond the liver. The liver has become an extremely competitive space along with cell therapies. Every company on earth is in these 2 spaces.

10/ Valuation

I think $5 billion dollars for a company with just phase 1 data is still massively over valued. Most companies in at this stage are only $3 billion or less.

I think $5 billion dollars for a company with just phase 1 data is still massively over valued. Most companies in at this stage are only $3 billion or less.

11/ They have just over $1 billion in cash and burned about $270 million in 2021. That gives them well over 2 years of cash as they move more programs into the clinic.

• • •

Missing some Tweet in this thread? You can try to

force a refresh