Pidilite Industries Analysis !!

#PidiliteIndustries

A detailed #Thread below 🪡🧵

#StockMarket #investing

#PidiliteIndustries

A detailed #Thread below 🪡🧵

#StockMarket #investing

About -

Pidilite Industries Limited is a leading manufacturer of adhesives & sealants. Their brand Fevicol has become synonymous with adhesives to millions in India & is ranked amongst the most trusted brands in the country. Its other brands are FeviKwik, Dr. Fixit, M-seal, etc.

Pidilite Industries Limited is a leading manufacturer of adhesives & sealants. Their brand Fevicol has become synonymous with adhesives to millions in India & is ranked amongst the most trusted brands in the country. Its other brands are FeviKwik, Dr. Fixit, M-seal, etc.

Pidilite manufactures products across verticals such as art materials & stationery, food & fabric care, car products, adhesives & sealants, & speciality industrial products like adhesives, pigments, textile resins, leather chemicals & construction chemicals.

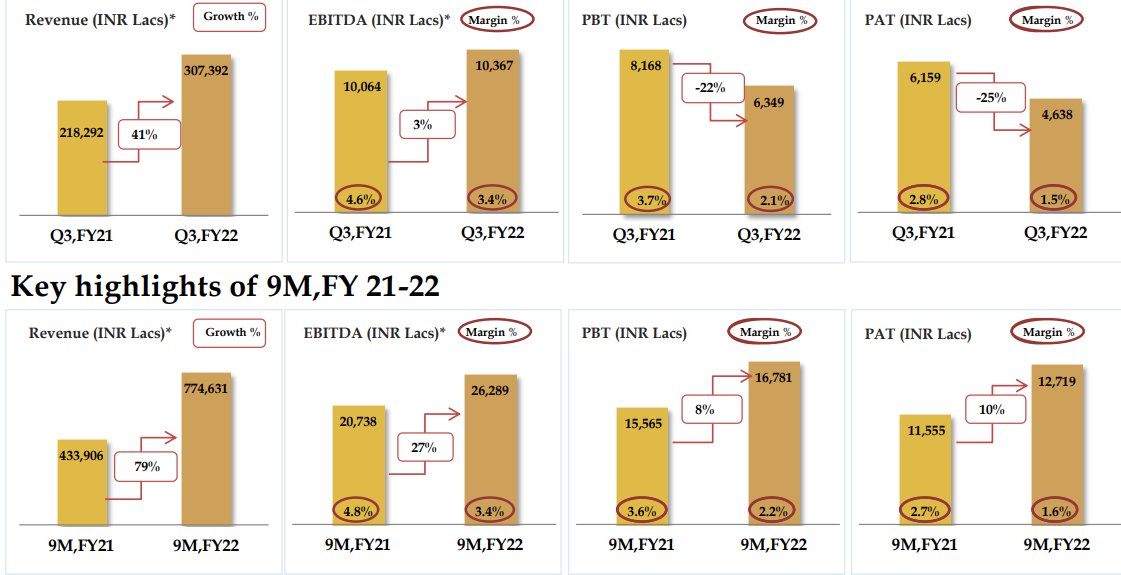

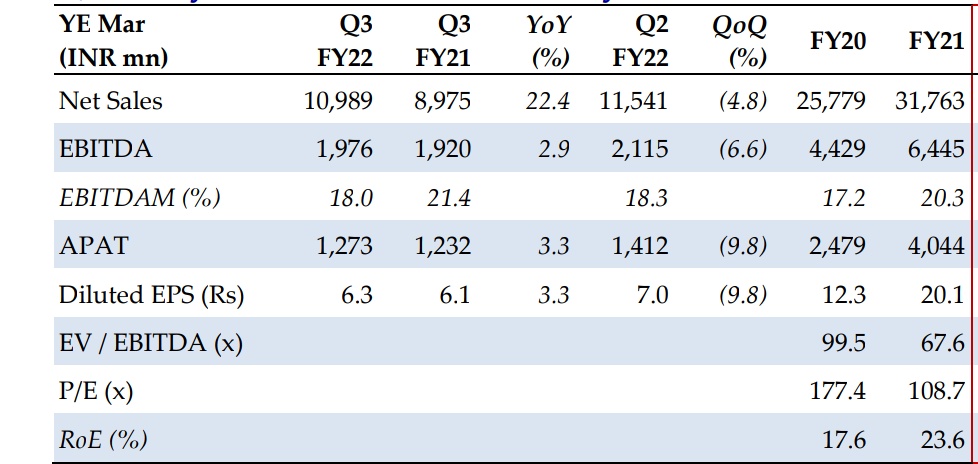

Financial Summary -

Q3 FY22 (YoY)

Revenue were at Rs. 2,841 Cr. ⬆️24%

EBITDA at Rs. 550 Cr. ⬇️14%

PAT at Rs. 359 Cr. ⬇️19.5%

Q3 FY22 (YoY)

Revenue were at Rs. 2,841 Cr. ⬆️24%

EBITDA at Rs. 550 Cr. ⬇️14%

PAT at Rs. 359 Cr. ⬇️19.5%

Revenue Breakup -

Pidilite earns about (54.2%) of its revenues from Adhesives & Sealants, Construction & Paint Chemicals (20%), Art & Craft materials (7.1%), Industrial Adhesives (6%), Pigment & Preparation (6%) & Industrial Resins & Construction chemicals (6.4%).

Pidilite earns about (54.2%) of its revenues from Adhesives & Sealants, Construction & Paint Chemicals (20%), Art & Craft materials (7.1%), Industrial Adhesives (6%), Pigment & Preparation (6%) & Industrial Resins & Construction chemicals (6.4%).

In total the company produces 500 products for its brands.

The Company operates under

two major business segments:

Branded Consumer & Bazaar which accounts for (81%) of revenue.

&

Business to Business accounts for (18%).

The Company operates under

