0/18

BREAKING: #BTC Mining can drive us to 70% renewables-based energy consumption by 2030.

To say "#BTC mining is good for the environment" is like saying "the sun is warm": a massive understatement. #BTCmining is our unexpected superhero. Here's how.

vimeo.com/698811685

BREAKING: #BTC Mining can drive us to 70% renewables-based energy consumption by 2030.

To say "#BTC mining is good for the environment" is like saying "the sun is warm": a massive understatement. #BTCmining is our unexpected superhero. Here's how.

vimeo.com/698811685

1/18

Here’s our energy mix today. While renewables are growing. However - so too is fossil fuels. It's still by far the major source of our global energy consumption.

Unless we have mostly renewable energy by 2030, the IPCC tells us we'll have runaway climate change. Not cool.

Here’s our energy mix today. While renewables are growing. However - so too is fossil fuels. It's still by far the major source of our global energy consumption.

Unless we have mostly renewable energy by 2030, the IPCC tells us we'll have runaway climate change. Not cool.

2/18

Here's the picture by line item. Coal has peaked. That’s good. Solar & wind is increasing. But not fast enough. If we look at their annual growth, it's alarming

Both solar & wind have slowing growth rates

eg: Solar slowed from 54%/year 10 years ago to 22%/year in 2020.

Here's the picture by line item. Coal has peaked. That’s good. Solar & wind is increasing. But not fast enough. If we look at their annual growth, it's alarming

Both solar & wind have slowing growth rates

eg: Solar slowed from 54%/year 10 years ago to 22%/year in 2020.

3/18

This means renewables are not currently on a growth curve that'll challenge the incumbents: fossil fuels.

By 2030, all renewables combined are on track to supply just 24% of our global power needs.

That’s less than ¼.

Nowhere near enough to stop runaway climate change

This means renewables are not currently on a growth curve that'll challenge the incumbents: fossil fuels.

By 2030, all renewables combined are on track to supply just 24% of our global power needs.

That’s less than ¼.

Nowhere near enough to stop runaway climate change

4/18

So if we are to going to change the world we have to do something additional.

To do this we must understand something called the activation energy barrier.

So if we are to going to change the world we have to do something additional.

To do this we must understand something called the activation energy barrier.

5/18

The activation energy barrier exists throughout nature & commerce.

In chemistry, it stops 2 chemicals reacting, in life it stops us forming new habits.

It's also what stops new technologies going mainstream, even when they're superior (wind & solar)

The activation energy barrier exists throughout nature & commerce.

In chemistry, it stops 2 chemicals reacting, in life it stops us forming new habits.

It's also what stops new technologies going mainstream, even when they're superior (wind & solar)

6/18

We overcome the energy barrier with a catalyst. Often, this catalyst is a new customer type.

Eg: AirBnB’s catalyst was the new type of customer the GFC brought them, who sought low-cost short-term urban accom. This customer catapulted AirBnB to success where others failed

We overcome the energy barrier with a catalyst. Often, this catalyst is a new customer type.

Eg: AirBnB’s catalyst was the new type of customer the GFC brought them, who sought low-cost short-term urban accom. This customer catapulted AirBnB to success where others failed

7/18

Happily, in our renewable energy sector, we do have a unique type of customer who is such a catalyst.

This customer has 3 unique features. They:

1. Are location agnostic

2. Are time-of-day-agnostic

3. Have an insatiable appetite for both existing & new energy production

Happily, in our renewable energy sector, we do have a unique type of customer who is such a catalyst.

This customer has 3 unique features. They:

1. Are location agnostic

2. Are time-of-day-agnostic

3. Have an insatiable appetite for both existing & new energy production

8/18

10 yrs ago, there was no such customer

But today, we have many of them.

They are growing.

And critically, they lower the economic barrier that has been preventing faster adoption of renewables.

They are ... [cue drum roll] #Bitcoin miners

10 yrs ago, there was no such customer

But today, we have many of them.

