(1/21)

Paint Industry-

The sector is classified into two broad segments:

1. Decorative Segment

2. Industrial Segment

Decorative segment includes interior paints, exterior paints, primers etc

Industrial includes automotive paints, protective coatings, marine coatings etc

Paint Industry-

The sector is classified into two broad segments:

1. Decorative Segment

2. Industrial Segment

Decorative segment includes interior paints, exterior paints, primers etc

Industrial includes automotive paints, protective coatings, marine coatings etc

(2/21)

Global Paint Sector:

The Global paint industry generates ~$170Bn in annual revenue.

Asia Pacific has the largest share in the world. China is the

largest part of the APAC market, comprising nearly 60% of volume and value.

Global Paint Sector:

The Global paint industry generates ~$170Bn in annual revenue.

Asia Pacific has the largest share in the world. China is the

largest part of the APAC market, comprising nearly 60% of volume and value.

(3/21)

Indian Paint Industry:

India has a huge decorative segment with ~75% market share. This is unlike the global markets’ structure where decorative segment contributes less than 40%.

India’s top 4 players control ~70% market share of the overall domestic paint industry.

Indian Paint Industry:

India has a huge decorative segment with ~75% market share. This is unlike the global markets’ structure where decorative segment contributes less than 40%.

India’s top 4 players control ~70% market share of the overall domestic paint industry.

(4/21)

Indian Paint Industry is the 7th largest globally. Valued at around ₹50,000Cr.

It is the fastest growing paint market in the world with a 15 year CAGR of 10%

Premiumisation and Urbanisation are the key factors that are acting as a tailwind for this sector in India.

Indian Paint Industry is the 7th largest globally. Valued at around ₹50,000Cr.

It is the fastest growing paint market in the world with a 15 year CAGR of 10%

Premiumisation and Urbanisation are the key factors that are acting as a tailwind for this sector in India.

(5/21)

India Paint Segments overview:

The decorative segment has outperformed the industrial segment in India over the years.

Reasons:

1. Fast urbanization

2. Rising income

3. Reduction in repainting cycle

4. Auto industry slowdown affecting the industrial Paint segment.

India Paint Segments overview:

The decorative segment has outperformed the industrial segment in India over the years.

Reasons:

1. Fast urbanization

2. Rising income

3. Reduction in repainting cycle

4. Auto industry slowdown affecting the industrial Paint segment.

(6/21)

Industrial segment only account for ~25% of the total domestic paint industry in India (Decreased from 33% in FY08).

It is highly dependent on Auto sector which generates rightly 50% of the total Industrial paint demand.

Industrial segment only account for ~25% of the total domestic paint industry in India (Decreased from 33% in FY08).

It is highly dependent on Auto sector which generates rightly 50% of the total Industrial paint demand.

(7/21)

Reason for the slowdown-

This segment has been facing tough times due to the slowdown faced by the auto industry over the last two years.

Also, Industrial paint has grown in line with the GDP growth of India.

So slowdown in the economy resulted in the weak performance.

Reason for the slowdown-

This segment has been facing tough times due to the slowdown faced by the auto industry over the last two years.

Also, Industrial paint has grown in line with the GDP growth of India.

So slowdown in the economy resulted in the weak performance.

(8/21)

Repainting Cycle-

Repainting constitutes ~70% of the decorative segment demand in India. It has reduced significantly from 7-8 years in 2010s to 4-5 years now.

Reasons-

1. Ease of the painting process

2. Rise in rented houses (owners prefer repainting to get tenants)

Repainting Cycle-

Repainting constitutes ~70% of the decorative segment demand in India. It has reduced significantly from 7-8 years in 2010s to 4-5 years now.

Reasons-

1. Ease of the painting process

2. Rise in rented houses (owners prefer repainting to get tenants)

(9/21)

3. Conversion of mud and clay houses to brick and mortar

4. Availability of paints at reasonable prices

5. Increasing disposable incomes in Tier 2 & 3 towns

6. Independent houses being replaced by apartments

3. Conversion of mud and clay houses to brick and mortar

4. Availability of paints at reasonable prices

5. Increasing disposable incomes in Tier 2 & 3 towns

6. Independent houses being replaced by apartments

(10/21)

Demand from Tier 2&3 Cities:

Surprisingly Big cities only account for ~25% of the demand.