two major business segments:

Branded Consumer & Bazaar which accounts for (81%) of revenue.

&

Business to Business accounts for (18%).

Long Term Triggers -

• Management is targeting the core segment (adhesive, sealants) & the growth segment to grow at 1-2x & 2-4x of GDP, in

long term.

• Strong demand from urban regions helped drive strong volume

growth for the company.

• Management is targeting the core segment (adhesive, sealants) & the growth segment to grow at 1-2x & 2-4x of GDP, in

long term.

• Strong demand from urban regions helped drive strong volume

growth for the company.

• Construction chemical, water proofing categories are highly under

penetrated in India. These categories are expected to drive

long term growth for Pidilite.

penetrated in India. These categories are expected to drive

long term growth for Pidilite.

Risks -

• Any sudden rise in raw material prices,

especially for crude-linked products, could effect the margins.

• Any unexpected demand slowdown in housing

market.

• Any sudden rise in raw material prices,

especially for crude-linked products, could effect the margins.

• Any unexpected demand slowdown in housing

market.

Conclusion -

Pidilite is well placed to benefit from the revival in the real estate industry,

which drives demand in its C&B business.

The B2B business includes industrial adhesive, construction chemical, etc will benefit from a revival in mfg. activity in the near future.

Pidilite is well placed to benefit from the revival in the real estate industry,

which drives demand in its C&B business.

The B2B business includes industrial adhesive, construction chemical, etc will benefit from a revival in mfg. activity in the near future.

Please 🙏 like 👍, comment & retweet ♻️ if you find this useful.

@caniravkaria @DrdhimanBhatta1 @shubhfin @AshishZBiz @SumitResearch @deepdbhandari @HareshVithlani @sahneydeepak @AdeParimal

@caniravkaria @DrdhimanBhatta1 @shubhfin @AshishZBiz @SumitResearch @deepdbhandari @HareshVithlani @sahneydeepak @AdeParimal

• • •

Missing some Tweet in this thread? You can try to

force a refresh