The newsflow on Russian gas payments in past days remains confusing. My current interpretation of the situation and the status quo of the market...

1/n #TTF

1/n #TTF

On 23 March the Kremlin requested EU gas deliveries to be denominated in rubel. Putin said: “If these payments are not made [in rubel], we will consider it a failure of the buyer to fulfil its obligations, with all the ensuing consequences.”

2/n

abcnews.go.com/International/…

2/n

abcnews.go.com/International/…

Russia delivers 35% of EU gas of which 60% is paid for in € & rest in US$. Such are the contractual obligations. Therefore, all G-7 ministers agreed on Monday 28th that such a request would be "a one-sided & clear breach of the existing contracts.”

3/n

ft.com/content/158ae4…

3/n

ft.com/content/158ae4…

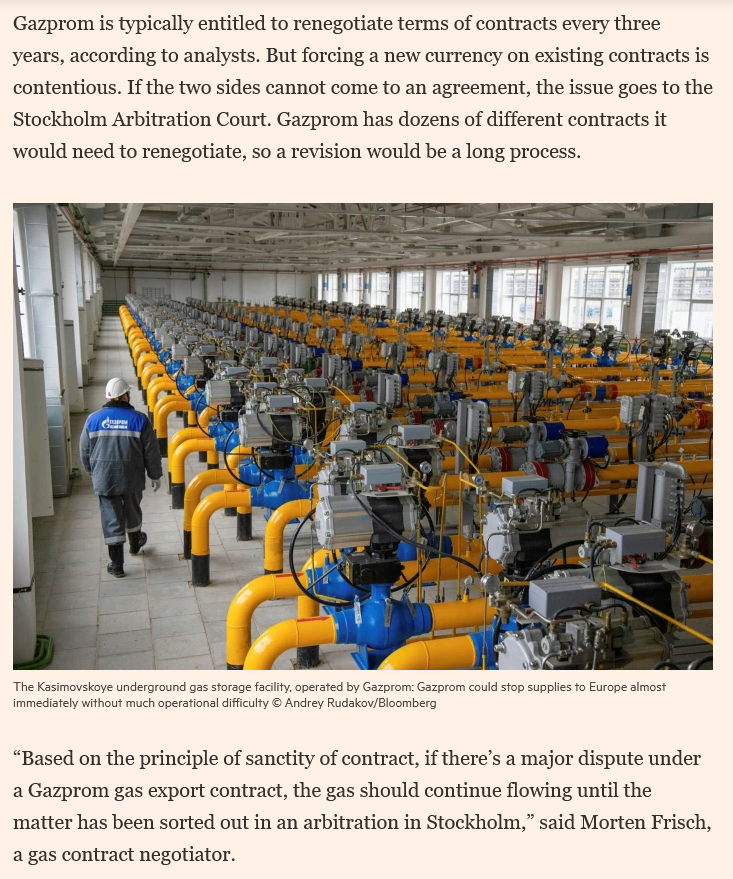

VVP only knows escalation. Does the EU have to prepare for a loss of Russian gas if Putin insists on his request? I don't know but the German economic ministers introduced a 3-step emergency plan & addressed consumers to self-ration their gas use.

4/n

4/n

https://twitter.com/BurggrabenH/status/1509181258047369226?s=20&t=kdbk4uqQ9yxTyc8-E4nQ_Q

@Bundeskanzler Scholz then summarised his conversation with VVP as follows: “We looked at the contracts which request payments to be made in euros, sometimes in dollars. I made it clear in the conversation with the Russian president that it will remain this way."