Which has led Paint companies to actively widen their distribution networks in small cities. This has also reduced the market share of informal paint sector. Which stands at ~25%

Demand from Tier 2&3 Cities:

Surprisingly Big cities only account for ~25% of the demand.

Which has led Paint companies to actively widen their distribution networks in small cities. This has also reduced the market share of informal paint sector. Which stands at ~25%

(11/21)

Increasing Dealer base-

The dealer base in expanding at an healthy rate of ~10% annually.

Asian pants has the highest number of dealers in the country standing at around ~55000 dealers.

Increasing Dealer base-

The dealer base in expanding at an healthy rate of ~10% annually.

Asian pants has the highest number of dealers in the country standing at around ~55000 dealers.

(12/21)

Features of Industrial Paints-

1. It’s a B2B business. As paints are bought by industries making products for customers.

2. It is highly custom made as each business has its own specific requirements.

3. The R&D requirement is huge.

Features of Industrial Paints-

1. It’s a B2B business. As paints are bought by industries making products for customers.

2. It is highly custom made as each business has its own specific requirements.

3. The R&D requirement is huge.

(13/21)

Types of Industrial Paints

1. Automotive and refinish coating

2. GI coatings

3. Protective coating

4. Powder coatings

Types of Decorative Paints:

1. Emulsions

2. Enamel

3. Distemper

4. Wood coatings

5. Putty

6. Primers

7. Thinner

Types of Industrial Paints

1. Automotive and refinish coating

2. GI coatings

3. Protective coating

4. Powder coatings

Types of Decorative Paints:

1. Emulsions

2. Enamel

3. Distemper

4. Wood coatings

5. Putty

6. Primers

7. Thinner

(14/21)

Raw Materials used in Manufacturing Paints-

1. Resins

2. Pigments

3. Solvents

4. Additives

5. Titanium dioxide

Raw Materials used in Manufacturing Paints-

1. Resins

2. Pigments

3. Solvents

4. Additives

5. Titanium dioxide

(15/21)

Top 5 Players in Paint Industry and their market share-

1. Asian Paints - ~57%

2. Berger Paints - ~18%

3. Kansai Nerolac - ~15%

4. Akzo Nobel - ~8%

5. Shalimar Paints - ~ 1%

Top 5 Players in Paint Industry and their market share-

1. Asian Paints - ~57%

2. Berger Paints - ~18%

3. Kansai Nerolac - ~15%

4. Akzo Nobel - ~8%

5. Shalimar Paints - ~ 1%

(16/21)

Top Paint stocks in terms of Profitability share

1. Asian Paints - 64%

2. Berger Paints - 16.5%

3. Kansai Nerolac - 11.5%

4. Akzo Nobel - 14.5%

Top Paint stocks in terms of Profitability share

1. Asian Paints - 64%

2. Berger Paints - 16.5%

3. Kansai Nerolac - 11.5%

4. Akzo Nobel - 14.5%

(17/21)

Product Mix of top 4 companies

1. Asian Paints : 91% Decorative, 9% Industrial

2. Berger Paints : 83% Decorative, 17% Industrial

3. Kansai Nerolac : 64% Decorative, 36% Industrial

4. Akzo Nobel - 61% Decorative, 39% Industrial

Product Mix of top 4 companies

1. Asian Paints : 91% Decorative, 9% Industrial

2. Berger Paints : 83% Decorative, 17% Industrial

3. Kansai Nerolac : 64% Decorative, 36% Industrial

4. Akzo Nobel - 61% Decorative, 39% Industrial

(18/21)

Key Risks to the Industry Goong forward-

1. Covid-19 restrictions

2. Rising crude prices

3. Slowdown of the economy has a direct impact on this sector

4. Derailment of infrastructure push by the Govt

Key Risks to the Industry Goong forward-

1. Covid-19 restrictions

2. Rising crude prices

3. Slowdown of the economy has a direct impact on this sector

4. Derailment of infrastructure push by the Govt

(19/21)

What are the current valuations of Paint companies?

