1/ Terra CEO is buying billions in #Bitcoin with free money. How?

Is the end game to create a Terra “ecosystem” or to accumulate BTC, the best asset in the world?

This is happening right under your nose as I post this. Possibly at your expense! Best to prepare.

A thread. 👇

Is the end game to create a Terra “ecosystem” or to accumulate BTC, the best asset in the world?

This is happening right under your nose as I post this. Possibly at your expense! Best to prepare.

A thread. 👇

2/ Terra’s CEO is buying #BTC with UST & Luna

Why?

Why not buy and hold Luna instead?

Because he knows Luna is a poor long term investment.

He’s so smart he is buying billions in BTC with free money! Got to give him credit for that.

Here is how 👇

Why?

Why not buy and hold Luna instead?

Because he knows Luna is a poor long term investment.

He’s so smart he is buying billions in BTC with free money! Got to give him credit for that.

Here is how 👇

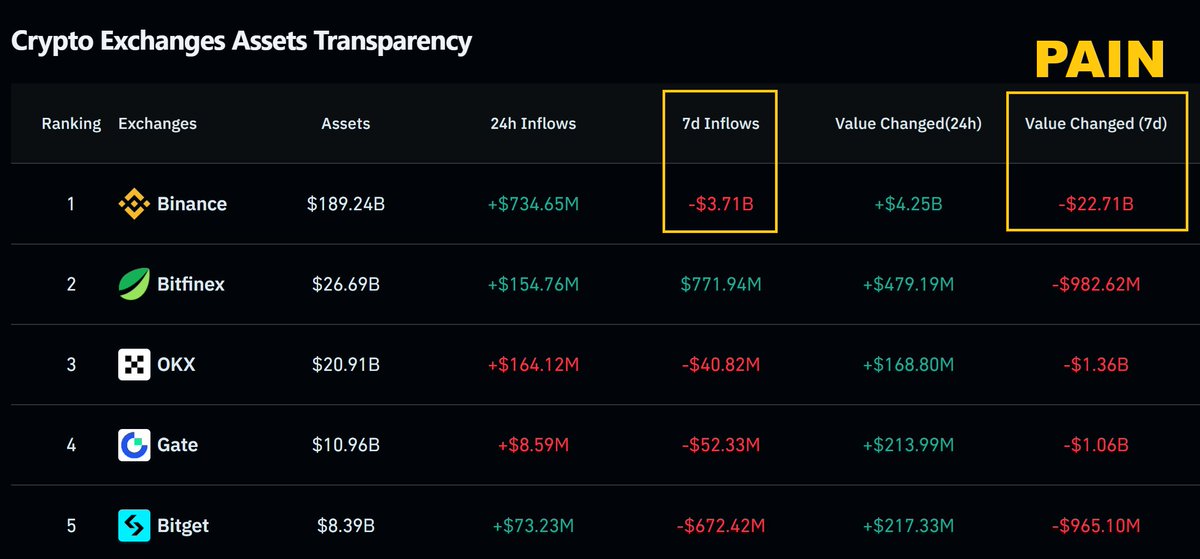

3/ How do they create free money to buy BTC?

By using smart tokenomics!

They burn Luna to mint UST.

Instead of the dollar value transferring from Luna’s market cap (mc) to UST mc, the dollar value is retained in both market caps!

WOW I just doubled my money! Better yet 👇

By using smart tokenomics!

They burn Luna to mint UST.

Instead of the dollar value transferring from Luna’s market cap (mc) to UST mc, the dollar value is retained in both market caps!

WOW I just doubled my money! Better yet 👇

4/ This free money creation process is further compounded upwards as Luna’s circulating supply decreases & its price increases during the burn/mint process!

More free money as Luna's price goes up!

We're picking up speed now. UST mc is rocketing up at $100 mil/day (max). 👇

More free money as Luna's price goes up!

We're picking up speed now. UST mc is rocketing up at $100 mil/day (max). 👇

5/ The UST/Luna market caps are like hot air balloons.

The more money they create out of nothing, the higher the price of Luna & more UST can be created.

Smart! Check the yearly chart.

But this has a catch!

You can’t have your cake and eat it too! 👇

The more money they create out of nothing, the higher the price of Luna & more UST can be created.

Smart! Check the yearly chart.

But this has a catch!

You can’t have your cake and eat it too! 👇

6/ As more Luna is burned to print UST the number of Luna in circulation decreases.

Market cap = circulating coins x price/coin.

