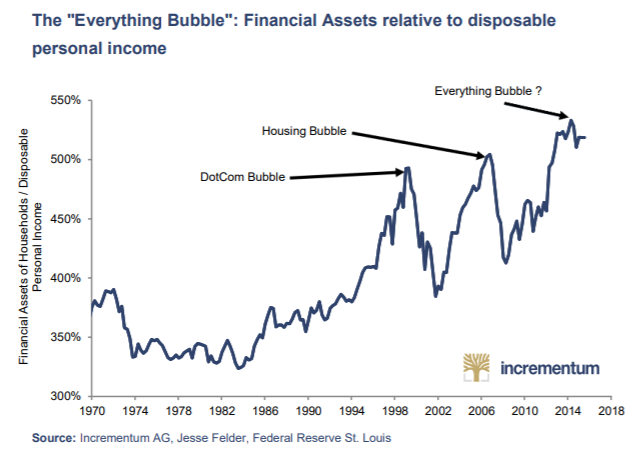

We are now entering the second stage of the busting of the #everythingbubble.

On Mar 2, 2020 I laid out some thoughts for the sequence of events during and post the COVID shock. Time for a short retrospective and some ideas what may happen next.

On Mar 2, 2020 I laid out some thoughts for the sequence of events during and post the COVID shock. Time for a short retrospective and some ideas what may happen next.

https://twitter.com/MarkValek/status/1234406559956029440

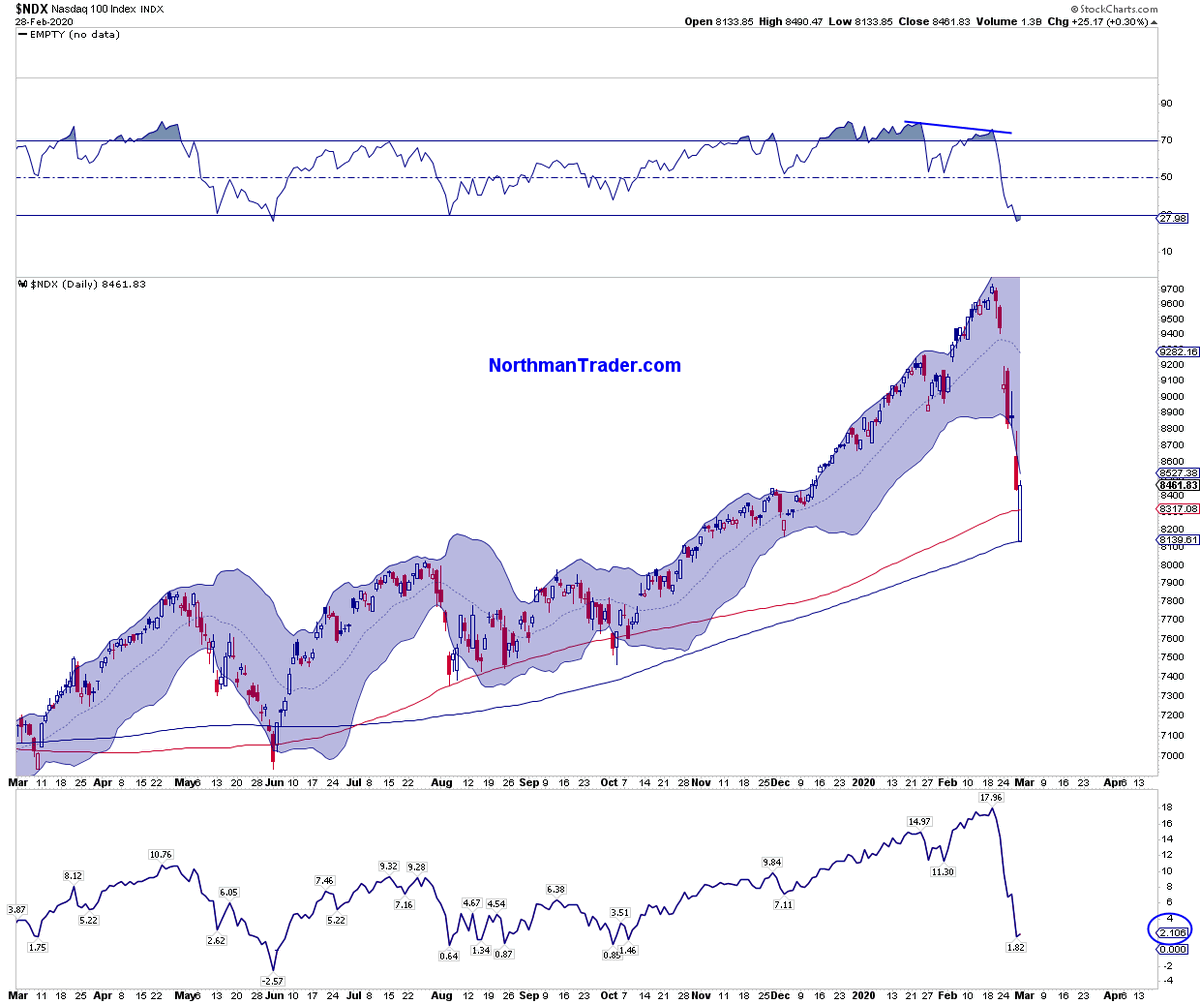

The the initial market reaction to the pandemic and the lockdown was highly deflationary.