They are growing.

And critically, they lower the economic barrier that has been preventing faster adoption of renewables.

They are ... [cue drum roll] #Bitcoin miners

9/18

Here’s how #BTCMiners change the game:

A wind farmer goes to get capital to build a new wind farm - teaming up with a #BTCminer

She shows the spreadsheet to her financial backer who sees a steady customer buying all year round, including previously unprofitable times

Here’s how #BTCMiners change the game:

A wind farmer goes to get capital to build a new wind farm - teaming up with a #BTCminer

She shows the spreadsheet to her financial backer who sees a steady customer buying all year round, including previously unprofitable times

10/18

That means higher revenue & profit.

It also means less time to pay off the capital investment for the new wind-farm.

Then she unveils a signed contract from the #BTC miner that says “I'll be your 1st customer "off the plans".

This gives guaranteed locked-in income.

That means higher revenue & profit.

It also means less time to pay off the capital investment for the new wind-farm.

Then she unveils a signed contract from the #BTC miner that says “I'll be your 1st customer "off the plans".

This gives guaranteed locked-in income.

11/18

The financial backer says,

"Well – you’ve got 40% more revenue, 60% more profit and you’re paying off the build cost 3 months ahead of time.

Plus you've reduced risk by having a buyer off the plans.

I can actually approve a loan to build 5 new wind farms."

The financial backer says,

"Well – you’ve got 40% more revenue, 60% more profit and you’re paying off the build cost 3 months ahead of time.

Plus you've reduced risk by having a buyer off the plans.

I can actually approve a loan to build 5 new wind farms."

12/18

Now we’ve still got to convert our vehicles from fossil fuel onto the grid, decarbonize many of our major industries and stop methane emissions from oil fields and livestock going into the sky.

However, this would still be a major step forward for all humanity.

Now we’ve still got to convert our vehicles from fossil fuel onto the grid, decarbonize many of our major industries and stop methane emissions from oil fields and livestock going into the sky.

However, this would still be a major step forward for all humanity.

13/18

But the story gets better.

It’s not only existing renewable operators that can expand, #BTC mining lowers the barrier to entry so new operators can get in the game.

But the story gets better.

It’s not only existing renewable operators that can expand, #BTC mining lowers the barrier to entry so new operators can get in the game.

14/18

Eg: In NZ, we’re in the roaring 40s. We have abundant wind. You’d never know it.

Big utilities have the customers but are moving slowly.

Meanwhile independent operators want to go fast, but lacked customers.

But with #BTCMiners, suddenly their business case stacks up

Eg: In NZ, we’re in the roaring 40s. We have abundant wind. You’d never know it.

Big utilities have the customers but are moving slowly.

Meanwhile independent operators want to go fast, but lacked customers.

But with #BTCMiners, suddenly their business case stacks up

15/18

When we add the #BTC mining customer to the renewable energy adoption curve, we can achieve an almost 20% year-on-year growth both in new operators, and in growing existing operators.

Compounding the 2 together, the entire renewables sector expands at 43% per year.

When we add the #BTC mining customer to the renewable energy adoption curve, we can achieve an almost 20% year-on-year growth both in new operators, and in growing existing operators.

Compounding the 2 together, the entire renewables sector expands at 43% per year.

