/1

A few weeks ago I asked you guys to shill me a good project which could be interesting in the future. I saw some really nice projects coming by but a fren said to me that I had to dive into the tech of @agoric. I dived into it and I have no regrets!

👇🏽🧵

A few weeks ago I asked you guys to shill me a good project which could be interesting in the future. I saw some really nice projects coming by but a fren said to me that I had to dive into the tech of @agoric. I dived into it and I have no regrets!

👇🏽🧵

/2

What is @agoric? It’s a "Decentralized Proof-of-Stake smart contract platform in the #Cosmos ecosystem which allows for smart contract possibilities written in JavaScript".

What is @agoric? It’s a "Decentralized Proof-of-Stake smart contract platform in the #Cosmos ecosystem which allows for smart contract possibilities written in JavaScript".

/3

As you might know, there is a serious shortage on #Web3 developers. This often is due to the fact that special programming language such as #Rust of #Solidity needs to be mastered before one can start working on a #dApp.

As you might know, there is a serious shortage on #Web3 developers. This often is due to the fact that special programming language such as #Rust of #Solidity needs to be mastered before one can start working on a #dApp.

/4

JavaScript is by far the most used programming language, it's estimated that almost 65% of the Web2 developers are using JavaScript. But there's a trade-off here, regular JavaScript is notoriously hard to secure but the team took care of that.

JavaScript is by far the most used programming language, it's estimated that almost 65% of the Web2 developers are using JavaScript. But there's a trade-off here, regular JavaScript is notoriously hard to secure but the team took care of that.

/5

The team has applied a modified version of JavaScript into their project called “ENSO”. Developers can create smart contracts in a "hardened" version of JavaScript. Without the details, it's just like regular JavaScript but without the hard-to-secure features that JS offers.

The team has applied a modified version of JavaScript into their project called “ENSO”. Developers can create smart contracts in a "hardened" version of JavaScript. Without the details, it's just like regular JavaScript but without the hard-to-secure features that JS offers.

/6

There’s also another security feature that’s called “Zoe” and offers additional safety. It will get the users its product or his own deposit he offered to swap. So, it’s kind of an atomic swap. Zoe even works when the code of the smart contract contains bugs!

There’s also another security feature that’s called “Zoe” and offers additional safety. It will get the users its product or his own deposit he offered to swap. So, it’s kind of an atomic swap. Zoe even works when the code of the smart contract contains bugs!

/7

Regarding the smart contracts; the team has some template smart contracts ready to use. There are multiple smart contracts for use cases such as:

- AMM’s

- OTC desks

- Option contracts

- NFT contracts

This makes it easy for a dev, just tweak the way you want and deploy it!

Regarding the smart contracts; the team has some template smart contracts ready to use. There are multiple smart contracts for use cases such as:

- AMM’s

- OTC desks

- Option contracts

- NFT contracts

This makes it easy for a dev, just tweak the way you want and deploy it!

/8

The @agoric ecosystem contains 2 tokens and these tokens are $RUN and $BLD and they both have a different use case.

The @agoric ecosystem contains 2 tokens and these tokens are $RUN and $BLD and they both have a different use case.

/9

The $RUN #token will be a stablecoin pegged to the US dollar and will be used for all kind of payments such as transaction fees etc.

The token will be collateral backed by on-chain assets such as $ETH, $ATOM etc. More types of collateral can be added through governance.

The $RUN #token will be a stablecoin pegged to the US dollar and will be used for all kind of payments such as transaction fees etc.

The token will be collateral backed by on-chain assets such as $ETH, $ATOM etc. More types of collateral can be added through governance.

/10

The $BLD #token is the governance token and will be used to stake (and therefore secure the chain) and will be used for governance purposes as well.

The $BLD #token is the governance token and will be used to stake (and therefore secure the chain) and will be used for governance purposes as well.

