🧨CALL TO ACTION🧨

#XRPCommunity

I need the internet sleuths to start digging. As bad as it already looks for Hinman, I firmly believe his involvement and his conflicts are even greater than presently known. I also believe the SEC has been in full cover up mode.

#XRPCommunity

I need the internet sleuths to start digging. As bad as it already looks for Hinman, I firmly believe his involvement and his conflicts are even greater than presently known. I also believe the SEC has been in full cover up mode.

https://twitter.com/digitalassetbuy/status/1512901039439159297

The SEC made a false statement when it originally stated there were no responsive documents relevant to the @EMPOWR_us FOIA requests. Only after @JsnFostr and Empower filed suit in federal court did they “realize” the error and correct the falsehood (b/c Empower didn’t fold).

Likewise, the SEC initially informed me the Hinman Calendar was not used for official government reasons and denied my FOIA request. I appealed and its on remand. But I fully expect to sue them for violating FOIA before they turn over his calendar. Why are they fighting so hard?

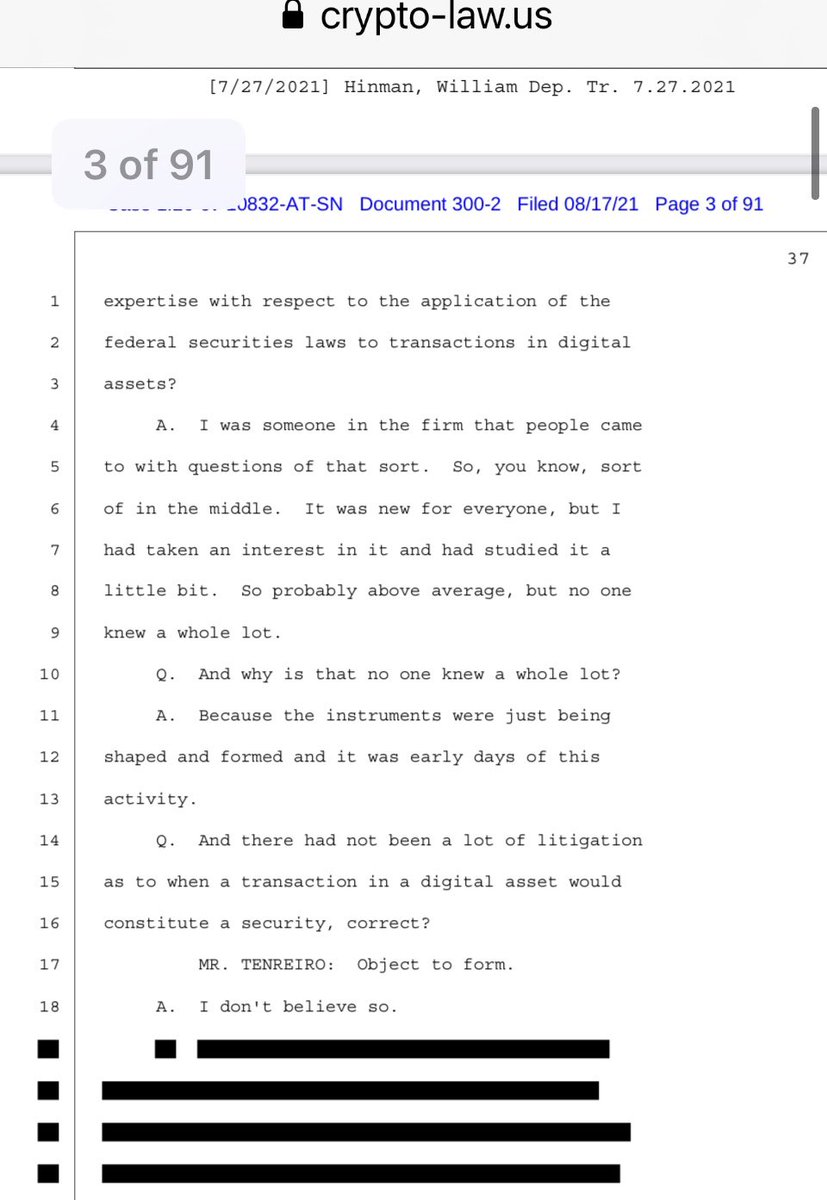

👆 on page 37, the @Ripple lawyers ask a question about whether a specific company or entity was a client of Hinman’s or his law firm’s. The SEC redacted the identity of that entity. Why?

On page 38 Hinman said he didn’t think they were a client, but were involved in matters he was involved in.