5/n

5/n

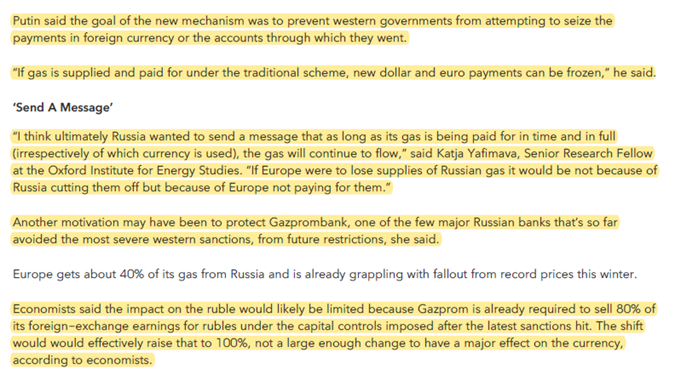

Today (31 March), VVP signed a Kremlin decree for gas payments to be paid in rubel starting from April 1 (i.e. tomorrow). For that, it seems that clients must open a Gazprombank (GPB) account but can still pay in € or US$ while GPB will change it in rubel. VVP then said..

6/n

6/n

So what is this all about? In practical terms, it seems to makes little difference: Either EU companies buy directly in €, in which case Russia insists exporters convert 80% of revenues in rubles, or the money is converted first, most probably involving its central bank..

7/n

7/n

VVP gave the Russian CB, the customs authorities & the government 10 days to implement the new system. Either way, it seems that the EU is "safe" paying in euros for 1 month as payments for April deliveries are not due until May in case their is a "misunderstanding". Also...

8/n

8/n

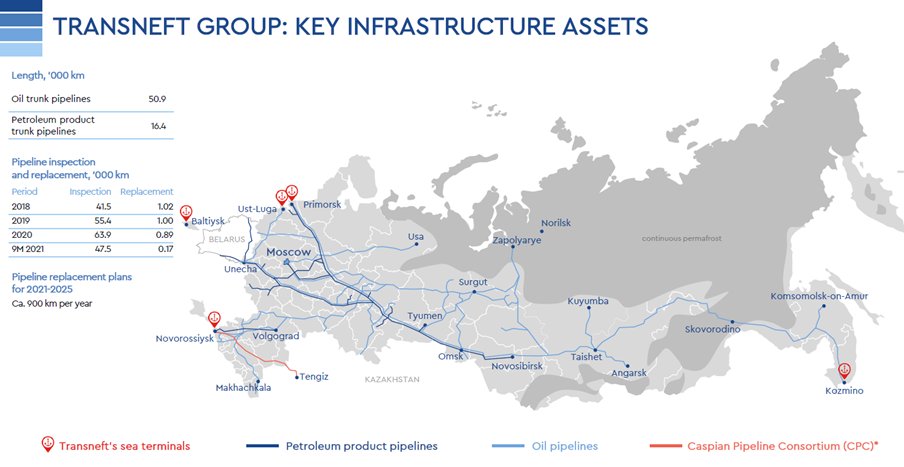

Could Gazprom sell its 150bcm pa EU gas to China? Big volumes need big pipelines. There are no such connections b/w West Siberian fields (where Gazprom pumps gas for EU) and China. Completing a 50bcm pa pipe through Mongolia to China would take 5+ years & $10bn+..!?