/11

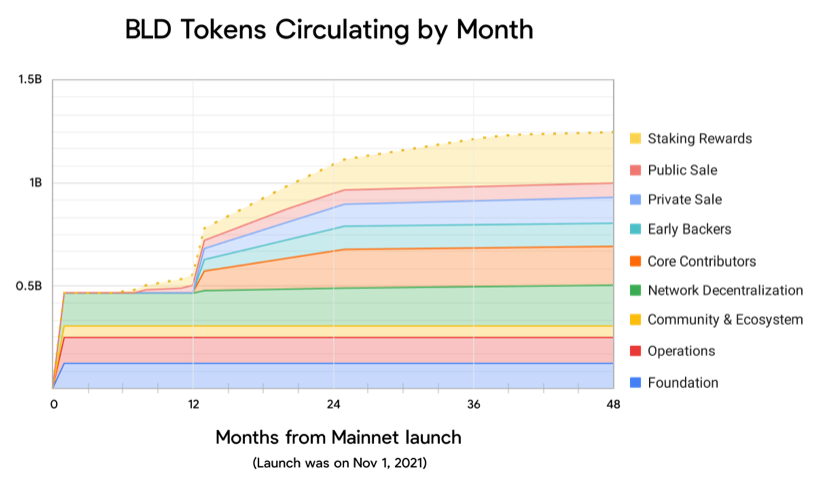

The token supply of $BLD will be as follow:

Initial token distribution: 1.000.000.000

Expected token supply: 1.250.000.000

The token supply of $BLD will be as follow:

Initial token distribution: 1.000.000.000

Expected token supply: 1.250.000.000

/12

The $BLD #token will be paid out to the stakers of the token but the rewards will gradually be paid out overtime in $RUN token.

The $BLD #token will be paid out to the stakers of the token but the rewards will gradually be paid out overtime in $RUN token.

/13

I find it quite cool what the team did, but I wouldn’t expect anything else from them. Look at team members such as:

- @DeanTribble

- @marksammiller

- @dckc

- Actually every single one of them

There’s a lot of big 🧠 in the team and they’ve got lots of experience!

I find it quite cool what the team did, but I wouldn’t expect anything else from them. Look at team members such as:

- @DeanTribble

- @marksammiller

- @dckc

- Actually every single one of them

There’s a lot of big 🧠 in the team and they’ve got lots of experience!

/14

Not only the team is incredible but their backers as well:

- @polychaincap (they led the funding round of $32 million in November 2021)

- @NGC_Ventures

- @Lemniscap & more

There are also (technical) partnerships with:

- Chainlink

- Interchain foundation

- M e t a Mask & more

Not only the team is incredible but their backers as well:

- @polychaincap (they led the funding round of $32 million in November 2021)

- @NGC_Ventures

- @Lemniscap & more

There are also (technical) partnerships with:

- Chainlink

- Interchain foundation

- M e t a Mask & more

/15

An example of one of these technical partnerships is that MM and @agoric have worked together on bug hunting to harden JavaScript. Even better news here is that no critical issues were found!

An example of one of these technical partnerships is that MM and @agoric have worked together on bug hunting to harden JavaScript. Even better news here is that no critical issues were found!

/16

What I really like about this project is that it solves a problem by not looking into the same pool as that everyone else does but by using a pool of developers that lot of other projects can’t use.

What I really like about this project is that it solves a problem by not looking into the same pool as that everyone else does but by using a pool of developers that lot of other projects can’t use.

/17

One remark here is that the tokensale already happened on CoinList but the token will become tradeable in the future and I probably will buy the token.

One remark here is that the tokensale already happened on CoinList but the token will become tradeable in the future and I probably will buy the token.

/18

Found this #tweet interesting? Please give me a:

- Like❤️

- RT🗣

- Follow me @Awinish_M

To stay up-to-date for any further developments of this project. If this project will gain more traction and followers, it can become something big I think!

Found this #tweet interesting? Please give me a:

- Like❤️

- RT🗣

- Follow me @Awinish_M

To stay up-to-date for any further developments of this project. If this project will gain more traction and followers, it can become something big I think!

/19

I’d really love it if you could help me by retweeting the first tweet so we’ll reach more people!

I’d really love it if you could help me by retweeting the first tweet so we’ll reach more people!

https://twitter.com/Awinish_M/status/1508752598303748104?s=20&t=2bnpKUIPWeardC7N8mIyQQ

• • •

Missing some Tweet in this thread? You can try to

force a refresh