About -

Tata Motors is a leading global automobile mfg. company with diverse portfolio includes an extensive range of cars, sports utility vehicles, trucks, buses & defence vehicles.

Tata Motors is a leading global automobile mfg. company with diverse portfolio includes an extensive range of cars, sports utility vehicles, trucks, buses & defence vehicles.

Tata Motors is one of India's largest OEMs offering an extensive range of integrated, smart and e-mobility solutions.

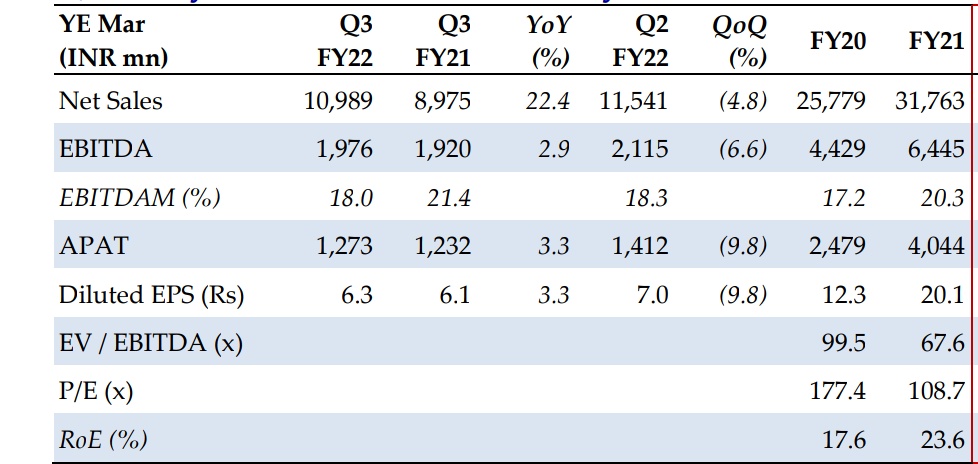

Financial Summary -

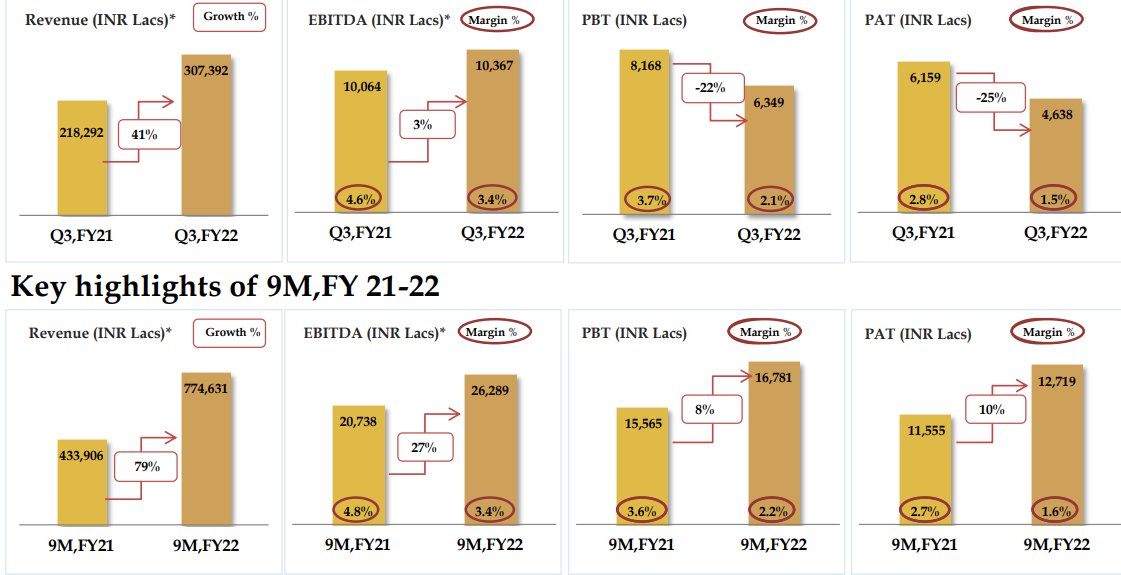

Q3 FY22 (YoY)

Revenue were at Rs.72,229 Cr. ⬇️ 4.5%

EBITDA at Rs. 7,395 Cr. ⬇️ 34%

PAT at Rs. 1,451 Cr. ⬇️ 51%

Q3 FY22 (YoY)

