I have many DMs about the putative class action filed in Arizona. Here are my honest thoughts:

I was the first person to publicly raise the conflicts of interests and gross appearances of impropriety related to Clayton and Hinman.

I was the first person to publicly raise the conflicts of interests and gross appearances of impropriety related to Clayton and Hinman.

https://twitter.com/EleanorTerrett/status/1514310210340466693

One of the alternative motives I raised in the Writ of Mandamus, filed only 9 days after the @Ripple lawsuit, was about Clayton’s personal gain. Immediately after the case against #XRP was filed, I wrote the lawsuit appeared to be used as a weapon.

Many of you may recall, I wrote the Ethereum Free Pass memo and the original undisputed facts timeline 🧵 that has 6 million impressions. 👇

In other words, I fully understand the sentiment and frustration that people have regarding Calyton, Hinman and lawsuit against #XRP. I also know that we live in an age where people want results today.

I need to make clear that I had nothing to do with filing the Arizona class action 🆚 Clayton and Hinman. People have asked be about pursuing them and the SEC for damages. I’ve maintained that you cannot rush a case where there are issues of sovereign and qualified immunity.

I’ve communicated that once you file a case either against them personally or against the SEC itself, there will be motions to dismiss based on multiple grounds. Rule 12(b)6 motions (failure to state a claim); motions to dismiss based on qualified immunity, etc.

When going after a government employee in their personal capacity it is best to have as much evidence as possible to demonstrate to the Court that these government actors were acting outside the scope of their employment.

Many of you believe this has already been proven and I understand why. Some unbiased people however, like @CGasparino or @EleanorTerrett may admit that it looks bad but are not convinced there’s been actual wrongdoing or criminal laws violated.

@freddyriz filed the case against Clayton and Hinman. If Fred knows the judge presiding over this case and he is extremely confident that the judge will deny the initial motions and grant Fred the ability to engage in liberal discovery, then it could prove to be a good move.

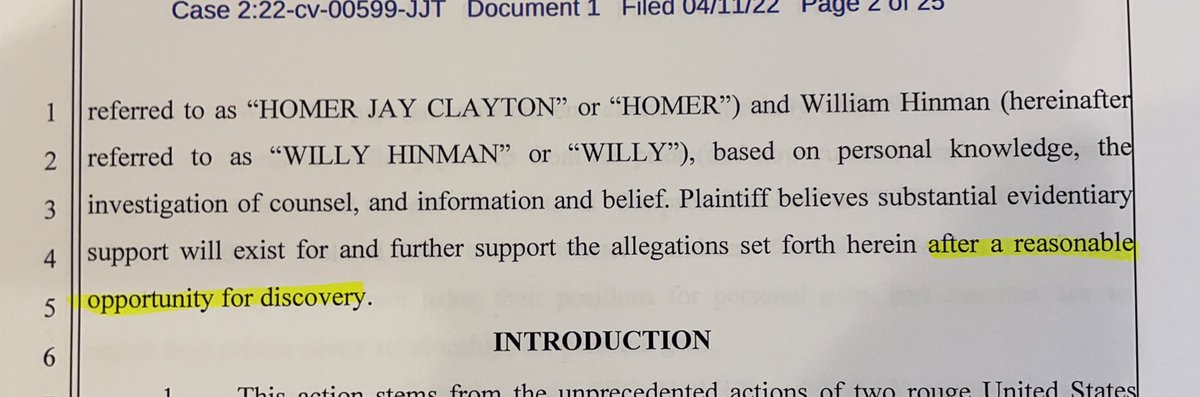

Notice how the Complaint makes reference for the need to engage in discovery. It reads:

“Plaintiff believes substantial evidentiary support will exist for and further support the allegations set forth herein after a reasonable opportunity for discovery.” 👇

“Plaintiff believes substantial evidentiary support will exist for and further support the allegations set forth herein after a reasonable opportunity for discovery.” 👇

The problem is if the Judge doesn’t allow Fred to subpoena third parties or get emails etc, the case could get thrown out quickly. Look how hard it is for @Ripple to get discovery and Ripple was actually sued. Fred’s plaintiff wasn’t actually sued.

The problem for #XRPHolders is that if this case isn’t taken serious and thrown out what if a judge writes something like “the claims against Clayton and Hinman are totally without merit.” Imagine that. I bet CNBC will finally report on it and Clayton and a Hinman will be happy.

Now why wouldn’t this case be taken seriously? Unfortunately, it is written in a manner that attempts to entertain. Calling Clayton Homer and Hinman Willy has a cartoonish ring to it. But maybe Fred knows the Judge and he or she will be receptive.

I certainly wouldn’t write that before Judge Torres or the Federal Judge I filed the Writ of Mandamus before.

The Complaint alleges tortious interference with business expectancy but never explains what that business expectancy was. Is it simply price appreciation?

The Complaint alleges tortious interference with business expectancy but never explains what that business expectancy was. Is it simply price appreciation?

The Complaint alleges Clayton and Hinman filed a lawsuit against Shannon O’Learly and all other “XRPL Network Users.” Technically, they didn’t and I was denied a motion to intervene and this will be challenged immediately.

The Complaint alleges:

“HOMER and WILLY concocted THE SPEECH outside of the scope of their employment with the SEC…”

But we know there are 63 emails and 68 drafts and edits and comments from many other SEC employees.

“HOMER and WILLY concocted THE SPEECH outside of the scope of their employment with the SEC…”

But we know there are 63 emails and 68 drafts and edits and comments from many other SEC employees.

There are other issues that concern me but the bottom line is I fear that there are possible other reasons for rushing this lawsuit and using the language it did. What those reasons are, I do not know.

After all the hard work that myself, @EMPOWR_us, @digitalassetbuy @DigPerspectives @CryptoLawUS @MoonLamboio @TAIGxrp @on_the_chain @sentosumosaba @Leerzeit and all the other sleuths have contributed I will hate to possibly see some Judge dismiss the case and hurt a future case.

Fred’s 🧵 said no investigation is coming. Although one may not be coming very soon, he hasn’t been privy to the progress made in convincing some that certain inquiries need to be made.

My fear is that I run into someone saying to me down the road: “didn’t a federal judge look at this and throw it out?”

With all that said, of course, I hope my concerns don’t come true. I hope Fred is confident he will be taking serious and his judge will allow discovery.

With all that said, of course, I hope my concerns don’t come true. I hope Fred is confident he will be taking serious and his judge will allow discovery.

I hope he has the research and case law ready to defend the qualified and sovereign immunity challenges.

Anyways, those are my thoughts. To be candid, as amicus counsel, I needed to make sure that this lawsuit isn’t conflated with what we are attempting.

Anyways, those are my thoughts. To be candid, as amicus counsel, I needed to make sure that this lawsuit isn’t conflated with what we are attempting.

• • •

Missing some Tweet in this thread? You can try to

force a refresh