1/8

#BookRecommendations

Bitly links of the #BookSummaries I have written from Non-Finance to Finance.

Do share if helpful !🙂

🔸 The only self help book I recommend.

Made these notes post my 3rd reading & implementation of the book.

Atomic Habits : bit.ly/36uCKpD

#BookRecommendations

Bitly links of the #BookSummaries I have written from Non-Finance to Finance.

Do share if helpful !🙂

🔸 The only self help book I recommend.

Made these notes post my 3rd reading & implementation of the book.

Atomic Habits : bit.ly/36uCKpD

2/8

🔸The secret to a productive, happy & healthy life.

Wisdom in simple words !

Ikigai : bit.ly/3qgM5c2

🔸 My all time favourite , read in any mood kinda book, for simplicity is the ultimate sophistication.

A Book Of Simple Living :

bit.ly/3CSxLLG

🔸The secret to a productive, happy & healthy life.

Wisdom in simple words !

Ikigai : bit.ly/3qgM5c2

🔸 My all time favourite , read in any mood kinda book, for simplicity is the ultimate sophistication.

A Book Of Simple Living :

bit.ly/3CSxLLG

3/8

🔸Social Media makes us crave for validation. How one can stay true to themselves despite it.

The Courage to be Disliked :

bit.ly/3N4ZaP6

🔸 Nuggets of wisdom by Naval Ravikant shared by Eric Jorgensen

The Almanack of Naval Ravikant :

bit.ly/3qjvpAB

🔸Social Media makes us crave for validation. How one can stay true to themselves despite it.

The Courage to be Disliked :

bit.ly/3N4ZaP6

🔸 Nuggets of wisdom by Naval Ravikant shared by Eric Jorgensen

The Almanack of Naval Ravikant :

bit.ly/3qjvpAB

4/8

🔸On death and dying. How would one live their life knowing that their time on earth is limited.

A book that I revisit every year.

Tuesdays with Morrie :

bit.ly/3CUKzkJ

🔸Loved the simplistic thought process of

Zen & The Art of Happiness :

bit.ly/3CR1Yee

🔸On death and dying. How would one live their life knowing that their time on earth is limited.

A book that I revisit every year.

Tuesdays with Morrie :

bit.ly/3CUKzkJ

🔸Loved the simplistic thought process of

Zen & The Art of Happiness :

bit.ly/3CR1Yee

5/8

Onto Personal Finance

🔸The only book I recommend time & again for newbies written in an Indian context.

Let's Talk Money :

bit.ly/3JsyHsI

🔸From an International context , I liked

The Psychology of Money :

bit.ly/3CR22uu

Onto Personal Finance

🔸The only book I recommend time & again for newbies written in an Indian context.

Let's Talk Money :

bit.ly/3JsyHsI

🔸From an International context , I liked

The Psychology of Money :

bit.ly/3CR22uu

6/8

🔸A beautiful book on content curation and creation !

Loved reading it as it contains snippets of investing philosophy from so many different veterans.

Wordly wisdom at its best !

The Joys of Compounding:

bit.ly/3tm6qhL

🔸A beautiful book on content curation and creation !

Loved reading it as it contains snippets of investing philosophy from so many different veterans.

Wordly wisdom at its best !

The Joys of Compounding:

bit.ly/3tm6qhL

7/8

🔸 India's Money Monarchs contains Nuggets of Wisdom from legendary investors with special focus on Indian Capital Markets.

A thread based on only Sanjoy Bhattacharyaji's thought process from the book

India's Money Monarchs :

bit.ly/3D0DKy7

🔸 India's Money Monarchs contains Nuggets of Wisdom from legendary investors with special focus on Indian Capital Markets.

A thread based on only Sanjoy Bhattacharyaji's thought process from the book

India's Money Monarchs :

bit.ly/3D0DKy7

8/8

🔸 Behavioural finance is still underrated & Late Parag Parikh sir had elucidated why.

Stocks to Riches :

bit.ly/3inVpWQ

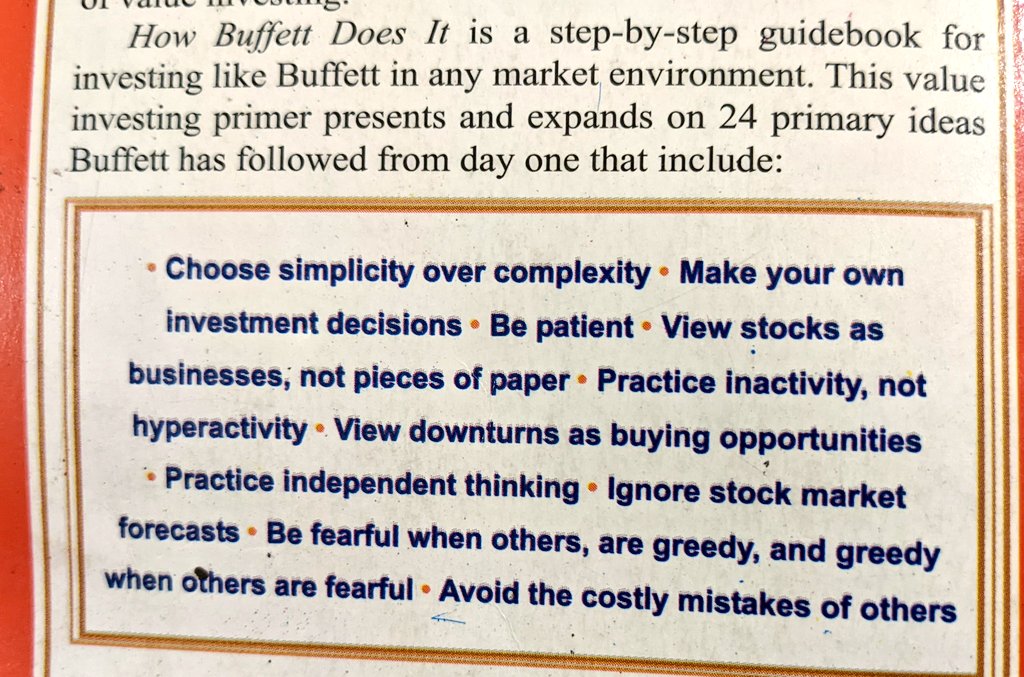

🔸The first book I read on Warren Buffett & Investing

HOW BUFFETT DOES IT - 24 SIMPLE INVESTING STRATEGIES :

bit.ly/37v7UxJ

🔸 Behavioural finance is still underrated & Late Parag Parikh sir had elucidated why.

Stocks to Riches :

bit.ly/3inVpWQ

🔸The first book I read on Warren Buffett & Investing

HOW BUFFETT DOES IT - 24 SIMPLE INVESTING STRATEGIES :

bit.ly/37v7UxJ

• • •

Missing some Tweet in this thread? You can try to

force a refresh