Revenue were at Rs.72,229 Cr. ⬇️ 4.5%

EBITDA at Rs. 7,395 Cr. ⬇️ 34%

PAT at Rs. 1,451 Cr. ⬇️ 51%

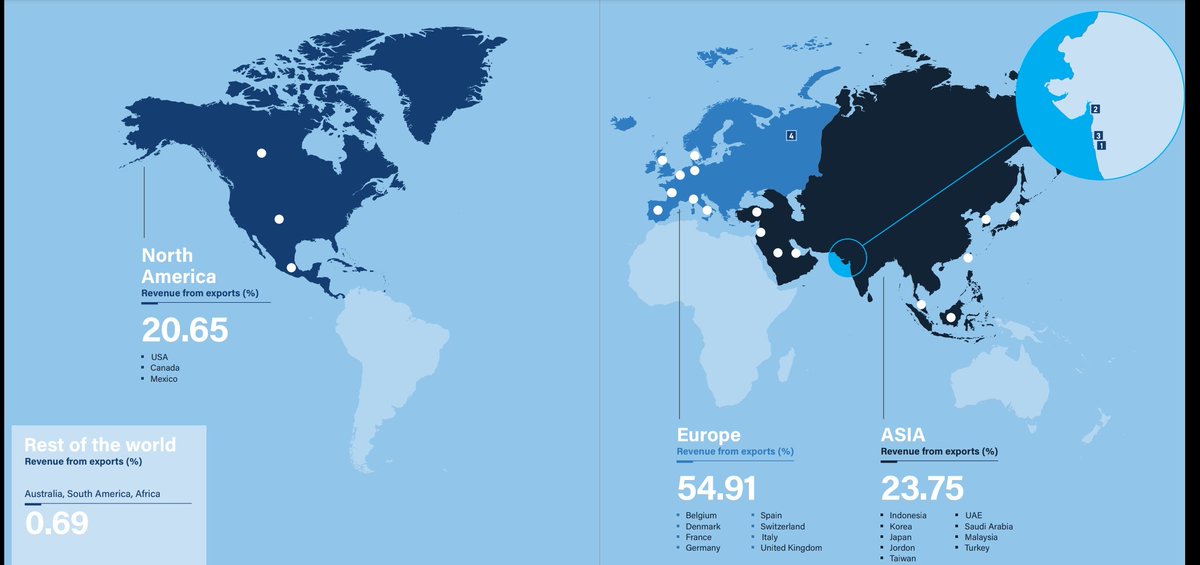

Revenue mix -

Tata Motors earned 78% from Jaguar Land Rover, 13.3% from Commercial Vehicle, 6.8% from Passenger Vehicle, 1.8% from TMFL & Others 0.1%.

Tata Motors earned 78% from Jaguar Land Rover, 13.3% from Commercial Vehicle, 6.8% from Passenger Vehicle, 1.8% from TMFL & Others 0.1%.

▪️ Jaguar Land Rover:

JLR continues to shape the future of modern

luxury vehicles globally. Jaguar Land Rover

aspires to become the creator of the world's most desirable, luxury

vehicles & services for the most discerning of customers.

JLR continues to shape the future of modern

luxury vehicles globally. Jaguar Land Rover

aspires to become the creator of the world's most desirable, luxury

vehicles & services for the most discerning of customers.

▪️Commercial Vehicle:

Tata Motors is the leading player in the CV segment in India, offers a broad portfolio of auto products including trucks,buses, coaches & defence vehicles.

Tata Motors is the leading player in the CV segment in India, offers a broad portfolio of auto products including trucks,buses, coaches & defence vehicles.

▪️ Passenger Vehicle:

Tata Motors began mfg Passenger Vehicles in India in 1991. Apart from India, it's new as well as legacy cars are also available in many countries through exclusive dealerships.

Tata Motors began mfg Passenger Vehicles in India in 1991. Apart from India, it's new as well as legacy cars are also available in many countries through exclusive dealerships.

▪️Vehicle financing:

Tata Motors Finance Limited (TMFL) & Tata

Motors Finance Solutions Limited (TMFSL)

are NBFCs. TMFL

facilitates new vehicle financing. TMFSL

undertakes the dealer/vendor financing

business & the used vehicle refinance/repurchase business.

Tata Motors Finance Limited (TMFL) & Tata

Motors Finance Solutions Limited (TMFSL)

are NBFCs. TMFL

facilitates new vehicle financing. TMFSL

undertakes the dealer/vendor financing

business & the used vehicle refinance/repurchase business.