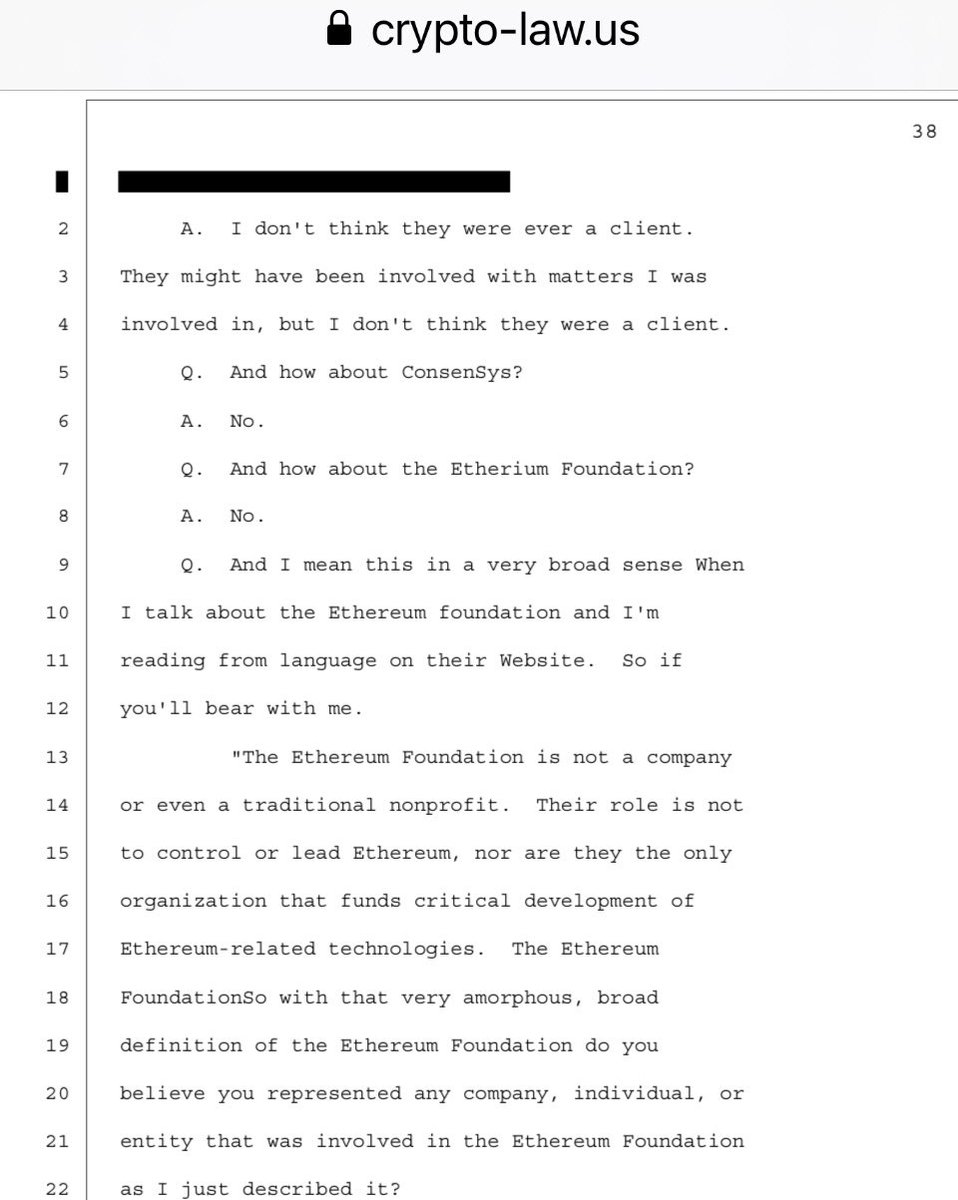

Who’s identity was redacted? Was it the Brooklyn Project? 🤷♂️ I ask b/c the next one asked about is whether @ConsenSys was a client. He said no.

Who’s identity was redacted? Was it the Brooklyn Project? 🤷♂️ I ask b/c the next one asked about is whether @ConsenSys was a client. He said no.

We know Sullivan & Cromwell represented Consensys. Then they ask if Hinman represented the Ethereum Foundation and he replied no. But look what happened when the Ripple lawyer expanded the definition of the Ethereum Foundation on page 38.

The next 3 pages are redacted!!

The next 3 pages are redacted!!

Why hide the answer from the public? As @digitalassetbuy stated, we need to focus on Hinman and Simpson Thacher’s involvement in any crypto platform or project from 2014 until he arrived at the SEC. Who was he involved with? My instinct tells me there is much more to uncover.

• • •

Missing some Tweet in this thread? You can try to

force a refresh