This means that the total market cap of Luna can actually be quite low as UST mc increases even if Luna’s price will be high. 👇

Market cap = circulating coins x price/coin.

This means that the total market cap of Luna can actually be quite low as UST mc increases even if Luna’s price will be high. 👇

7/ As soon as Luna’s mc is lower than UST mc, trouble starts. 😱

Luna's purpose is to absorb the volatility in UST market cap (increase/decrease in mc).

As UST mc grows, the risks increase too, particularly for Luna holders. 👇

Luna's purpose is to absorb the volatility in UST market cap (increase/decrease in mc).

As UST mc grows, the risks increase too, particularly for Luna holders. 👇

8/ To accommodate a larger UST market cap, Luna's price swings will have to increase, particularly if its mc decreases below UST!

Luna’s price increases with an expanding UST mc & crashes with a contracting UST mc. See May 2021 crash: -82%!

But here is the catch! 👇

Luna’s price increases with an expanding UST mc & crashes with a contracting UST mc. See May 2021 crash: -82%!

But here is the catch! 👇

9/ There is a limit to how much UST you can mint or burn per day!

How do you think a UST depeg event starts?

Currently we have a huge demand for UST with the max mint limit/day ($100 mil) being hit on a regular basis. 👇

How do you think a UST depeg event starts?

Currently we have a huge demand for UST with the max mint limit/day ($100 mil) being hit on a regular basis. 👇

10/ This means there is a premium on 1 UST which is valued at slightly over 1 USD.

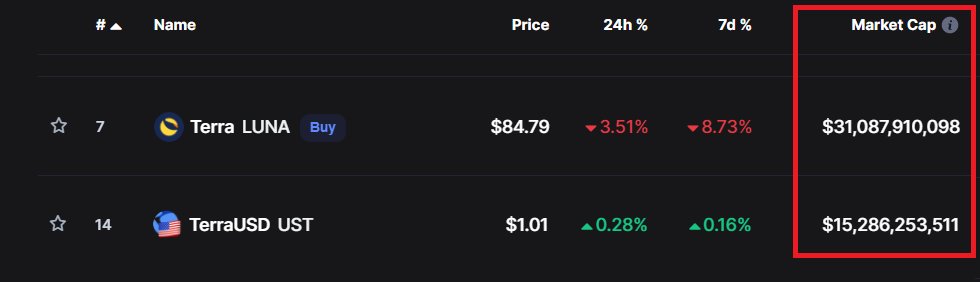

The demand for UST is because people drop their life savings into Anchor’s artificial 20% yield/year.

Anchor has over $10 bil in UST deposits. UST mc is $15 bil atm. 👇

The demand for UST is because people drop their life savings into Anchor’s artificial 20% yield/year.

Anchor has over $10 bil in UST deposits. UST mc is $15 bil atm. 👇

11/ 66% (10 bil/15 bil) of Terra’s “ecosystem” is in this one single protocol = Anchor.

It is definitely not ok for one protocol to drive almost all demand for UST.

Its a huge risk. See my other thread on this. Next 👇

It is definitely not ok for one protocol to drive almost all demand for UST.

Its a huge risk. See my other thread on this. Next 👇

https://twitter.com/DU09BTC/status/1496062513301049350?s=20&t=g5quxAy_VgytTXYgSkVlMw

12/ When demand drops and people will seek to sell UST and exit Terra, the reverse will happen and 1 UST will be worth less than 1 USD.

This happened several times so far = depeg. See May 2021 (tweet #8).

Another depeg event is almost certain as volatility and mc increase. 👇

This happened several times so far = depeg. See May 2021 (tweet #8).

Another depeg event is almost certain as volatility and mc increase. 👇

13/ To avoid panic (as people will see their life savings lost overnight during a depeg event), Terra’s team hinted they are ready to drop billions of UST into Anchor’s yield reserve to keep the 20% yield.

Of course they will, they did it before ($450 mil). See pic. 👇

Of course they will, they did it before ($450 mil). See pic. 👇

14/ Your signal to exit before shit hits the fan is rather simple: UST market cap > Luna’s market cap.

Ideally you exit well before that.

There is nothing wrong with farming Anchor’s yield reserve, enjoy it! 👇

Ideally you exit well before that.

There is nothing wrong with farming Anchor’s yield reserve, enjoy it! 👇

15/ But understand that UST mc is essentially created from nothing & if everyone wants to exit there won’t be enough for all!