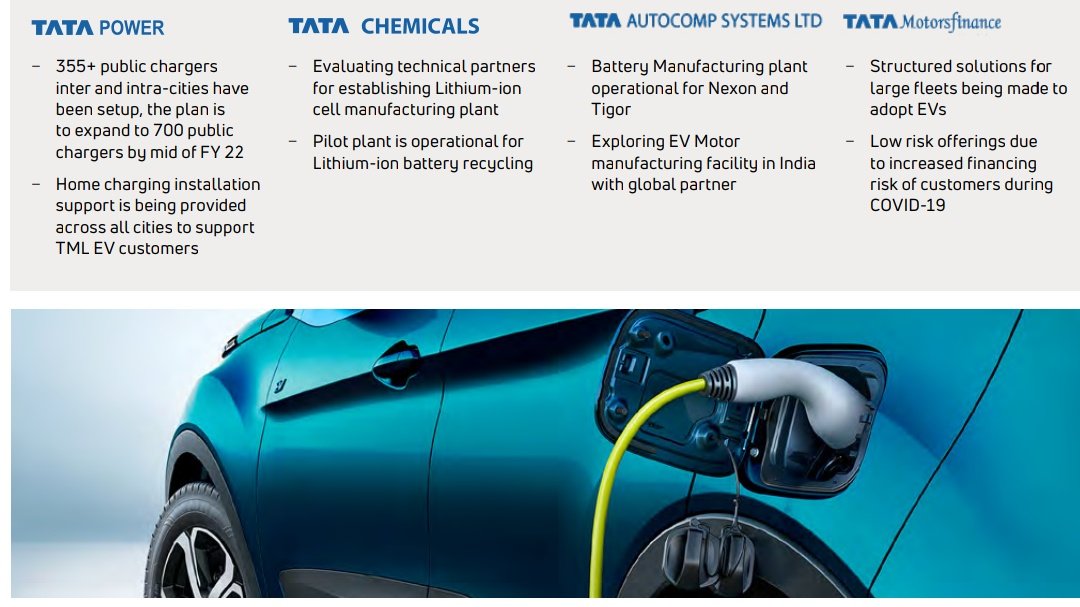

Long Term Triggers -

• EV alertness in India (PV market leader with Nexon; plans to

introduce 10 models by 2025) & JLR (Jaguar all-electric by 2025; 1st BEVs

in Land Rover in 2024).

• EV alertness in India (PV market leader with Nexon; plans to

introduce 10 models by 2025) & JLR (Jaguar all-electric by 2025; 1st BEVs

in Land Rover in 2024).

• Exploring solutions on alternative fuels

such as Ethanol E10/E20, Bio-diesel blends,

LNG, H-CNG as well as zero emission Battery

Electric Vehicles & Fuel Cell Electric

Vehicles.

such as Ethanol E10/E20, Bio-diesel blends,

LNG, H-CNG as well as zero emission Battery

Electric Vehicles & Fuel Cell Electric

Vehicles.

• Launched India’s first compact truck Tata INTRA, creating a new segment in the Small Commercial Vehicle (SCV) space.

• An EV ecosystem Tata UniEVerse was launched in FY 20 providing a unique collaboration

platform (‘One Tata’) for Tata companies to leverage mutual competencies to support e-mobility in India.

platform (‘One Tata’) for Tata companies to leverage mutual competencies to support e-mobility in India.

Risks -

• Ukraine is leading supplier of "neon gas" used in semiconductor & Russia is largest producer of rare earth metal

"palladium", which is another important component for semiconductor. Supply chain disruption of these

raw materials can impact the availability of chips.

• Ukraine is leading supplier of "neon gas" used in semiconductor & Russia is largest producer of rare earth metal

"palladium", which is another important component for semiconductor. Supply chain disruption of these

raw materials can impact the availability of chips.

• Increases in commodities and input prices may have a material

adverse effect on Company’s results of operations.

• Automotive industry is highly competitive, intensifying competition could adversely affect

the Company’s business.

adverse effect on Company’s results of operations.

• Automotive industry is highly competitive, intensifying competition could adversely affect

the Company’s business.

Conclusion -

Long term growth prospects seems positive as the automotive industry is continuing to see huge changes in business models as electrification & connectivity technology rises.

India is

expected to be world’s 3rd largest automotive market in terms of

volume by 2026.

Long term growth prospects seems positive as the automotive industry is continuing to see huge changes in business models as electrification & connectivity technology rises.

India is

expected to be world’s 3rd largest automotive market in terms of

volume by 2026.

Please 🙏 like 👍, comment & retweet ♻️ if you find this useful

@DrdhimanBhatta1 @caniravkaria @shubhfin @saketreddy @anandchokshi19

@DrdhimanBhatta1 @caniravkaria @shubhfin @saketreddy @anandchokshi19

• • •

Missing some Tweet in this thread? You can try to

force a refresh