Yesterday #Russia missed its first debt payment.

Today #SriLanka did the same.

In 30 days they will be in default.

Another 30 countries could follow.

What is happening and what does it mean? 🧵

Today #SriLanka did the same.

In 30 days they will be in default.

Another 30 countries could follow.

What is happening and what does it mean? 🧵

A debt default happens when a county can’t keep up with regular repayments.

It can happen because the economy tanks, there’s a sudden drop in revenue, the cost of the debt increases, there is too much debt, or because of external shocks.

It can happen because the economy tanks, there’s a sudden drop in revenue, the cost of the debt increases, there is too much debt, or because of external shocks.

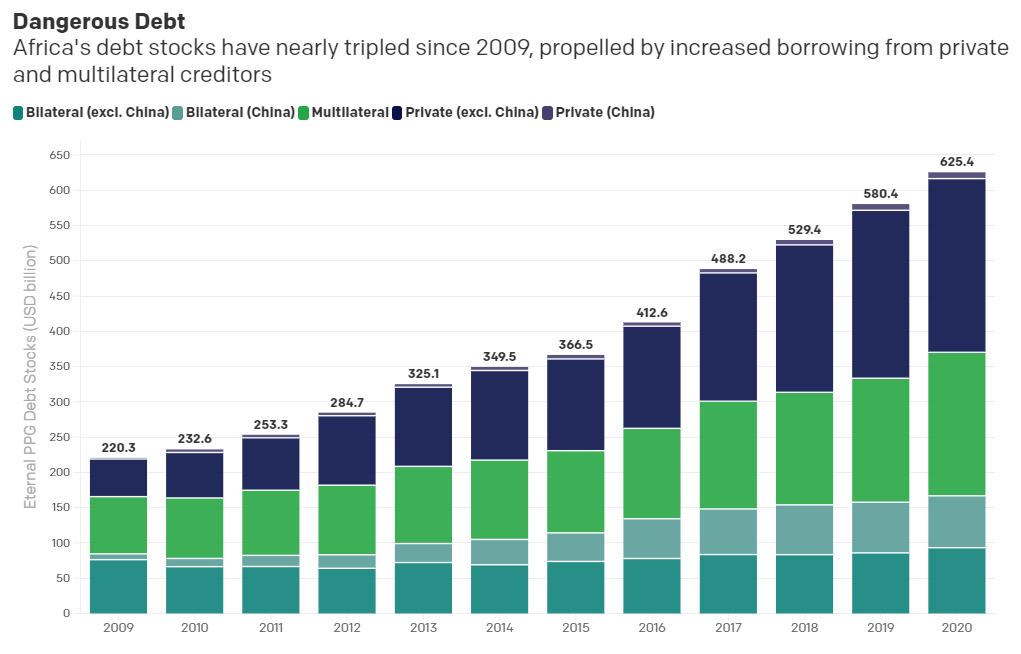

But before we get to #Russia, #SriLanka and those other countries at risk of default, let’s talk about debt.

Sovereign debt can be a good thing: if it is affordable and allows a country to invest in infrastructure or other things that grow the economy.

Problems arise if the debt isn’t invested well or if circumstances unexpectedly change.

Problems arise if the debt isn’t invested well or if circumstances unexpectedly change.

Governments borrow from other governments, from private lenders (which include big banks and bond holders), and from multilateral institutions like the @IMFNews and @WorldBank.

The cost of borrowing from private lenders depends on the country’s credit rating which is determined by three private companies: @MoodysInvSvc @Fitchratings and @SPGlobalRatings.

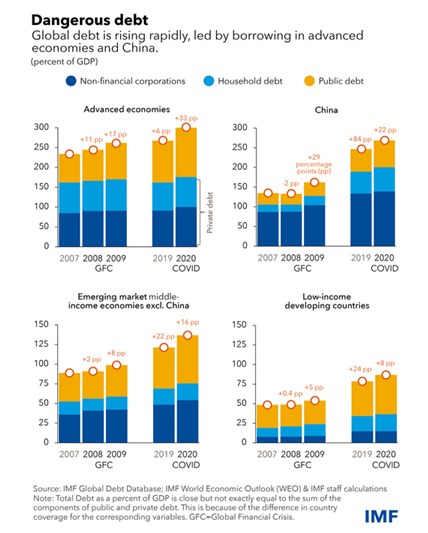

Countries can accrue debt when interest rates are low, but when rates rise or incomes fall (say, as a result of a global pandemic), they no longer have the revenues to pay them.