16/18

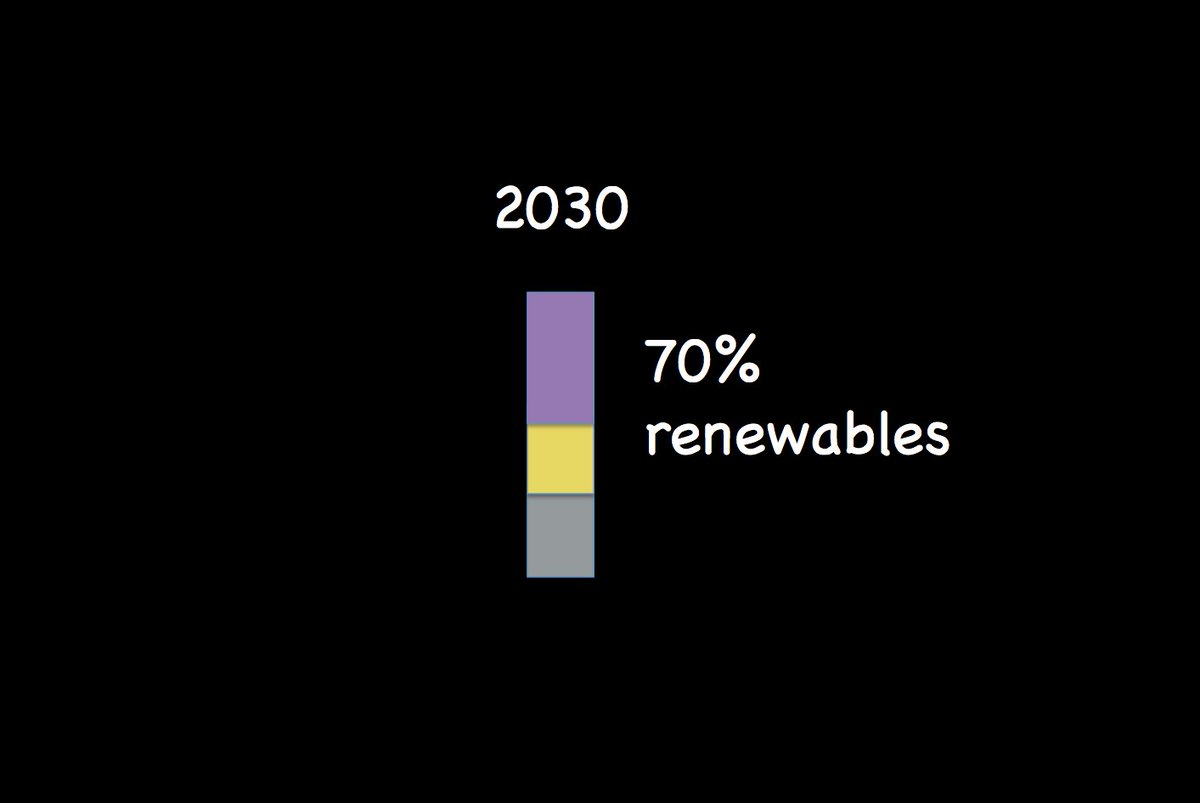

Compounding 43% renewable growth over 8 years gives us 70% of all global energy being renewable by 2030.

That’s huge: it's the difference between runaway climate change, and hope.

And #BTC mining is our catalyst for this mainstream renewable energy adoption.

Compounding 43% renewable growth over 8 years gives us 70% of all global energy being renewable by 2030.

That’s huge: it's the difference between runaway climate change, and hope.

And #BTC mining is our catalyst for this mainstream renewable energy adoption.

17/18

This picture should give us hope

Remember, this is not just electricity consumption, this is all global energy consumption

And we now have a valid, sustainable, practical path towards achieving it

I believe we'll get there. However it'll take a shift in our thinking

This picture should give us hope

Remember, this is not just electricity consumption, this is all global energy consumption

And we now have a valid, sustainable, practical path towards achieving it

I believe we'll get there. However it'll take a shift in our thinking

18/18

We'll need to think more critically, debunk old myths faster, and believe in a better future, deeper than we've dared.

Let's champion our unexpected heroes, our #BTCminers, and spread hope that's been carefully thought through. It does make a difference

and so can you

We'll need to think more critically, debunk old myths faster, and believe in a better future, deeper than we've dared.

Let's champion our unexpected heroes, our #BTCminers, and spread hope that's been carefully thought through. It does make a difference

and so can you

• • •

Missing some Tweet in this thread? You can try to

force a refresh