9/n

9/n

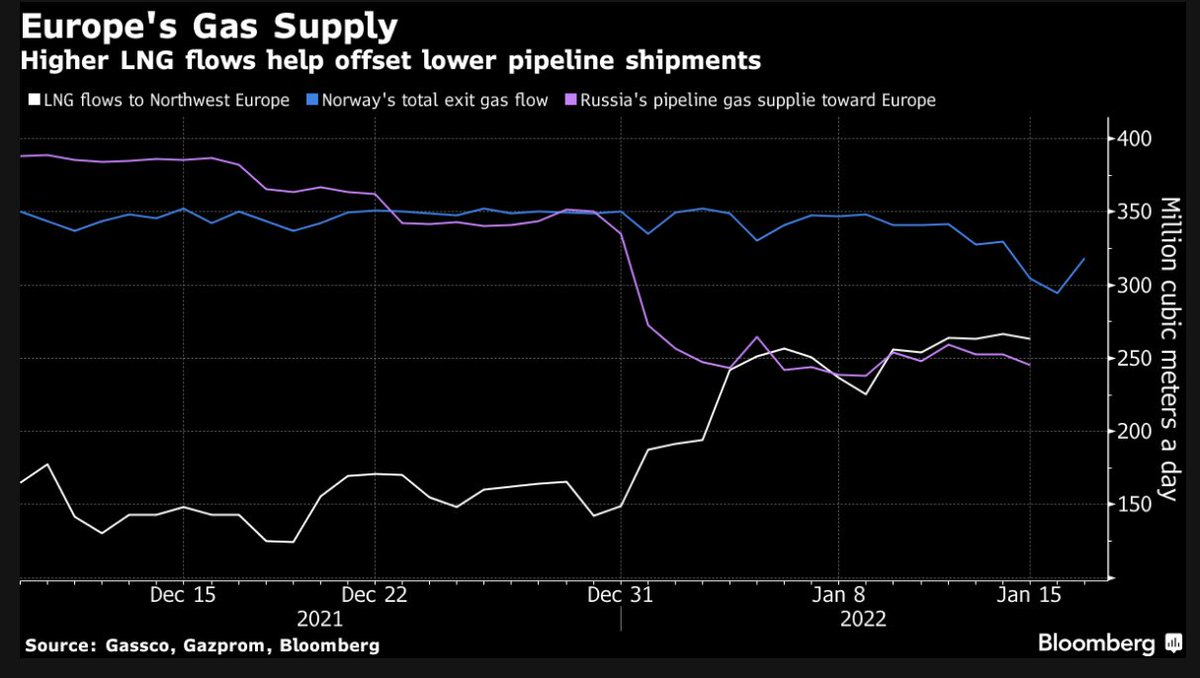

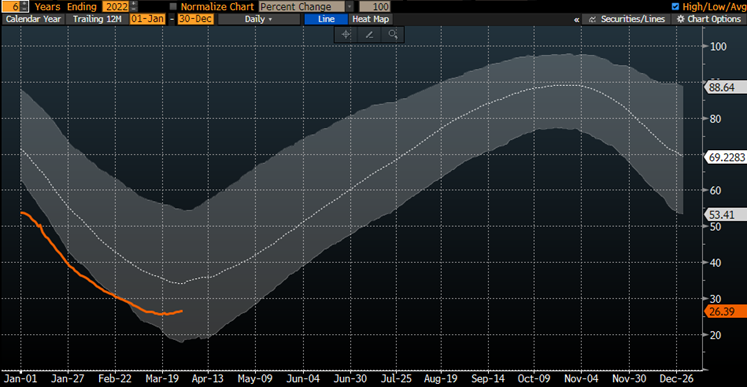

Meanwhile, the EU managed - thx to mild weather, record LNG imports & some rationing - to get storage levels back into 6-year averages - although they remain low (below in %-fill)...but the right trend.

10/n

10/n

So why is TTF at €122/MWh ($39/MMBtu; $240/boe)? IMHO, D/S is too uncertain to allow for "cost-curve" pricing. Instead TTF needs to keep arb open to attract non-contracted LNG barrel away from Asia & into EU. Asian JKM prices at $35.7/MMBtu.

11/11 Thx!

11/11 Thx!

https://twitter.com/BurggrabenH/status/1508948995661520901?s=20&t=kdbk4uqQ9yxTyc8-E4nQ_Q

VVP explaining Gazprombank involvement for new transactions - i.e. a way to circumvent sanctions of the Russian central bank - as explained above - without having to renegotiate contact terms. Latter would allow EU clients to reduce (duration) purchase obligations.

12/n

12/n

https://twitter.com/The_Real_Fly/status/1509669745263624197

• • •

Missing some Tweet in this thread? You can try to

force a refresh