When a country defaults on its debt, it is seen as more risky by investors, meaning; it’s harder to get finance in the future, and it will be more expensive.

What happens when a country defaults?

Economic growth sharply drops, with lower investment and even trade for years to come.

Poverty can increase by up to 25%, and government spending on health and education are reduced.

Economic growth sharply drops, with lower investment and even trade for years to come.

Poverty can increase by up to 25%, and government spending on health and education are reduced.

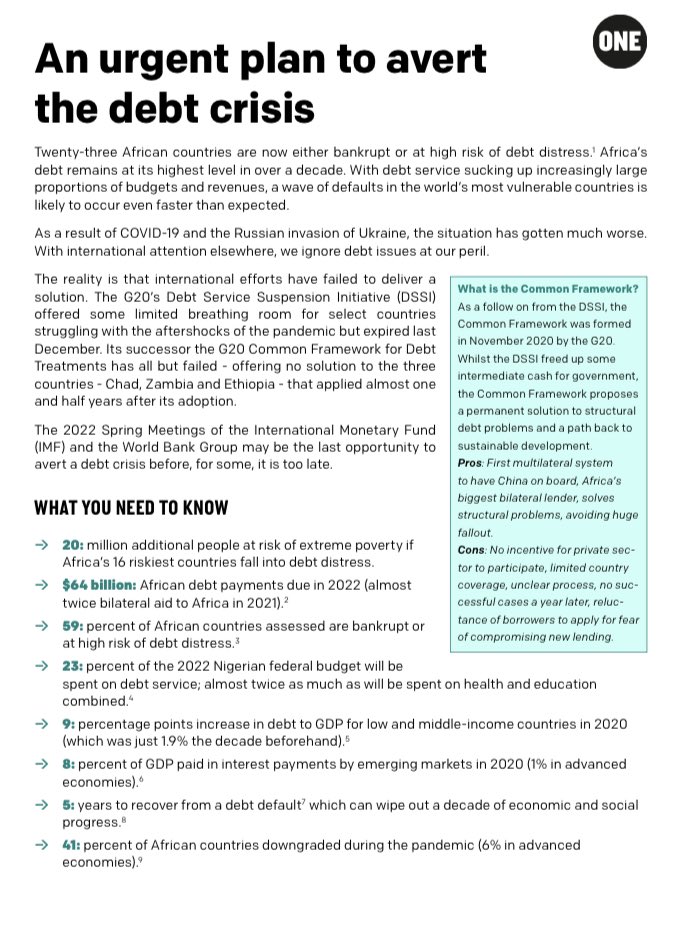

20 million additional people are at risk of falling into extreme poverty if Africa’s 16 riskiest countries fall into debt distress.

So what happened with #Russia? #Sanctions worked and Russia’s economy has been cut off from the global economy.