1. Asian Paints -

P/E: 96; 5year Average P/E: 70.5

2. Berger Paints -

P/E: 81.5; 5year Average P/E: 77

3. Kansai Nerolac -

P/E: 53.4; 5year Average P/E: 51.5

4. Akzo Nobel-

P/E: 30.6; 5year Average P/E: 40.5

What are the current valuations of Paint companies?

1. Asian Paints -

P/E: 96; 5year Average P/E: 70.5

2. Berger Paints -

P/E: 81.5; 5year Average P/E: 77

3. Kansai Nerolac -

P/E: 53.4; 5year Average P/E: 51.5

4. Akzo Nobel-

P/E: 30.6; 5year Average P/E: 40.5

(20/21)

Conclusion-

Over FY14-19, India's GDP grew at 7.1%, while the paint industry grew 1.5 times faster at 11% CAGR.

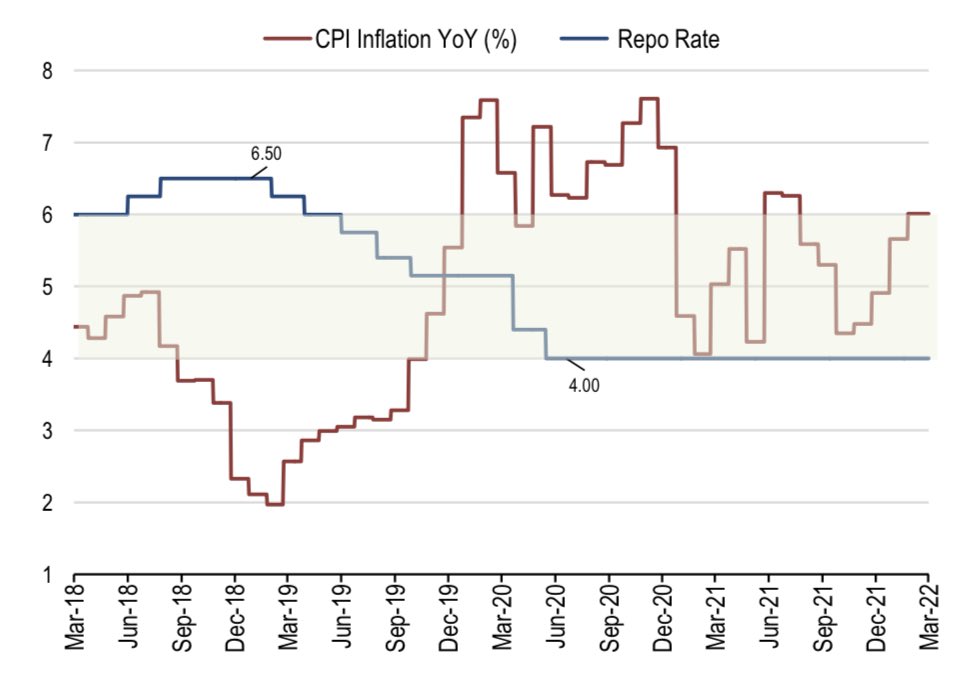

However, inflation can put a dent on this sector. As this sector has a direct correlation with the overall economy.

Conclusion-

Over FY14-19, India's GDP grew at 7.1%, while the paint industry grew 1.5 times faster at 11% CAGR.

However, inflation can put a dent on this sector. As this sector has a direct correlation with the overall economy.

(21/21)

Are you bullish on this sector?

@AvadhMaheshwar2 @ishmohit1 @caniravkaria @Jitendra_stock @ArjunB9591 @AdityaTodmal @kuttrapali26

Are you bullish on this sector?

@AvadhMaheshwar2 @ishmohit1 @caniravkaria @Jitendra_stock @ArjunB9591 @AdityaTodmal @kuttrapali26

• • •

Missing some Tweet in this thread? You can try to

force a refresh