The market cap of UST & Luna are not real and are backed by subsidized demand.

They will crash extremely fast when incentives stop (ie no top ups). 👇

The market cap of UST & Luna are not real and are backed by subsidized demand.

They will crash extremely fast when incentives stop (ie no top ups). 👇

16/ This money machine seems like the perfect way to accumulate BTC that has real value.

They are buying billions worth of BTC as we speak with this free money.

The more BTC they buy with Luna/UST the more I question the resilience of their experiment and Terra “ecosystem”. 👇

They are buying billions worth of BTC as we speak with this free money.

The more BTC they buy with Luna/UST the more I question the resilience of their experiment and Terra “ecosystem”. 👇

17/ Ironically, Terra's CEO says they buy BTC to protect the UST peg.

They also know it & there is an expectation that this “only up” price action for Luna/UST is on borrowed time.

They need BTC to protect the peg.

How much money are you willing to risk on this? 👇

They also know it & there is an expectation that this “only up” price action for Luna/UST is on borrowed time.

They need BTC to protect the peg.

How much money are you willing to risk on this? 👇

18/ Don’t fall for the narrative.

It may turn quite nasty later on when people realize most of the UST and Luna market caps have no real backing, apart from artificial demand driven by Anchor mostly.

Will they buy enough BTC before a crash happens? 👇

It may turn quite nasty later on when people realize most of the UST and Luna market caps have no real backing, apart from artificial demand driven by Anchor mostly.

Will they buy enough BTC before a crash happens? 👇

19/ In the case of UST, the recently acquired BTC treasury to “protect” the peg starts to sound like the frog nation treasuries… check how that went.

98% crash for #Time / #Wonderland (from $10,000 to $200), but they have a "treasury" to back up the price... 👇

98% crash for #Time / #Wonderland (from $10,000 to $200), but they have a "treasury" to back up the price... 👇

20/ Granted, the Terra / Luna / UST ecosystem is a very smart setup.

But be smarter and understand that there is no free lunch and no such thing as free money.

This will become evident when the growth stops or stalls for UST. 👇

But be smarter and understand that there is no free lunch and no such thing as free money.

This will become evident when the growth stops or stalls for UST. 👇

21/ Be sure to exit early and not look back. Don’t be exit liquidity!

I suspect the Terra team did not expect such a fast growth and they are doing their best to maintain growth at all costs and diversify into BTC “just in case”, ASAP.

But don’t be naive to think... 👇

I suspect the Terra team did not expect such a fast growth and they are doing their best to maintain growth at all costs and diversify into BTC “just in case”, ASAP.

But don’t be naive to think... 👇

22/ ...the Luna/UST market cap has only one direction. Stairs up, elevator down...

They hope that by subsidizing growth (ie Anchor top-ups), UST can capture sufficient market share to mitigate a possible crash by diluting the pressure on the burn/mint mechanism limit. 👇

They hope that by subsidizing growth (ie Anchor top-ups), UST can capture sufficient market share to mitigate a possible crash by diluting the pressure on the burn/mint mechanism limit. 👇

23/ Can they avoid a depeg scenario with sufficient "adoption" or BTC?

Probably not.

Particularly if this "adoption" and market cap growth is just UST sitting in Anchor at over 60% of all circulating UST like today. 👇

Probably not.

Particularly if this "adoption" and market cap growth is just UST sitting in Anchor at over 60% of all circulating UST like today. 👇

24/ This is a bet and a huge gamble with YOUR money. Are you comfortable to see if this works out?

These uncomfortable questions are too much to take for Terra's CEO (pictured).

As UST mc grows, the risks increase. Be smarter than the FOMO narrative! 👇

These uncomfortable questions are too much to take for Terra's CEO (pictured).

As UST mc grows, the risks increase. Be smarter than the FOMO narrative! 👇

25/ If you liked this thread, #retweet the first post to get more of this content in the future! 😍

Stay in touch + follow @DU09BTC:

Discord: bit.ly/3n2gng0

TradingView: bit.ly/3FUjwHj

YouTube: bit.ly/3p8vPdf

Newsletter: bit.ly/3BuXf13

Stay in touch + follow @DU09BTC:

Discord: bit.ly/3n2gng0

TradingView: bit.ly/3FUjwHj

YouTube: bit.ly/3p8vPdf

Newsletter: bit.ly/3BuXf13

• • •

Missing some Tweet in this thread? You can try to

force a refresh