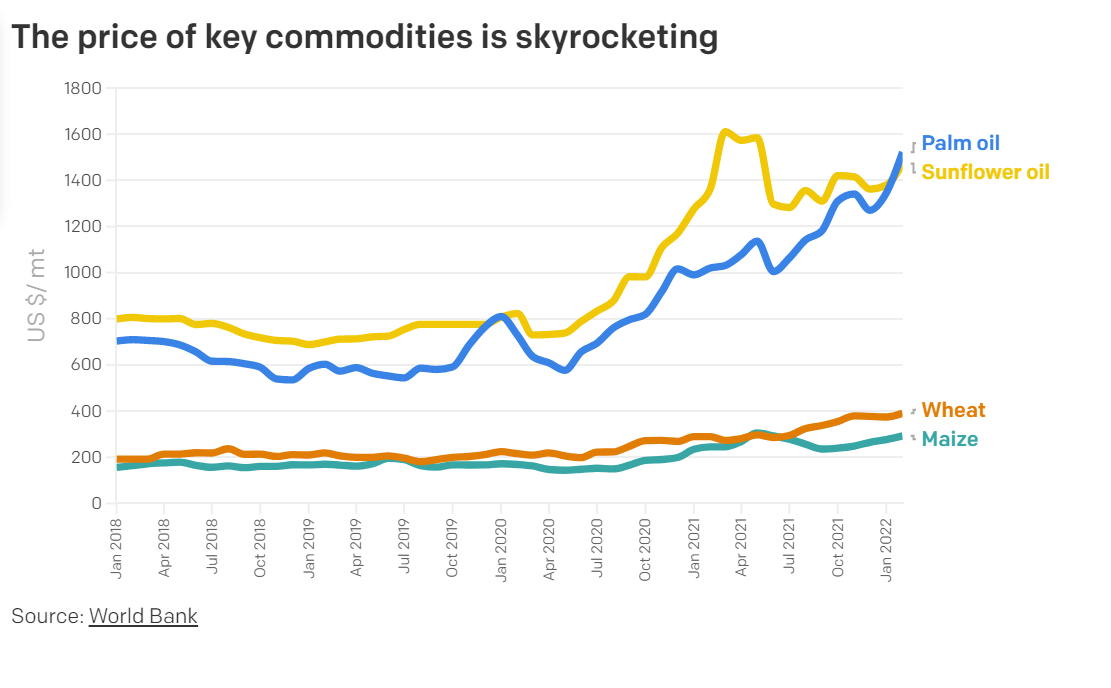

And what happened with Sri Lanka? Debts were a problem before Putin’s war pushed up prices.

They raised money on financial markets and took loans from China to invest in infrastructure, relying on its steady income from tourism to repay loans.

Covid decimated this income.

They raised money on financial markets and took loans from China to invest in infrastructure, relying on its steady income from tourism to repay loans.

Covid decimated this income.

And what about those other 30 countries I mentioned?

@IMFnews says they are at high risk of debt distress, meaning they have little room to maneuver if things get even worse.

Their buffers have been eroded by covid+the war. imf.org/external/Pubs/…

@IMFnews says they are at high risk of debt distress, meaning they have little room to maneuver if things get even worse.

Their buffers have been eroded by covid+the war. imf.org/external/Pubs/…

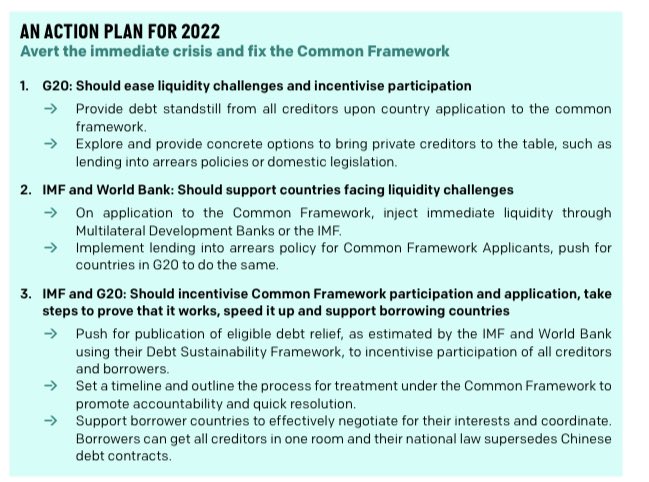

This week both the @worldbank and @imfnews warned about the risks. The IMF said the “Dangerous Global Debt Burden Requires Decisive Cooperation.” blogs.imf.org/2022/04/11/dan…

"Decisive Cooperation” is just about the opposite of what we have seen from the @g20org.

Its so-called solution the “Common Framework” has left the three countries that applied for support hanging for a year and a half.

Unsurprising then that no others have applied.

Its so-called solution the “Common Framework” has left the three countries that applied for support hanging for a year and a half.

Unsurprising then that no others have applied.

The fundamental problem is that the system isn’t fair and systemically disadvantages poorer countries.

They are considered more risky and their debt is therefore more expensive. It needs to be repaid quicker and in a currency you can’t control.

They are considered more risky and their debt is therefore more expensive. It needs to be repaid quicker and in a currency you can’t control.

How do we get out of a default?

The defaulting country needs to reach an agreement with their creditors to reprofile- and in some cases reduce- the amount they owe, so that they can make repayments that are affordable.

The defaulting country needs to reach an agreement with their creditors to reprofile- and in some cases reduce- the amount they owe, so that they can make repayments that are affordable.

Next week Finance Ministers @IMFnews and @WorldBank meet to discuss the state of the world economy.

They would do well to agree on a solution before we see many more scenes like this.

They would do well to agree on a solution before we see many more scenes like this.

https://twitter.com/MaudhuiHouse/status/1513793672592113665?s=20&t=KqGhNxhHFwVQL-hbyPY9aw

• • •

Missing some Tweet in this thread? You can try to

force a refresh