The easy part was predicting that monetary and fiscal policy would throw everything they had onto the “deflationary crisis”. Pointing out the chance of severe price inflation and the opportunities that lay in investing in commodities definitely was way more outlandish.

Contrary to the post 08 reflation, post 20 QE was not only injected into fin markets but also distributed to consumers and businesses via enormous government handouts. The first reflation inflated financial assets (#everythingbubble), now real assets (commodities) are popping it.

Many analysts as well as central bankers did not see the inflationary environment coming and labeled it transitory for way too long.

Finally, the price inflation has become too great to be ignored and the central bank of the global reserve currency has violently pivoted its communication to a hawkish stance. This IMO will have severe implications which I will discuss here in due course.

One of the fallouts of the beginning bond market collapse will be the return of the Euro Crisis. Spreads are widening again, eventhough the ECB is currently not even thinking about raising rates.

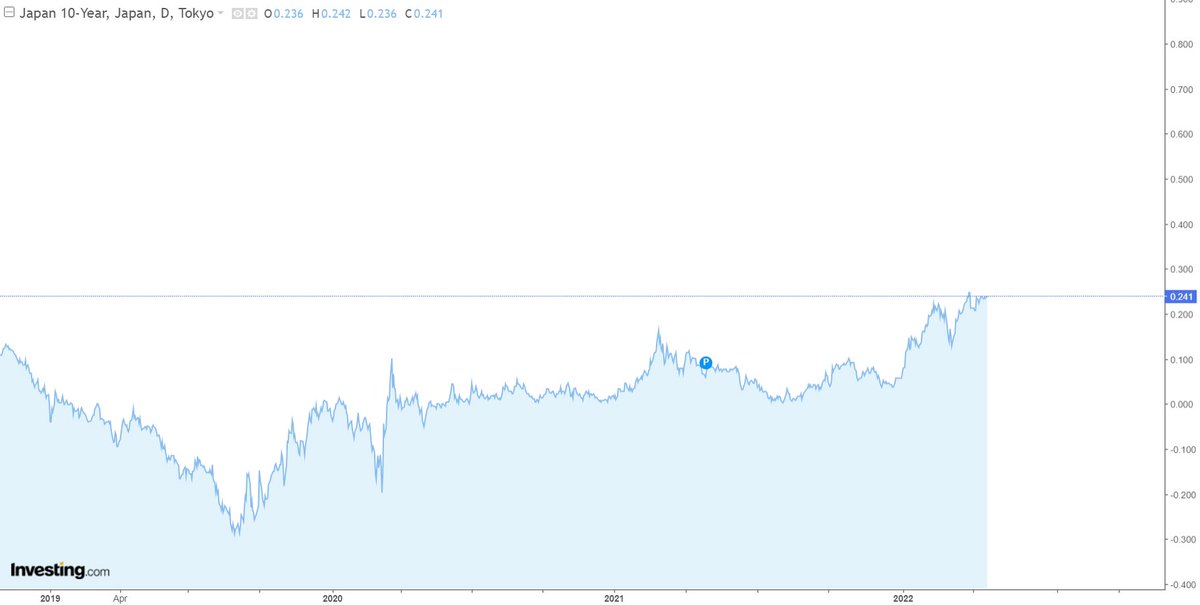

Another consequence will be, that the BoJ will have to surrender their yield curve control. Going short JGBs now IMO is a very promising asymmetric trade which we have implimented in some of our strategies.

Nothing remotely close like this has happened before to the bond market.

https://twitter.com/biancoresearch/status/1518233484413837312?s=20&t=kEOM2PY4PBXsFBHBZdQPIA

IT-GER spreads are steadily creeping higher, and ECB has not even started to tighten...

#Eurocrisis when?

#Eurocrisis when?

A new #EUROCRISIS seems almost inevitable.

A crash of the bond market means a crash of the everything bubble. FED can't let that happen.

Once the FED does a 180 from #QT to #YCC things will become extremly interesting.

#Gold & #Bitcoin

Once the FED does a 180 from #QT to #YCC things will become extremly interesting.

#Gold & #Bitcoin

• • •

Missing some Tweet in this thread? You can try to

force a refresh